Energy & Critical Metals

Tesla Faces One Key Business Problem to Solve Soon

TSLA stock tanked 10% on April 20, 2023 after releasing its Q1 earnings on investor concerns Key points: The 10% … Read more

TSLA stock tanked 10% on April 20, 2023 after releasing its Q1 earnings on investor concerns

Key points:

- The main economic problem is that Tesla without knowing the exact profitability and cost margins the business is at extremely substantial risk.

- The decline in profitability margin shows a lack of focus on its business model.

The 10% drop in Tesla’s (NASDAQ:TSLA) share price that followed last week’s first quarter earnings report was a justified market reaction.

To begin with, missing expectations on both earnings per share and revenue did little to boost the positive narrative around TSLA stock. The Q1 report showed that Tesla reported first-quarter revenue of $23.33 billion, slightly below Street estimates of $23.35 billion, with adjusted earnings per share coming in at $0.85, below estimates of $0.86.

As price cuts weighed on profits, Tesla reported net income of $2.9 billion, $700 million less than the same period a year prior.

I now consider Tesla to be in a very tough position now having to solve two severe economic problems and one business challenge.

Economic problem #1: Not knowing your business margins

“It’s difficult to say what the margin will be,” Tesla CEO Elon Musk said on the company’s earnings call. He was referring to the profit margin, a projection for the future, which is however very vague. Not having a clear trend for profitability makes a company and its stock riskier compared to another one that has a clear and well-defined profitability trend.

This is very alarming as not knowing the exact margins of the business it is too easy to turn profitability into losses. Economics 101 teaches us that the variable costs combined with fixed costs make up the total cost. As production increases the total cost increases, too. To be profitable a business must know the sweet spot, the ideal number of production capacity that makes marginal revenue higher than marginal cost.

What is the marginal revenue? Marginal revenue is the income gained by selling one additional unit, while marginal cost is the expense incurred for selling that one unit. For any business to be profitable there is a specific quantity of goods produced that makes marginal revenue equal to marginal cost, and above that marginal cost starts increasing. Any business maximizes its profit when marginal cost equals marginal revenue.

Tesla, by selling cars beyond the level that makes marginal revenue lower than marginal cost, means more expenses are incurred than revenue received for each good. This is not good as it will harm profitability.

Economic problem #2: Elasticity of demand higher than one

Tesla has already made several price cuts to boost its sales by reducing its profitability as explained above. The firm must have an elasticity of demand higher than one for its premium luxury cars, meaning that by lowering prices it anticipates a higher percentage of sales.

But this can turn against it should it decide that price cuts are not sustainable over time but are only a temporary solution. The stock price reaction on April 20, 2023, showed that investors did not like the decision to harm profitability while targeting higher sales.

Business challenge: Where is the focus on being a luxury brand car manufacturer now?

Tesla may have just started a price war among car manufacturers. I consider the firm has lost its vision of being a premium manufacturer of electric cars.

Why is that?

It is simple, as luxury car manufacturers have a strategic vision and business philosophy, soaring prices, and premium products that have a well-designed price tag, a premium over other products that consumers perceive as attractive and be synonymous with success and prestige.

Tesla wants more sales, with less profit to increase its market share in the electric vehicle market focusing on the priority to increase its sales volume, sacrificing part of its profit, to beat the Chinese manufacturers.

Another key business problem to my analysis is that a series of price cuts may turn out to be harmful to Tesla sales as consumers will either delay their decision to buy an electric car by hoping for more savings based on the history of recent price cuts, or request by Tesla dealers an attractive deduction in the price so as to be convinced to buy its cars. The first problem is bad for sales, the second is bad for profitability.

CEO Musk stated that “the economic environment at the moment is uncertain. It is better for us to reduce our profit margins by increasing our sales than to be faced with unpleasant surprises soon.’

Speaking in a conference call with Tesla’s board of directors of his company, Elon Musk made clear to everyone the new strategy for the next period. The American brand will also proceed with new price reductions in its models, to face the Chinese competition and to be able to compete with BYD, which dominates the Chinese market, the largest in the world.

BYD has an abundance of raw materials, cheaper labor, and a wide variety of electric models at affordable prices, being advantages, which, as it turns out, the rest of its competitors do not have.

Sales of BYD’s electric and plug-in hybrid models increased 69% in the first three months of 2023, giving the car maker an 11% share of the Chinese market. And that’s before it’s even made a global push.

Musk, seeing what is coming, is trying to increase Tesla’s market share in electric vehicle sales, which is why he prefers to significantly reduce his profit, while increasing the sales of his electric models.

Tesla is currently developing a new generation of batteries which, when put into production, will offer greater autonomy to its models and more affordable sales prices. Of course, the project does not seem to be progressing according to the original schedule, as it has been developing for 3 years without anything tangible yet.

The affordable $25,000 electric car that Tesla promises to bring to market is based on the development of this new generation of batteries. When these batteries are ready then the “People’s Tesla” will start to be produced.

Musk had set a goal for 2023 to sell 2 million models, but as he admitted to the company’s board members, even with 1.8 million sales this year, he will be completely satisfied.

Tesla has pricing power, the problem is BYD Auto has even more

As of Q4 2022, Tesla was the second biggest global electric vehicle maker, as the first one was BYD Auto, a Chinese EV maker. I see plenty of fundamental problems and weaknesses for Tesla stock now. First, its global market share has been slowing.

Tesla has a Piotroski F-Score of 7 out of (, which is not bad, but it received 0 points in the total score in the gross margin factor, as it has seen its gross margin declining. Pushing its production to higher levels will have a negative effect on its gross margin and to its profitability, namely to its net income and EPS.

The industry outlook is favorable as the global electric vehicles market is expected to reach 148.4 million Units by 2028, which means a remarkable CAGR of 42% during 2022-2028. In 2022 the global EV sales were 18.1 million units.

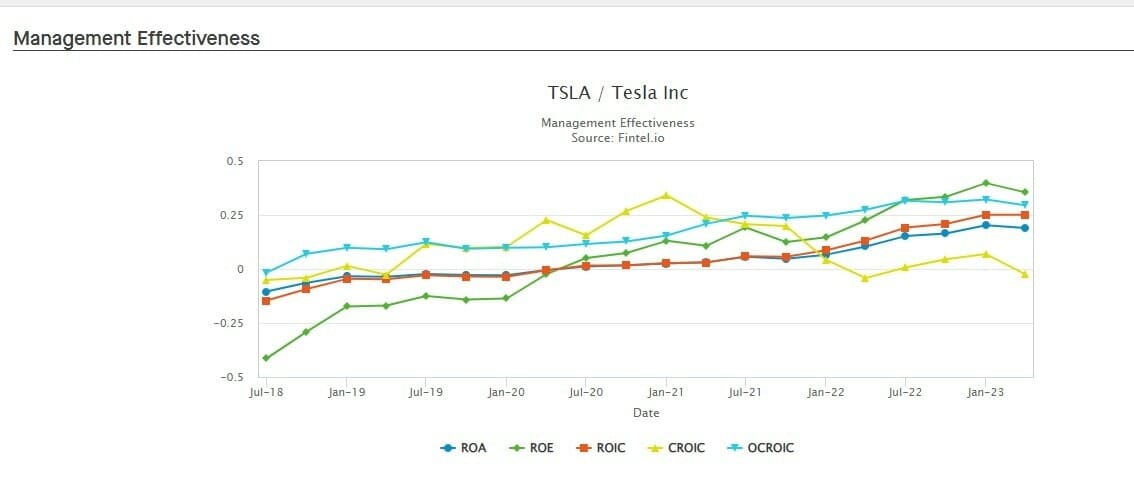

The Cash Return On Invested Capital, or CROIC, measures how effectively a company uses its invested Capital to generate cash. Tesla has been performing very poorly as the higher the CROIC, the better. Tesla has seen its CROIC ratio declining as of January 2021.

The revenue growth slowed down in 2022 to 13.35% from 26.69% in 2021 and Cash from Operating Activities has witnessed a second consecutive decline for the quarter ending on March 31, 2023, having peaked during September 2022.

Tesla has a quality score of 92.44, which is very good but on the other side it has a Value Score of 49.32, which is very poor and a momentum score of 31.02 which is also very low. The shares are not cheap either as the S&P 500 has a P/E ratio of 22.09 now and Tesla stock has a P/E ratio of 52.45, a P/Book ratio of 14.35 and a P/TBV ratio of 14.54.

By not having a clear picture of the business margins and by altering completely the vision of the firm Tesla seems to have lost its shine now. I consider more weaknesses ahead given these business conditions.

The post Tesla Faces One Key Business Problem to Solve Soon appeared first on Fintel.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…