Precious Metals

Platinum Demand Forecast for 2023 Up by 24%, Supply by 3%

The 2022 fourth-quarter report suggests significant growth in platinum investments in 2023.

The post Platinum demand forecast for 2023 up by 24%, supply…

The platinum deficit forecast for 2023 shows that demand will grow by 24% and supply will go up by 3% due to severe constraints.

The World Platinum Investment Council said in its fourth-quarter report that there was a change from a surplus of 776,000 tonnes (t) in 2022 to the forecast deficit of 556,000t in 2023. This reflects total supply remaining close to the weak level in 2022, up only 3%, and strong demand growth of 24%.

Total mining supply and refined mine production declined 11% year-on-year, and the former is forecasted to remain flat in 2023. The report said that refined mine production declined due to lower output from South Africa.

Russian production in the fourth quarter also declined by 10% due to logistical challenges impacting material flow between Russian and Finnish processing facilities. According to the report, global recycling on reduced availability of end-of-life vehicles and lower jewellery recycling fell 17% last year.

The report said industrial demand for platinum is expected to increase in 2023, up by 12% year-on-year to 2.505 million tonnes, which is 26,000t below the level in 2021, the strongest year on record.

Platinum investment demand could improve significantly in 2023. The report said platinum bar and coin demand could jump by 100% this year, recording a three-year high.

Trevor Raymond, CEO of the World Platinum Investment Council, said: “From a macro perspective, 2023 is expected to be a difficult year, with an uncertain economic environment, inflationary headwinds and a global energy crisis.

“Power supply risks and operational challenges are included in the forecast mining supply for 2023, a worsening electricity supply shortages in major producer South Africa or sanctions-related operational challenges in Russia present downside risks to supply.”

The post Platinum demand forecast for 2023 up by 24%, supply by 3% appeared first on Mining Technology.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

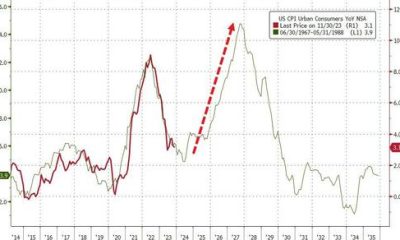

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…