Precious Metals

Traders Bet Big On Fed Blowing It: Gold Call Volume Explodes After Hawkish Powell

Traders Bet Big On Fed Blowing It: Gold Call Volume Explodes After Hawkish Powell

Ahead of yesterday’s FOMC statement, SEP, and press conference,…

Traders Bet Big On Fed Blowing It: Gold Call Volume Explodes After Hawkish Powell

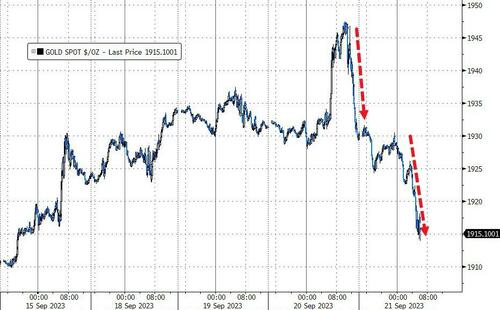

Ahead of yesterday’s FOMC statement, SEP, and press conference, spot gold prices had been rallying, back up near two-month highs.

But the hawkish bias in the SEP, and with Powell’s words, sent the dollar soaring higher and precious metals plunging.

Source: Bloomberg

Yesterday’s high took out the 100DMA and closed around the 50DMA. This morning’s tumble has pushed spot gold back below its 200DMA…

Source: Bloomberg

However, under the hood, Goldman Sachs noted that: “we started to see clients re-engage in GLD with 440k calls trading, the most since March…”

Source: Bloomberg

Specifically, they note:

“We saw a cust sell 75,000 Oct 180 190 call spread to buy 75,000 Nov 185 195 call spread and sell 37,000 Nov 175 puts.”

UBS also confirmed that there was a large gold trade going through in the equity space.

“Someone is rolling 1m area 180/190 call spread (in-the-money call spread) into 2m area, 185/195 out-the-money call spread and selling 2m (ish) 175 puts to partially finance. Size in OTC equivalent is 750k per leg on the call spreads and 370k on the outright put. Net that’s a purchase of ~500k vega of front end optionality.”

As the following chart shows, that surge in gold options action took place around the FOMC statement and press conference…

Basically, someone is betting that The Fed will blow everything up.

A hawkish path by the central bank may upend Fed Chair Jerome Powell’s goal of achieving a soft landing for the world’s biggest economy, according to Nicky Shiels, head of metals strategy at MKS PAMP SA.

That could boost its haven status, she added.

Adding to that sentiment, Goldman suggests a trade: “We like owning [Gold] calls outright with l-3m implied vol trading near 4y lows.”

“This ‘higher-for-longer’ purgatory certainly raises hard-landing risks, which makes precious metals surprisingly one of the only safe places to hide out,” Shiels concluded in a note, and it seems more than one trader is betting on that outcome.

Tyler Durden

Thu, 09/21/2023 – 12:45

otc

gold

precious metals

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…