Precious Metals

Stocks, Bonds, & Bitcoin Dump As Black Gold & The Buck Jump

Stocks, Bonds, & Bitcoin Dump As Black Gold & The Buck Jump

Soaring UK inflation, escalating Ukraine tensions, ugly housing starts…

Stocks, Bonds, & Bitcoin Dump As Black Gold & The Buck Jump

Soaring UK inflation, escalating Ukraine tensions, ugly housing starts data, hawkish Kashkari comments, more UK govt chaos, Biden blame-scaping everyone but himself for high gas prices, a ‘meh’ Beige Book, and The Fed’s Jim Bullard re-iterating his previous hawkish stance and adding that “The Fed should not react to declines in the stock market” summed up the day.

The machines refused to rally despite all this bad news…

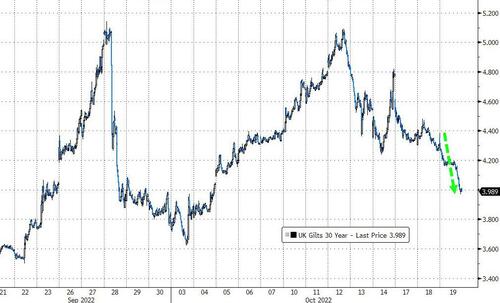

Despite UK inflation soaring back above 10% today, gilt yields continued to slide (pension crisis over?) with 30Y gilt yields puking back below 4.00% after the BOE said it would exclude long-maturity debt from QT which is set to start on Nov. 1…

Source: Bloomberg

US Treasury yields exploded higher today (and the 20Y auction was a bloodbath) with yields up 10-12bps across the entire curve. On the week, the 30Y is underperforming (+13bps) while the short-end (2Y) is up only 5bps or so…

Source: Bloomberg

10Y yields soared above 4.00% to their highest since June 2008…

Source: Bloomberg

As the much-watched 3m10y yield spread tumbled to just 7bps…

Source: Bloomberg

Fed rate-trajectory expectations shifted hawkishly today (with the terminal rate reaching new cycle highs around 4.977%)…

Source: Bloomberg

The market is now pricing in a full 75bps for Nov (and a 12% chance of 100bps hike) and pricing in 60% odds of 75bps more in December.

Credit markets were weaker today (while HYG has been rallying along with stocks the last few days, LQD has not and hit new cycle lows today)…

Source: Bloomberg

Consider this: LQD on 10/19/2022 is at $100. LQD on 9/15/2008 was $100…

Source: Bloomberg

High yield credit spreads are at their highest since the start of the pandemic. As Bloomberg reports, HYCDX, the gauge measuring risk of 100 non-investment grade entities, hit the three standard-deviation threshold on Sept. 27 for only the second time in the last decade.

Source: Bloomberg

A “tremendous amount” of leverage has been added over the past dozen years, especially since March 2020, and the process of unwinding “takes time,” according to Matt Maley, chief market strategist at Miller Tabak + Co.

While risk levels aren’t yet extreme, “it’s during the second leg of a bear market that something blows-up,” he wrote in a note.

US equity markets rallied briefly after the close last night thanks to NFLX earnings but as Asian and then European sessions rolled by, futures weakness accelerated. This was briefly interrupted at the US cash equity open, but then the selling resumed, erasing all of yesterday’s gains. Small Caps were the ugliest horse in the glue factory, down over 2% on the day…

The Energy Sector was the only one to close green today (as oil soared after Biden’s remarks) and Real Estate and Financials were the day’s biggest losers…

Source: Bloomberg

The USDollar soared back to unchanged on the week today as JPY and GBP both stumbled further…

Source: Bloomberg

The offshore yuan fell to a new record low against the dollar…

Source: Bloomberg

Bitcoin drifted lower once again but held above $19k for now…

Source: Bloomberg

Energy prices spiked today despite Biden’s cunning plan to lower gas prices.

WTI ramped back above $85…

Wholesale gasoline prices also spiked notably after Biden’s remarks…

Gold continued to roundtrip back towards 9/28 lows…

Finally, we note that FX volatility has exploded, credit spreads have exploded, bond uncertainty has exploded… but equity risk expectations remain muted…

Source: Bloomberg

…for now.

Tyler Durden

Wed, 10/19/2022 – 16:00

gold

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…