Energy & Critical Metals

ICCT study assesses infrastructure needed to support near term deployment of zero-emission Class 4-8 vehicles in US

A new study by the International Council on Clean Transportation (ICCT) assesses the near-term charging and refueling infrastructure needs for zero-emission…

A new study by the International Council on Clean Transportation (ICCT) assesses the near-term charging and refueling infrastructure needs for zero-emission Class 4-8 medium- and heavy-duty vehicles (MHDV) at the national and sub-national levels. Charger needs in 2025 and 2030 are projected based on zero-emission vehicle market growth, and priority locations are identified in key areas.

About 1.1 million zero-emission trucks and buses are projected to be on the roads by 2030, including 130,000 combination tractor-trailers. Rapidly declining battery costs, low-cost electricity, and federal purchase incentives mean these vehicles will be cheaper to own and operate than diesel trucks before the end of this decade.

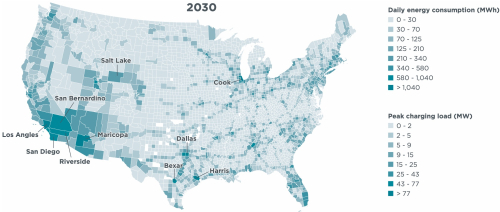

This medium- and heavy-duty vehicle electrification is projected to increase the US daily electric energy consumption by 140,000 megawatt-hours per day by 2030. This equates to around 1% of the total national electricity retail sales in 2021.

The vehicles’ energy needs will be met by slow overnight charging between 50-150 kW and ultra-fast megawatt charging of 1MW or greater. (Earlier post.) Local distribution capacity needs will be significant.

There are many options to meet both near- and long-term charging needs, the ICCT paper notes. Utilities and their regulators can match the readiness of fleets to deploy electric trucks with workable, commonsense plans to maximize the use of existing grid distribution capacity and plan for growth to meet future needs.

In some locations, depending on available infrastructure, utilities may be able to meet charging needs immediately with flexible and sometimes temporary solutions pending permanent grid upgrades. To match accelerating growth, state officials can authorize utilities to plan for and invest in distribution capacity in high priority ‘no regret’ zones based on realistic projected needs, not general historical trends.

County-level electric MHDV daily energy consumption in 2030 based on projections of near-term ZEV market growth (data labels indicate the ten counties with the highest energy consumption from electric MHDV). Source: The ICCT

The US heavy-duty charging infrastructure does not all need to be built at once, the ICCT authors observe. Growth in energy demand will concentrate in freight zones, such as ports, industrial zones, and freight corridors.

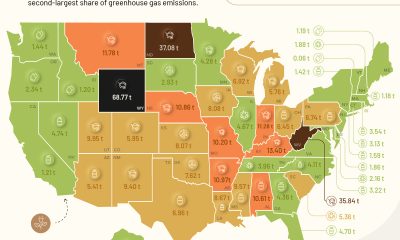

In the near term, a few US states are expected to experience the highest energy needs from medium- and heavy-duty vehicle charging. Those include states that have adopted California’s Advanced Clean Trucks rule, as well as states with the largest industrial activity. California and Texas alone are projected to account for a combined 19% of charging energy needs in 2030.

Within those states, charging needs will be concentrated in a few industrial areas and along freight corridors. The energy needs of long-haul trucks will concentrate on the corridors of the National Highway Freight Network (NHFN). The NHFN is projected to comprise 85% of the charging needs from long-haul trucks by 2030.

Counties in Southern California, the Texas triangle, and around Phoenix, Salt Lake City, and Chicago will experience the greatest energy demands from electric trucks. Targeting investments and policy support in priority areas such as those along heavily traveled corridors will accelerate the transition to zero-emission freight.

With charging infrastructure in the right places at the right time, zero-emission trucks will deliver cleaner air and save money in the long run. Now is the time for electric utilities to step up and deliver the power freight trucks need.

—Ray Minjares, Director of the ICCT Heavy-Duty Vehicles Program

Planning needs to start now so that capacity building may begin as soon as possible, the authors say. Upgrades on a project-by-project basis are unlikely to meet future needs. Rather, investments in charging infrastructure must be made at scale and at strategic locations around the country.

The paper provides state- and county-level data on projected charging needs.

Hydrogen. The ICCT paper investigates infrastructure needs for two decarbonization technology pathways: battery-electric vehicles (BEVs) and hydrogen vehicles, the latter including fuel cell electric vehicles (FCEVs) and hydrogen internal combustion engine vehicles (H2- ICEVs), assuming both share the same refueling infrastructure.

However, ICCT’s most recent TCO analysis for the US shows no case of positive TCO for hydrogen trucks relative to battery-electric trucks, even in a case with

charging costs as high as $0.25/kWh and hydrogen prices as low as $8/kg.

The ICCT acknowledges that there is interest in hydrogen trucks (both FCEVs and H2-ICEVs) as an alternative to battery electric trucks, because their higher driving ranges could limit the operational challenges associated with electric charging. Therefore, the authors assessed the needs for hydrogen refueling infrastructure under hypothetical scenarios for hydrogen prices dropping significantly lower than the projected $9/kg in 2040.

If median hydrogen prices were to drop to $6/kg in 2040, there could be 85,000 long-haul hydrogen trucks on US roads by 2050, requiring a total of 7,500 refueling stations producing hydrogen from on-site renewable electrolysis. If median prices were to drop to $5/kg, a total of 250,000 long-haul hydrogen trucks would require 22,000 refueling stations.

The ICCT authors did not attempt to identify deployment locations or by how much the need for charging infrastructure would be reduced.

Resources

-

Pierre-Louis Ragon, Sara Kelly, Nicole Egerstrom, Jerold Brito, Ben Sharpe, Charlie Allcock, Ray Minjares, and Felipe Rodríguez (2023) “Near-Term Infrastructure Deployment To Support Zero-Emission Medium- And Heavy-Duty Vehicles In

The United States”

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…