Energy & Critical Metals

J.D. Power: US growing increasingly divided on EV adoption

According to the latest data from J.D. Power, EV adoption in the US is growing increasingly divided, with the most active states for EV adoption already…

According to the latest data from J.D. Power, EV adoption in the US is growing increasingly divided, with the most active states for EV adoption already on the path to parity with internal combustion engine (ICE) vehicles and consumers steadily pulling back on EV purchases in the least-active states.

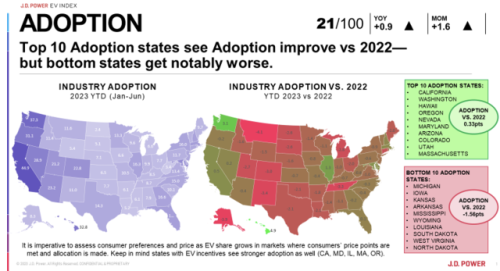

On a nationwide basis, EV adoption rates have continued to rise steadily, with EV sales now representing 8.6% of the total new-vehicle retail market. On a year-over-year basis, overall EV adoption is up 1 point on the J.D. Power 100-point index, bringing the total Adoption score to 21. What’s underneath that nationwide score, however, is significant variation on a state-by-state basis.

Increasingly, the US is splitting into two camps when it comes to EV adoption: those states who’ve been aggressive about offering incentives and building infrastructure to support EVs and those that have not. Accordingly, the top 10 states with the highest overall EV adoption rates—California, Washington, Hawaii, Oregon, Nevada, Maryland, Arizona, Colorado, Utah and Massachusetts—have continued to see EV adoption rates grow steadily, climbing year-over-year through the first half of 2023.

Meanwhile, the states with the lowest levels of EV adoption—Michigan, Iowa, Kansas, Arkansas, Mississippi, Wyoming, Louisiana, South Dakota, West Virginia and North Dakota—have gone in the opposite direction, with adoption rates declining on average in the first half of 2023.

J.D. Power has just introduced a new EV Retail Share Forecast, which captures granular EV sales, consideration, pricing, infrastructure growth and other census and demographic factors to project state-by-state EV adoption rates through 2035. Updated twice per year, the forecast projects EV adoption rates by segment by state and designated market area (DMA) and offers insights into the specific variables contributing to projected growth rates.

At a nationwide level, the EV Retail Share Forecast anticipates a baseline estimate of 70% EV market share by 2035. In line with the state-level trends discussed above, however, those projections vary considerably by state. California, for example, which currently has the highest EV adoption rate in the nation, is projected to reach 94% market share by 2035. North Dakota, by contrast, which currently has the lowest EV adoption rate, is projected to have a 19% EV market share by 2035. Similarly, South Dakota is projected to reach just 35% share and Michigan is projected to reach 41% share by 2035.

Luxury EVs Still Wield Outsize Influence on Affordability. While true parity between the EV and ICE vehicle markets will only be achieved when manufacturers produce more mainstream EVs, the recent news cycle has been dominated with updates on luxury SUVs and trucks like the new Escalade IQ from Cadillac and the Tesla Cybertruck. Even among current EV sales, total affordability scores are being heavily influenced by the Tesla models, which have recently undergone a series of price cuts that has increased their overall affordability. Industry-wide, Tesla currently accounts for 63% of all EV sales year to date.

Driven largely by Tesla, the luxury market skew that currently exists in the EV market has resulted in overall affordability scores improving 15 (on a 100-point scale) through the first half of this year. However, as buyers make their way through this growth phase of the EV marketplace, J.D.Power expects to see continued volatility as new models are introduced and manufacturers continue to put their marketing budgets behind high-priced, halo EVs.

Methodology. This J.D. Power E-Vision Intelligence Report is based on data and insights from the J.D. Power EV Index and the J.D. Power EV Retail Share Forecast. The J.D. Power EV Index is an analytics tool to benchmark the growing EV market in the United States. It tracks millions of data points aggregated into six categories—interest, availability, adoption, affordability, infrastructure and experience—to evaluate the progress to parity of EVs with ICE vehicles in the US. Each month, the J.D. Power electric vehicle practice will analyze these data points, and others to spotlight emerging trends and important shifts in consumer sentiment that are helping to define the fast-moving EV marketplace.

The J.D. Power E-Vision initiative is a company-wide program focused on maximizing J.D. Power industry-leading EV data, analytics, insights and solutions.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…