Precious Metals

Hey Joe, where you going with that gun in your hand?

Joseph Capurso CBA’s head of international and sustainable economics, backed as always by the quickest draw (er of graphs) economist … Read More

The…

Joseph Capurso CBA’s head of international and sustainable economics, backed as always by the quickest draw (er of graphs) economist and currency strategist Carol Kong, and of course the meanest average senior economist and senior currency strategist Kristina Clifton, just walked on into town with dark news and a clear intent to wake the place up.

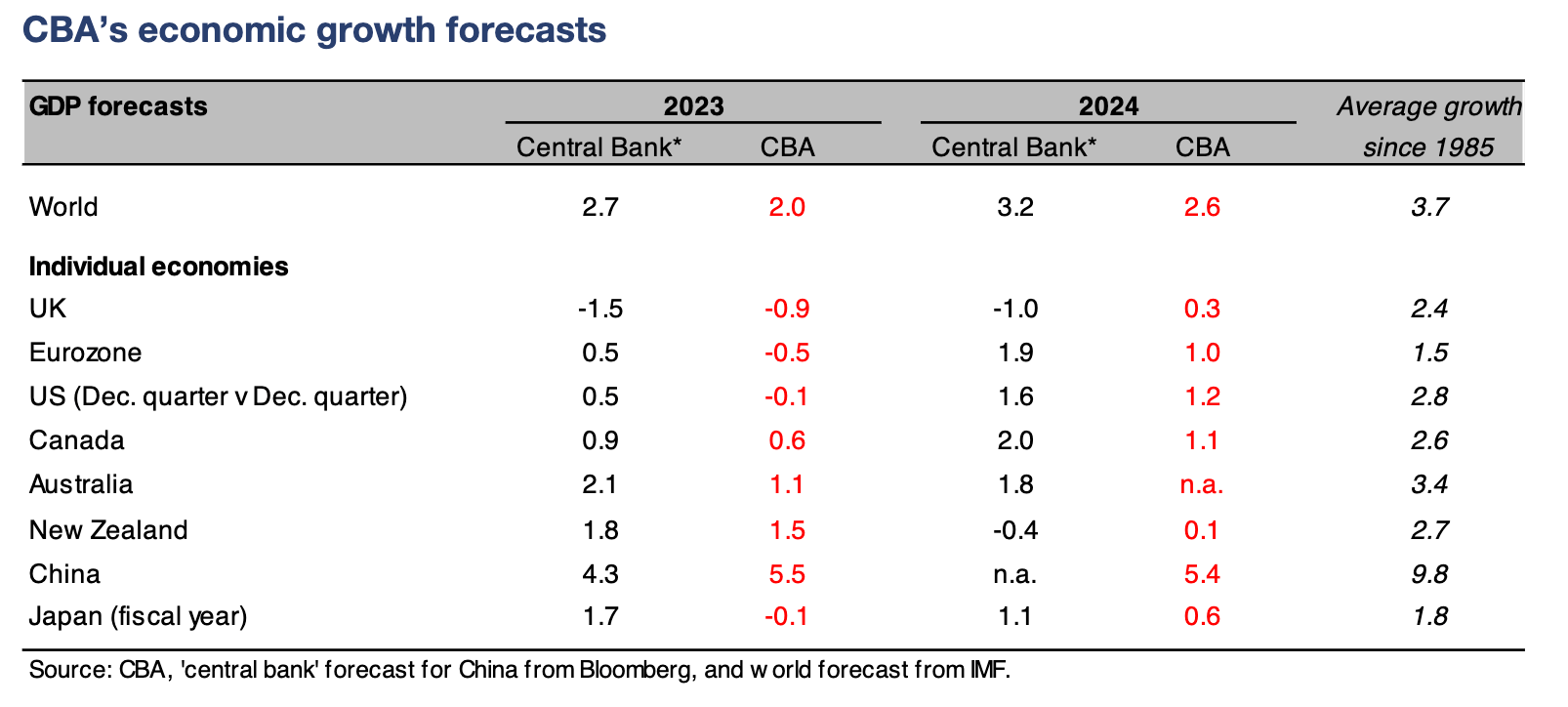

“We continue to predict recessions in many of the major advanced economies,” they were overheard saying at the Silver Dollar Saloon.

You’d better wake the Sheriff…

INT. Silver Dollar Saloon, Day. Friday, January 20

The piano player has stopped mid-Beethoven, mouth open.

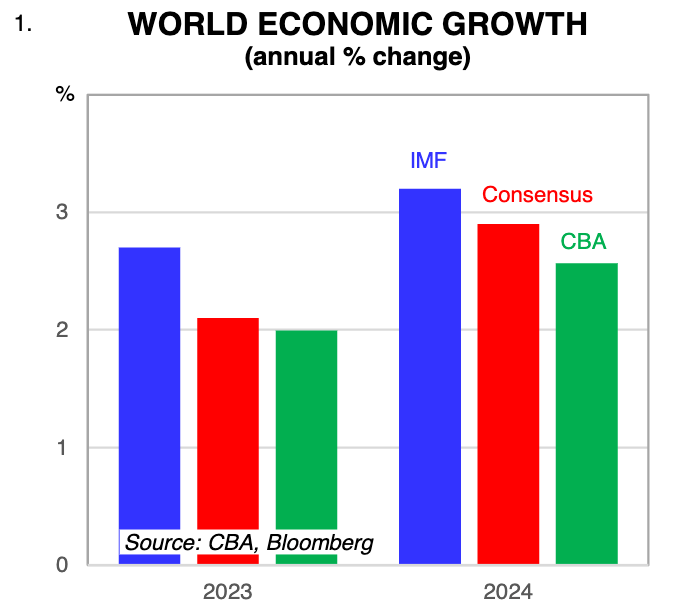

All eyes in the dusty Silver Dollar are on the trio at the bar and the graphic (Chart #1) which has appeared behind them:

Capurso:

(Throwing down whiskey, continues…)

The recessions reflect aggressive monetary policy tightening to bring down high inflation, and disruptions to energy supply.

Clifton:

(Throwing down whiskey, nodding)

We expect the recessions to be much shallower than during covid.

Kong:

(Throwing down whiskey, eyeing piano player)

The most important decision for central bankers this year will be to judge when to stop increasing policy interest rates. Lower inflation is not enough to stop increases in policy interest rates. (she suddenly slams her fist on the bar, making the barkeep drop the glass he’s been manically polishing) Central banks need to be confident inflation is on a path to sustainably returning to their target.

Clifton snatches the whiskey bottle. Kong kicks a small cat. Capurso leads them to a corner booth.

INT. Candlelit booth. Silver Dollar Saloon. Later.

Capurso:

(sotto voce:)

Higher unemployment will give central banks confidence wages growth will slow and help consumer inflation return to target. (He leans back)

So long as inflation continues to ease, we expect the central banks in the major advanced economies to stop tightening monetary policy by the middle of 2023.

Clifton:

(…spits in one of those spit buckets, spit bucket goes ding! Patrons jump. An unseen cat whimpers)

Some central banks may start cutting their policy interest rates at the end of this year. In our view, to cut interest rates central banks require the unemployment rate to increase too high and inflation to threaten to stabilise below target. (She suddenly turns to the silent room, the threat clear in her voice…)

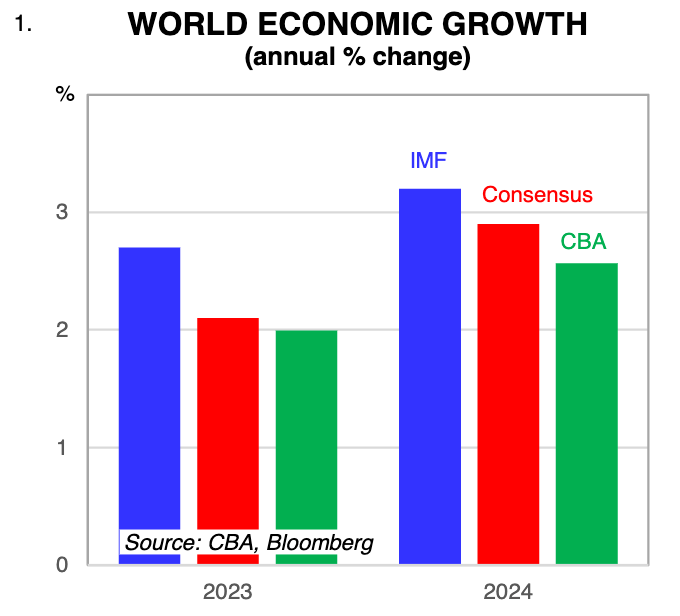

High interest rates increases the risk of a ‘financial accident’ in addition to recession. The sharp increase in yields on government bonds increases the risk of a ‘vicious cycle ‘forming between governments and the banks with high exposure to these government bonds.

The saloon gets the message: They make a show of business as usual – the music starts, gold diggers and saloon girls resume their chatter which is however, now low and nervous.

(Clifton returns to her co-conspirators…)

However, the risk is mainly in emerging markets AND… (she sighs, a little disdainfully…)

…AND some European economies – see Chart #2

(All three turn to look at Chart #2)

Silence. They drink.

Kong:

(Striking a match off the sole of her boot, lighting a giant cheroot, upon which she takes a long lung-full, leans back, blows smoke toward ceiling…)

We expect China’s economy to travel a different path to the major advanced economies. Headline and core inflation has been low, albeit until increasing recently. Policy interest rates have been cut. The economy will recover this year now that the covid zero policy has been dumped and macro and industry policy has been loosened.

There is a moment of unspoken agreement: ‘Then it’s settled.’ Capurso stands, the others also rise, Clifton kicking over a chair with real venom this time, for no apparent reason.

Kong, before she knows why, shoots a chandelier which crashes down on top of another cat.

Capurso never blinks. He surveys the crowd and addresses them directly in a strong but fiscally clear voice.

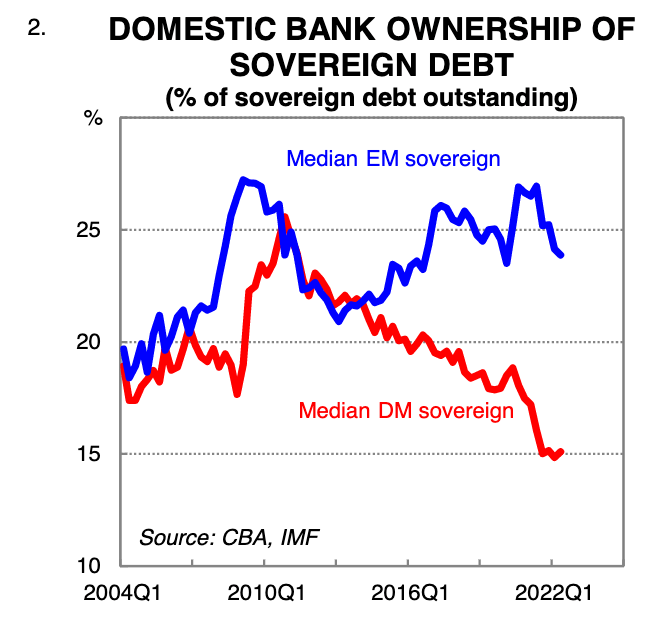

Capurso:

A recession in the US is more likely than not. We expect the US economy to contract by 0.1% in 2023. We expect a modest recovery in 2024 with growth of 1.2%. (silence as the floor digests this information). I suggest you all please take a look at Chart #3.

They all look as one at Chart #3.

…A lot of spitting in buckets and loosening of suddenly too tight collars.

Capurso:

He laughs grimly, (but not without some small hint of solidarity)

But… (He sighs)

The Saloon looks up, full of hope.

Capurso:

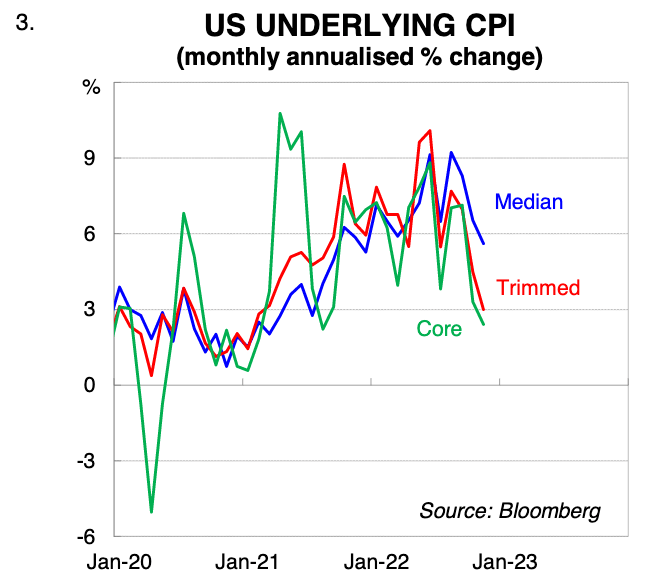

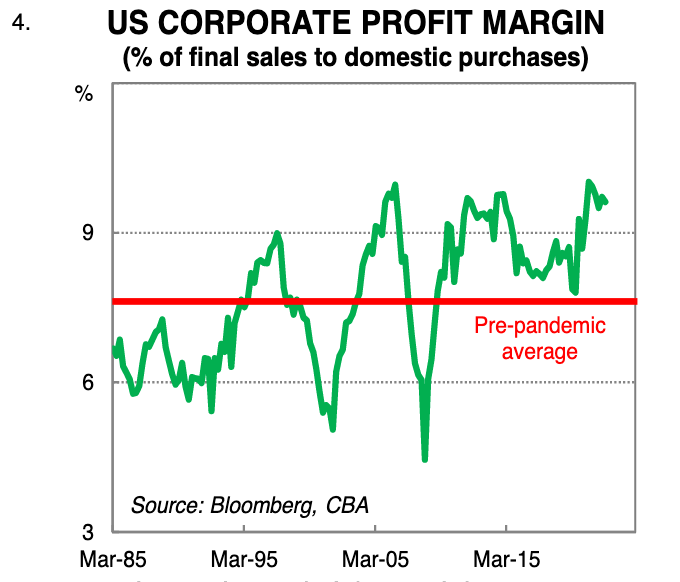

What if I were to say corporate profit margins also play a role in determining inflation outcomes?

The patrons look at one another.

You see, the very high US corporate profit margins are gradually easing and could be a disinflationary force. That’s right. And now kindly refer to chart 4. (He right hand waves the Colt.44 – which has somehow materialised, in the general direction of chart #4. They do so.)

After a moment, a few of the more grizzled patrons begin to nod their heads in agreement. There is a chorus of oohs and ahhs.

Capurso nods once. Holsters his sidearm. Puts on his 28 gallon hat. Looks at the others: ‘Our work here is done.’ They leave, but not before Clifton kicks over a TABLE this time.

Kong flips a silver US dollar – now worth less than when they entered – to the skinny publican. He snatches it out of the air, returns to cowering behind the bar, staring.

Kong:

She looks around one last time, and then with some menace to no one in particular:

And thanks for the cats.

They exit.

There is silence again. A cough.

Nothing to show the enormity of what’s just happened but for a few upturned chairs, a broken chandelier and two dead cats.

INT. Silver Saloon. Day.

Seconds later…

Sheriff CBA chief economist Gareth Aird bursts into the Silver Dollar desperately trying to buckle up his Buscadero holster.

The saloon watches his struggle for a few painful seconds until the thing is around his waist and he triumphantly pulls out his Colt 1849 Pocket, which flies out of his hand and lands in the chandelier.

Aird:

What? What’d they say??

The publican still too nervous to rise from behind his bar gestures toward Clifton’s over-turned table. Aird follows his gaze.

Aird:

(Understanding dawning in his voice…)

O.M.G. It’s worse than I thought…

Kristina Clifton’s Table:

The post Hey Joe, where you going with that gun in your hand? appeared first on Stockhead.

dollar

gold

silver

inflation

monetary

markets

policy

interest rates

us dollar

monetary policy

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…