Energy & Critical Metals

Plenti continues to grow loan portfolio and deliver profitable growth

Special Report: Plenti is on track to meet its H2 FY23 objectives after providing a strong quarterly update. … Read More

The post Plenti continues to…

Plenti is on track to meet its H2 FY23 objectives after providing a strong quarterly update.

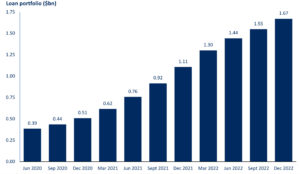

Fintech Plenti Group (ASX:PLT) saw its loan portfolio increase to $1.67 billion, 51% above pcp and 8% above the prior quarter in Q3, FY23.

The loan portfolio is a key driver of revenue for the company and is continuing to increase, hitting an impressive 69% rise to $1.55 billion in H1 FY23.

Among other key financial highlights for the quarter:

- Loan originations of $297 million, up 10% on prior quarter

- Increased net interest margins on new loan originations

- Revenue of $37.4 million, positive cash NPAT in the quarter.

Renewable and personal loan originations achieve record quarter

Renewable energy and personal loan originations had a record quarter. Renewable energy originations were $34 million in Q3, 16% above the prior quarter.

Personal loan originations were $121 million, 21% above the prior quarter.

Net interest margins on new loans originated increased in the quarter. However, Plenti said overall portfolio net interest margin remained broadly stable on the prior quarter due to the offsetting impact of an interest rate increase in one of its automotive warehouse facilities, which was extended in November2022.

Strong and stable credit performance

Plenti maintained its strong and stable credit performance throughout the quarter.

The company said annualised net credit losses of 69 basis points were consistent with the prior quarter and reflected the prime nature of its borrowers across each of its three verticals.

90+ day arrears was 35 basis points, while the loan portfolio weighted average Equifax credit score remained high at 833 at quarter end.

Plenti said during Q3 it sold certain written-off or defaulted loans to a third-party debt purchaser, with the financial benefit expected to be recognised in Q4 FY23.

Similar debt sales are expected to take place as Plenti continues to build scale.

Retail investment platform

Plenti renewed its focus on growing its retail investor platform, the Plenti Lending Platform, during the quarter.

The investment markets were simplified and reshaped to enable retail investors to fund a higher proportion of Plenti’s lending.

Additionally, a new investment market, the Notes Market, was introduced to provide qualifying investors with a higher investment return option by providing exposure to notes issued as part of Plenti’s ABS transactions.

Plenti said the Notes Market provides further diversity to its ABS funding whilst also releasing corporate capital invested in its ABS transactions.

Heading in right direction

Plenti CEO Daniel Foggo said Q3 was a positive quarter and the fintech remains on-track to meet H2 FY23 objectives.

“This was another positive quarter for Plenti, with strong loan portfolio growth achieved whilst also increasing net interest margins on new originations, demonstrating the continued appeal of Plenti offerings to both referral partners and customers,” he said.

“We continue to invest in extending our technology-led customer experience and efficiency advantages as we work towards achieving our mission of building Australia’s best lender.”

This article was developed in collaboration with Plenti Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Plenti continues to grow loan portfolio and deliver profitable growth appeared first on Stockhead.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…