Energy & Critical Metals

ESG investing is still very much in play…. and booming – says two global experts

ESG investing has received a lot of flak since the market downturn, with investors seemingly losing their appetite. … Read More

The post The Ethical…

- Recent market turmoil has reduced appetite for ESG investing

- But recent surveys from PWC and KPMG have revealed otherwise

- So what does it all mean for the ethical investor?

ESG investing has received a lot of flak since the market downturn, with investors seemingly losing their appetite.

But just when you thought it was another fad, recent surveys from two powerhouse consulting firms maybe prove that it is anything but.

A recent survey conducted by PCW revealed that ESG is poised to become a key market driver as economic headwinds threaten the traditional growth engines of investing.

The PWC report says that ESG-focused funds will grow much faster than the market as a whole, at a base-case CAGR of 12.9%.

And as market headwinds persist, ESG will rapidly become one of the go-to assets for differentiation. Under this scenario, ESG assets under management are expected to reach US$33.9 trillion by 2026.

What does this mean for investors?

Well, it means that stocks with high ESG credentials will be in hot demand over the next couple of years as fund managers look to include them in their ESG portfolio.

According to the PWC survey, 8 in 10 institutional investors plan to increase their allocations to ESG products over the next two years.

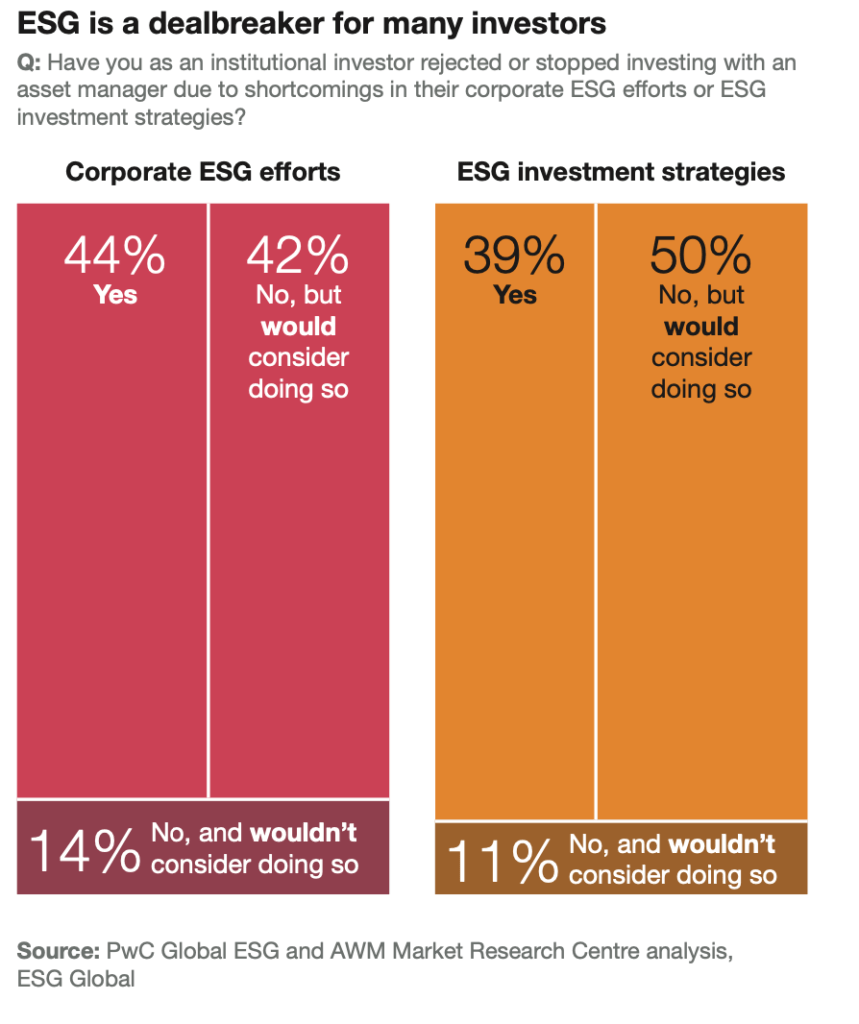

Almost half of those surveyed said they would even leave their asset manager if they found shortcomings in their corporate ESG efforts or ESG investment strategies.

For the ethical investor, the trend clearly suggests that the investible universe for ESG funds is set to open up.

With strong demand, asset managers will be more incentivised and become more proactive in developing new ESG products.

Right now, the number of securities that could be classed as sustainable, and hence included as part of an ESG-orientated fund, is still somewhat limited.

But demand for new ESG products is rapidly outstripping supply, with 78% of institutional investors surveyed saying they were willing to pay higher fees for ESG funds.

Global CEOs all-in on ESG

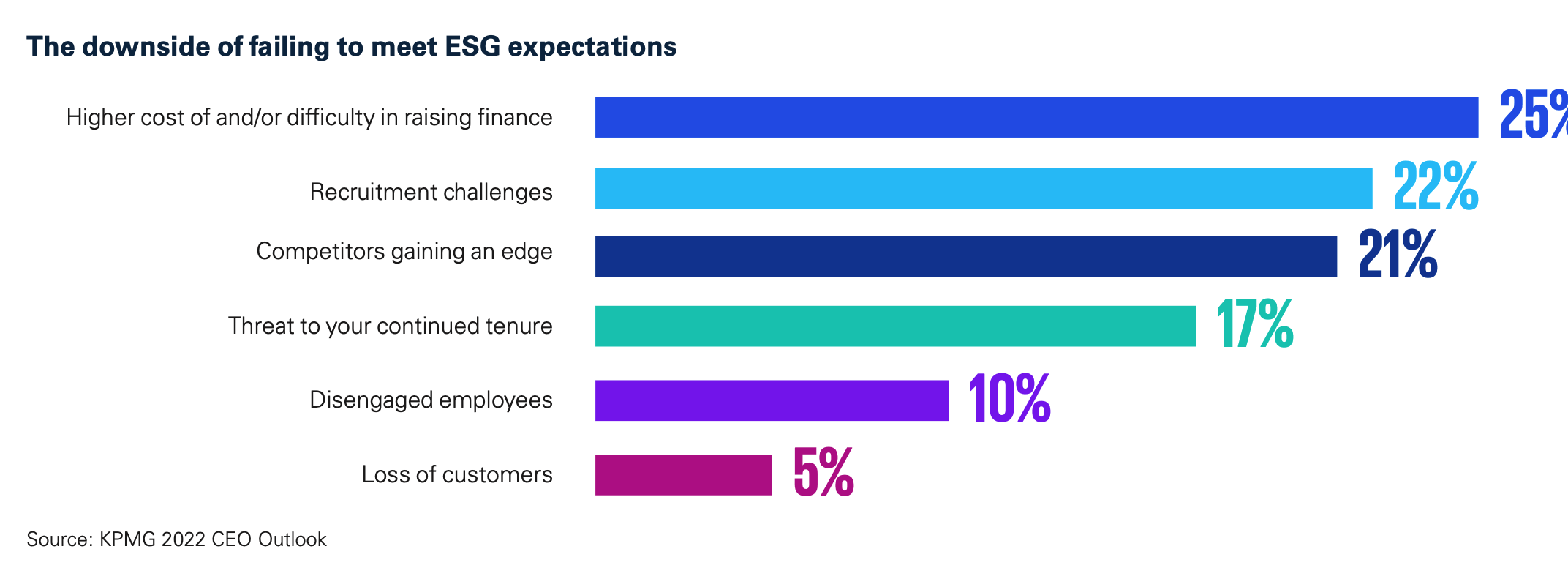

The results of the PWC survey mirrored that of a separate KPMG survey on global CEOs – released earlier this week.

The KPMG survey also predicted great expectations for ESG, with global CEOs seeing the importance of ESG initiatives across every aspect of their business.

Around 62% of global CEOs say they will be looking to invest at least 6% of revenue in programs that enable their organisations to become more sustainable.

What’s more, 74% agree that their organisation’s digital and ESG strategic investments are inextricably linked.

Global CEOs find it difficult to pick just one key driver when it comes to accelerating their companies’ ESG strategies:

“Proactivity on social issues (34%), more transparency (26%), inclusion, diversity and equity strategy (21%) and net-zero strategy (19%).”

This shows there’s a growing consensus that they all matter.

Meanwhile, around three-quarters of Australian CEOs, a higher proportion than their global counterparts, said they were already seeing demand for increased reporting and transparency on ESG issues from stakeholders including investors, regulators, employees and customers.

And 78% of them believed stakeholder scrutiny in this area would accelerate over the next three years.

Over half of Australian CEOs, however, admitted they struggled to communicate their ESG performance to stakeholders effectively.

One key reason could be that only 28% (45% global) said their ESG programs currently led to improved financial performance.

But encouragingly, Australian CEOs are ahead of the global pack on their use of company purpose, inclusion and diversity, and the benefits of gender equity, the KPMG survey found.

ESG themed funds on the ASX

Against that backdrop, we thought it would be appropriate to now mention some of the ESG-themed funds (ETFs) investors can buy on the ASX.

Please note this list is not exhaustive.

Janus Henderson Global Sustainable Equity Active ETF (ASX: FUTR)

Janus launched its Global Sustainable Equity Active ETF onto the ASX in September last year.

The FUTR ETF invests in companies seeking to confront global challenges posed by so-called “mega trends”.

Speaking with Stockhead, Janus Henderson’s head of Australia Matt Gaden said things that fall into this category include climate change, resource constraints, and population growth.

“I think there are different categories of ESG strategies, you’ve got what might be referred to as ‘integrated’ – meaning that a fund considers and integrates ESG considerations into the portfolio,” Gaden told Stockhead.

“This fund FUTR is in the category of sustainably themed investing, so we’re looking at particularly the thoughts of global mega trends that are playing out.”

BetaShares Global Sustainability Leaders ETF (ASX:ETHI)

The ETHI fund aims to track the performance of an index that includes a portfolio of large global stocks identified as “Climate Leaders”.

This fund excludes companies with direct or significant exposure to fossil fuels, or engaged in activities deemed inconsistent with responsible investment considerations.

Notable stocks in the portfolio include Apple, Home Depot, and PayPal.

The fund says the the investment process is three-fold:

First, it will select companies in developed markets with a market capitalisation greater than $2 billion.

Second, these companies must have a carbon efficiency (carbon emissions divided by revenue) that places it in the top one-third of companies in its industry.

And finally, the index excludes any climate leader with operations in “sin” industries such as fossil fuels, gambling, alcohol or junk food.

BetaShares Climate Change Innovation ETF (ASX:ERTH)

The ERTH fund debuted in March last year, and is focused on the fight against climate change.

BetaShares CEO Alex Vynokur said that while climate change was a threat, it was also an opportunity the ERTH fund would seek to capitalise on.

“Our new fund will provide exposure to global companies leading the fight, and likely to benefit from what we believe is a long-term megatrend,” he said.

“This will include not only clean energy but electric vehicles, energy efficiency technologies, sustainable food, water efficiency and pollution control – in short, a broad range of solutions that directly enable the reduction or avoidance of carbon emissions,” Vynokur declared.

The fund seeks to track the Solactive Climate Change and Environmental Opportunities Index.

VanEck MSCI International Sustainable Equity ETF (ASX:ESGI)

ESGI gives investors exposure to a diversified portfolio of sustainable international companies listed on exchanges in developed markets around the world (excluding Australia).

The fund tracks the MSCI World ex Australia ex Fossil Fuel Select SRI and Low Carbon Capped Index.

The index represents the performance of a set of companies that have high ESG performance and low carbon impact, with focus on screening out fossil fuels, and companies with human rights controversies.

More than a third of its portfolio is invested in US companies.

Vanguard Ethically Conscious International Shares Index ETF (ASX:VESG)

The VESG ETF tracks the return of the FTSE Developed ex Australia Choice Index.

The index measures the performance of the FTSE Developed ex Australia Index, after excluding companies involved in vice products such as adult entertainment, alcohol, gambling and tobacco.

Other industries the fund avoids include non-renewable energy, and weapons.

ETF unit prices today:

The post The Ethical Investor: ESG investing is still very much in play…. and booming – says two global experts appeared first on Stockhead.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…