Energy & Critical Metals

Tier 1 Development: Scoping study demonstrates ‘world class potential’ of Lithium Energy’s $6.2bn Solaroz Lithium brine project

Special Report: Lithium Energy’s Solaroz lithium brine project comes is expected to take just 2-2.5 years to pay back development … Read More

The post…

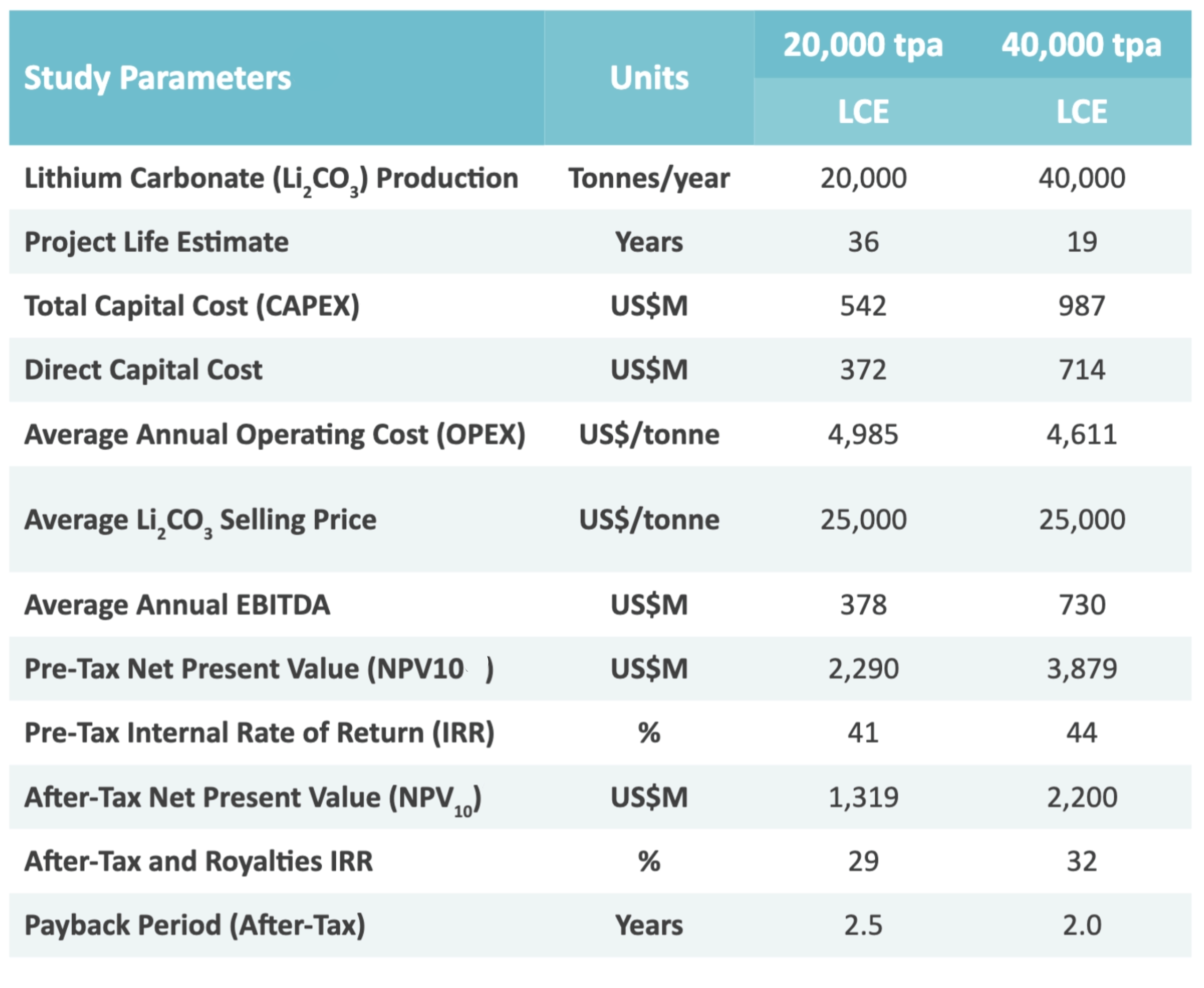

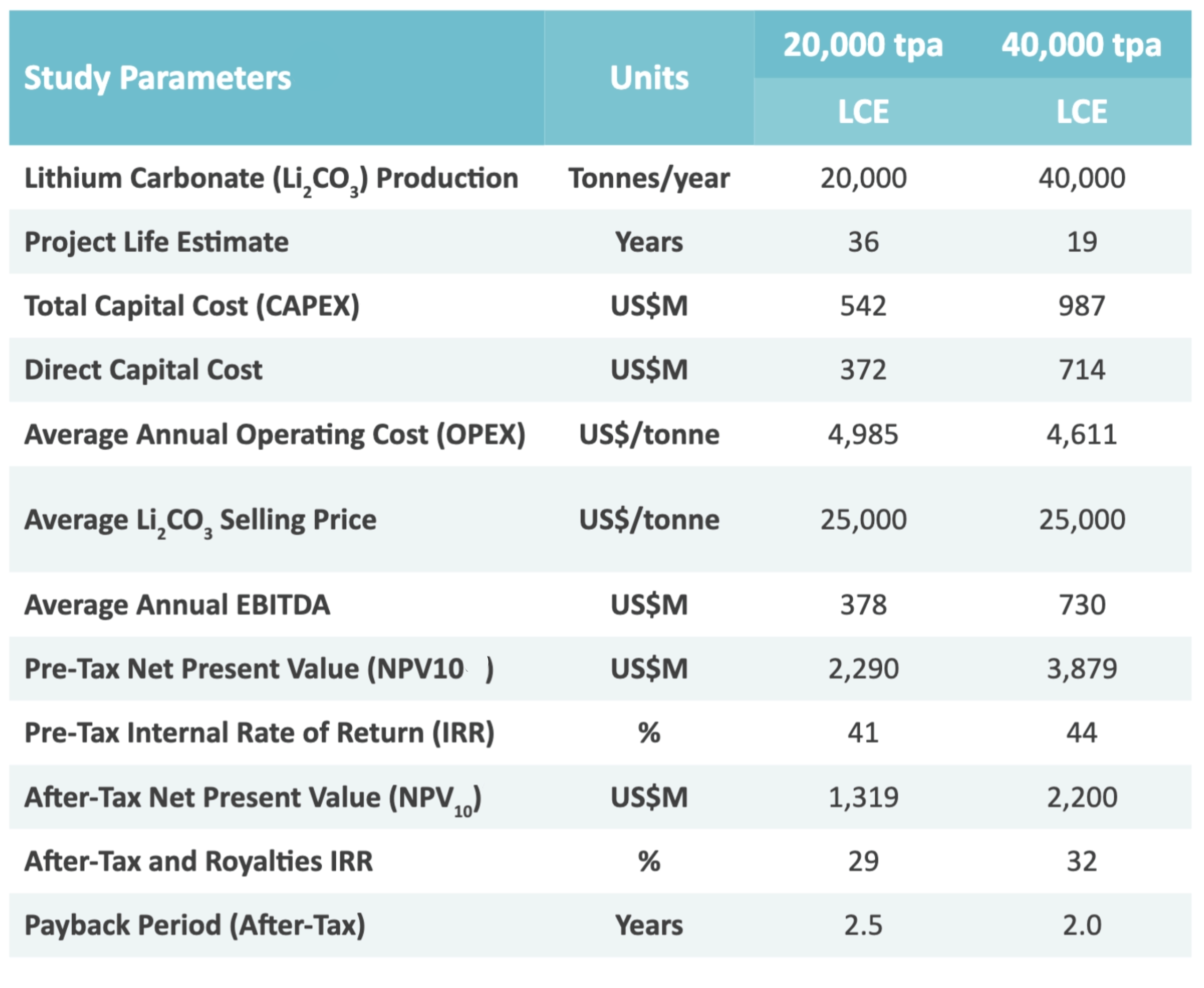

- Scoping study for Solaroz shows strong NPV of $6.2bn, IRR of up to 44%

- Capital cost (ex contingency) for 20,000tpa LCE over 36yrs US$542m; US$987m for 40,000tpa LCE over 19yrs

- Payback period of 2-2.5 years, significant exploration upside

- The stock is up 10% in morning trade Tuesday

A widely anticipated scoping study shows Lithium Energy’s 3.3Mt Solaroz lithium brine project comes with an impressive IRR of 41-44% and will take just 2-2.5 years to pay back development costs once in production.

Lithium Energy’s (ASX:LEL) Solaroz Lithium brine project in Argentina is on the Olaroz salar, where it rubs shoulders with Allkem’s (ASX:AKE) 22.6Mt Olaroz JV with Toyota Tsusho and Lithium Argentina’s 24.6Mt LCE Olaroz-Cauchari JV with Ganfeng Lithium.

Development pathway

According to the scoping study, Solaroz will be developed using conventional evaporation pounds for processing brines into LCE from the salar, following in the footsteps of its neighbours.

That comes with low technical and development risks. However, LEL says it’s still leaving the door open for direct lithium extraction (DLE) methods, which are currently being evaluated to potentially further improve project metrics.

LEL’s scoping study revealed two production scenarios for Solaroz.

Producing 20,000tpa LCE would cost US$542m (excluding contingency) at an average opex of US$4,985/t, while at 40,000tpa, opex would drop down to US$4,611.

Assuming an average Li2CO3 selling price of US$25,000/t over the life of mine (LOM) periods, the company is set to bank a pre-tax IRR of 41-44% and post-tax and royalties of 29-32% – figures that any mining project would be chuffed to have on their balance sheet.

Tip of the iceberg

The kicker here is that the study is based on only the high-grade 1.3Mt @ 400mg/l LCE core of the 3.3Mt resource – presenting the company with significant upside to add to the size and grade with further drilling.

The study also confirms that brine grades are suitable for producing battery-grade LCE by conventional evaporation pond tech, which “gives us an immediate low-risk go-forward case to produce from the same salar next door to Allkem,” according to LEL chair William Johnson.

Looking to the future

LEL says to achieve the range of outcomes indicated in the study, it will require funding of US$700m (for a 20ktpa LCE 36-year LOM plant) to US$1.3bn (for a 40ktpa LCE 19-year LOM plant) – both of which include 30% contingencies in respect of capital costs.

Now that the scoping study is complete, discussions with several financiers and potential partners that have expressed interest can move forward.

“We are extremely pleased with the results of the scoping study, confirming the Solaroz lithium brine project as a high-margin project with significant upside, positioned to become a material producer of battery-grade lithium into the accelerating demand curve of the net zero energy transition,” Johnson says.

“As the global economy decarbonises, the supply of lithium remains of great importance to fulfil electrification demand.

“We are proud to demonstrate such a strong project at Solaroz and are excited to move forward with its next stage of development.”

This article was developed in collaboration with Lithium Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Tier 1 Development: Scoping study demonstrates ‘world class potential’ of Lithium Energy’s $6.2bn Solaroz Lithium brine project appeared first on Stockhead.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…