Precious Metals

Africa! Where the #gold is Cheap…

The West African gold developers have been smashed over the last couple of years with the gold price in retreat…

Market Ructions: In gold we trust

Gold (figure 1) finished flat last week around US$1,797/ounce. Platinum was up 1% to close at US$1,022/ounce and palladium, after a big 10% fall a few weeks ago, closed up 3% to US$1,800/ounce. Silver (one of our picks for 2023) closed at US$23.42/ounce up 1.4% for the week.

WTI 71.51 was down 11% on the week on softening demand from China and the EU. The USD index traded in the range of 104.5-105.5, closing at 104.95, up 45 basis points for the week with 10-year treasuries finishing at 3.57% in anticipation of a 50-basis point rise mid-week (consensus 50 basis points). And the 2–3-year treasury inversion is now a whopping 86 basis point divergence.

The Dow was off 2.5% to 33,476 and the NASDAQ 4% to 11,005 while the VIX remains relatively subdued around 22.7.

I thought it would be interesting to see what the doomsday preppers are saying this week to give us a look into the new year, and importantly for the Stockhead Faithful, where to put our hard-earned dollars.

Gareth Soloway, co-founder and president of Verified Investing Education, points out something very important for those who haven’t seen a bear market (i.e., such as some of the millennials on my upcoming ski holiday in January). Given stubborn inflation, further quantitative easing is unlikely, so we are at the mercy of the economy from here.

As he pointed out in a recent interview with Kitco Metals (9 December 2022) since 2009, the US Federal Reserve has bailed everyone out with aggressive interest rate cuts and government stimuli. As Jerome Powell has reiterated on a number of occasions, he is not stopping until “the job is done”.

Given inflation, according to Soloway, is likely to remain high at +3% for a number of years, this is going to hurt the economy. In particular, wages inflation has been stubbornly high which, as the Stockhead luminaries all know, can’t all be passed on to consumers. The result – declining earnings and a falling stock market.

Drawing parallels (figure 2) with the period 1900-1930 (the roaring ’20s, followed by the Great Depression) which saw a move towards electricity and cars, Soloway believes the current cycle looks eerily similar (figure 3) and marks another step change; this time toward renewable energy and electric cars which should support the battery metals space for a while to come.

His prediction is for a retracement of the S&P to between 3,000 (bear case) and 3,300 (bull case) next year (figure 4). That is 15% downside on the optimistic case!

So where should we be placing our bets next year?

Soloway is steering away from technology stocks but sees plenty of growth in key South American economies such as Brazil. He also favours gold, which he is calling from current levels of just under US$1,800 (figure 4) to US$2,070/ounce (surpassing previous highs) and to a lesser extent silver, which he is calling from US$23/oz to US$28-US$30/oz. The Chinese government has certainly been busy adding 1Moz of gold to their coffers in November, taking their holdings to just under 64Moz according to SCMP (figure 5).

So, what does he see as the key drivers? A deteriorating labour market and a US recession.

He cautions investing in gold producers, however, which have borne the brunt of rising inflation. For the September Quarter, ASX listed gold miners reported all in sustaining costs (AISC) to $2,000/ounce, a quarterly rise of around 10%. So, as I outline in the next paragraph, exposure to gold developers, many of which are yet to recover from a broad sell down over 2021-2022, may represent an attractive re-entry back into the gold sector.

Another couple of Soloway’s calls included a bounce in oil from the mid to low US$70/bbl and a further 45% fall in Bitcoin (fear and greed to blame just for something different) before recovering to +US$100,000 in 2028.

Along with Donald Trump, I think WA should seriously consider granting him honorary citizenship.

Well, I have checked out a few of his earlier calls and he seems to be getting more right than wrong. He also has a “guru”-like air of confidence around him which could either lead us to the Promised Land… or to another “Jonestown”.

Last week, China announced 10 optimisation measures on their Covid-19 response which many believe marks a turning point in the county’s reopening and growth outlook. The news seem to spur on copper which finished the week at a five-month high of US$3.82/lb, up 3% for the week with the futures back in contango (figure 6).

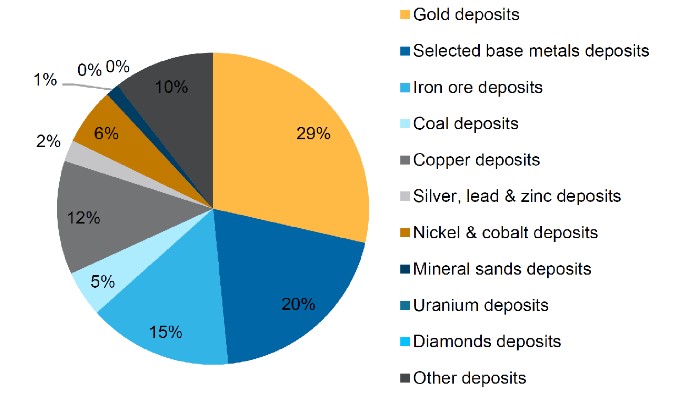

It appears the Australian resources sector is convinced about the metals thematic given the trend in mineral exploration. According to Macquarie Research (6 December 2022) exploration spending rose in the 3Q22 by 9% yoy to $1,084.9 million with metres drilled down by 16% to 3,049km. Expenditure is dominated by WA representing 64% of the total spend in Australia.

3Q expenditure (figure 7) was broken down as follows: gold -8% yoy (12m to 3Q22 -2% yoy), select base metals +13% (+31%), copper +2% (+29%), nickel & cobalt +29% (+32%), silver lead and zinc +50% (+41%), iron ore +15% (+25%) and coal -4% (-2%).

Market conditions in both Canada and Australia for junior resource companies however have remained challenging as the drop in capital raisings (figure 8) shows.

Figure 9: TBR 2-year price chart (Source: CMC Markets, 12 December 2022).

Figure 9: TBR 2-year price chart (Source: CMC Markets, 12 December 2022).First, I have to thank the Stockhead faithful for accumulating Tribune Resources (ASX: TBR) (figure 9) over the last few weeks which has seen the stock move from $3.30 to $4.18 at last close. I think we should see +$5.00/share 1Q next year which is around the value of its gold holdings and still values its East Kundana (2.4Moz gold JORC Resource), Philippine Gold Project (1Moz gold NON-JORC Resource) and Japa Project (1.81Moz gold JORC Resource) at zero.

Maybe you could buy your better half some TBR shares for Christmas and wrap them up? I am sure Homer Simpson would approve…

Staying on the gold theme and taking into consideration the comments of our Doomsday prepper Soloway (i.e., to consider avoiding gold producers for the time being) it might be time to look at some advanced explorers/developers.

The West African gold developers have been smashed over the last couple of years with the gold price in retreat and the exchange rate heading in the wrong direction. I am going to roll out two ideas; namely Turaco Gold (ASX: TCA) and Chesser Resources (ASX: CHZ).

I mentioned Chesser earlier this year and I think the mention of the South Australian component must have been the reason for the share price decline so I will revisit this at a later point.

Turaco (figure 10) holds around 7,600km2 in Cote d’Ivoire within the prospective Birimian greenstone terrain (figure 11). The main interest centres around the Eburnea Gold Project (central Cote d’Ivoire) and three advanced projects in northern Cote d’Ivoire (figure 11).

The company is led by Perth-based managing director Justin Tremain, formerly a regular visitor to NextGeneration Gym and now a regular visitor to the home fridge (not the fruit and veg section) according to rumours on the terrace.

It appears Turaco has been holding off delineating JORC Resources until the sentiment towards gold explorers (particular ASX listed African explorers) improves. A number of projects are likely to deliver some substantial resources in the near term including Eburnea Project (90-10% owned) which is returning promising intersections including 12m @ 3.8g/t gold from 24m down hole and is situated along strike from Endeavour’s 2.5Moz Fetekro Project.

Other prospects include Boundali (89% owned), covering over 570km2 and the Ferke Gold Project (earning 89%) covering 300km2 where a 16-kilometre gold trend has been outlined. These projects are all returning impressive drill results.

Watch out for a maiden resource early to mid-2023 and a re-rating of the company. A logical first step would be 12 cents where they undertook their 84 million share placement for $10 million in November last year.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

The post Guy on Rocks: Africa! Where the gold is cheap, chunky… and due for a re-rate appeared first on Stockhead.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…