Precious Metals

Global Precious Metals MMI: Prices Rally, Downturn Likely

The Global Precious Metals MMI (Monthly MetalMiner Index) traded upwards by 3% as precious metal prices advanced. Gold, silver, and palladium all began…

The Global Precious Metals MMI (Monthly MetalMiner Index) traded upwards by 3% as precious metal prices advanced. Gold, silver, and palladium all began a rally coming into 2023. However, that rally has solid potential for both a short and long-term downturn. The surge in the index price was mainly due to silver and gold bullions rising more steeply than palladium, which was the only outlier. After dropping steadily since November of 2022, it currently shows signs of turning upward. But with recession fears building once again, investors continue to turn to precious metal investments.

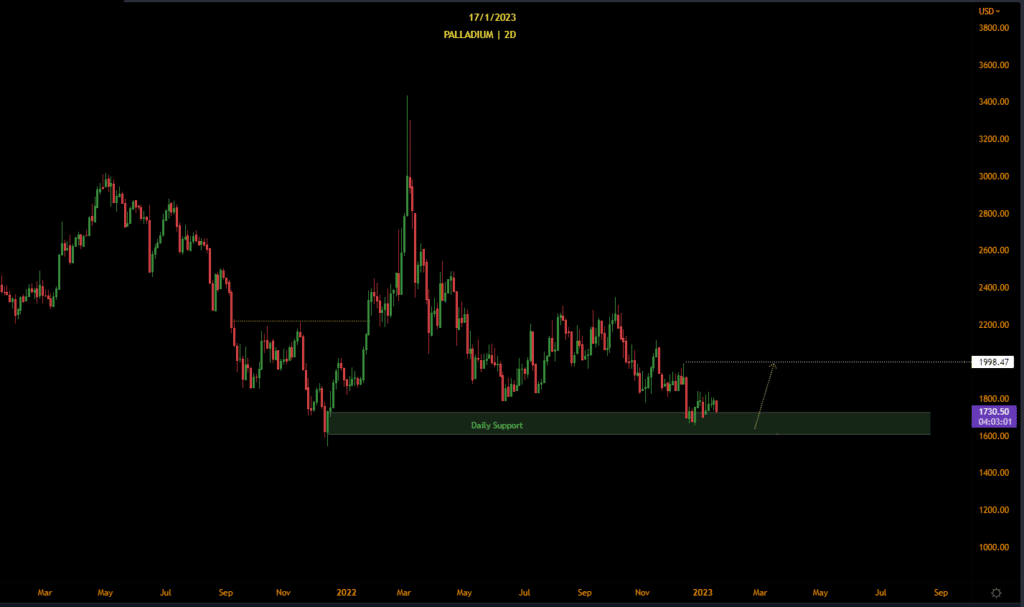

Precious Metal Prices: Palladium

Palladium’s trend changed entering November 2022, as prices broke through short-term resistance. Strong rallies are typically formed by a number of thresholds, and daily support is one of them. Therefore, it seems possible prices could reverse to the upside and seek relief by moving back toward the $2,000 level.

Stay on top of all the latest precious metal trends with MetalMiner’s monthly MMI Report. Sign up here to receive it FREE of charge.

Platinum Could Turn Upward

Platinum began to form a resistance zone when prices broke down and created new highs in March 2022. Like other precious metal prices, platinum fell and rose multiple times over the remainder of 2022. This generated a lot of market volatility. And as platinum reaches resistance zones, prices remain susceptible to downturn risks.

Precious Metal Prices: Silver

Once silver price action began to show displacement to the downside (meaning strong declines), it broke through the prior lows established back in March of 2022. This signaled to many that the index was forming a long-term resistance.

In November 2022, prices began to show short-term bullish strength. However, buyers should remain wary. Considering where resistance currently sits, prices are still subject to an overall decline in the long term. A strong break above the April 2022 resistance would likely create a new trend.

Get updates on precious metal prices and other commodity news with MetalMiner’s free weekly newsletter. Click here.

Gold Prices Projected to Turn Downward

In May 2022, price action shattered short-term support levels, creating a solid downtrend. This put seller resistance in an excellent position to pressure bullish rallies like the ones we’re currently seeing.

The downtrend broke in November 2022, which established a new short-term trend. This included a strong rally right up to long-term resistance levels. That said, a short-term bearish reaction could still occur. Indeed, a reversal isn’t out of the question, given long-term resistance pressure.

Global Precious Metals MMI: Notable Price Trends

- US gold bullions increased slightly by 2.64%, leaving prices at $1,815.40 per ounce.

- US silver ingots rose in price. The index increased by 7.66%. Prices hit $23.88 per ounce.

- Indian gold bullions rose in price by 7.89%. Prices hit $661.18 per 10 grams.

- Lastly, US palladium bars dropped in price by 2.78%. Prices month-over-month hit $1,748 per ounce.

All the precious metals intelligence you need in one user-friendly platform with unlimited usage – Request a MetalMiner Insights platform demo.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…