Precious Metals

Mooners and Shakers: Bitcoin flat after Fed holds rates, but ImmutableX surges 35pc

Post Fed meeting, Bitcoin is trading pretty flat, around US$27k. Aussie-founded ImmutableX (IMX), though… what’s going on there? … Read More

The post…

Another US Fed interest rates decision out in the wild, and crypto’s chief asset Bitcoin is trading pretty flat, just around US$27k at time of writing. ImmutableX (IMX), though… what’s going on there?

We’ll touch on IMX briefly further below.

First, though, as widely predicted and as you’ll know by now, Jerome Powell and co have held interest rates where they have been of late, but are projecting a possible rate hike to come before year’s out. That is, before a series of likely modest cuts in 2024. Yep, it’s a mixed bag of sentiment.

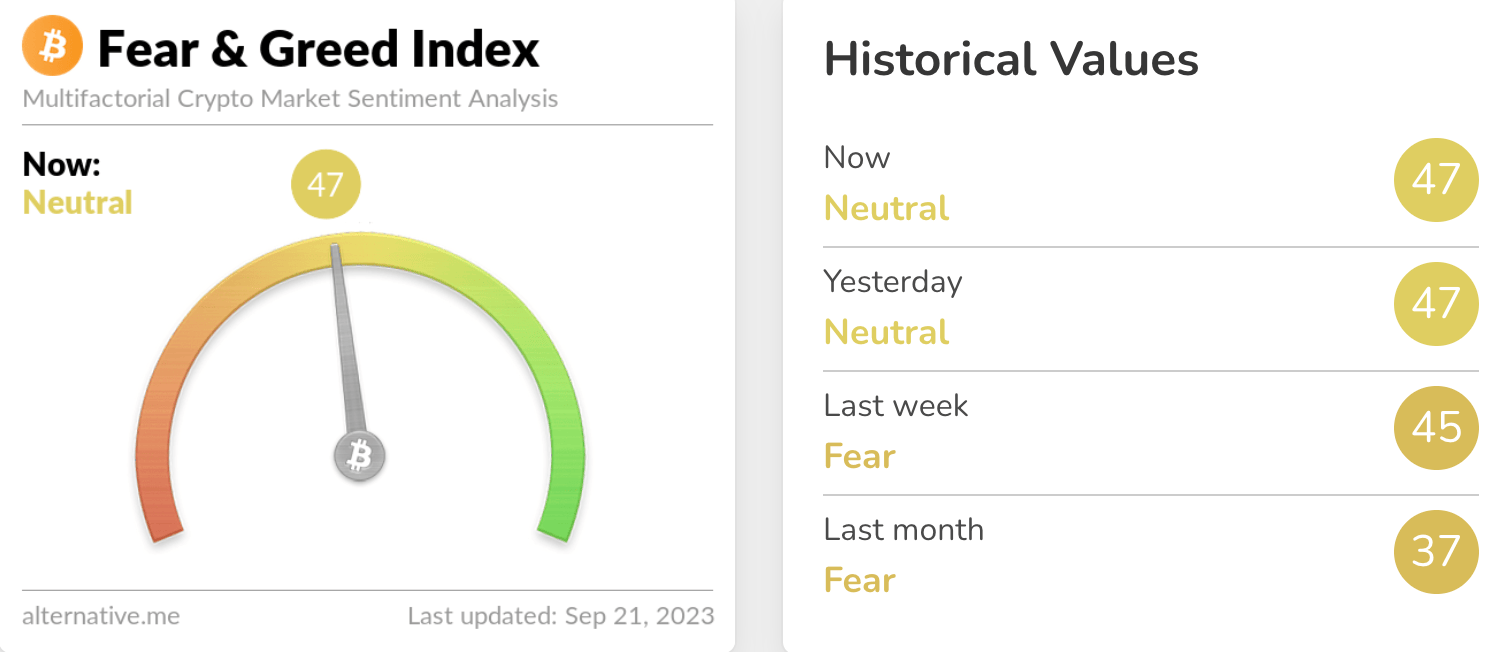

Speaking of sentiment, a quick check in on the Crypto Fear & Greed Index and it looks like we’ve moved back from “Daddy, I’m scared, hold me” territory, to “Muuummm, I’m bored”. And that’s pretty much been the back-and-forth narrative of Crypto 2023 to date.

Per the Fed’s announcement, the central bank “decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent.”

Eddy’s morning Market Highlights column, which is a 98% non-crypto-specific read, has more on this here.

But here’s another take – from crypto and blockchain data analytics gurus Santiment, which notes that crypto is holding up really quite well compared with the S&P 500’s dip to four-week lows…

The #Fed left interest rates where they were at the #FOMC meeting today. However, they did keep the door open for further rises. #Crypto market caps have held up well, despite the #SP500 plummeting to 4-week lows. A promising correlation break sign. https://t.co/xgQ9FCern3 pic.twitter.com/dEyJaOv959

— Santiment (@santimentfeed) September 20, 2023

Rich Dad, Poor Dad bloke still likes Bitcoin

Meanwhile, Robert Kiyosaki, the author of popular, ancient (1997) tome Rich Dad, Poor Dad, is maintaining his vocal support for Bitcoin, along with gold and silver.

I am constantly asked “What price will gold, silver, or Bitcoin be in 2025. My reply is that is a silly question. More important question is how many gold, silver, Bitcoins do you have TODAY? Gold, silver, Bitcoin are bargains today… but not tommow. America is broke. Buy GSBC…

— Robert Kiyosaki (@theRealKiyosaki) September 19, 2023

Predicting an impending crash in stocks, bonds, and real estate, Kiyosaki firmly believes the US dollar is on a path to obliteration and that “America is broke”.

The financial commentator also recently predicted a pretty high price for BTC in 2024 – US$120,000, which he expects along with Brazil, Russia, India, China, and South Africa (the BRICS nations) potentially launching a new cryptocurrency backed by gold.

Ray Dalio forsees money printer going ‘brrr’

The renowned US billionaire investor Ray Dalio meanwhile believes America will once again hit the on switch on its money printers as the country takes on even greater debt.

Dalio was speaking at the All-In Summit earlier this week in the States, hosted by the popular All-In podcast group.

Dalio believes that a recession is likely, which he says would see the Fed and US government bring back quantitative easing, in other words… “money printer goes brrr”.

“What happens is debt rise is relative to incomes,” said Dalio.

“What that means, mechanistically, is that debt service payments rise relative to incomes, and so it squeezes out consumption as the debt compounds. And what happens is there’s a realisation that they have to print money.

“I think you’re going to see in the next downturn another move to print money.”

This, of course, ties in with the predictions of Kioysaki (above) and others regarding the US dollar’s path to destruction, hence the case for gold, silver and Bitcoin.

The Fed, meanwhile, believes it’s on track to deliver the US economy a “soft landing”, taming inflation and avoiding recession. If it achieves this, it’ll be the first time it’s truly done so in almost eight decades.

Top 10 overview

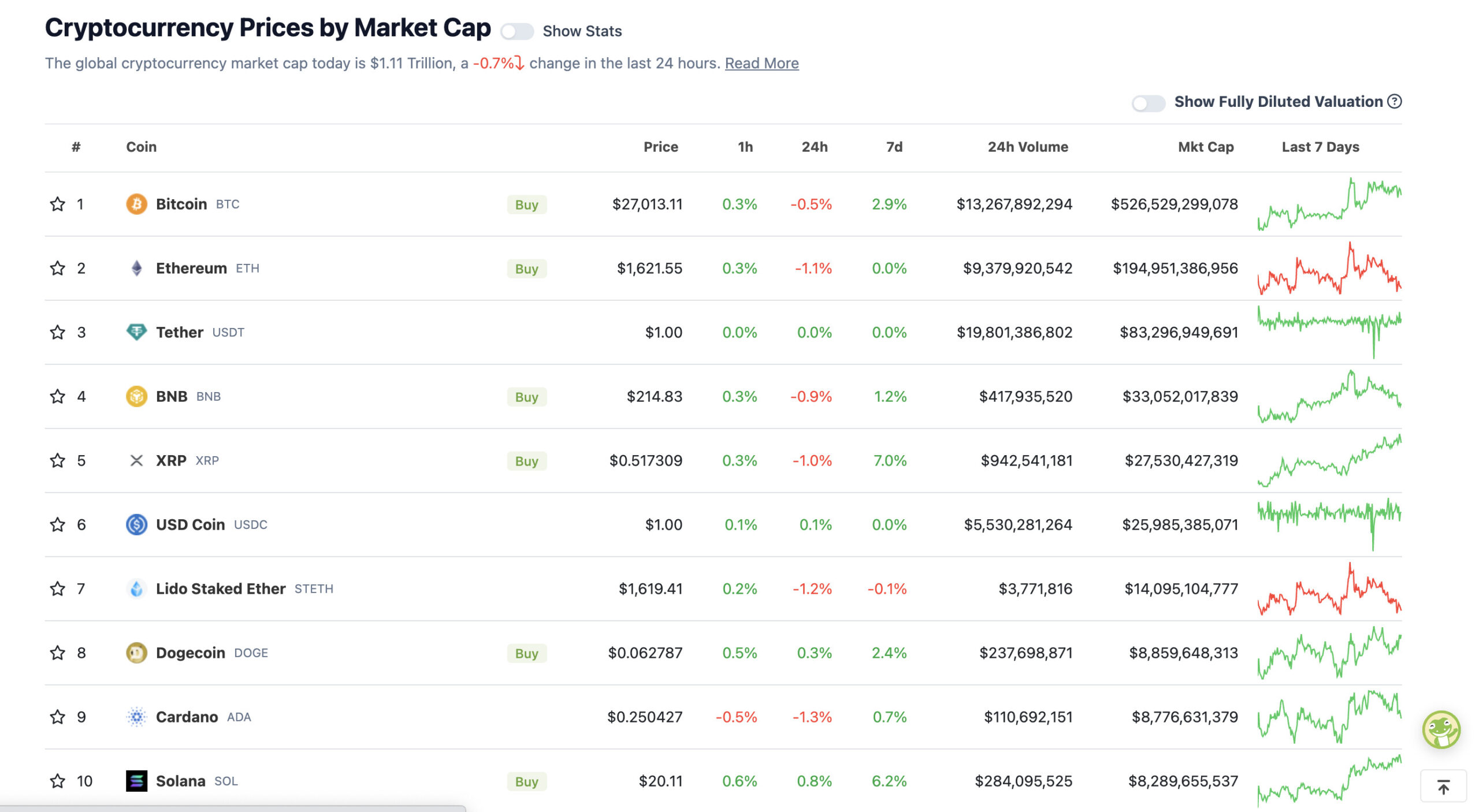

With the overall crypto market cap at US$1.1 trillion, down a fraction since about this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Not much movement at the station here, then, although layer 1 blockchain Solana (SOL) has jostled it’s way back into the top 10 at Toncoin (TON)’s expense.

No news to report on that specifically, other than perhaps some inevitable fading of Toncoin’s stonking-good recent form.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• ImmutableX (IMX), (market cap: US$889 million) +36%

• MultiversX (EGLD), (market cap: US$723 million) +7%

• Algorand (ALGO), (market cap: US$800 million) +6%

• Aave (AAVE), (market cap: US$946 million) +6%

• Maker (MKR), (market cap: US$1.2 billion) +4%

ImmutableX (IMX), the web3 layer 2 Ethereum blockchain built by Aussie-founded company Immutable, is on a bit of a tear today.

There’s no fresh news we’re seeing, although we do know the company has had a very prominent presence lately across global blockchain and gaming-related events – including the Animoca Brands investor day in Sydney recently, the major crypto conference Token 2049 in Singapore, as well as heading over to the Tokyo Game Show, as we type.

#Immutable is headed to Tokyo Game Show 2023!

Press Play: The future of gaming continues on September 21st – September 24th! pic.twitter.com/PpSqwr1FGk

— Immutable (@Immutable) September 20, 2023

Cross the Ages with 100K+ downloads, new games coming to #Immutable, creator royalties and Zynga’s first web3 title!

Join us for S2E3 of Between 2 Layers as we dive into exciting updates from the frontier of gaming!

Watch now: https://t.co/FCNJOTTV4X pic.twitter.com/D3dadysF5e

— Immutable (@Immutable) September 20, 2023

SLUMPERS

• THORChain (RUNE), (market cap: US$532 million) -8%

• Kaspa (KAS), (market cap: US$1.01 billion) -5%

• Toncoin (TON), (market cap: US$8.21 billion) -5%

• eCash (XEC), (market cap: US$478 million) -5%

• Rollbit Coin (RLB), (market cap: US$383 million) -4%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

25-year old video shows Bitcoin pioneer Hal Finney (Satoshi?) talking zero-knowledge proofs pic.twitter.com/gS5wtQLkOL

— Altcoin Daily (@AltcoinDailyio) September 20, 2023

Breaking news:

No rate hike from the FED.

My best guess: we’re done with the hiking policy. #Bitcoin is likely to start trending up from here (yes, a fakeout usually happens at the news).

— Michaël van de Poppe (@CryptoMichNL) September 20, 2023

Fed Chair Jerome reveals the truth about what the Fed is expecting to happen to the US Dollar and what he is personally investing in to prepare for that scenario.

…

Amazing how frank he has become lately in these FOMC press conferences. It is refreshing to hear what is… pic.twitter.com/Pp3aDl4wj6

— Wall Street Silver (@WallStreetSilv) September 20, 2023

JUST IN: US Congressman’s bill to ban the Federal Reserve from issuing a CBDC has passed the Financial Services Committee.

— Bitcoin Magazine (@BitcoinMagazine) September 20, 2023

This is the only time I’ve given unsolicited advice (or any advice for that matter) to @Ripple’s CEO & GC. Since you were sued only days before Christmas, I suggest you make this picture a postcard that reads

DON’T BLAME US

and send it to Clayton, Hinman and Gensler this X-mas! https://t.co/B7qLHBFq1O

— John E Deaton (@JohnEDeaton1) September 19, 2023

The post Mooners and Shakers: Bitcoin flat after Fed holds rates, but ImmutableX surges 35pc appeared first on Stockhead.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…