Precious Metals

New Research: A Diversified Portfolio Should Allocate 4-5% To Silver

A report by Oxford Economics has concluded that silver’s return characteristics are sufficiently different from gold to make it a valuable diversification…

While silver’s price movements are often closely correlated with gold, a report by Oxford Economics, a leading independent economic advisory firm commissioned by the Silver Institute to explore the risk-adjusted returns of model portfolios with differing levels of silver exposure entitled, “The Relevance of Silver in a Global Multi-Asset Portfolio,” has concluded that silver’s return characteristics are sufficiently different from gold to make it a valuable diversification tool that deserves its own portfolio commitment.

By* Lorimer Wilson, Managing Editor of munKNEE.com – Your KEY to Making Money. Here’s why.

To examine the potential long-run benefits of holding silver in a portfolio, Oxford Economics compared silver’s historical performance with a range of traditional asset classes, including stocks, bonds, gold, and other commodities, from January 1999 to June 2022. Among the findings, silver was shown to have a relatively low historical correlation with asset classes other than gold, suggesting silver’s valuable diversification potential in investment portfolios.

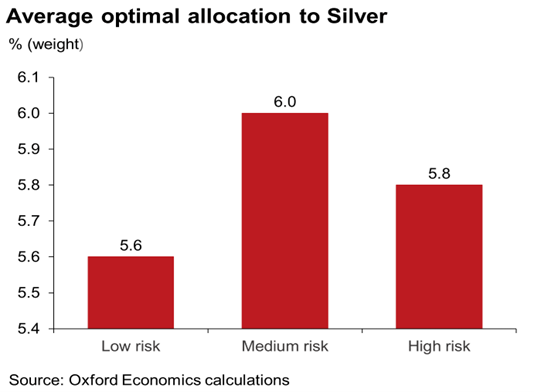

Based on their projections for asset returns, Oxford Economics concluded that investors would benefit from an average 4-6 percent silver allocation within their portfolio, significantly higher than current holdings of silver by most institutional and individual investors.

Further, the firm conducted a more rigorous test to determine whether silver should have a consistent allocation alongside gold in a multi-asset portfolio by running dynamic portfolio optimization simulations. These simulations were run with the aim of maximizing the risk-adjusted returns of a mixed-asset portfolio under varying constraints designed to reflect differing investor risk preferences. Across the historic sample period, the authors found the average optimal allocation to silver was in the range of 4-5 percent for a portfolio with a five-year holding period.

Optimal allocations to silver by risk threshold (2022 – 2032)

Based on their projections for asset returns, Oxford Economics investigated the potential behavior of silver relative to other asset classes and its role in an optimal portfolio over the next decade. This analysis suggests an even higher optimal portfolio allocation to silver of around 6 percent would be warranted over this period.

*The content of the above article is sourced from and has been edited ([ ]) and abridged (…) for the sake of clarity and brevity to provide the reader with a fast and easy read.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…