Companies

MoneyTalks: Peak Asset Management’s Niv Dagan has conviction in the uranium run and hard rocking lithium explorers

Peak Asset Management founder and executive director Niv Dagan joins with his thoughts on uranium prices and hard rock lithium … Read More

The post MoneyTalks:…

MoneyTalks is Stockhead’s regular recap of the ASX stocks, sectors and trends that fund managers and analysts are looking at right now.

Today we hear from Niv Dagan, who moves and shakes as the founder and executive director investment manager of Melbourne boutique investment management and corporate advisory firm Peak Asset Management.

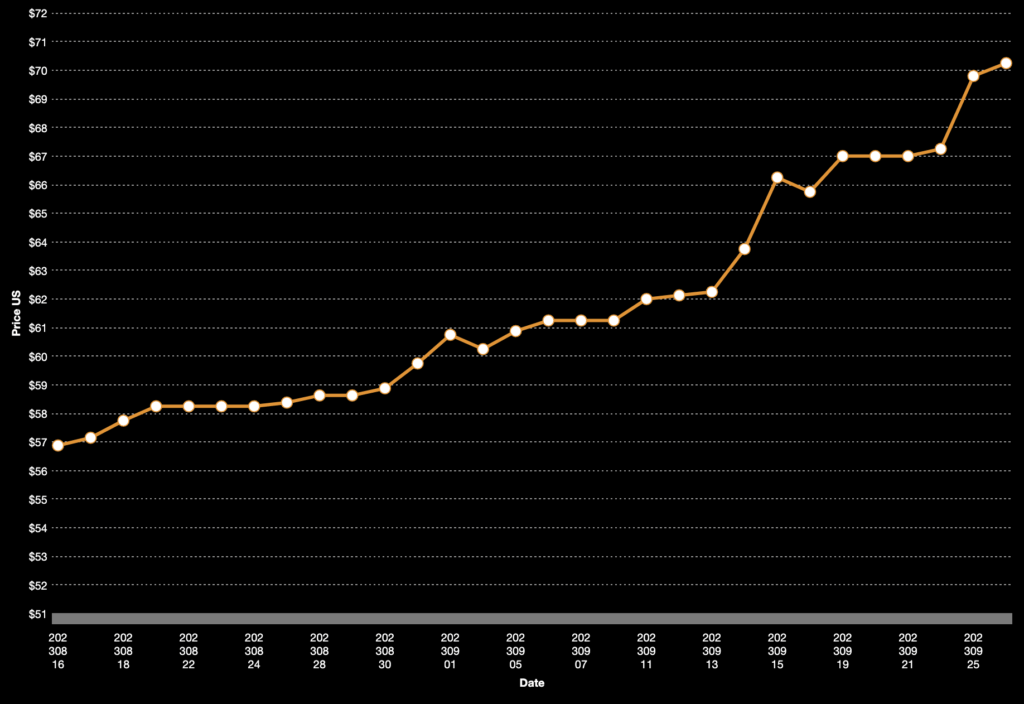

Over the past six weeks uranium prices have done, well, this.

That’s a 23% gain so fast you could erect a small modular nuclear reactor. Well, not quite.

But in an industry whose boundless enthusiasm for a brighter radioactive future has pretty much become a meme, it pays to be cautious.

Still, experts are beginning to say the current uranium rally is real, spurred on not by ETFs and speculators but by contracting from utilities increasingly seeing their reactor lives extended to feed a global transition from fossil fuels with low carbon baseload power.

Peak Asset Management’s Niv Dagan casts a watchful eye over the resources sector and its high risk, high reward junior end.

He sees uranium and lithium as two areas of a tough market still worth playing in.

“The first one is uranium. We’re seeing spot prices surpass US$70 a pound, which is the highest we’ve seen in about 12 years, and we’re seeing a lot of money coming back into the uranium sector as a whole,” he said.

“And the second one is lithium pegmatites, hard rock spodumene lithium, so they’re really the two where we’re seeing a lot of money flow at the moment.”

Uranium to US$100/lb?

Dagan says discussions with key figures in the yellowcake market had convinced him the current run in uranium prices was more concrete than previous escalators to nowhere.

“We spoke to an exec director yesterday that actually is a major shareholder in NexGen (ASX:NXG) from five cents a share and NexGen is (now) above $8 per share,” Dagan said.

“So he’s done OK for himself and we had a coffee with him in the office yesterday and he’s saying this is real.

“The relation between spot and forward is there. And what we’re actually seeing is long term contract prices starting to reflect that spot price and that hasn’t happened in the last 10 year, since Fukushima.

“We’re seeing a lot of supply disruptions with what’s happened with Cameco, the move to zero carbon emissions, obviously Ukraine and Russia and supply coming out of Kazakhstan.

“So we believe that uranium could surpass US$100/lb over the next few months.”

Why hard rock is lithium’s place to be

When it comes to lithium, where falling prices in China contrasted with a flurry of M&A activity in the major WA market is pulling equities in two directions, Dagan says hard rock explorers remain a hot commodity.

Dagan said uncertainty around processing pathways was hanging over brine stocks — mostly focused in South America. But explorers finding hints of spodumene, the lithium mineral found in abundance in WA, Canada and Brazil, were sought after.

“The brines are expensive, right? And the whole process is still unproven in terms of DLE (direct lithium extraction) versus pond,” he said.

“In hard rock we’re actually seeing still a lot of money flow coming through because of the capex and ease, especially what’s happening in Canada and Brazil, where you’ve essentially got lithium pegmatites on the surface essentially and Li2O values of, you know, 3-4-5%.

“So, the market’s really fixated in the hard rock lithium space, where you have rock chips above sort of 2, 3, 4 or 5%, and ability to drill really quickly.”

Dagan says it remains unclear whether the Chinese price was a true barometer of where the lithium market was at, with Gina Rinehart’s push to insert herself in Albemarle’s $6.6 billion takeover of Liontown Resources (ASX:LTR) by spending a further $132m to build a 10.76% blocking stake this week showing how hard and fast money was still flowing into the lithium sector.

Where is Niv Dagan looking for uranium value?

In uranium, Niv says he likes the look of the major producers and developers overseas, including NexGen, Cameco and ETFs like Sprott as a play on the uranium price.

“Here in Australia, you’ve seen stocks like Boss Energy (ASX:BOE), Bannerman (ASX:BMN), we caught up with the CEO of Elevate Uranium (ASX:EL8) just last week, and he’s really, really bullish on the sector,” he said.

But Peak is also top shareholder of junior Terra Uranium (ASX:T92), a play a bit lower down the food chain where Dagan sees plenty of value.

It is down 60% year to date after launching an ASX IPO last year, but holds the HawkRock, Pasfield Lake and Parker Lake projects in Saskatchewan’s Athabasca Basin, a region famed for hosting the world’s largest and highest grade uranium deposits.

“They’re sitting at around a $4 million enterprise value with really advanced projects in Pasfield (and) Parker,” Dagan said.

“And they’ve done an exceptional job in terms of the RC campaigns and the drilling leading into the upcoming drill campaign in this winter, so they’re really the main ones that we really like at the moment.”

Where is Peak looking in lithium?

Peak was one of the parties behind a deal that saw Alderan Resources (ASX:AL8) pick up seven exploration projects over 472km2 in Brazil’s Minas Gerais region.

The area has become a hotspot for spodumene explorers with TSX listed Sigma Lithium’s successful construction of the Grota do Cirilo mine this year the largest development of hard rock lithium outside Australia.

The acquisition last week saw the stock rise 50% on the day of the announcement, moving from 0.8c to 1.2c, before sliding back to 1.1c on Monday.

Dagan also likes the look of Odessa Minerals (ASX:ODE), a former diamond explorer which has shifted focus to the Gascoyne region of WA where Delta Lithium’s (ASX:DLI) Yinnetharra discovery has pulled multiple explorers into the new lithium hotspot.

“They’ve identified 56,000m (strike length) of pegmatites, have got rock chips in the lab sampling and the whole Gascoyne region is starting to get a little bit of activity,” Dagan said.

“They’ve identified over 10,400m of strike length previously undiscovered with 187 rock chips and 1900 soil samples collected.”

Dagan said the Gascoyne could follow other regions like the Pilbara in becoming a hotspot for spodumene discoveries, with the mature Pilbara still throwing up new finds in the past year including Azure Minerals’ (ASX:AZS) massive Andover.

Niv Dagan’s featured stocks prices today

The post MoneyTalks: Peak Asset Management’s Niv Dagan has conviction in the uranium run and hard rocking lithium explorers appeared first on Stockhead.

tsx

asx

lithium

uranium

diamond

tsxv-sgml

sigma-lithium

sigma lithium

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…