Precious Metals

This Will Not Be A Normal Recession

This Will Not Be A Normal Recession

Authored by Simon White, Bloomberg macro strategist,

A US recession is looking increasingly imminent,…

This Will Not Be A Normal Recession

Authored by Simon White, Bloomberg macro strategist,

A US recession is looking increasingly imminent, but the usual playbook of a deep equity selloff and Treasuries acting as a hedge may not apply to the same extent.

The US looks as if it will be in a recession very soon, if it isn’t already in one.

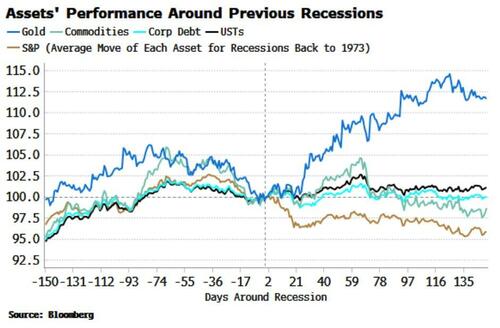

The chart below shows the average evolution of the main assets around a downturn.

The chart shows that gold typically fares best of the selected assets shown after a recession, followed by USTs and corporate debt. Equities and commodities (Bloomberg Commodity index) come off worst in the six months after the recession begins.

But this recession will come with an unwelcome helping of elevated inflation, which means the usual rules cannot be relied upon.

-

Firstly, Treasuries may not deliver the same degree of protection as normal. Longer-duration USTs in particular are riskier propositions than they would normally be, especially if term premium begins to factor in a more structural inflation problem.

-

Secondly, equities may not face the same downside as they have in past recessions. As the chart above shows, we should expect a further decline, quite possibly taking them to new cycle-lows, but price action has been unusually constructive.

Some rare and reliable signals, such as the Coppock shown in the chart below, suggest the S&P could be much better supported than would normally be expected.

Gold (and silver) are intriguing as they have already been rallying, intimating they are already sniffing out that this will not be a garden-variety recession, one through which inflation potentially rises and for which Treasuries are an inadequate hedge.

Commodities might also be expected to perform better than their recession average as real assets are best-placed to weather inflation likely to prove more persistent than the consensus expects.

An atypical recession requires an atypical response, and there are several more adjustments that would make portfolios better prepared for such an outcome.

Tyler Durden

Tue, 04/18/2023 – 15:10

gold

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…