Precious Metals

The Dollar Trend Projections & Outlook For The Next Few Years

May 4, 2006 The Dollar Trend Projections A penny saved is a penny earned; we say maybe this is true if the penny is made of silver, palladium, platinum…

May 4, 2006

The Dollar Trend Projections

A penny saved is a penny earned; we say maybe this is true if the penny is made of silver, palladium, platinum or Gold.

Despite many interest rate hikes, the dollar is breaking down because foreign governments have run out of places to invest their huge dollar reserves.

The Unicoal deal prevented the Chinese company CNOCC from buying it, even though about 80% of its assets are overseas. Then there is talk of slapping a tariff of 27% on some of China’s exports because of the ever-increasing trade deficits. They have dropped this idea, but the damage has already been done. Looking at what’s happening, one cannot help but feel the US wants bread, butter, jam and cream simultaneously. China will be the world’s largest holder of US debt by year’s end, and if they are busy bankrolling our extravagant lifestyles, how can we tell them how they should run their business? Eventually, they are going to get tired and say you know what we don’t want to lend you any more money.

The Dollar Outlook For The Next Few Years

The US prevented DP World, a Dubai company, from taking over the ports even though an overseas company managed them before this deal. And so these foreign governments must ask themselves what they will do with this worthless paper if the US government won’t let us buy any US assets. The only value now that the United States has is in its assets. Take away these, and no one will want to hold the dollar. This is one of the primary reasons the dollar failed to break past 92 for any significant period. Though it did rally significantly from its lows, it could have done much better.

The dollar could have rallied higher.

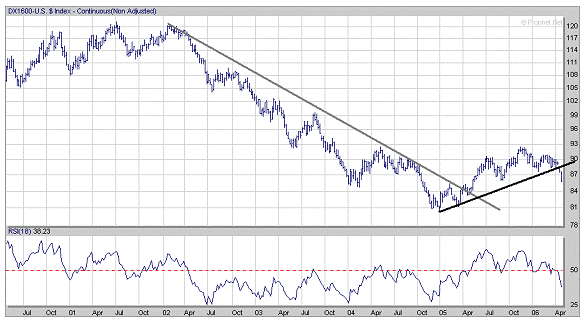

But foreigners are probably reluctant to hold the dollar just for its beauty. One must be able to do something with it other than hatch eggs. The only thing that might help is if overseas investors make up for this shortfall, as many countries are now divesting from the dollar by increasing their Gold reserves and Euro reserves, investing in the infrastructure of energy-rich nations, etc. Relying on overseas investors to buoy the dollar might not be the best strategy as most individuals in the world have somewhat of a negative opinion regarding the United States. Therefore we feel that technically the Dollar rally is over; it could (the keyword being could) mount another rally, but the momentum is ending.

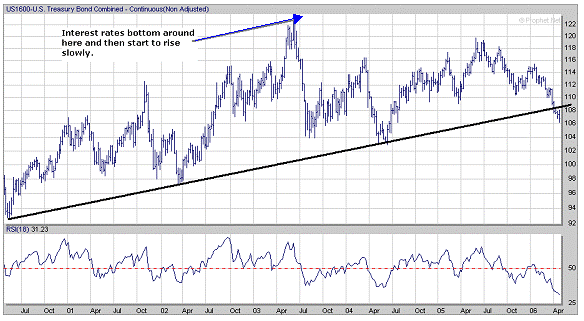

Interest rates and the dollar

When interest rates rise, bond rates fall and vice versa. From the above chart, we can see that Interest rates bottomed between April- July 04; they then rose slowly. Notice also that the long-term six years trend line has been violated, which suggests that higher interest rates will be a fixture in the coming years. Now it would be expected for the dollar to keep rallying in the face of higher interest rates, but the chart below clearly illustrates this is not the case. As stated clearly upwards, one of the huge reasons for this is that foreign governments are swapping their dollars for Euros and Gold or investing them in the infrastructure of other nations because they are being restricted from purchasing US assets.

The most exciting part is that the US is playing hardball with China when its set to become the largest holder of US paper. The Chinese and the Russians have openly stated that they will readjust their reserve ratios to allocate a more significant portion to Euros and Gold.

If you look at the chart of the dollar, you notice it actually was able to break through the long-term downtrend and establish a new uptrend. We were one of the first to turn bullish on the dollar, but you will notice that it has now broken the new up-trend line, and it appears certain that the long-term downtrend line will re-establish itself sooner or later. We closed half our longs on the dollar about nine weeks ago and the remaining half about six weeks ago. We are now long another currency, which has already rallied very nicely; we will mention this currency publicly in a few weeks

Final notes on the dollar

Bonds have broken their long-term six years uptrend, indicating that higher interest rates are here to stay. We might have a respite here and there but nothing that will last. Conversely, the dollar has broken its newly established up trend line, indicating that it is just a matter of time before the long-term old trend line is re-established. The high cost of these multiple wars, combined with the fact that we are blocking foreigners from purchasing US assets, has resulted in the dollar breaking down even faster than it should have.

The primary reason right now is the restriction the US places on foreign governments. We need their dollars to finance our deficits, but at the same time, we want to tell them how they should spend those dollars. It reminds me of this expression “Those that bite the hand that feeds them are doomed to lick the boot that kicks them”.

Sure of their qualities and demanding praise, more go to ruined fortunes than are raised.

Alexander Pope 1688-1744, British Poet, Critic, Translator

Other Articles of Interest

Inflation News: Real Inflation Set to Surge

Resource Wars: Navigating a Shifting Global Landscape

Stock Market Sell-Off: Embrace Fear & Seize Opportunities

Stock Investing Mistakes: Fear Should Never Dominate

Stock Market Crash Today: Should You Be Concerned?

Defy Pavlov’s Theory: Buy When the Masses Sell

Examples of Groupthink: Instances of Collective Decision-Making

Investing in a Bear Market: Ignore the Naysayers

Yuan Vs Yen: Yuan On course to Challenge Yen

ASAN Stock Price Trends: Poised for Takeoff or Set to Decline

Stock Market Prediction: Avoiding the Herd Mentality

Greenspan Put: Why the Maestro has it Wrong?

Financial Insights: Cutting Through the Noise

Analyzing Trends: Stock Market Forecast for the Next 6 Months

Stock Market Futures Investing: Navigate for Success or Risk Loss

Stock market crashes timelines

In 1929 the stock market crashed because of

The post The Dollar Trend Projections & Outlook For The Next Few Years appeared first on Tactical Investor.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…