Precious Metals

Platinum Market “Entering Substantial Deficit This Year”

Platinum Market "Entering Substantial Deficit This Year"

The global shortage of platinum is set to worsen in the coming quarters, resulting…

Platinum Market “Entering Substantial Deficit This Year”

The global shortage of platinum is set to worsen in the coming quarters, resulting in one of the most significant deficits in half a century, the World Platinum Investment Council (WPIC) said in a quarterly report on Monday. This should continue to support spot prices of the metal.

Rolling power blackouts in South Africa, a country responsible for mining approximately 70% of the world’s supply, disrupt production. It comes as demand remains robust and will outstrip supply by 983,000 ounces in 2023. This means the shortfall will be the largest since the 1970s — and compares with a deficit forecast of 556,000 ounces made by WPIC in March.

The forecast deficit for 2023 (-983 koz) is 77% deeper than projected in the Q4’22 Platinum Quarterly in March 2023, and reflects a 1% decline in total supply and a 28% increase in demand versus 2022.

Besides South Africa, WPIC said Western sanctions against Russia have also contributed to sliding global supplies.

“This reflects the attractive investment outlook of a market entering a substantial deficit this year, with deficits likely to be sustained for several years unless there is a substantial increase in supply or significant demand destruction, both seeming unlikely. It is quite possible that this interest in platinum investment could spread to other geographies as well, and of course, the more broad-based the investment thesis is acted upon, the more self-fulfilling the result,” said Trevor Raymond, WPIC chief executive.

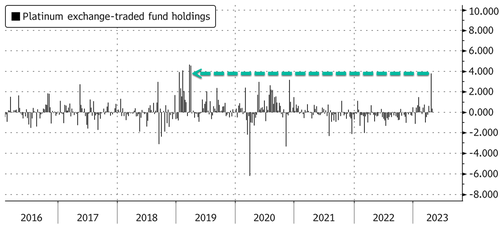

In April, we pointed out global platinum production was at risk as investors were plowing money into platinum exchange-traded funds.

“The trend over the last few years in South Africa has been to buy the equities over the metal.

“Now with the challenges facing the companies in terms of inflation and Eskom the funds there are preferring the metal itself,” Ed Sterck, director of research at WPIC, told Bloomberg.

The surge in exchange-traded platinum funds led platinum prices to a more than 20% rally between mid-February into late April from $907 per announce to $1,127. Prices have since struggled to break above $1,100.

Meanwhile, WPIC said industrial demand is expected to surge 17% year-on-year to an unprecedented level, primarily fueled by glass and chemical-making capacity in China.

* * *

Read the full report here:

Tyler Durden

Mon, 05/15/2023 – 09:30

platinum

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…