Economics

Sprott Says Lithium Demand Will Outrun Price. Why Their Analysts are both Wong and White

Sprott analysts Paul Wong and Jacob White say the burst to secure critical minerals is like a run to a Cold War…

Yes. Lithium prices have been tanking lately as sales of electric vehicles (EVs) take a bit of a breather. It’s even possible this may back things up a bit in the as-yet adolescent global supply chains of the energy transition.

Over the weekend Reuters reported from the sidelines of a very big China lithium conference somewhere in Guangdong that the country’s biggest handful of lithium producers agreed to put a floor price of 250,000 yuan (US$36,380) per tonne on lithium carbonate.

The price was agreed on last week by circa 10 companies including all the majors – a la Tianqi and Ganfeng – Reuters said, citing six sources who refused to be identified for fear of being sent to Elon Musk.

If accurate, the cartel creep comes as lithium prices take a dive on the slowdown in local EV sales across the world’s biggest EV market.

Spot prices for lithium carbonate globally have also slumped by more than 60% since their peak in late November, with the decline picking up pace in recent weeks on what is clearly becoming a price war in China’s increasingly competitive auto market.

It is not clear how long the companies, which account for over half China’s lithium carbonate output, will follow the floor price, Reuters mused.

Spot prices dropped to 220,000 yuan a tonne on Friday, down from 260,000 yuan a week earlier according to Fastmarkets’ weekly.

Oversupply: Not overly concerned says Sprott

The metal of the moment – used in every single battery out there both big and small – could even encounter oversupply burden in the near-term.

The lithium carbonate spot price continued the wobblies it caught around the November 2022 peak, sliding almost 25% in February.

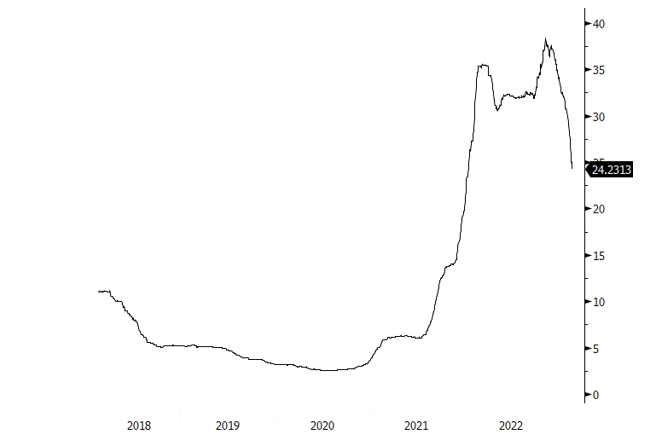

Lithium prices remain above long-term averages (2018-2023) in US$

Despite this drop, lithium prices remained higher than their level 12 months ago, largely due to the exponential growth in EV sales in recent years. As per Bloomberg, EVs were responsible for three-quarters of lithium demand last year.

Nevertheless, “lithium is the star” when it comes to battery storage, says the CEO of Sprott Asset Management John Ciampaglia.

As nations try to minimise supply chain weaknesses for the energy transition, they’re allocating huge chunks of investment.

According to Bloomberg, spending on the energy transition jumped 31% to US$1.1 trillion last year, matching that attributed to fossil fuels for the first time in history.

Cold War mentality

Sprott analysts Paul Wong and Jacob White say the burst to secure critical minerals is like a run to a Cold War, just as West and the East built an arms race across nuclear weapons and the technologies needed to maintaining military superiority.

Misguided? Possibly.

Insane? Not quite. Although I’m not a historian.

The math of Mutually Assured Destruction (MAD) dictates the only possible deterrent in technological weapons advancement is to ensure the enemy knows you are just as capable as they are.

This competition drove significant investments in conducting research and development (R&D), stockpiling materials and developing supply chains to support military production.

Below are some of Wong and White’s brilliantly gleamed bullet-point takes on the current global death match to secure critical minerals:

- The run to secure critical minerals is highly inflationary because building entirely new energy infrastructure — from obtaining raw materials to processing and refining them to distributing them via resilient supply chains — is extremely capital intensive.

- A massive amount of upfront capital will be needed before the benefits of the energy transition may be realised. Capital must be sourced and deployed, creating demand-pull on the entire energy transition sector and industrial base.

- Capital availability will likely outpace the capacity to spend. After three decades of offshoring and over a decade of chronic underinvestment in commodity resources, capacity (including commodity supply and stockpiles, skilled trades, equipment, engineering and construction) is starting from a decades-low base relative to the overall economy.

- Commodities (especially critical minerals) are becoming scarcer and therefore more valuable. The market is well past “peak cheap commodities”. We foresee concurrent demand and supply shocks and the emergence of a commodity supercycle.

- Industrial policy is moving toward industrial sovereignty with national security as a focal point.

- Governments are using policy, legislation, capital investment, grants, loans and other means to “crowd in” private sector investment, de-risking it to create more predictable returns and long-term incentives.

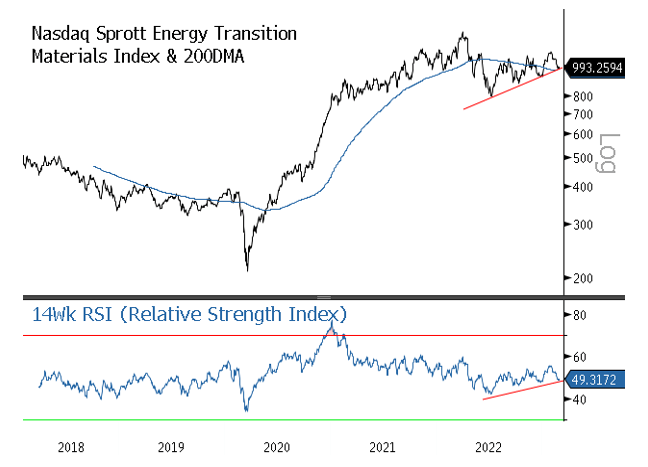

The Sprott Energy Transition Materials ETF collects a bunch of rare earths producers and developers with diverse diggers of lithium, silver, copper, cobalt and manganese, all of which are essential to the production of EVs and batteries.

The fund’s exposure to lithium, as well as other metals, is capped at 25%, to maintain balance within its weightings. The fund is down 17.9% since launching in early February, but is up 6.1% in the past week.

Despite these challenges, say Wong and White, the lithium market landscape remains the most critical of minerals, and its central role in the race to reach full transition makes price secondary to security.

Sprott: Supply trumps Price

Wong and White say that the COVID pandemic exposed the fragile state of the EV industry’s supply chain, and the Russia-Ukraine war further disrupted metal markets.

“Over the past several months, major corporations and government agencies have made headlines with significant investments in key mineral suppliers to secure or hedge supply. While this activity is bullish for critical minerals and commodities, it also indicates that supply is becoming more important than price for corporate and government players.”

As LG Chem — the parent company of the world’s second-largest producer of EV batteries told Bloomberg, their “first and foremost priority is to secure enough raw material for the future.”

“The US government is increasing investment to bring EV component industries back stateside — and reshore a significant element of its national security.”

American government agencies such as the Department of Defense (DoD) and Department of Energy (DoE) have also announced direct funding in mining projects to secure critical minerals.

This de facto national industrial strategy acknowledges the sheer amount of critical minerals and immense upfront capital requirements.

The Biden Administration, they point out, is stepping up its investment in disrupting global supply chains to bring EV component industries back to the US and essentially reshore a significant element of its national security.

“The price of lithium is still significantly higher than its long-term average and above many lithium miners’ cost curves. Lithium demand is forecast to grow exponentially due to the metal’s dominant role in EV lithium-ion batteries.”

Large OEMs are well aware of this, and some have taken strategic stakes in lithium producers. For example, General Motors invested $650 million in Lithium Americas in January 2023, and Stellantis invested €50 million in Vulcan Energy in June 2022. Tesla is also said to be considering the acquisition of Brazilian miner Sigma Lithium.

“We think that this transition is going to take trillions of dollars and last decades,” Sprott boss Ciampaglia this week told a CMC Markets podcast, emphasising that it can take a lithium mine between eight to 15 years to become operational.

Recognising the need to diversify where they source battery materials, Washington and Tokyo signed a trade agreement last week that extends tax breaks offered through the US Inflation Reduction Act to any metals mined and processed in Japan.

The post Sprott says lithium demand will outrun price. Their analysts are both Wong and White appeared first on Stockhead.

silver inflation commodities commodity markets policy metals mining inflationary ax lithium manganese rare earths tsxv-sgml sigma-lithium sigma lithium

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…