Precious Metals

Is the Fed done hiking? Markets think so, Powell doesn’t

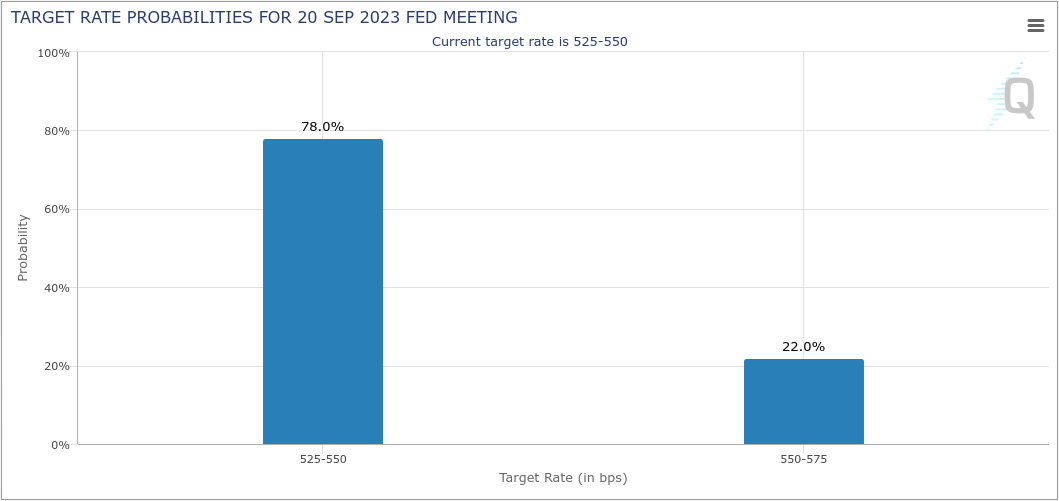

Market Expects No Further Hikes in 2023 According to the CME’s FedWatch tool, market participants now overwhelmingly expect that the Fed’s hikes for…

Market Expects No Further Hikes in 2023

According to the CME’s FedWatch tool, market participants now overwhelmingly expect that the Fed’s hikes for 2023 are over. There is currently a 78% probability of a pause in September, a 65.7% probability of a pause in November, and a 61.4% probability of a pause in December.

Interestingly, participants are also currently predicting a 6.7% chance of a 0.25% cut in December, a 27.2% chance of a 0.25% hike, and a 2.8% chance of a 0.5% hike. This is obviously subject to change, but it does provide a clue as to the confidence are seeing in terms of upcoming inflation data moving lower.

More Data to Come in

With no FOMC meeting in August, the Fed will have two further monthly employment and CPI reports to base their September decision on. Powell has left the door open both for the possibility of further hikes before the end of the year, but also for the prospect of leaving interest rates higher for longer, particularly with his 2025, 2% inflation forecast.

Having paused in the last meeting, July’s hike gives the Fed ample time to monitor financial conditions in the underlying economy for the impact of raising and maintaining US rates at two-decade highs.

August tends to be relatively quiet on the Fed front, but the next opportunity participants will have to gauge Powell’s sentiment will be at the Jackson Hole Symposium to be held between the 24th and 26th of August. Upcoming inflation and jobs data will be closely watched for signs of how well the Fed’s inflation battle is going. Weak jobs prints and inflation misses will see market expectations continue to drop for further rate hikes from the Fed.

S&P Closes Higher

The S&P 500 closed higher on the day, with S&P 500 futures also opening higher following the FOMC meeting. This has taken the US benchmark to its highest level since March of 2022. On the daily timeframe, that March 2022 peak at around 4630 is all that remains for the S&P’s 2021 all-time high to come into view.

On the weekly timeframe, however, this week’s performance so far has seen the S&P 500 actually breaking above that March 2022 high. Should this hold until the close on Sunday it could be significant.

With just 5% between the S&P and its former record high, and with the index just now straying into overbought territory, the question for investors now is whether there’s enough momentum for a last push to all-time highs, or whether the Fed’s last rate hike has effectively capped the gains in US equities, at least until the next meeting.

HYCM has recently expanded its own equities offering, including the world’s leading stocks available for investing commission free*, possibility to buy fractional shares as low as $10, and earn income from dividend-paying stocks.

While some traders are bullish on equities gold interest is also growing as lower rates, falling yields, and a softer dollar is a natural tailwind for gold. However, will those conditions last?

*Note: Commission free stocks are not available for trading under HYCM (Europe) Ltd and HYCM Capital Markets (UK) Limited. Other fees may apply such as withdraw fees, dormant account fees, swaps and spreads.

Disclaimer: The content of this article is sponsored and does not represent the opinions of LeapRate

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Cryptocurrencies are not available for trading under HYCM (Europe) Limited and HYCM Capital Markets (UK) Limited (retail clients only)

*Certain products & services mentioned herein may or may not be available to all clients depending on which HYCM Capital Markets Group entity their trading accounts(s) adheres to.

*Any opinions made in this material are personal to the author and do not reflect the opinion of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise.

The post Is the Fed done hiking? Markets think so, Powell doesn’t appeared first on LeapRate.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…