Precious Metals

Gold Industry Review: Is 2023 Set to be Gold’s Time to Shine?

With the global economy in a bit of a state of flux, thoughts turn to the future…

Industry Review: With the global economy in a bit of a state of flux, thoughts turn to the future as investors think about where the right balance of risk and reward might lie. The 2023 Gold Industry Review may provide some insights.

There are a number of factors driving markets worldwide at the moment that are adding to produce far more volatility than many investors really have the appetite for – inflationary pressures in the US and global conflict are just two that have brought pressure on markets.

To help sort out what the gold landscape is looking like for 2023, Reach Markets has compiled a comprehensive Gold Industry Review that mines the knowledge of industry leaders, including three resource-focused fund managers, a gold miner and a research company, to provide greater insight into the outlook for gold, what factors will drive gold and what types of gold stocks these experts are investing in.

With the price of gold driven by a variety of variables – many outside of the usual supply and demand factors involved in commodity analysis – inflation, interest rates, geopolitical risk and macroeconomic uncertainty are all currently playing a strong role in determining prices.

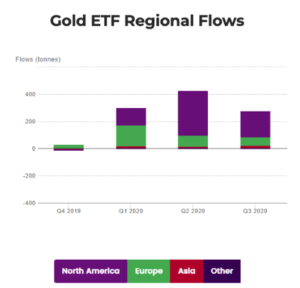

Sentiment is a crucially important indicator, and carefully watching the inflows and outflows of gold ETFs can give investors a good indication of what the market is expecting.

Ultimately, while short-term volatility is critical to consider, the research points to a bullish outlook for gold.

Asking the real experts

The Gold Industry Review, designed to help investors better understand the current state of play and the potential opportunity with investing in gold, features expert analysis from Terra Capital’s Matt Langsford, Lowell Resources Fund’s John Forwood, Triple Eight Capital’s Roscoe Widdup, Pilar Gold’s Jeremy Gray, and Banyantree Investment Group’s Zach Riaz.

In order for Reach to compile this comprehensive and in-depth overview, they formulated and addressed a range of key questions surrounding the precious metal, including:

- What drove gold prices to historical highs?

- Is gold a sometimes safe haven or an always hedge for equity investors?

- What are the main drivers of gold demand?

- What is the forecasted demand of gold?

- What is the world’s gold supply capacity?

- What is the forecasted supply of gold?

- What are the current valuations of gold producers, and how do they compare to the past?

- How have these valuation disparities translated to explorers in the current market?

- Is gold the only true precious metal, in the sense that its demand is not driven by industrial uses like other precious metals such as platinum and palladium?

What’s been driving gold prices and movement?

There are a variety of variables that drive the price of gold, many outside of the usual supply and demand factors involved in commodity analysis. Inflation, interest rates, geopolitical risk and macroeconomic uncertainty all play a strong role in determining the gold price.

Sentiment is a crucially important indicator, and carefully watching the inflows and outflows of gold exchange-traded funds (ETFs) can give investors a good indication of what the market is expecting.

When gold hit a new all-time high in August 2020, it was due to a culmination of all of these variables at once. The US dollar, which is also a rival safe haven asset, was weakened by the havoc COVID-19 wreaked on the economy. Central banks started slashing interest rates, US-China trade tensions were heating up, bonds were barely producing a yield and equity markets were volatile.

As shown in the chart below, money flowed (demand shown by tonnage) into gold ETFs at an incredible pace:

At the same time, as shown in the chart below, the US dollar was taking a beating, leaving gold as the only option for safety:

However, the aversion to risk exhibited by investors was short lived, and outflows from gold flooded the market as equities began a bull run that would last until early this year. The trillions in pandemic government stimulus and central bank interventions from around the world had worked – a bit too well.

There were two quarters of high volume outflows followed by three quarters of lower volume activity. But the cheap money wouldn’t last, and right after the Russian invasion of Ukraine rocked equity markets, the very real and now persistent beast that is inflation revealed itself.

A permanent portfolio hedge, just a safe haven…or neither?

An important question for an investor who considers adding a new asset to their portfolio is how this asset will behave relative to the rest of the portfolio and what its effect will be on overall performance.

Modern portfolio theory suggests that assets with a low (or even negative) correlation to the rest of a portfolio can improve performance by reducing the volatility of the overall portfolio. If a negative correlation lasts over time, such an asset is called a ‘hedge’.

If it only exists in times of crisis, the asset is referred to as a ‘safe haven’.

As we near the end of a turbulent year in markets, many investors may be questioning gold’s ability to serve as either – after all, its price decreased from its March 2022 high along with most risky assets.

A University of York study found that the average correlation between gold and US equities was -0.0475, a low correlation that warrants hedge status. In fact, the same study compared gold to stocks and bonds from the US, UK and Germany – finding that the average relationship with gold was between -0.18 and 0.1.

The low correlation of gold between markets was also proven during the 1987 crash and the 1997 Asian crisis highlighting gold’s special role as a ‘safe haven’ when things get tough and therefore a valuable part in a portfolio.

Ultimately, it was determined that gold is both a hedge and a haven because while a portfolio does benefit from gold exposure during a market crash, it also benefits in a remarkably similar way during average times. Despite it not acting differently during the crash, it still technically fit the criteria of a haven.

Reach went one step further and posed a host of critical and topical questions to the aforementioned industry leaders for their insider’s perspective, including:

- What drove the gold price to its 2022 high, and what has kept it subdued since?

- What will be the drivers of the gold price in 2023 and what is your outlook?

- The GDX reported a 19.7% year-on-year rise in the All-In-Sustaining-Cost (AISC) of its top 25 gold producers, averaging US$1281/oz for Q2 CY22. How much further do you see these costs blowing out?

- What do you think this will do to the price of gold, and how much of gold’s value do you believe is underwritten by the cost to mine it?

- What type of movements are you expecting to see in explorers if the gold price moves up, given the potential for lower small cap liquidity in this market?

- What are the best ways to invest in gold in this environment? For example, bullion, producers, explorers, royalties?

- When do you see the US dollar weakening?

What will be the drivers of the gold price in 2023 and what is your outlook?

“The US dollar is at 20-year highs and real yields have experienced their fastest rise on record” – Roscoe Widdup

Roscoe Widdup, Co-Chief Investment Officer and Managing Director of T8 Capital believes it was fear and uncertainty (the war in Ukraine and rising inflation) that drove gold to its 2022 high. He shares some valuable insights on what has kept it subdued since:

“Gold’s two sworn enemies are the US dollar and real yields on US treasuries. Entering 2022, the real yield on a 10 year US treasury was negative 1%. Fast forward to recent times, and the real yield on that same US treasury is positive 1.4%. The commentators are calling that shift the fastest on record.”

He asserts that because gold doesn’t have a yield, a change in real yields (the opportunity cost) is a serious factor. Real yields falling is a great tailwind for gold, but real yields rising to that degree is an enormous headwind. Roscoe then commented on the US dollar, stating that:

“The US dollar at 20-year highs based on the trade-weighted US dollar index which started the year at 95 points, and today (11/11/22) it is 108, having touched 114. This magnitude of US dollar strength has been a major headwind for gold bullion. Despite all of these headwinds, gold bullion has outperformed all major asset classes (bonds and equities) during 2022.”

Lowell Resources Fund Chief Investment Officer John Forwood shares similar views, stating that negative real US interest rates are a powerful driver of gold prices, and this spurred on the precious metal earlier in the year.

What are the best ways to invest in gold in this environment?

“Ultimately, if you think the market (gold price) is going to go up, you’ve got to buy every high cost producer there is, and forget about the low cost producers.” – Jeremy Gray

There are a number of ways to gain exposure to gold, and each alternative has its own risks, opportunities and requires different experience. Buying the commodity outright, for example through bullion or an ETF, is considered the most straight-forward and ‘traditional’ method, while shares in explorers, producers and royalty companies are driven by very different dynamics.

Junior explorers have far larger risks around discovery and the ability to finance their exploration journey, while producers’ values are more driven by their gross margin between their production cost and the price at which they sell their product, in combination with the life of the mine.

Modern portfolio theory has been widely implemented because it is a practical method for selecting investments in order to maximise overall returns with an acceptable level of risk.

Roscoe Widdup believes that there is greater upside in gold producers (rather than gold bullion) in an upward trending gold bullion price environment..

The former Goldman Sachs mining and metals investment manager has an interesting way of breaking it down:

“Gold bullion and gold producers are very different segments within the gold asset class. A producer has natural leverage to the gold bullion price via its operating margin and reserve ounces. So, what does that mean? If the gold bullion price goes up by one unit, the gold producer goes up by two units (based on the typical gold producer beta to gold bullion of 2-2.5).”

The old tale of commodities’ power to generate exponential returns certainly rings true.

“It doesn’t stop there. Within liquid institutional-grade gold producers, you have senior producers, royalty companies, mid caps and industrial metal byproduct intensive gold producers.

All four of these segments play quite different tunes through different market environments and cycles and this provides a portfolio manager with considerable optionality.”

To read the full review including expert commentary on the drivers of gold price, outlook and the best way to invest in gold, click here.

This article was developed in collaboration with Reach Markets, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Gold Industry Review: Is 2023 set to be gold’s time to shine? appeared first on Stockhead.

dollar gold inflation commodities commodity markets reserve metals mining interest rates central bank correlation us dollar inflationary palladium

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…