Energy & Critical Metals

First Lithium’s Mali project has all the right ingredients for a ‘rich lithium resource’

Special Report: Explorers like First Lithium are moving fast to unlock Africa’s mineral-rich and underexplored battery mineral endowment. … Read More

The…

- First Lithium has raised $2m and will relist on the ASX *this week* with a total of $6m cash at bank

- Proceeds will help fund exploration including extensive drilling of its Mali lithium project

- Project is located close to Leo Lithium’s Goulamina project

Mineral-rich and underexplored, Africa is emerging as a tier 1 lithium mining destination. Explorers like First Lithium are moving fast to unlock its battery mineral endowment.

The US Geological Survey has estimated that Zimbabwe, the Democratic Republic of Congo, Ghana, Namibia and Mali have a combined 4.38 million tonnes in lithium resources.

There’s also plenty of potential for further growth, given that the continent is still largely unexplored.

Highlighting this potential, Benchmark Minerals Intelligence (BMI) has forecast that Africa’s mined lithium production could increase more than 10-fold this decade.

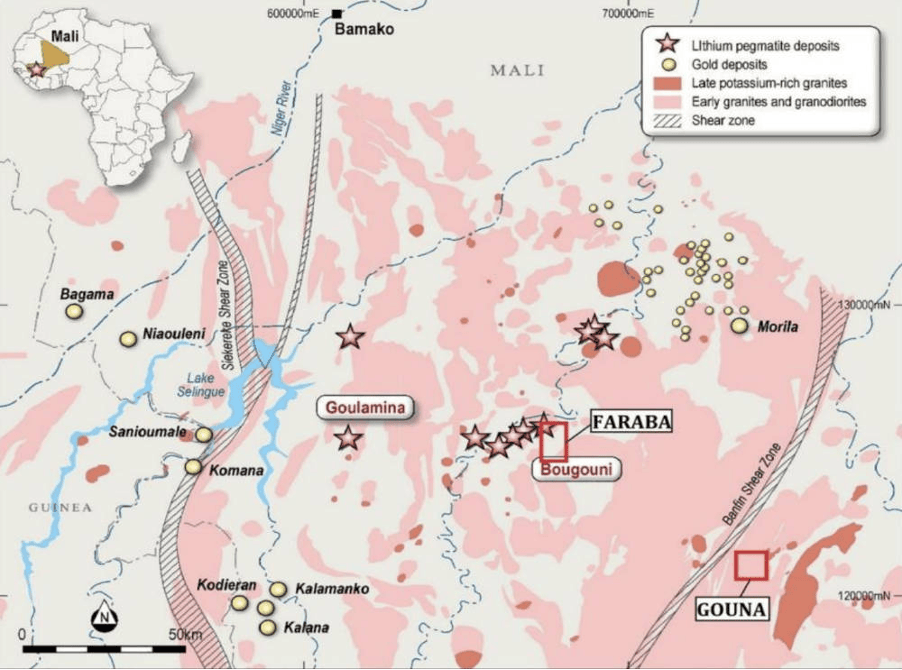

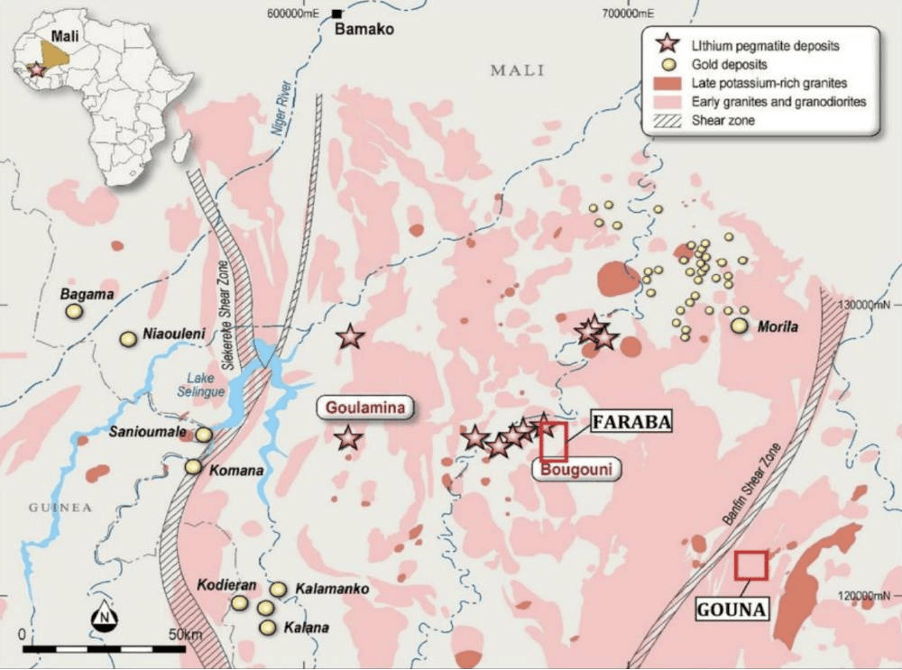

Looking to carve out its own piece of the pie is First Lithium, which is relisting on the ASX with a newly acquired and highly promising 175km2 lithium project in Mali’s Sikasso region.

What makes this project stand out?

Speaking to Stockhead, managing director Venkatesh Padala said the early stage project — which includes the Faraba and Gouna permits — so far showed a high possibility of a rich lithium resource which the company would seek to prove up through extensive drilling.

It is surrounded by world class lithium projects, including Leo Lithium’s Goulamina joint venture project with Ganfeng Lithium Group and on the same strike as Kodal’s ~24Mt Bougouni project.

Goulamina is one of the world’s largest spodumene projects with a 211Mt resource grading 1.37% Li2O, which neatly highlights the prospectivity of the region.

Importantly, both permits are located within the same Goulamina spodumene pegmatite as Leo Lithium’s advanced mine development.

Bougouni includes a feasibility study based on three identified lithium prospects – Sogola-Baoule, Ngoualana, and Boumou – that have combined resources of 21.3Mt at 1.11% Li2O.

The feasibility study forecasts an annual production of 220,000 tonnes of 6% grade spodumene concentrates containing 71% recoverable lithium over a mine life of 8.5 years.

Padala says historical exploration carried out in the 1970s by the Russians and later by BRG highlighted the promising lithium potential in different areas of Mali.

“Two of these have been proven by Leo Lithium and Kodal Minerals (LON:KOD),” he says.

“One of First Lithium’s areas lies on the same strike as Kodal’s Bougouni project with proven results by the Russians whilst the second area has similarities to other similar projects and has a 500m long by 40m wide outcrop which has been sampled and tested showing high grades of spodumene.

“The licence areas are also close to highways and the terrain is flat, which helps in keeping transportation costs to a minimum.”

Exploration plans

First Lithium is keen to get to grips with its asset with Padala noting that the company had already kicked off an extensive drill program over the next 6-12 months that seeks to prove up an initial resource.

This drilling, which will be carried out across both Faraba and Gouna, is part of a broader two-year program that will systematically explore the project.

Other surface exploration work to be carried out include geophysical, gravity survey and soil sampling activities that will seek to identify additional drill targets.

Exploration success will also allow First Lithium to evaluate opportunities for lithium production and seek further exploration, acquisition, and joint venture opportunities in Africa and elsewhere.

Re-listing and management

First Lithium has raised $2m through the issue of 10 million shares priced at 20c each as part of its re-listing on the ASX under the ticker FL1 *this week*.

On completion, the company will list with a market capitalisation of $19.81m, 99.1 million shares on issue and $6m in cash, allowing it to complete its aggressive exploration campaign.

Guiding the company through the re-listing process and exploration campaign is its new management team led by Padala who has more than 25 years of experience in technical, financial, AI-based manufacturing and mining.

He has successfully executed his role as executive director in mining, technical and manufacturing industries in India and US for the past 15 years.

Padala has been on the board of Intermin Mines Corporation since 2016 and is a hands-on director who works closely with the team on the ground and has been critical in identifying lithium resources.

Other key personnel include non-executive chairman Lee Christensen, who is a lawyer and former senior partner at both Dentons and Gadens in Perth and is currently the chairman of Titanium Sands (ASX:TSL).

He is specialised in dispute resolution, insolvency and restructures, and has extensive ASX board experience.

Non-executive director Andrew Law is a qualified mining engineer with 35 years’ of experience in mining and resources industry in Australia, Africa and South America.

Law has extensive technical and management experience at the ASX board, corporateand operational levels.

This article was developed in collaboration with First Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post First Lithium’s Mali project has all the right ingredients for a ‘rich lithium resource’ appeared first on Stockhead.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…