Energy & Critical Metals

IRR of 132pc? Payback in just 7 months? Latin Resources’ Colina project could host one of the biggest, lowest cost spodumene mines in the world

Special Report: The Colina project could establish Latin Resources as the second largest spodumene concentrate producer in Brazil and among … Read More

The…

- PEA outlines attractive returns for Colina with NPV of $3.6bn and IRR of 132%

- Phase 1 capex is an unchallenging US$253m with payback in just seven months

- Colina to produce both 5.5% spodumene concentrate and 3% spodumene tails concentrate

- Drilling ongoing to further grow resource

The Colina project could establish Latin Resources as the second largest spodumene concentrate producer in Brazil and among the lowest cost spodumene concentrate producers globally.

Latin Resources (ASX:LRS) was a first mover into the red-hot Minas Gerais region of Brazil, where Sigma Lithium (TSXV:SGML) is enjoying tremendous success at the newly developed 766,000tpa Grota do Cirilo mine.

Next in line is Latin’s Colina project, where a 45.2Mt at 1.32% resource is looking ripe for a substantial upgrade after its massive – and ongoing – 65,000m drill program.

This drilling has also reinforced the company’s belief that the mineralisation corridor extends a significant distance of ~12km to the southwest from the existing Colina resource.

That means there is potential for multiple deposits.

Importantly, metallurgical test work has confirmed that Colina ore can be processed using simple dense media separation to produce a high-grade, low impurity spodumene concentrate grading 5.5% Li2O with an impressive 91.3% recovery.

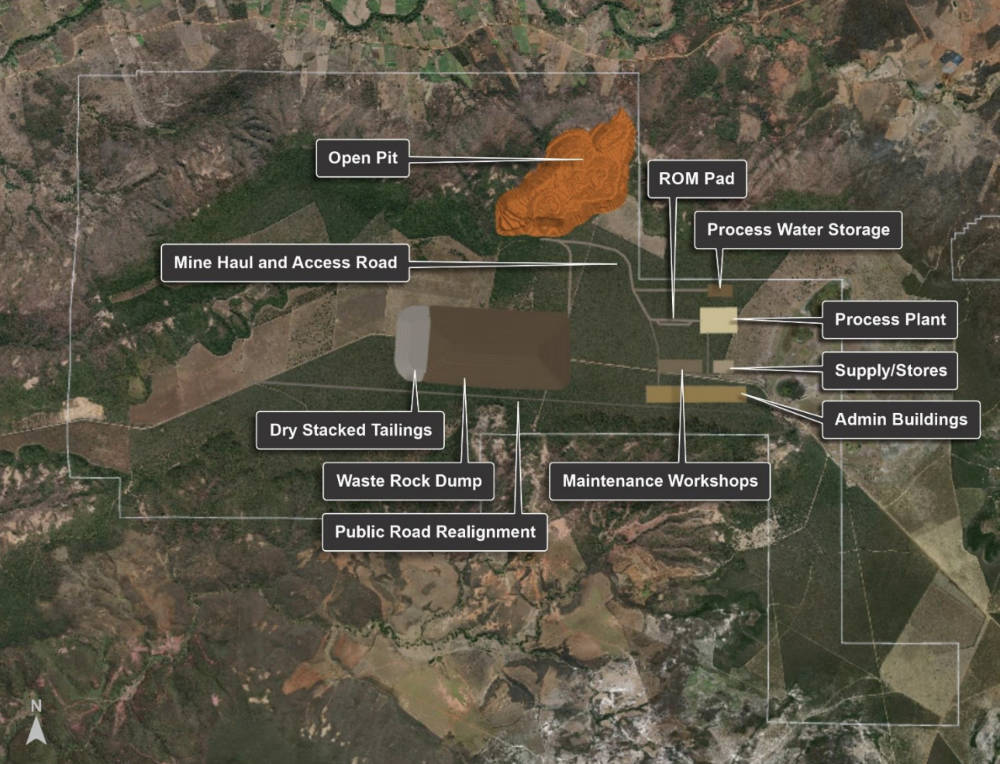

Robust, low-capital operation

Latin Resources has now released the PEA – equivalent to a Scoping Study – which outlines some truly impressive numbers.

Colina is envisaged as a low-capital, two phase operation that will deliver two revenue streams – a 5.5% Li2O spodumene concentrate and a 3% Li2O spodumene tails concentrate product with Phase 1 life of mine average production of about 405,000tpa and 123,000tpa respectively.

Using a weighted average LOM spodumene concentrate price of US$1,699/t and US$927/t for the two products – based on average price forecasts from Fast Markets and Benchmark Minerals – as well as all-in-sustaining costs of US$536/t, this is expected to deliver LOM revenue of $12.6bn with free cash flow of $6.8bn over 11 years of operations.

Returns are equally impressive with net present value and internal rate of return estimated at $3.6bn and 132% respectively.

Phase 1 Capex is estimated at US$253m to deliver first production in 2026 with payback in just seven months whilst Phase 2 Capex of a further US$55m will be fully funded by Phase 1 production and increase LOM production to 525,000tpa of SC5.5 and 159,000t of SC3.

This has the potential to establish Latin Resources as the second largest spodumene concentrate producer in Brazil and among the lowest cost spodumene concentrate producers globally.

“Latin Resources is extremely proud to have produced such compelling economic results with our first feasibility study on the Colina project,” managing director Chris Gale said.

“The low-cost capex and fast track to production in 2026 will hit the sweet spot of rising lithium prices many are predicting over the coming years. The Colina project is on track to become one the world’s largest spodumene mines with very low operational costs.

“The company is very committed to developing a lithium mine with true sustainable mining practices, which will include hydro power, dry-stack tailings and recycled water systems. The phased capital development strategy provides a viable ramp-up that self-funds its expansion to become a Tier one lithium mine.

“Minas Gerais is an excellent jurisdiction to support the delivery of the Colina project into a sustainable, large and low-cost spodumene operation on an accelerated basis.”

Further activity

Besides starting work on feasibility studies, the company continues to expand the resource through drilling with 11 rigs currently on site.

Latin’s vice president of operations Americas Tony Greenaway said the company continues to aggressively explore its tenement package as it is confident of making new discoveries in the wider project area like the new Fog’s Block prospect.

This is expected to deliver a resource upgrade, which will lead into a Definitive Feasibility Study that will also evaluate a Phase 3 extension and expansion to production.

This article was developed in collaboration with Latin Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post IRR of 132pc? Payback in just 7 months? Latin Resources’ Colina project could host one of the biggest, lowest cost spodumene mines in the world appeared first on Stockhead.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…