Precious Metals

Fed-Hawk Quadruple-Whammy Sends Stocks, Bonds, & Gold Lower

Fed-Hawk Quadruple-Whammy Sends Stocks, Bonds, & Gold Lower

After a long weekend, China set the market narrative with almost unprecedented…

Fed-Hawk Quadruple-Whammy Sends Stocks, Bonds, & Gold Lower

After a long weekend, China set the market narrative with almost unprecedented scenes of dissent from the communist nation raising fears of more protracted and widespread lockdowns crushing global demand even more.

Then a triple whammy wave of hawktard-ism from The Fed’s Mester, Williams, and Bullard sparked the beginning of the selling pressure…

-

0950ET *MESTER SAYS SHE DOESN’T THINK FED NEAR A PAUSE IN TIGHTENING, NEED TO SEE SEVERAL MORE GOOD INFLATION READINGS

-

1200ET *WILLIAMS SAYS FED STILL HAS MORE WORK TO DO ON INFLATION, FURTHER TIGHTENING SHOULD HELP REDUCE INFLATION

-

1200ET *BULLARD: RISK THAT FED WILL HAVE TO GO HIGHER ON RATES IN 2023, MARKETS UNDERPRICING RISK FOMC MAY BE MORE AGGRESSIVE, FED HAS `A WAYS TO GO TO GET TO’ RESTRICTIVE RATES, FIRST 250 BPS OF TIGHTENING WAS JUST GETTING TO NEUTRAL, TIME TO LET QT PROGRAM RUN FOR NOW; SO FAR, SO GOOD

Then late in the day Fed Vice Chair Brainard made it a quorum of hawks (bear in mind that her presentation was an updated version of June 24 comments made by Brainard during a Bank for International Settlements conference in Basel, Switzerland)…

“In the presence of a protracted series of supply shocks and high inflation, it is important for monetary policy to take a risk-management posture to avoid the risk of inflation expectations drifting above target,” Brainard said in remarks released Monday.

“A drawn-out sequence of adverse supply shocks that has the cumulative effect of constraining potential output for an extended period is likely to call for monetary policy tightening to restore balance between demand and supply.”

Putting it all together, they reset the narrative… there’s no imminent pause and definitely no pivot…

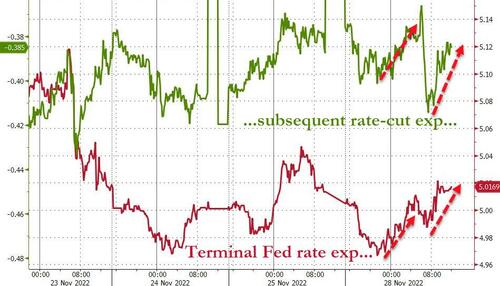

The STIRs market took that and ran with it – hawkishly adjusting the terminal rate expectations back above 5.00% and lowering expectations of subsequent rate cuts…

Source: Bloomberg

The cash equity open provided a brief buying panic respite from overnight weakness but The Feds sent it all lower as the market began to realize that a pivot is not coming anytime soon. Small Caps were the day’s laggard with the S&P, Nasdaq, and Dow all grouped around a loss of 1.5% or so on the day…

Big drop in ‘most shorted’ stocks today…

Source: Bloomberg

Treasuries were bid overnight as China sparked global growth scares but once Europe opened, bond yields started to rise ending higher on the day with the short-end underperforming…

Source: Bloomberg

The dollar saw a huge intraday swing today with overnight weakness reversing hard and filling the gap to pre-Thanksgiving data dump…

Source: Bloomberg

Cryptos were all lower from Friday’s close after tanking in the early Asia session last night…

Source: Bloomberg

Bitcoin found support at $16,000…

Source: Bloomberg

What was odd was the reversal in Oil as it dived overnight on the same China demand threat as the rest of the world’s risk markets, but reversed during the day on comments from Eurasia Group that OPEC might be discussing more production cuts… not hikes…

Gold roller-coastered wildly too – rallying up to $1178 (futs) before diving back to $1753…

Finally, will this third pause/pivot surge end the same way as the last two…

Source: Bloomberg

Do you feel lucky?

Tyler Durden

Mon, 11/28/2022 – 16:00

dollar

gold

inflation

monetary

markets

policy

fed

monetary policy

nasdaq

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…