Energy & Critical Metals

Ford ready to burn rubber on Wall St; EV sales double as Tesla in Elon trouble

Over in crazy land, The Ford’s Motor Company’s (F) absolutely critical EV sales have finally burned a little rubber, if … Read More

The post Ford…

Over in crazy land, The Ford’s Motor Company’s (F) absolutely critical EV sales have finally burned a little rubber, if one can labour the point.

I think I will, because the acceleration is happening, as Yoda recently foretold, just as market monster Tesla begins to look vulnerable.

The industry’s forgotten giant, actually looks like remembering its gigantism (outside the F-series), with a super December sales update revealing genuine gains into the Electric Vehicle market share.

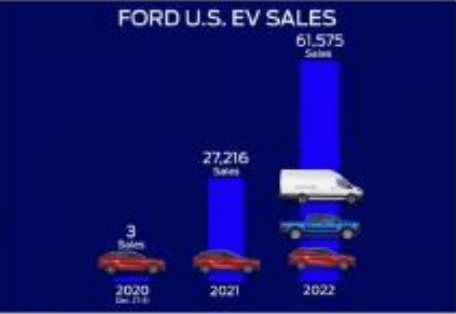

EV sales more than doubled in the FY to December, with 61,575 vehicles rolling out the door. The additional sales brought Ford’s full-year deliveries to a smidgen below the 1.91M sold last year, but well in line with an auto-industry still on the frontline of supply issues and microchip backlogs.

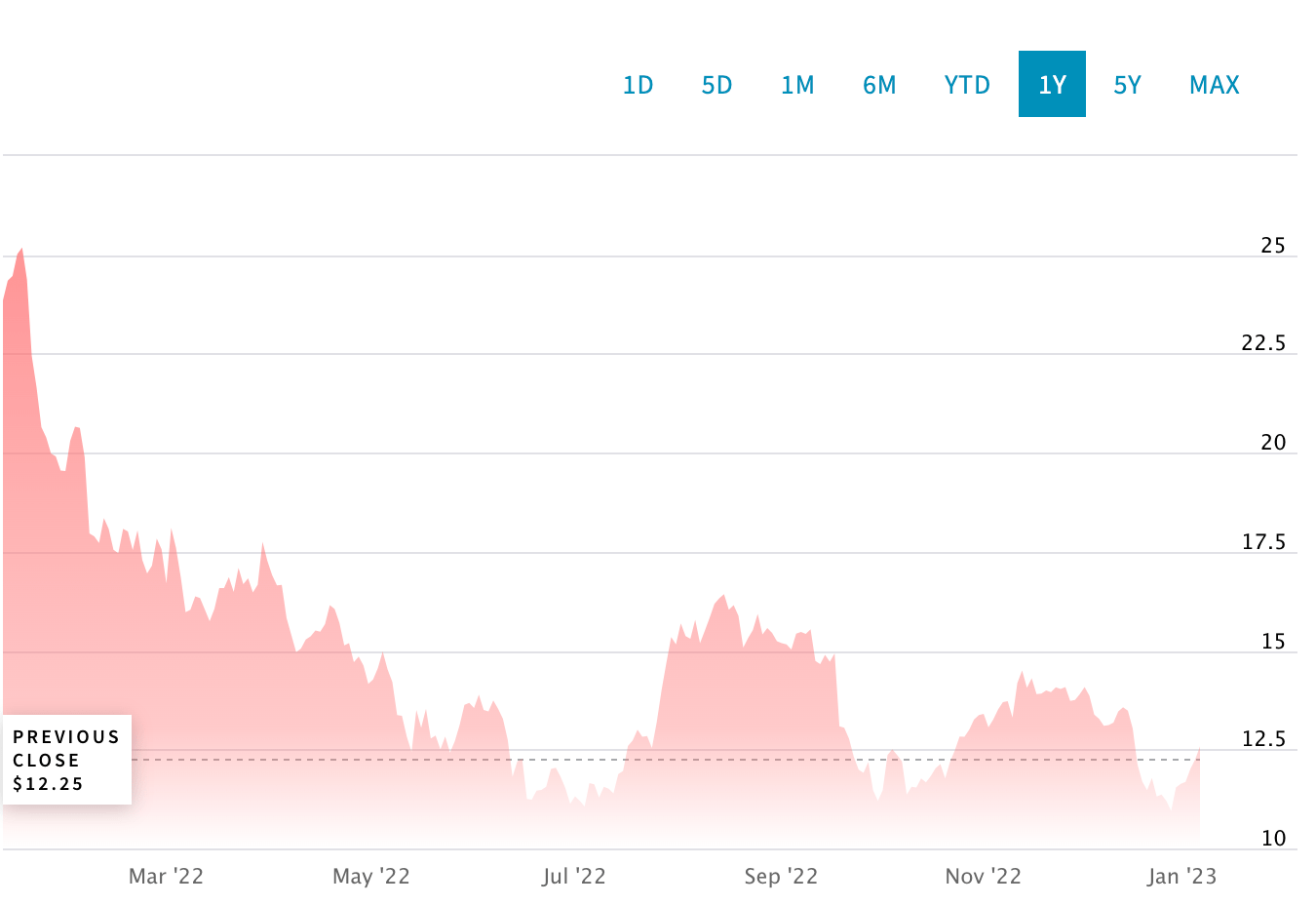

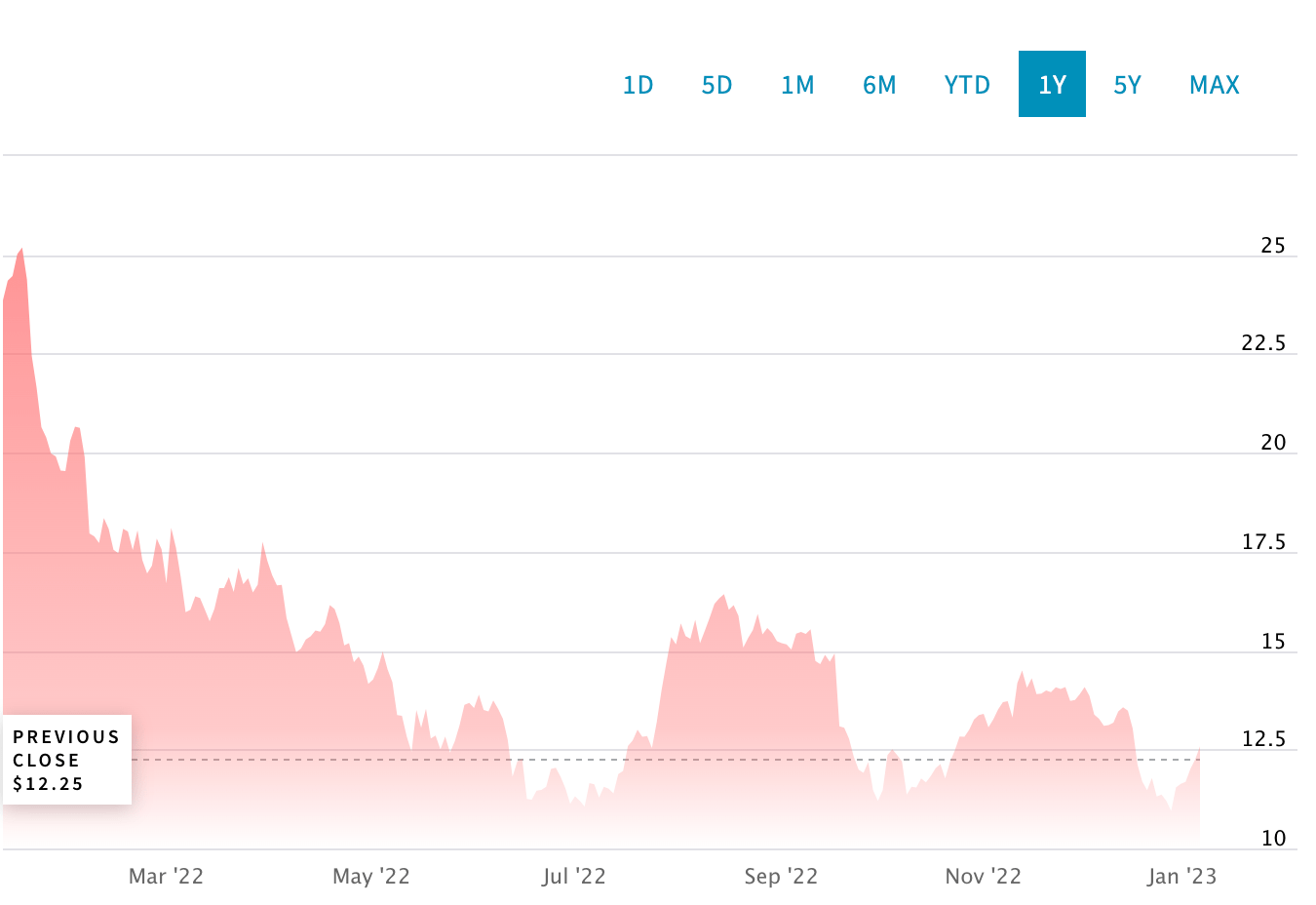

Ford Motor Company Common Stock (F)

Ford’s share price has fallen by half since this time last year, and while that’ll be stinging for the many long-term Ford investors, it makes the December sales update look even rosier.

The numbers are fab for a company with a terminal share price problem, which is still massively undervalued compared to EV market leader Tesla (TSLA).

But right now, for the first time – in terms of EV sales in the US – Ford is now in second place.

EV on the Ford CV

December has put some icing on Ford’s 2H 2022 performance which will be closely scrutinised (by someone, we hope) over at Twitter CEO, Elon Musk’s Tesla.

The arrival of Ford’s electric pickup truck in the states last year, the F-150 Lightning, helped shine a spotlight on the former giant’s gains in the critical EV market. Ford is ready to take a peice of the Tesla pie, and the automaker will be banking – literally – on an electric surge to renew its brand and deliver real growth in 2023.

There’s a long road to travel. Tesla is valued about eight times more than Ford and the other biggie General Motors, even though Elon’s carmaker makes far fewer cars.

Tesla meanwhile, has endured its worst annual decline on record over the past turbulent 12 months, the share prive crashing more than 60% as even true believers grew weary of watching Elon play with his new Twitter toy at the cost of an apparent commitment to Tesla.

Ford sold 15,617 F-150 Lightnings last tear, under expectations as attempts to accelerate car production stalled all overt he place.

For Ford it was a need to fast track battery pack production for the Lightnings.

But the company out of Michigan said it sold 6,500 electric delivery vans. That’s pretty good. And sales of a prototype electric SUV, the Mustang Mach E, really jumped, up almost 50% on this time last year , to almost 40k sold.

America’s most American automaker is also building a couple of battery factories somewhere in Kentucky, while a 3rd, I think is on the cards to go with the new great big electric truck plant in Tennessee.

December truck sales jumped 10.9% from the prior year to 101,649 and leapt to 653,957 sold in the full year. F series truck sales were cited as outpacing the next-closest competitor in the GM (GM) manufactured Chevrolet Silverado by more than 140,000 units.

Electric shadow

According to Ford’s VP of sales Andrew Frick the F-Series we’re seeing a lot more of in Australia these days, was again the best selling truck in the states for a ludicrous 46th straight year.

“Much was accomplished in 2022, with Ford increasing its share of the industry by 0.7 percentage points.

Delivering on our strategy, share expansion came from broad- based growth from our SUV lineup and our all-new EVs growing at twice the rate of the overall EV segment.

“With a strong retail order bank, Ford is well positioned heading into 2023.”

Meanwhile, the woes at Tesla continue, and for the first time the EV market looks open to competition from almost every corner and the market is huge, remember Tesla is still worth more than the 4 biggest auto companies worldwide… combined.

Both Ford and GM have a market cap of about US$45b. Even minus Elon, Tesla’s market cap is US$375b, and that’s after leaking about $710b in market value this year.

But if Ford is gaining market share in the EV space, then the ball game is wide open.

The post Ford ready to burn rubber on Wall St; EV sales double as Tesla in Elon trouble appeared first on Stockhead.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…