Precious Metals

A Market That’s Intensely Relaxed About Inflation

A Market That’s Intensely Relaxed About Inflation

Authored by Simon White, Bloomberg macro strategist,

Inflation that’s primed to re-accelerate…

A Market That’s Intensely Relaxed About Inflation

Authored by Simon White, Bloomberg macro strategist,

Inflation that’s primed to re-accelerate later in the year will trigger a reversal in underperforming hedges.

Around October last year, four months after US CPI peaked, the market began to trade as if it was no longer a concern. The headline figure was still running at over 7%, but the market exorcised its inflation demons and embraced a future where price growth would soon return to the previous, low-and-stable regime.

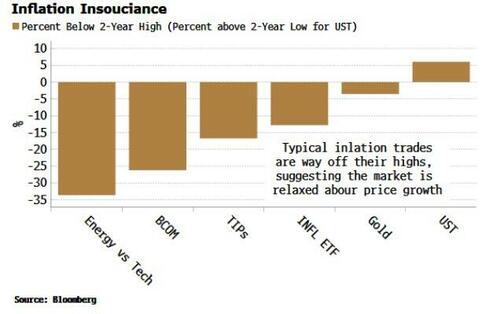

Inflation trades, such as TIPS and energy versus tech, which were performing well, are now considerably off their recent highs.

Gold is the exception, at only a few percent off its record high. Adherents to the precious metal would tell you that gold is sensing something that less clairvoyant assets are not. Perhaps. But whether gold is omniscient or not, there are strong reasons to believe the market’s lack of inflation concern may be misguided.

One of which is M2. Most analysis points to M2 growth’s recent collapse, and that the fact it is now contracting for the first time ever. Therefore this must be a strong disinflationary tailwind, with some even calling for outright deflation.

But this is a misunderstanding of different money aggregates. While M1 is cyclical, M2 is typically counter-cyclical. It rose in September 2008 when Lehman collapsed. If you thought this was a sign of impending animal spirits and an imminent upturn in activity, you would have got a savagely rude awakening.

It rose as money was swept from current accounts to savings accounts, as no-one had any intention of spending it until economic stability was restored.

Thus it is the savings deposits component of M2 that matters for inflation, with rises in deposits preceding falls in inflation, and vice-versa.

The continued decline in savings deposits today suggests that median inflation is likely to remain elevated.

This will limit how far headline inflation can fall before cyclical forces cause it to start rising again. This is when the market may become slightly less relaxed about price growth, and inflation trades will be back in vogue.

Tyler Durden

Fri, 05/19/2023 – 12:05

gold

inflation

deflation

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…