Precious Metals

B2Gold To Acquire Sabina Gold In $1.1 Billion All-Stock Deal

Consolidation within the gold sector continues, with B2Gold (TSX: BTO) this morning revealing it has reached a definitive agreement to

The post B2Gold…

Consolidation within the gold sector continues, with B2Gold (TSX: BTO) this morning revealing it has reached a definitive agreement to acquire Sabina Gold & Silver Corp (TSX: SBB) in an all-share transaction.

The deal will see B2Gold acquire the firm at a rate of 0.3867 of a B2Gold share for each Sabina share held, equating to a per-share value of $1.87. Overall, the exchange rate values Sabina at roughly $1.1 billion, representing a 45% premium to the 20-day volume weighted average price of the firm. The premium however is just 18% based on Friday’s close of $1.58.

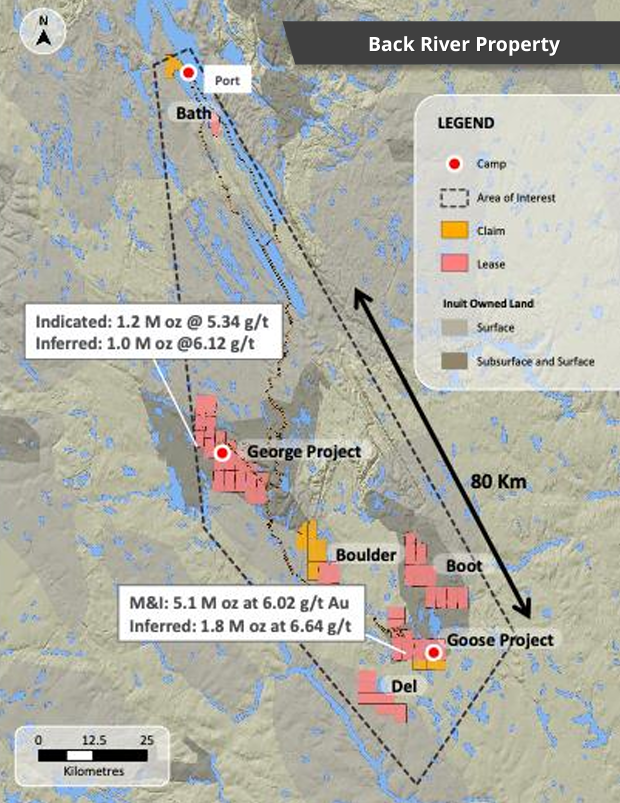

The purchase of Sabina will bring the firms Back River Gold district in Nunavut, Canada to that of B2Gold, which it wholly owns. A 2021 feasibility study indicates the flagship Goose project is capable of producing 223,000 ounces of gold per year over a 15-year mine life, with current mineral reserves amount to 3.6 million ounces at 5.97 g/t gold. Cash costs are estimated at US$679 per ounce, with all in sustaining costs pegged at US$775 per ounce.

Pre-stripping of the project has already begun, and 97% of procurement for the project is said to have already been completed.

Untapped exploration potential is said to exist elsewhere at Back River, with five current known deposits along an 80 kilometre belt remaining open and providing potential for mine life extension.

“B2Gold has strong construction expertise and experience to successfully develop the fully permitted Goose project and unlock considerable value for the shareholders of both Sabina and B2Gold. The Back River Gold District has multiple high-potential mineralized zones which remain open, and we are confident that the district has strong untapped upside with numerous avenues for resource growth,” commented B2Gold CEO Clive Johnson on the transaction.

The deal remains subject to shareholder approval, with a special meeting slated to occur in April 2023. The transaction is currently slated to close in Q2 2023, pending customary approvals.

B2Gold last traded at $4.83 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

The post B2Gold To Acquire Sabina Gold In $1.1 Billion All-Stock Deal appeared first on the deep dive.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…