Precious Metals

Gold Still Looks Pricey Based On A “Fair Value” Model

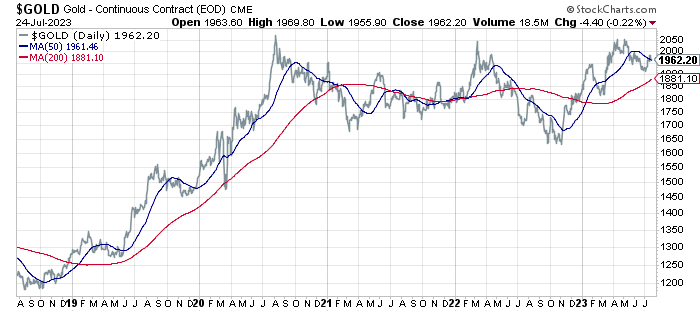

The price of the world’s favorite precious metal remains near its upper range of the past three years, but for gold bulls this is disappointing. The…

The price of the world’s favorite precious metal remains near its upper range of the past three years, but for gold bulls this is disappointing. The surge of inflation in the wake of the pandemic should have by now pushed the price much higher than the current $1962 per ounce, its more zealous supporters complain. But while inflation is, or at least, can be a factor in gold’s price, real (inflation-adjusted) interest rates and the US dollar tend to dominate pricing. By that reasoning, the spike in real rates in recent years explains a lot. No wonder, then, that CapitalSpectator.com’s “fair value” gold model, which uses the greenback and real rates, still advises that the precious metal’s valuation is lofty.

Gold bugs may be inclined to disagree. After all, the metal’s price has been range-bound in recent years and recently made another (failed) attempt at breaking decisively above the $2000-plus ceiling.

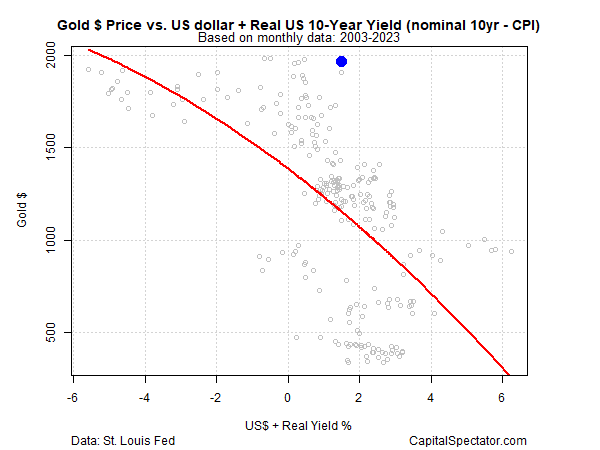

Disappointing if you bought into the narrative the last year’s inflation surge would drive gold to $3,000-$5,000, as some of the metal’s most enthusiastic supporters predicted. But our fair value model throws cold water on that idea. Echoing the analysis published in May, today’s update continues to suggest the gold’s current price remains well above the estimate implied by current levels of the US dollar and real rates.

Using the 10-year inflation indexed Treasury (TIPS) as a proxy for the real yield with a measure of the US dollar suggests that the near-$2000-an-ounce price for gold is significantly overvalued… still.

Running the numbers using monthly data (as opposed to daily in the chart above), and replacing the TIPS yield with the nominal 10-year Treasury rate less the year-over-year change in the Consumer Price Index (CPI) tells a similar story. (Current data is shown by the blue dot in the chart below.)

Why should real rates and the dollar be such dominant forces for estimating gold’s fair value? The empirical record for one. Gold tends to trade inversely against those two factors with a fair amount of regularity. Why? Competition for scarce investor resources is probably the best answer. Gold yields no payout and so there’s an opportunity cost to holding it vs. cash, bonds, stocks and real estate. When real rates are low or negative, the opportunity cost fades, or goes away entirely. But real rates (based on TIPS) are relatively high, near the highest in well over a decade. Ergo, a “safe” inflation hedge is available. That’s tough competition for gold. An added headwind for gold: the Federal Reserve, although it was slow out of the gate, appears to be getting ahead of the curve in taming inflation.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…