Precious Metals

Stocks Up, Gold Down As Yield Curve Steepens Further

Stocks Up, Gold Down As Yield Curve Steepens Further

After the worst week in months, it’s perhaps no surprise that we got a little BTFD today…

Stocks Up, Gold Down As Yield Curve Steepens Further

After the worst week in months, it’s perhaps no surprise that we got a little BTFD today in stocks, but bonds kept doing more of the same – bear-steepening – the max-pain trade for markets right now. As Goldman noted this morning:

It’s a trade that hurts real money both from a curve and level perspective.

The rates macro Hedge Fund community didn’t have it on as it’s still reeling from the March VaR shock.

It hurts anyone who had a conditional view, that is anyone in the bull steepening camp.

In 2022, we also saw a lot of banks move their mortgages into Held-to-Maturity portfolio as the Fed started hiking.

These moves will amplify the losses already accumulated.

Finally when you look at more recent MBS vintages, the negative convexity will be painful here. (Side note: older vintages have actually turned positive convexity so those MBSs should be much better off).

The only cohorts that seem to have the right trade are cross over accounts that hedged against higher rates and CTAs – trend following Hedge Funds – that were picking the carry by shorting the frontend and selling the backend.

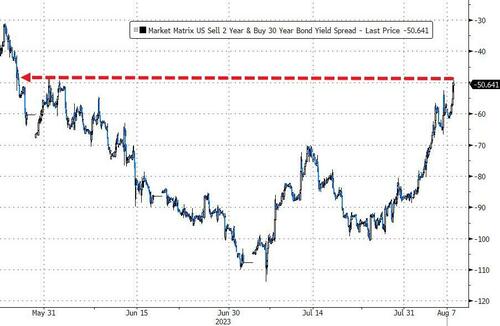

2s30s is back at its least inverted since May…

Source: Bloomberg

The short-end of the curve and stocks benefited from NYFed’s Williams dovish comments to NYT that the need for more rate hikes is “an open question,” … And if the inflation rate keeps falling, the central bank may need to lower interest rates in 2024 or 2025 to ensure that real interest rates don’t rise further.

“Monetary policy is in a good place – we’ve got the policy where we need to be,” Williams said in an Aug. 2 interview with the New York Times that was published Monday.

“Whether we need to adjust it in terms of that peak rate – but also how long we need to keep a restrictive stance — is going to depend on the data.”

In equity-land, Small Caps were the day’s laggard (ending around unch) while The Dow led the gains…

Notably, 0-DTE traders pushed back against the rebound in the S&P (buying Puts while Calls were flat)…

AAPL down for the 5th straight day – down around 10%, its biggest such drop since Nov 2022 (and back below the Jan 2022 prior record highs)…

TSN also tumbled but dip-buyers put some lipstick on that pig…

VIX (and VVIX) slid lower today (but remain elevated from last week’s lows)…

Source: Bloomberg

But bear in mind, VIX seasonality is not an equity bull’s friend…

US Treasuries were mixed today with the short-end outperforming and long-end sold (2Y unch vs 30Y +6bps)

Source: Bloomberg

The yield on 30-year German bonds rose nine basis points to 2.72%, the highest since early 2014…

Source: Bloomberg

The dollar ended basically unchanged on the day, selling off vs its fiat peers during the US session after overnight gains…

Source: Bloomberg

Bitcoin ended unchanged, bouncing back from morning weakness, back below $29,000…

Source: Bloomberg

Gold ended the day marginally lower, bouncing off pre-payrolls levels from Friday…

Oil also sank to pre-payrolls levels and bounced…

Finally, the rebound in Fed repo balances has stalled the Q2 meltup in stocks…

Source: Bloomberg

What happens next?

Tyler Durden

Mon, 08/07/2023 – 16:00

dollar

gold

inflation

monetary

markets

policy

interest rates

fed

central bank

monetary policy

ax

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…