Precious Metals

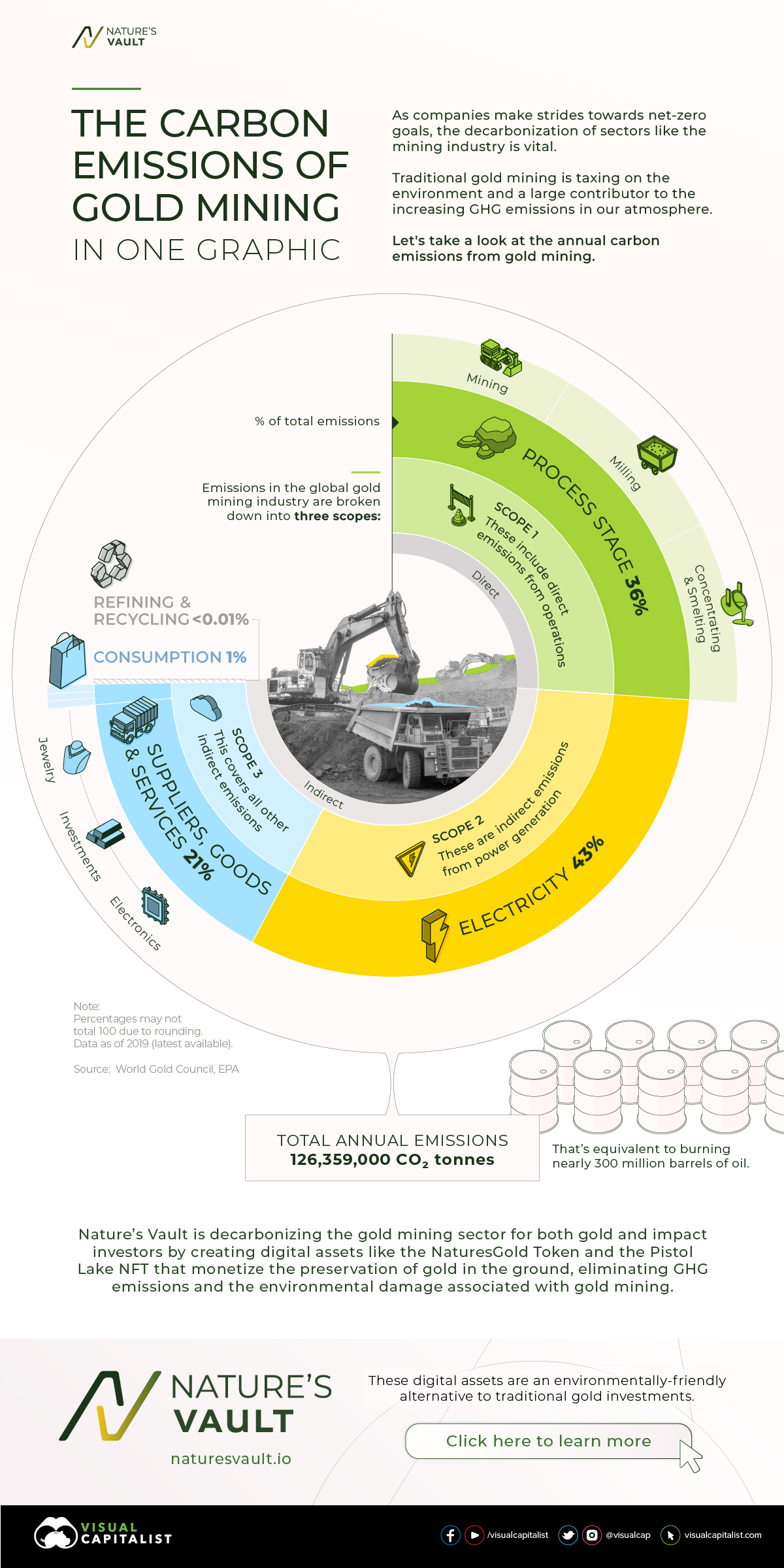

The Carbon Emissions of Gold Mining

Gold has a long history as a precious metal, but just how many carbon emissions does mining it contribute to?

The post The Carbon Emissions of Gold Mining…

The Carbon Emissions of Gold Mining

As companies progress towards net-zero goals, decarbonizing all sectors, including mining, has become a vital need.

Gold has a long history as a valuable metal due to its rarity, durability, and universal acceptance as a store of value. However, traditional gold mining is a process that is taxing on the environment and a major contributor to the increasing carbon emissions in our atmosphere.

The above infographic from our sponsor Nature’s Vault provides an overview of the global carbon footprint of gold mining.

The Price of Gold

To understand more about the carbon emissions that gold mining contributes to, we need to understand the different scopes that all emissions fall under.

In the mining industry, these are divided into three scopes.

- Scope 1: These include direct emissions from operations.

- Scope 2: These are indirect emissions from power generation.

- Scope 3: These cover all other indirect emissions.

With this in mind, let’s break down annual emissions in CO2e tonnes using data from the World Gold Council as of 2019. Note that total emissions are rounded to the nearest 1,000.

| Scope | Type | CO2e tonnes |

|---|---|---|

| 1 | Mining, milling, concentrating and smelting | 45,490,000 |

| 2 | Electricity | 54,914,000 |

| 3 | Suppliers, goods, and services | 25,118,000 |

| 1,2,3 | Recycled Gold | 4,200 |

| 3 | Jewelry | 828,000 |

| 3 | Investment | 4,500 |

| 3 | Electronics | 168 |

| TOTAL | 126,359,000 |

Total annual emissions reach around 126,359,000 CO2e tonnes. To put this in perspective, that means that one year’s worth of gold mining is equivalent to burning nearly 300 million barrels of oil.

Gold in Nature’s Vault

The majority of gold’s downstream use is either for private investment or placed in banks. In other words, a large portion of gold is mined, milled, smelted, and transported only to be locked away again in a vault.

Nature’s Vault is decarbonizing the gold mining sector for both gold and impact investors by eliminating the most emission-intensive part of the mining process—mining itself.

By creating digital assets like the NaturesGold Token and the Pistol Lake NFT that monetize the preservation of gold in the ground, emissions and the environmental damage associated with gold mining are avoided.

How Does it Work?

Through the same forms of validation used in traditional mining by Canada’s National Instrument NI 43-101 and Australia’s Joint Ore Reserve Committee (JORC), Nature’s Vault first determines that there is gold in an ore body.

Then, using blockchain and asset fractionalization, the mineral rights and quantified in-ground gold associated with these mineral rights are tokenized.

This way, gold for investment can still be used without the emission-intensive process that goes into mining it. Therefore, these digital assets are an environmentally-friendly alternative to traditional gold investments.

Click here to learn more about Nature’s Vault.

-

Commodities18 hours ago

Commodities18 hours agoCharted: Commodities vs Equity Valuations (1970–2023)

The commodities-to-equities ratio recently hit a 50-year low. In the past, when this ratio reached such levels, commodity supercycles began.

-

Personal Finance23 hours ago

Personal Finance23 hours agoRanked: The Best U.S. States for Retirement

Getting ready for retirement? See which states score the highest in terms of affordability, quality of life, and health care.

-

Science4 days ago

Science4 days agoVisualizing the Biomass of All the World’s Mammals

When the world’s biomass—the stuff we’re made of—is tallied up, humans and cattle outweigh wild mammals by a massive margin.

-

Technology6 days ago

Technology6 days agoHow Smart is ChatGPT?

We visualize the performance of ChatGPT in various professional and academic exams, highlighting the improvements of GPT-4 over GPT-3.5.

-

Politics1 week ago

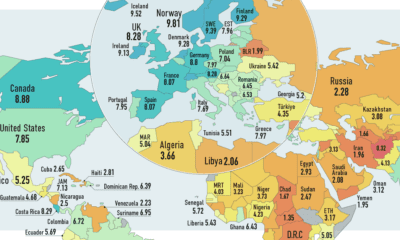

Politics1 week agoMapped: The State of Democracy Around the World

How many countries globally are true democracies? This map showcases the state of democracy in every country worldwide.

-

Datastream2 weeks ago

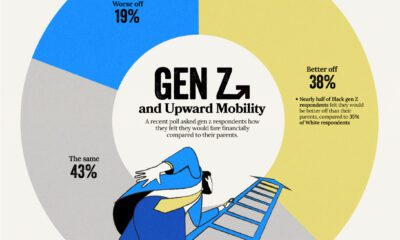

Datastream2 weeks agoHow Gen Z Feels About Its Financial Future

Despite the looming uncertainty, members of Gen Z maintains an optimistic outlook about their financial future

The post The Carbon Emissions of Gold Mining appeared first on Visual Capitalist.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…