Companies

Hedge Funds Betting Big On Uranium As Nuclear Energy Surges

Source: Streetwise Reports 11/03/2023

Hedge funds are significantly increasing their exposure to uranium stocks, betting on major price gains…

Source: Streetwise Reports 11/03/2023

Hedge funds are significantly increasing their exposure to uranium stocks, betting on major price gains as nuclear energy sees a global resurgence.

Several prominent hedge fund managers have begun substantially ramping up their investments in uranium stocks. They are betting on significant price appreciation as nuclear energy experiences a major global resurgence.

According to Bloomberg, managers, including Matthew Langsford of Terra Capital, Arthur Hyde of Segra Capital, Barry Norris of Argonaut Capital, and Renaud Saleur of Anaconda Invest, are building large positions in uranium mining companies.

Cameco Corp.

The hedge funds are particularly focused on acquiring shares of top uranium producers such as Cameco Corp. (CCO:TSX; CCJ:NYSE), Ur-Energy Inc. (URG:NYSE.MKT; URE:TSX), and NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT). [OWNERSHIP_CHART-173]

Cameco is a leading global uranium provider that powers the world with safe, reliable nuclear energy. As one of the largest uranium mining and processing companies, it supplies the fuel needed to generate emissions-free electricity for utilities across the globe.

With tier-one mining assets and mills, Cameco has the licensed capacity to produce over 30 million pounds of uranium concentrate per year. Our operations are backed by proven and probable reserves exceeding 469 million pounds of uranium. Beyond mining and milling, we also provide key refining, conversion, and fuel manufacturing services to our utility customers.

Recently, The Financial Post reported that “Cameco soared to a 52-week intraday high of US$57.62, before finishing ahead US$4.37 at US$56.73.”

Cantor Fitzgerald also put out a report on the company, giving it a Buy rating and a US$58 target price.

According to Reuters, 0.39% of the company is held by management and insiders. Director Tim Gitzel has 0.10%, with 0.44 million shares, and Executive Vice-President and Chief Financial Officer Grant Isaac has 0.06%, with 0.27 million.

73.04% is with institutional investors. Fidelity Management & Research Company LLC has 5.07%, with 21.99 million shares. The Vangaurd Group Inc. has 3.49%, with 15.13 million. Capital World Investors 3.29%, with 14.28 million. Capital World Investors has 3.29%, with 14.28 million. Mirae Asset Global Investments (USA) LLC has 2.89%, with 12.55 million, and T. Rowe Price Associates Inc. 2.35%, with 10.19 million.

0.01% is with strategic investors.

The rest is held by retail.

Market Watch notes that the company has a market cap of US$17.71 billion and 433.31 million shares outstanding. It trades in the 52-week range between US$21.22 and US$42.17.

Uranium Energy

Another company is Uranium Energy Corp. (UEC:NYSE AMERICAN), which has established itself as the fastest-growing uranium fuel supplier for the green energy transition. As the largest diversified North American-focused uranium company, UEC is advancing the development of low-cost, environmentally-friendly in-situ recovery (ISR) mining projects in the United States as well as high-grade conventional projects in Canada.

The company boasts two production-ready ISR hub and spoke platforms in South Texas and Wyoming anchored by fully licensed and operational central processing plants. UEC also holds permits for seven additional U.S. ISR uranium projects. [OWNERSHIP_CHART-402]

Beyond its mining assets, UEC has diversified uranium holdings, including one of the largest physical stockpiles of U.S. warehoused U3O8, a major equity stake in Uranium Royalty Corp as the only royalty company in the sector and a pipeline of resource-stage uranium projects.

UEC’s operations are managed by industry professionals with extensive first-hand experience across key aspects of uranium exploration, development, and mining. Their specialized expertise positions the company for further growth as a leading uranium supplier.

Reuters reports that 1.79% of the company is held by management and insiders. President, CEO, and Direct Amir Adnani has the most out of this category at 1.02%, with 3.92 million shares.

55.67% is with institutional investors. BlackRock Institutional Trust Company N.A. has 6.14%, with 23.69 million shares. Mirae Asset Global Investments (USA) LLC has 5.55%, with 21.42 million. The Vanguard Group Inc. has 5.43%, with 20.95 million, and MMCAP Asset Management has 4.91%, with 18.94 million.

The rest is owned by retail.

Market Watch notes the company has a market cap of US$2.3 billion and 385.85 million shares outstanding. It trades in the 52-week range between US$2.30 and US$6.03.

Nuclear Essential To Reaching Net Zero Emissions

Long after the Fukushima nuclear disaster turned many countries against nuclear power, it has reestablished itself as an essential part of the transition to a low-carbon future.

Nuclear energy does not directly emit carbon dioxide. The World Nuclear Association estimates that global nuclear capacity must double by 2050 to help meet net zero emissions targets. This is driven by a surging market in Europe, Asia, and Africa for new reactors, in addition to extending old plants’ lifespans.

China also continues expanding its nuclear fleet.

Increasing Focus on Energy Independence

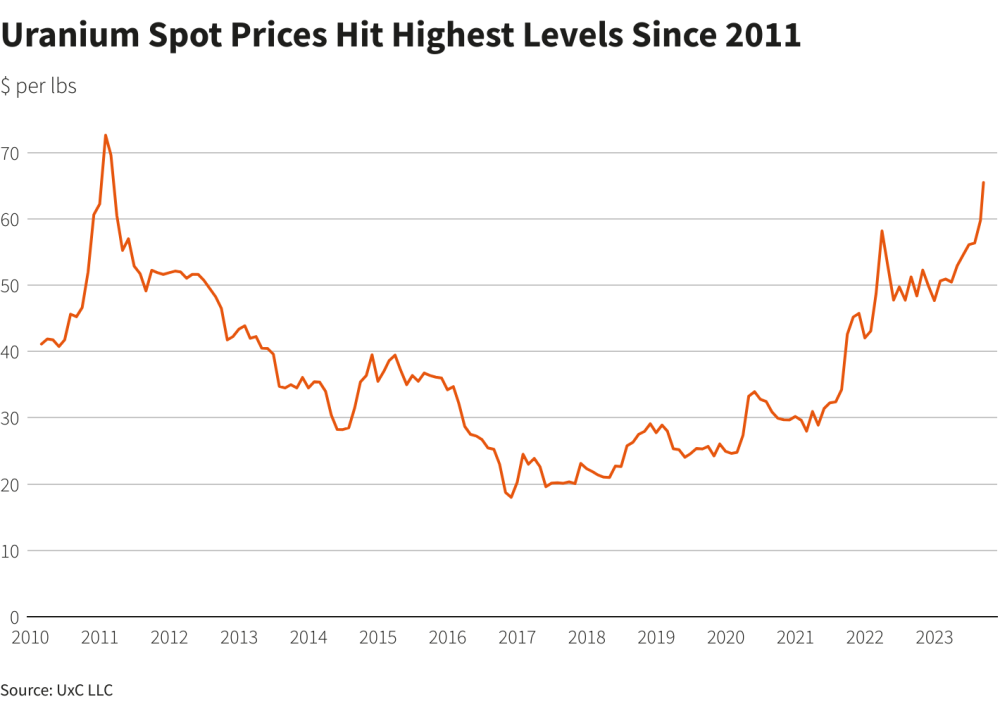

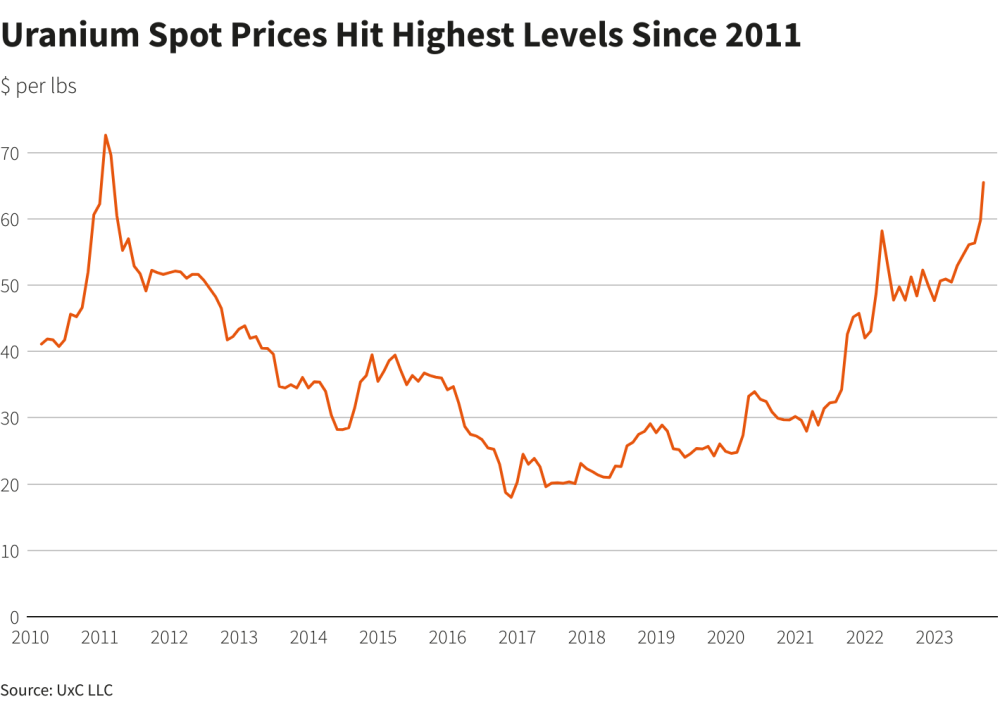

Reuters reported that “Uranium prices are likely to extend a blistering rally and end the year more than 50% higher as mounting worries over climate change accelerate a global shift to cleaner sources of energy, including nuclear power.”

With this, hedge funds see enormous potential in uranium miners to help Western countries achieve independence from Russia and China, which control significant parts of the global nuclear fuel supply chain.

Establishing new domestic mines, conversion, and enrichment facilities is key to that independence.

Environmental Concerns Remain

However, nuclear power remains controversial due to concerns over reactor safety and radioactive waste disposal.

High costs also inhibit wider adoption. But nuclear’s appeal has risen as Europe attempts to end its reliance on Russian natural gas following Russia’s invasion of Ukraine.

With Russia controlling around 8% of recoverable uranium, the West needs to make an even bigger energy supply shift.

Processing and Fuel Cycle Lengthy

Uranium goes through multiple complex processing steps before being ready for use in reactors. After mining and milling, it is converted to a gas, enriched, made into fuel rods, and loaded into reactors where fission occurs. The entire fuel cycle can take years and relies on international supply chains.

Hedge funds believe political pressures will drive Western nations to develop domestic fuel cycle capabilities. They agree on uranium’s positive macro outlook but diverge on stock picks. While most are bullish on large producers, some believe smaller miners offer greater upside.

Skyharbour Resourced Ltd.

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) has been making moves this year as it continues working on its uranium projects. Skyharbour has amassed an extensive portfolio of uranium exploration projects located in the uranium-rich Athabasca Basin region of Canada. With twenty-four total projects, ten of which are drill-ready, the company controls over 1.2 million acres (over 518,000 hectares) of mineral claims.

A key asset for Skyharbour is the Moore Uranium Project, acquired from Denison Mines, a major corporate strategic shareholder of the company. The Moore project is situated near Denison’s Wheeler River project and Cameco’s McArthur River mine in the eastern part of the Athabasca Basin. Moore is considered an advanced uranium exploration property, with high-grade uranium mineralization identified at the Maverick Zone. Previous drilling at Maverick yielded exceptional uranium intercepts, including 6.0% U3O8 over 5.9 meters and 20.8% U3O8 over 1.5 meters at a depth of 265 meters vertically. Adjacent to the Moore Uranium Project is Skyharbour’s other co-flagship, Russell Lake Uranium Project, which has been optioned from Rio Tinto. The project hosts historical high-grade drill intercepts over a large property area with robust exploration upside potential. Skyharbour has recently completed an inaugural 9,600m drill program with plans for an upcoming winter drill program to follow up on the success of the first program.

In August, Technical Analyst Clive Maund gave Skyharbour a Buy rating.

November 1, Skyharbour reported its partner company Tisdale Clean Energy Corp., plans to begin exploration at the South Falcon East Uranium Project, which hosts the Fraser Lakes Zone B uranium deposit (More details below.). [OWNERSHIP_CHART-6026]

Jordan P. Trimble owns 1.73% of the company with 2.79 million shares, and David Daniel Cates owns 0.77% with 1.25 million shares.

The following Institutions own approx. 22% of the company. Alps Advisors, Inc. owns 6.69% with 11.4 million shares, Mirae Asset Global Investments LLC owns 4.91% with 8.36 million shares, Sprott Asset Management LP owns 3.07% with 4.96 million shares, Exchange Traded Concepts, LLC, owns 2.62% with 4.24 million shares, MMCAP Asset Management owns 2.26% with 3.66 million shares, Incrementum AG owns 1.38% with 2.35 million shares, Vident Investment Advisory, LLC, owns 0.38% with 0.61 million shares, and DWS Investment GmbH owns 0.37% with 0.60 million shares.

Skyharbour has two strategic corporate investors, with Denison Mines owning 11.4 million shares and Rio Tinto owning 3.5 million shares.

The company has over CA$4 million in the bank, with approx. CA$10 million expected to come in from option partner payments over the next twenty four months and a burn rate of about CA$125k.

There are 170.4 million shares outstanding, with 144.2 free-float traded shares. The company has a market cap of CA$95.4 million. It trades in the 52-week period between CA$0.32 and CA$0.63.

Tisdale Clean Energy

Tisdale Clean Energy Corp. (TCEC:CSE), alongside Skyharbour, announced a planned exploration program at its South Falcon East Uranium Project, Athabasca Basin, Saskatchewan.

The South Falcon East property is located approximately 18 kilometers outside the southeast portion of the Athabasca Basin in Canada. With a total area of around 12,234 hectares, the property sits 55 kilometers east of the Key Lake Mine. The South Falcon East project benefits from proximity to two all-season highways in the north as well as access to grid power infrastructure.

Its strategic location just outside the Athabasca Basin makes South Falcon East a promising uranium exploration target. Additionally, the nearby Key Lake Mine demonstrates the broader region’s potential for significant uranium deposits. By leveraging these advantages of location and infrastructure, the South Falcon East property presents an attractive opportunity for further uranium exploration and development.

Jordan Trimble, President and CEO of Skyharbour, which has optioned up to 75% of South Falcon East to Tisdale, stated: “We are very excited to have this option agreement and partnership with Tisdale as they prepare for an upcoming winter drill program. Skyharbour is a large shareholder of Tisdale and we are looking forward to working with the company and its management team as they advance the South Falcon East Project over the coming years with a substantial amount of exploration planned. The project is host to a near-surface uranium deposit that is open along strike and at depth, and there are numerous other highly prospective targets in the project area.”

In early October, Clive Maund wrote, “Whilst it is clearly something of a “sleeper” in that it might take a while yet to get moving and of a speculative nature, Tisdale Clean Energy is viewed as good value here with little downside potential and a lot of upside, and with the very low number of shares in the float it won’t take all that much buying to lead to significant gains.”

Reuters reports no ownership information.

Market Watch notes that Tisdale has a market cap of US$2.02 million and 16.47 million shares outstanding. It trades in the 52-week range between US$0.1147 and US$0.5299.

All in all, experts are betting big that a supply ramp-up of this magnitude will be a game changer for nuclear energy and uranium prices.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tisdale Clean Energy Corp., Cameco Corp., and Uranium Energy Corp.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

( Companies Mentioned: CCO:TSX; CCJ:NYSE,

SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE,

TCEC:CSE,

UEC:NYSE AMERICAN,

)

tsx

cse

nyse

otcqx

tsxv

uranium

tsx-nxe

nexgen-energy-ltd

nexgen energy ltd

tsx-ure

ur-energy-inc

ur-energy inc

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…