Precious Metals

Massive Rally Ahead for Bitcoin with Institutions Rushing in Just Prior to the 2024 Halving

It is very important to understand the major shifts happening in the economic system and in the cryptocurrency sector in particular. For the past several…

It is very important to understand the major shifts happening in the economic system and in the cryptocurrency sector in particular. For the past several years the biggest asset managers in the world called Bitcoin and all crypto rat poison, claimed it was only used for money laundering, etc. Now those very same people are suddenly rushing into the crypto sector and getting the infrastructure set up for a new financial system.

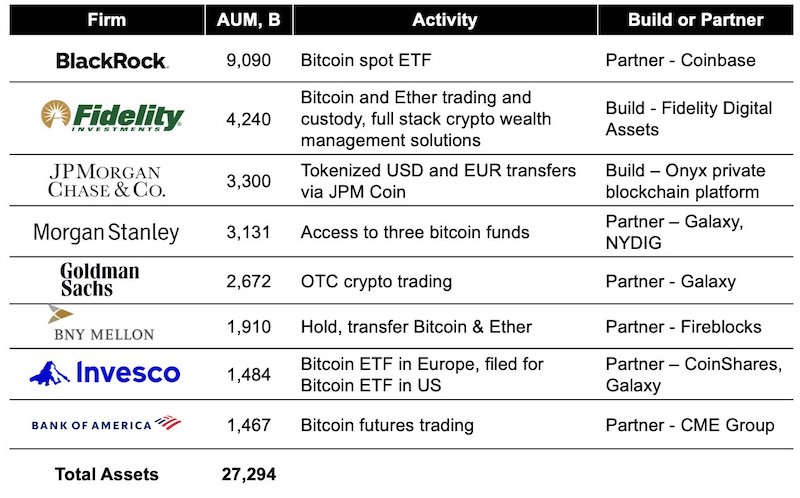

Between BlackRock, Fidelity, JPMorgan, and a handful of top financial institutions entering the space, we are talking about $27 trillion in assets under management that will soon be enabled to buy Bitcoin. This chart shows a quick summary but is not all inclusive.

In the past few weeks also, we also have Deutsche Bank launching crypto custody service, Citadel, Fidelity & Charles Schwab launch crypto exchange, Fidelity applying for a Bitcoin ETF, MicroStrategy buying another $347 million worth of Bitcoin, NASDAQ launching a crypto custody service, and Soros Fund Management doing an about face and stating “crypto is here to stay.”

Hong Kong’s biggest bank, the $1.3 trillion HSBC, now reportedly offers Bitcoin ETFs to clients. $5 trillion French asset manager CACEIS will also start to offer crypto custody services. The movement is global.

So we are likely to see institutions with well over $27 trillion in AUM start to offer crypto services of one kind or another. Bitcoin is just a $600 billion market cap asset today so this potential flood of new capital is around 50x the total market cap of Bitcoin or around 25x the total market cap of the entire cryptocurrency sector!

Yet, the supply of Bitcoin is capped at 21 million coins are they are tightly held by passionate investors. How tightly held?

“I got a call from Paul Tudor Jones and he says, “Do you know that when Bitcoin went from $17K to $3K that 86% of the people that owned it at $17,000, never sold it?”…So here’s something with a finite supply and 86% of the owners are religious zealots.” – Stanley Druckenmiller

In fact, over the past year roughly 70% of the entire Bitcoin supply has not moved.

According to Bloomberg, Cathie Wood’s ARK Bitcoin ETF may be in pole position to be approved after the application was amended to include a surveillance sharing agreement just like BlackRock’s. But this is not the only active Bitcoin ETF application. Others now include Blackrock, Valkyrie, Invesco, WisdomTree, BitWise and Fidelity. Of course, this does not guarantee approval, but increases the odds significantly. And importantly, we are talking about a spot Bitcoin ETF that buys and holds actual Bitcoin, with upward price momentum created from the new demand.

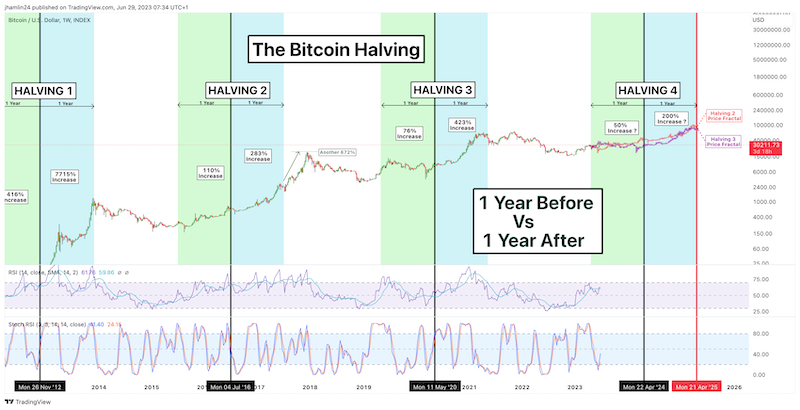

And if this all wasn’t bullish enough, Bitcoin is less than 10 months away from the next halving event. The next bitcoin halving is expected to occur inApril 2024, when the number of blocks hits 740,000. The block reward will decrease from 6.25 to 3.125 bitcoins. The Bitcoin inflation rate will drop from 1.7% to 0.84%. This will bring Bitcoin’s inflation rate under 1% for the first time and well below gold’s inflation rate of around 1.5%.

There is plenty of debate around what to expect from Bitcoin heading into the halving and whether it is priced in ahead of time or not. But looking back at the past halvings, we see that the price typically rallies in the year prior to the halving and then rallies even more strongly in the year following the halving. Of course, some of this will be priced in ahead of time and there are several other factors influencing the price. But we still can have a general expectation of the Bitcoin price trending higher going into and following the halving. This makes sense given that the rate of new supply gets cut in half.

The next 10 months is likely to be an accumulation phase with the Bitcoin price trending gradually higher before a more parabolic move in 2024. We typically add to our Bitcoin stack monthly in the Crypto Corner portfolio, while also adding on any major dips of 10% or more. I am a little cautious at the current time given that the Bitcoin price has roughly doubled in 8 months off the November 2022 lows around $15,000.

The RSI momentum indicator has been overbought for most of the past week and remains elevated at 65. The price made a slightly higher high in late June versus April and has bounced strongly off the 200-day EMA. As noted above, I think dollar-cost-averaging with purchases in regular intervals is a good strategy for most investors. And despite some caution in the near term, I am very bullish in the medium and long-term on Bitcoin and a handful of quality altcoins. I think a short period of consolidation or correction here is healthy for the bull cycle we have entered and would view any pullbacks as buying opportunities.

I expect the Bitcoin price to climb above $50,000 by the end of the year and well above $100,000 by the end of next year. Over the next 5 years, I would not be surprised to see Bitcoin reach $1 million per coin. For the market cap to match that of gold, Bitcoin would need to rise above $500,000 per coin. The late Hal Finney, who many believe was the creator or one of the creators of Bitcoin, once mused after the Genesis block that Bitcoin could one day be worth $10 million per coin.

Hal Finney wrote as part of what he termed an ‘amusing thought experiment,’

It’s interesting that the system can be configured to only allow a

certain maximum number of coins ever to be generated. I guess the

idea is that the amount of work needed to generate a new coin will

become more difficult as time goes on.One immediate problem with any new currency is how to value it. Even

ignoring the practical problem that virtually no one will accept it

at first, there is still a difficulty in coming up with a reasonable

argument in favor of a particular non-zero value for the coins.As an amusing thought experiment, imagine that Bitcoin is successful and

becomes the dominant payment system in use throughout the world. Then the

total value of the currency should be equal to the total value of all

the wealth in the world. Current estimates of total worldwide household

wealth that I have found range from $100 trillion to $300 trillion. With

20 million coins, that gives each coin a value of about $10 million.So the possibility of generating coins today with a few cents of compute

time may be quite a good bet, with a payoff of something like 100 million

to 1! Even if the odds of Bitcoin succeeding to this degree are slim,

are they really 100 million to one against? Something to think about…Hal

In today’s terms, it would be closer to $20 million per coin. Of course, that thought experiment depends on one thing: Hyperbitcoinization. This is the idea of the world running on Bitcoin. And it’s a big assumption. Yet with the world’s largest financial institutions suddenly rushing into the sector, maybe the odds aren’t as far-fetched as originally imagined.

Fast forward to today and we are seeing the largest asset manager in the world looking to launch a Bitcoin ETF to attract investors that have thus far been reluctant due to perceived risk of self-custody or lack of regulatory clarity. And I suspect it is only a matter of time before more governments start to buy and hold Bitcoin on their balance sheets. Just this week the North Carolina House passed a bill directing the state treasury to study the process of buying and holding Bitcoin. Countries that can print their own currency will be next and I think we will see a rush to the exits, with massive amounts of fiat money being created to accumulate as much Bitcoin as possible before other nations do the same. The race will be on and accelerate quickly once it gets going. When this occurs, it will be hard to keep the price from exploding higher.

In an encouraging development, a growing number of politicians and several Presidential candidates have come out in support of Bitcoin. Probably the most outspoken has been US Presidential candidate Robert F. Kennedy Jr.:

“Bitcoin is a bulwark against totalitarianism and the manipulation of our money supply. As president, I will make sure that your right to use and hold Bitcoin is inviolable. Bitcoin is not only a bulwark against totalitarianism and the manipulation of our money supply, it points the way toward a future in which government institutions are more transparent and more democratic.”

He also went on to say: “I oppose CBDCs because they are instruments of control and oppression.”

At Nicoya Research, we cover cryptocurrency investments with a monthly newsletter, model portfolio, trade alerts and a chat room where we are active daily (Mastermind Membership). Your subscription also includes a Guide to Crypto for Beginners and we have a long history of outperforming the broader markets. You can sign up here: https://nicoyaresearch.com/premium-services/crypto-corner/

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…