Companies

How to Find a Successful Resources IPO: A Punter’s Guide

Special Report: One of the best performing listings over the past year and a half is Southern Cross Gold (ASX:SXG) … Read More

The post How to find a…

Of the 50 odd new companies to list on the ASX over the past ~18 months, only 19 are currently in the green.

Just four of those have made gains above 100%.

One of the best performing listings over the past year and a half is Southern Cross Gold (ASX:SXG), which hit the bourse mid 2022 after raising $10m at 20c per share in an IPO.

The spinout of TSX-listed Mawson Gold is currently up 125% since launch which, in a very tough period for new listings, puts it in rarefied air.

Its main game is Sunday Creek; a large and high grade ‘Fosterville-like’ gold system in the state of Victoria, where the Geological Survey believes there could be 75Moz of undiscovered gold.

But what makes Southern Cross Gold stand out from other explorers on the ASX? How can investors get on board the next winning resources IPO?

We get some tips from managing director Michael Hudson.

1 – Find an exciting story

SXG is hunting a lookalike of Fosterville, one of the highest-grade gold mines on Earth which will spit out 340,000oz in 2022 at ~$378/oz cash costs.

A money-making machine.

But before the discovery of the 40g/t Eagle Zone at Fosterville in 2015, the mine was a struggling 5g/t refractory story.

In fact, Aussie explorers and miners had discounted Victoria since World War One.

It was the Canadians which swept in with optimistic naivety, Hudson says.

“They came in and spent the bucks and now they’ve got two of the top 10 highest grade gold mines today in Fosterville and [nearby] Costerfield,” he says.

“We were able to stand on the shoulders of those giants, seeing those systems transition to become very good systems.

“We are in the shadow of the headframes where no one has cared to look.”

There are nine historic ‘epizonal’ gold fields in Victoria, of which Fosterville and Costerfield are two. Southern Cross Gold has another three.

Epizonal systems are consistent, amenable to mine and reconcile well in resources and in production. Importantly, they can form uber high-grade systems at depth.

Southern Cross Gold believes it has caught the tail of something special at Sunday Creek, which exploded into mainstream consciousness last year on some monster hits.

One of these — 305.8 metres @ 2.4 g/t AuEq (1.6g/t gold and 0.50% antimony) from 319.2 metres — included 12 high-grade intersections >20 g/t gold including 5 over 100g/t gold.

The hits continued in 2023 as Southern Cross Gold worked to prove up the system’s scale.

“There were some very good holes into Sunday Creek before we got there, only 5000 metres, but I was staggered by the quality of those drill holes,” Hudson says.

“Pre IPO, we knew. We bought 320 acres of freehold over that project because we saw the tenor of the system.”

Then there’s the Redcastle project, which is immediately along strike from Costerfield.

“17km of veining was mined down to 150 metres by the old timers, at plus 100-gram dirt,” Hudson says.

“The deepest hole on that property until a year or so ago was 80 metres. It had 220 holes and they averaged 40 metres.

“Nobody had gone deeper than the guys in the 1870s-1880s and it’s next door to one of the top 10 highest grade gold mines on earth.”

2 – Does the IPO have its timing right?

Hudson had picked up a package of gold tenements in Victoria’s gold fields some 20 years ago, well ahead of the curve.

“I failed 20 years ago and am succeeding now, because the market is ready; that understanding is there,” he says.

“Fosterville as a tier 1 deposit is now understood, but not back then — why would we want to find another five-gram refractory deposit?

“It’s all timing. You’ve got to find your moment.”

3 – Location, location, location

A project’s jurisdiction can be ‘make or break’, with countless explorers globally becoming trapped in government red tape.

It’s a frustrating situation to be in as an investor.

“I’ve been caught everywhere around the world,” Hudson says.

“Working in Peru we can wait two years for drill permits. In Finland anyone can appeal any government decision. The government gives you a permit, and then somebody can appeal it and set back a year.”

Victoria has the most industry progressive permitting for drilling that Hudson’s seen anywhere in the world.

“You need one week’s notice for low impact exploration, which includes diamond drilling, if you’re staying on existing tracks and not cutting trees down to the bigger than your forearm,” Hudson says.

“You can be on the drilling within one week.

“Having that regularity of results, and that’s a big one.

“I’d never go anywhere anymore without having the ability to drill and drill quickly and drill with ferocity.”

4 – Drill hard and GO BIG

Southern Cross Gold has put 20km of drilling into Sunday Creek so far, with another 15km to go in 2023. There are four rigs turning as we speak.

Investors like to see a company drill hard and “with ferocity”, instead of just poking around the edges.

Hudson talks about mining magnate Joseph Gutnick and his chief geo Ed Eshyus who, in the ‘80s and ‘90s, made several big gold discoveries.

“Everyone said ‘they are just lucky’ but they drilled; they drilled hard,” Hudson says.

“You got to drill like a banshee, in context with a strategy but if you’re not drilling, you’re not finding anything.

“We’re going gangbusters, you know, this year to try and make it as big as possible. And next year, we’ve talked about putting out a resource.”

5 – Staying on the Lassonde Curve

But Southern Cross Gold is in no rush to release a maiden resource at Sunday Creek.

“Everyone asks in Australia about putting out a resource — when are you putting out a resource?” Hudson says.

“That’s the way that investors have been trained to think that that’s when you get value. But resources can be debilitating if they’re not big enough.”

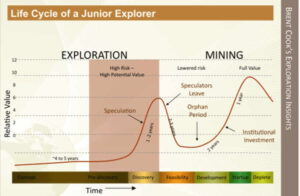

Southern Cross Gold has attracted high-profile investor and famous gold bug Pierre Lassonde, who started a highly successful royalty company called Franco-Nevada.

He’s been behind multiple billion-dollar companies. This is his world-famous curve:

Southern Cross Gold plans to stay on that exploration curve as long as possible to create value for shareholders, Hudson says.

“We have a system that allows us to do that,” he says.

“That’s where people make their money in exploration. They want 10 baggers, they want things to be huge, and they want them to be taken out by majors.

“Majors aren’t going to buy 300,000, 600,000 or even 1Moz systems.”

Last year, a company called Great Bear out of Red Lake Ontario was taken out for $1.8 billion by US$6bn capped Kinross (NYSE:KGC, TSX:K) without releasing a resource.

“They put 300km into that system, Great Bear, and never put a resource out,” Hudson says.

“They just kept on making it bigger and bigger. Kinross were no fools — they had all the data and saw where it was going.

“As soon as Kinross [bought the project] they put a 5Moz resource around it and said it was going to triple.”

6 – Does this IPO believe in their projects?

Southern Cross Gold has been able to attract large sums of money into the Sunday Creek project at a time when gold explorers are not that popular.

But good projects always rise to the top.

Many of today’s largest ASX lithium companies, for example, were nobodies before the battery metals bull market 2.0 kicked off circa January 2021.

At the time lithium prices were on the respirator and only the toughest ASX stocks (usually with the best projects) had stayed the course.

Lithium prices across the board have since gone parabolic. These stocks, and their investors who took risks during the dark days, are now receiving their due.

“I’d love to have a gold market to promote the stock into,” Hudson says.

“[The gold exploration sector] is going through a bit of lack of love now, but you’ve got to wear these sort of pullbacks and just keep a firm hand on the tiller.

“You can do that by having the bucks in the bank and belief in the project. We have those bucks in the bank, $17.6 million at the end of last quarter, which is more than enough to see us through this current drill campaign, so there is no fear of us needing to return to market in these tough times for exploration companies. When we do return to the market, maybe early next year, we expect to have many more positive results which will demonstrate our confidence that Sunday Creek is the best new gold discovery in Australia.”

This article was developed in collaboration with Southern Cross Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post How to find a successful resources IPO: A Punter’s Guide appeared first on Stockhead.

tsx nyse asx gold lithium antimony diamond tsx-k kinross-gold-corporation

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…