Precious Metals

Integra Resources releases first assay results from stockpile drill program

Integra Resources (ITR.V, ITRG) has released the first batch of results from the stockpile drill program which aims to test a portion of the 60 million…

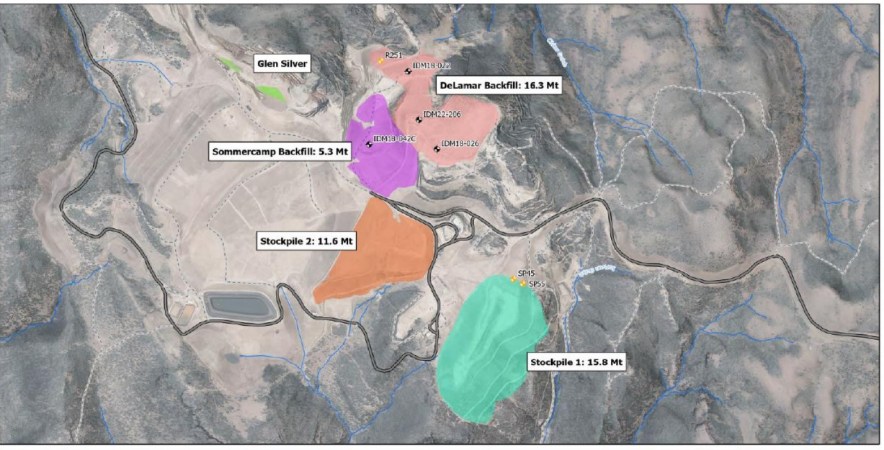

Integra Resources (ITR.V, ITRG) has released the first batch of results from the stockpile drill program which aims to test a portion of the 60 million tonnes of stockpiled and backfill material left behind by the previous operators of the DeLamar mine. In an ideal world, Integra would be able to add a substantial portion of that tonnage to the heap leach mine plan to boost the total amount of recoverable gold to in excess of 1 million ounces (currently 749,000 payable ounces of gold are included in the heap leach mine plan) and extend the mine life beyond 10 years. Integra has currently completed 2,500 meters of the planned 11,000 meters of drilling, and additional assay results will be released over the next few months. This should allow Integra to release an updated resource estimate in 2023 adding ounces to the existing leachable resources.

The first results are encouraging as the average grade of gold-equivalent grade meets the expectations and comes in at 0.3-0.6 g/t AuEq with numerous intervals having a gold-equivalent grade of in excess of 0.4 g/t AuEq.

That’s important, but keep in mind the recovery rate for the silver is quite low in the heap leach scenario. The initial gold recovery results from the recent drill program confirm the average gold recovery rate should be around 70-75% which is in line with the recovery rate used in the pre-feasibility study which was published earlier this year. The recovery rate for the silver was a bit all over the place with a recovery rate of 32% for the DeLamar silver and 47% for the Florida Mountain silver. If we would use an average recovery rate of 40% for the silver and 72% for the gold, the recoverable gold-equivalent grade of some of the reported intervals will look like this:

The table above contains the results from a back-of-the-envelope calculation based on assumptions and the 77.7 gold:silver ratio used by Integra Resources. We used a gold price of $1750/oz to calculate the rock value per tonne.

As we know the processing cost is $3.80 per tonne, the G&A costs are $0.60/tonne and the mining costs were estimated at $1.85/tonne, the total operating and processing cost should be in the $6.5-7 per tonne range. Throw in some transportation expenses of $1.5-2/t, and these stockpiles could likely be excavated, transported and processed for less than $10/t. Which means the highlighted results could be processed profitably at $1750 gold.

Disclosure: The author has a long position in Integra Resources. Integra is a sponsor of the website. Please read our disclaimer.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…