Energy & Critical Metals

Predator/Prey: Three ASX lithium stocks SQM could be gunning for next

Lithium continues to be a boom area of the market with consolidation a hot theme – we ask MST for … Read More

The post Predator/Prey: Three ASX lithium…

Lithium continues to be a boom area of the market with consolidation a hot theme following a few failed bids by industry heavyweights Albermarle and SQM.

In March this year, US$26 billion capped American lithium monster Albermarle was rejected for the third time in five months with its $2.50 a share bid for Liontown Resources (ASX:LTR), which valued the developer at a record high of $5.2bn.

The proposal represents a 64% premium to its last closing price and reflects just how much value industry participants place on tier 1 lithium assets these days.

LTR’s $895m Kathleen Valley mine in WA’s northern Goldfields region is one of the few Tier 1 lithium assets set to open next year with a nameplate capacity of 500,000t of spodumene concentrate per annum.

Meanwhile, Creasy/SQM-backed explorer Azure Minerals (ASX:AZS) knocked back a $900m takeover offer ($2.31 per share) from New-York listed SQM to preserve its 60% hold over the Andover lithium project in WA’s Pilbara region.

Azure’s exploration target for Andover – between 100Mt and 240Mt, grading at 1-1.5% Li20 for target areas 1, 2, and 3 – places the project “within the top 10 lithium deposits in the world”, AZS managing director Tony Rovira told Stockhead.

“If you take the upper part of the exploration target, that puts us in the top five lithium deposits in the world,” he explained.

“Azure’s share price has traded above that indicative offer price of $2.31 and hit an intraday high of $2.96 on 8 August 2023.

“In light of our rapidly evolving understanding of the potential of the Andover lithium project, Azure determined that the approaches did not warrant further engagement by the company and no further discussions have occurred.”

Who’s looking good?

With SQM – one of the biggest lithium miners in the world – clearly having an appetite for acquisitions in the space, and a key focus on Australia specifically, we asked MST Financial’s Michael Bentley for three ASX small cap lithium plays that he finds interesting and why.

Bentley says greenfield lithium projects are becoming more attractive to downstream producers who see vertical integration as a strategy to reduce supply risk.

From his point of view, there are a number of emerging lithium hubs around Australia featuring currently producing assets alongside explorers who’ve had strong success with early-stage exploration.

“Using Azure Minerals as an example, the company has seen large early stage exploration success and may in time turn into a mine, allowing other projects in the region with potential resources to feed into the hub.

“Other companies with good landholdings right next door to major deposits or discoveries include Raiden Resources (ASX:RDN), Zenith Minerals (ASX:ZNC), and Delta Lithium (ASX:DLI).”

If any of these three lithium companies have any near-term exploration success, they could be very attractive to their big brother next door.

Exciting lithium plays

Raiden Resources (ASX:RDN)

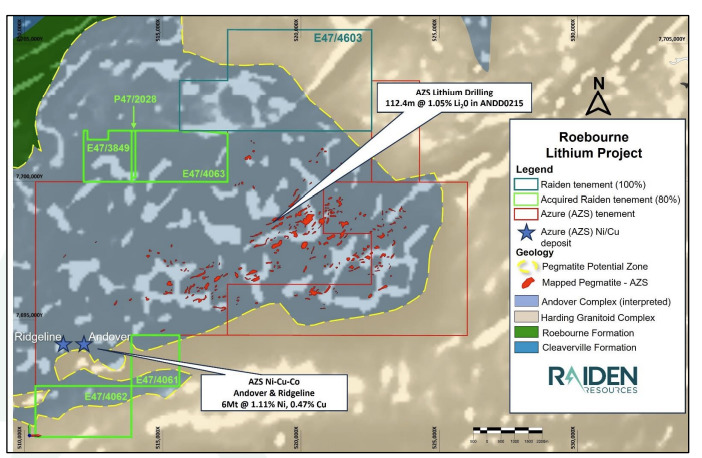

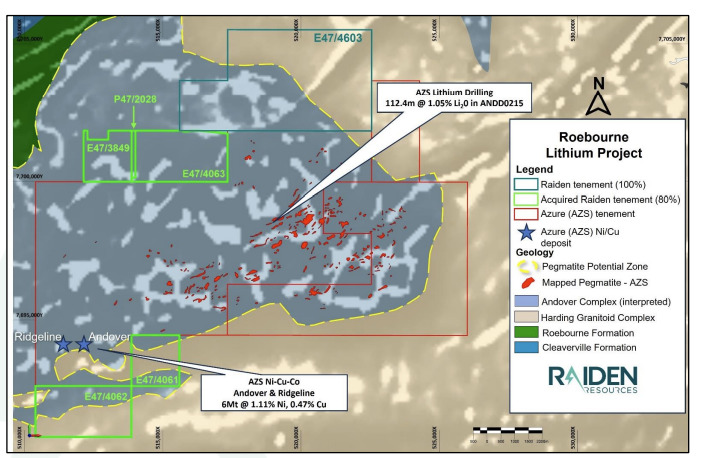

Raiden has fast become a lithium darling with its Andover south project in the Pilbara, which sandwiches Azure’s Andover project to the north and south, where drilling activities have been focused on delivering a maiden resource in Q1, 2024.

Investors have clearly caught on to the company’s potential, with its share price up 192% for the year, as it continues to find swarms of outcropping and interpreted pegmatites of up to 30m width at surface.

The $51.38m market cap company says early indications show that the lithium system at Andover South may be “significant in scope and nature” with pegmatites, so far, defined across a 3.5km long, 600m wide pegmatite field.

Raiden’s team is now mapping and sampling the remaining tenements at Andover South and conducting reconnaissance work at the Mt Sholl and Arrow projects.

Zenith Minerals (ASX:ZNC)

Zenith Minerals’ Split Rocks lithium project is in WA’s Forrestania greenstone belt, an emerging lithium district host to SQM-Wesfarmer’s Mt Holland/Early Grey lithium deposit containing 189Mt at 1.5% Li20.,

The company recently defined 30 new lithium targets in addition to the >3km long by 2km wide Cielo lithium target reported earlier this year.

These new targets lie outside the Rio prospect, where drilling returned 26m at 1.2% Li20.

ZNC MD Michael Clifford says the explorer is “very keen” to see these targets being tested to unlock the full potential of this exciting project area.

Delta Lithium (ASX:DLI)

Delta recently attracted a major new investor in mining behemoth Mineral Resources (ASX:MIN) which now holds a 14.24% stake in DLI.

The company’s Mt Ida project in WA’s Goldfields region boasts a resource estimate of 12.7Mt at 1.2% Li20 and according to executive chairman David Flanagan, it is the only lithium project in the current Western Australian mines department currently under consideration.

Mt Ida is in the same region as Zenith Minerals’ Mt Ida North project and MinRes’ Mt Marion mine.

Newly reported drilling results include 27m at 1.3% Li20 from 848m, 21.2m at 0.5% Li20 from 56.1m and 20.9m at 1.4% Li20 from 675.4m in a program designed to upgrade the resource from inferred to indicated classification.

The post Predator/Prey: Three ASX lithium stocks SQM could be gunning for next appeared first on Stockhead.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…