Energy & Critical Metals

Fraunhofer ISI releases roadmap for battery technologies up to 2045

Fraunhofer ISI has released a roadmap for alternative battery technologies for the period up to 2045. The roadmap analyzes technology-specific advantages,…

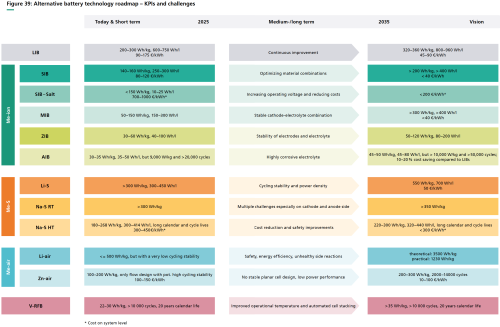

Fraunhofer ISI has released a roadmap for alternative battery technologies for the period up to 2045. The roadmap analyzes technology-specific advantages, future areas of application, markets and supply chains as well as Europe’s position, costs and industrial scalability.

The roadmap also shows fields of action for the EU and Germany with regard to technology sovereignty. The findings obtained are based on a comprehensive literature search, an online survey, a detailed expert survey and an expert workshop.

The roadmap covers the following alternative battery technologies:

- Metal-ion (Me-ion)

- Sodium-ion batteries (SIBs)

- Sodium-ion saltwater batteries (SIBs Salt)

- Magnesium-ion batteries (MIBs)

- Zinc-ion batteries (ZIBs)

- Aluminum-ion batteries (AIBs)

- Metal-sulfur (Me-S)

- Lithium-sulfur (Li-S)

- Sodium-sulfur room temperature (Na-S RT)

- Sodium-sulfur high temperature (Na-S HT)

- Metal-air

- Lithium-air (Li-air)

- Zinc-air (Zn-air)

- Redox flow batteries (RFBs)

Source: Fraunhofer ISI

The roadmap addresses a number of questions that are currently being asked with regard to alternative battery technologies:

-

What are the technological advantages of alternative battery technologies? Many alternative battery types such as metal-ion (e.g. sodium-ion or zinc-ion batteries) or metal-air batteries (e.g. zinc-air batteries) offer high potential for more sustainability, lower costs or less resource consumption, but sometimes also have disadvantages such as lower energy density or low technology maturity. Metal-sulfur batteries can have a higher energy density and their costs are expected to be significantly lower than those of the LIBs due to the low sulfur costs per kWh. Redox flow batteries are already available on the market, but still need to improve in terms of costs and carbon footprint.

-

Which applications are suitable for alternative battery technologies? For mobile applications, sodium-ion batteries are on the verge of far-reaching commercialization; the first sodium-ion batteries are already used in electric two-wheelers and small cars. Lithium-sulfur batteries could be used in larger drones from 2035 and even in other electric aircraft from 2040. For stationary applications, the requirements for example for energy density are lower. Here some storage systems already available on the market such as redox flow batteries, saltwater or sodium sulfur high-temperature batteries could become more relevant in the near future—just like sodium-ion batteries, which are characterized by good resource availability, safety and deep discharge capacity or zinc or aluminum ion batteries.

-

Are there alternative battery technologies that significantly reduce dependence on raw materials? Due to their lower energy density compared to LIBs, some promising alternative battery technologies require larger amounts of raw materials to achieve the same storage capacity. However, many of the non-tium-based technologies require less critical raw materials than LIBs. Due to the lack of large areas of application and markets, the production and supply of lithium, nickel and cobalt will nevertheless remain critical for the time being—especially in the next 5 to 10 years.

-

Are alternative battery technologies foreseeable that are produced and scalable similar to LIBs? Metal-ion batteries that are not among the LIBs are promising here in the coming decade because their production steps are very similar to those of LIB. Existing production technologies and environments could be used directly (drop-in technologies) or would only have to be adapted to a limited extent.

-

Can alternative battery technologies become cheaper than LIBs? Although alternative battery technologies have potentially lower material costs than LIBs, their cell costs are likely to be higher initially due to the small production volume. Scaling production brings significant cost advantages, but this requires sufficiently large markets and applications on a GWh scale. -

How is Europe positioned in alternative battery technologies? Patent and publication analyses show that the EU countries are better positioned for redox flow batteries, lithium-air or aluminum-ion batteries than currently for LIBs—but Japan and China remain leaders here. For some alternative battery technologies, the EU countries have a high dynamic with annual growth rates between 10 and 50 percent, for LIB the growth is about 10 percent.

Dr. Annegret Stephan, scientific coordinator of the roadmap at Fraunhofer ISI, points out the need for support from politicians to tap the potential of alternative battery technologies.

Especially in the initial phase, in which the future market development is still uncertain, incentives for the industry can be helpful. A holistic policy approach that takes into account the entire supply chain, basic research on technology-specific issues, patents, production processes, the safeguarding of resources and the perspectives of end users is essential here. In addition to large companies, this approach should also include SMEs and start-ups.

—Dr. Annegret Stephan

According to the study authors, however, such a holistic approach is associated with high costs and risks and can therefore only be applied to a limited number of technologies. Systematic and regular screening processes for the selection of key technologies as well as criteria for a possible termination of funding are particularly important.

The team of authors of the roadmap concluded that LIBs will continue to dominate the market, but selected alternative battery technologies can create relief from raw material, production and supply dependencies in certain markets and applications and thus contribute to technology sovereignty. Further efforts in the field of research and development in Germany and the EU are necessary and worthwhile.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…