Energy & Critical Metals

BW Equities flags BUY rating for Frontier and its near-term green hydrogen project

Special Report: Frontier Energy has nabbed a BUY recommendation from BW Equities and a target price of $0.71 per share … Read More

The post BW Equities…

Frontier Energy has nabbed a BUY recommendation from BW Equities and a target price of $0.71 per share – a 48% increase on the current price.

Governments around the world are increasingly implementing subsidies to build out their respective green hydrogen sectors.

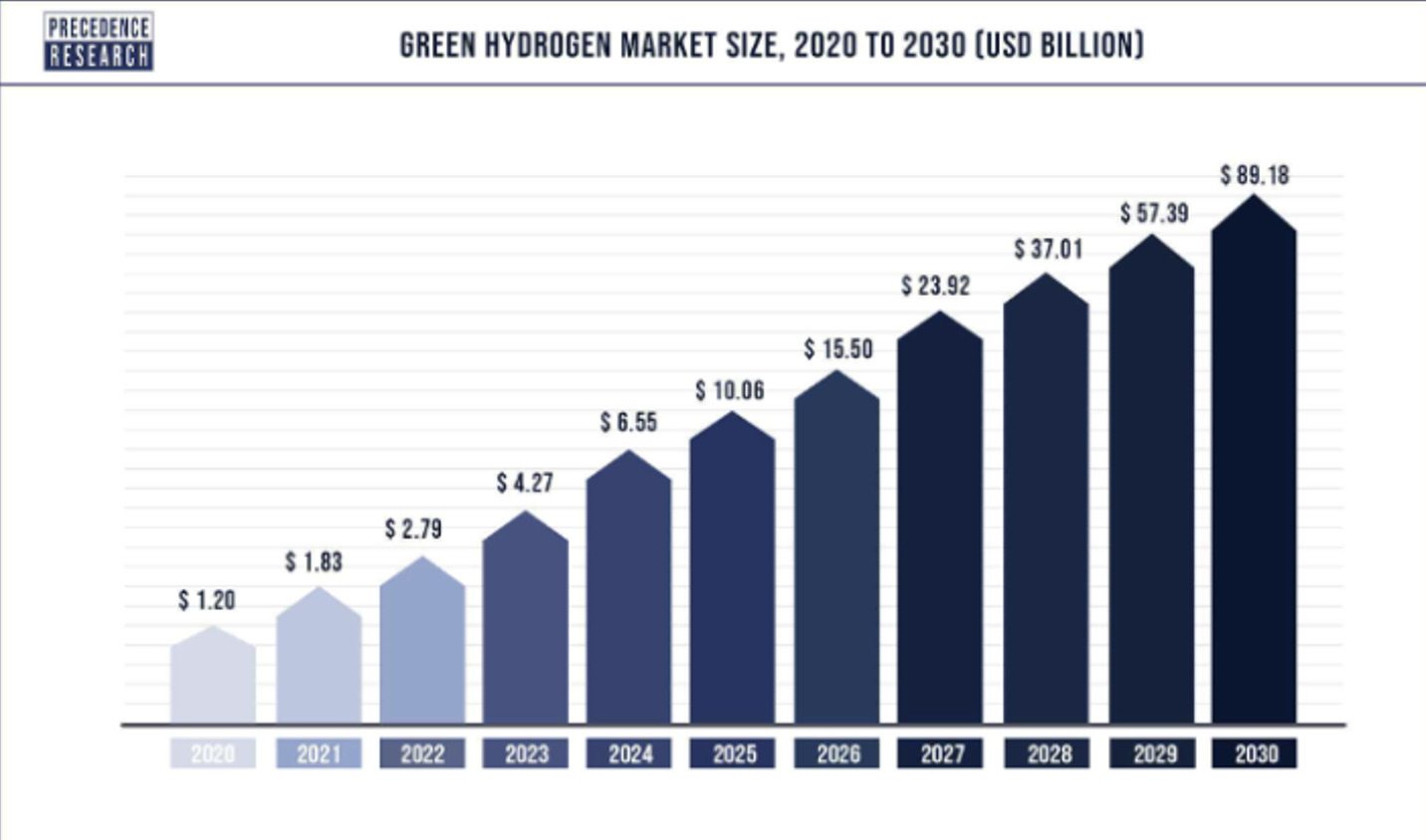

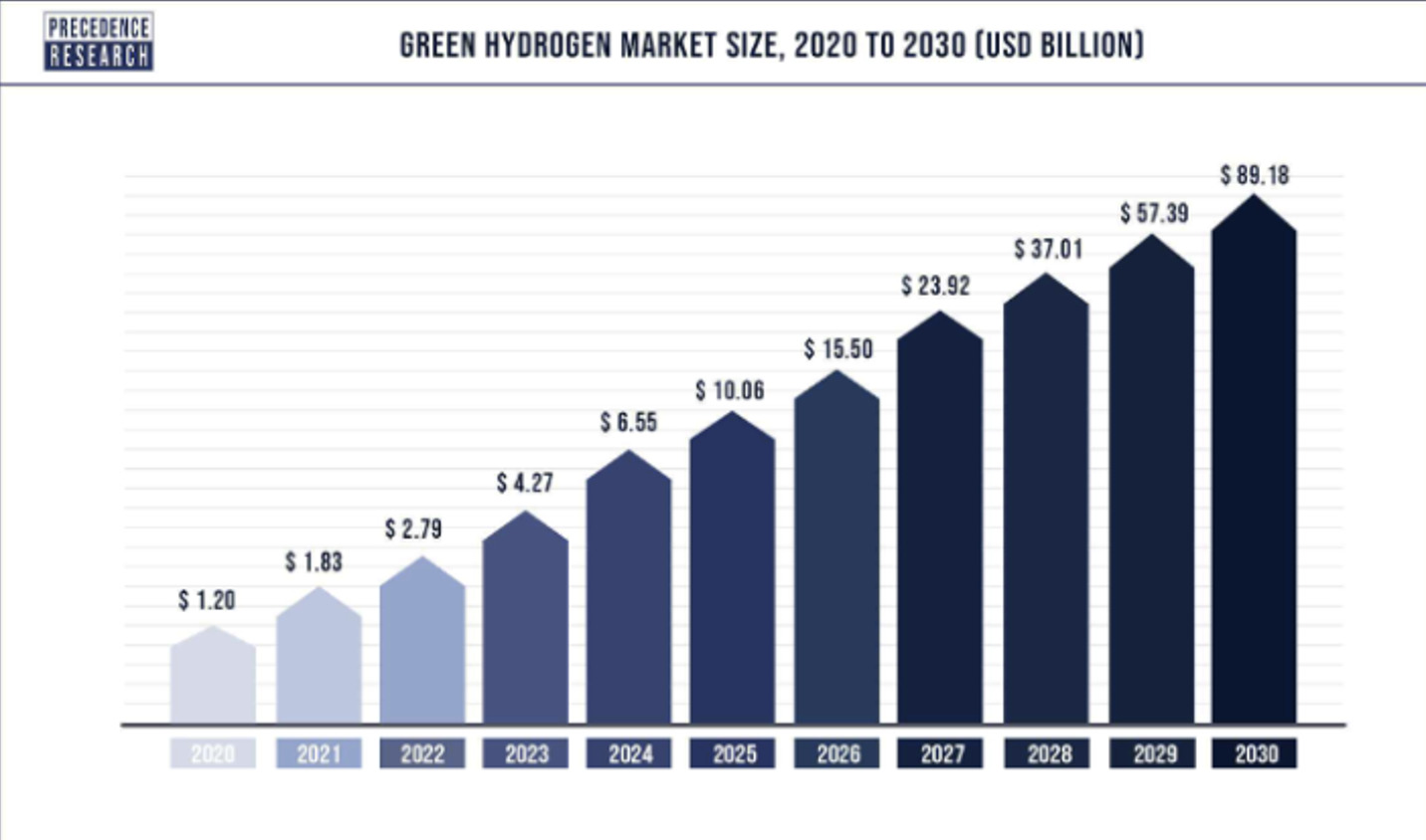

This global push is part of the reason why BW Equities head of research Lindsay Bettiol believes the hydrogen market can grow ~100x this decade.

“We believe a mix of primary and second energy sources will be required if governments and industries are to achieve their stated climate objectives,” he said.

“Hydrogen, as a high energy density, zero emissions fuel will unquestionably have a role to play in many industries such as ammonia, desulphurisation, long-haul transport, and others.

“For these reasons, growth in the use of green hydrogen is forecast to explode over the coming decade, with the chart below (and many others like it) showing a rise in demand from ~US$1bn at the start of this decade to ~US$90bn by 2030.”

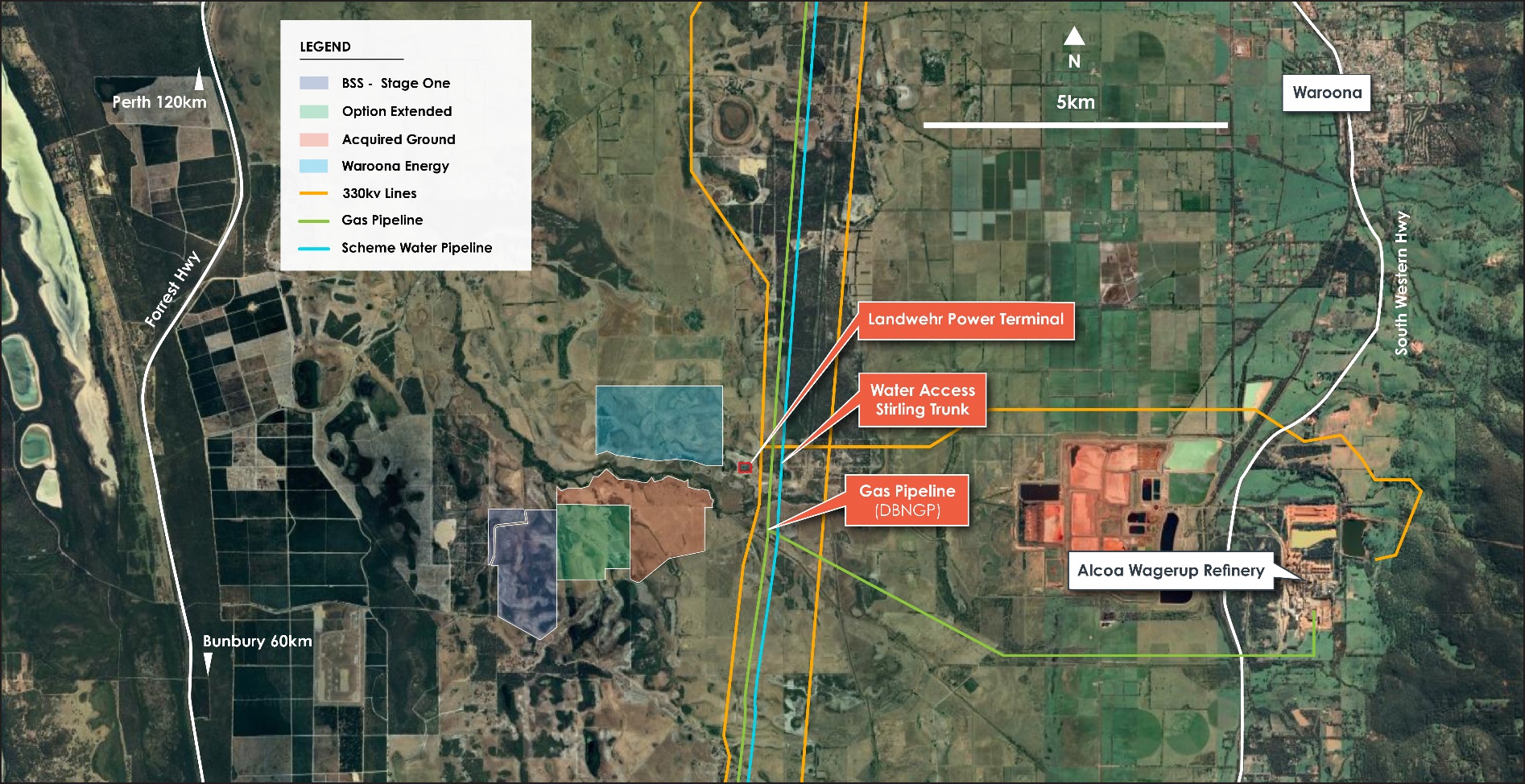

Bettiol says Frontier Energy (ASX:FHE) is the only way to play near-term production on the ASX, with its Bristol Springs project in WA.

Near-term production at Bristol Springs

“For investors looking to gain exposure to near-term green hydrogen production as an investment thematic, we note a distinct dearth of ASX-listed opportunities apart from FHE given other names are focused on new tech (Hazer Group (ASX:HZR)), Sparc Technologies (ASX:SPN)), or are larger and longer-dated propositions (Province Resources (ASX:PRL)) or target different parts of the hydrogen chain all together (Provaris Energy (ASX:PV1)),” he said.

“We expect early domestic uses of green hydrogen will include (1) blending within gas pipelines, (2) replacement of grey hydrogen in heavy industry, and (3) long-haul transportation.

“Encouragingly, BSP is located in close proximity to potential commercial customers from each of these verticals.”

Plenty of room to grow

BWE also flagged the project’s extremely low costs of production of $2.83/kg in the pre-feasibility study and expects to see production costs fall in Stage 2 and beyond due to improving electrolyser technologies and/or benefits of scale.

And there is certainly room to scale up.

“FHE controls land enabling it to increase solar production to 438MWdc, while its Collaboration Agreement with soon-to-be 20%-owned Waroona Energy increases this further to ~700MW,” Bettiol said.

“With long-term ambitions to generate >1GW of renewable energy from the BSP site, total green hydrogen production of ~40ktpa is possible in time.

“This would equate to ~$290m in annual revenues, if using our $7.50/kg price assumption.”

A final investment decision for the project is expected mid-year.

Global governments look to subsidies

Bettiol says Governments are throwing the kitchen sink at the hydrogen space.

“The current market for grey hydrogen is ~95mtpa (or ~95x the size of green) and the ONLY reason that users haven’t switched from grey to green historically (or even blue) is that clean hydrogen costs more to produce/purchase – nothing else… this is about to change,” he said.

In the past ~6 months, virtually every major country/region that hopes to play in green hydrogen has proposed some form of subsidy or credit to close the gap between grey/green.

The is US providing a $3/kg production subsidy, Canada will introduce a 40% hydrogen tax credit, the Eurozone is proposing a CFD program — which will see the govt pay any difference in price between green/grey hydrogen — and Japan trying to make green hydrogen cost competitive with LNG.

So, what about Australia?

“If the Federal government is serious about Australia becoming a green hydrogen superpower (hint: it is), then we expect governments at all levels – federal, state, local – will get much more aggressive with their support of the green hydrogen industry over the balance of 2023,” Bettiol said.

“Should anything even remotely resembling the USA’s US$3/kg production subsidy be introduced, it would be the mother of all positive catalysts for FHE – on our numbers, this would actually turn FHE’s costs of production NEGATIVE.”

McGowan showcases hydrogen opportunities in Japan

The WA State Government has this week announced Premier Mark McGowan will be travelling to Japan and South Korea next week to promote opportunities for investment, tourism, study and business in Western Australia – including our green hydrogen capabilities.

McGowan will speak at the 4th Clean Fuel Ammonia Association International Symposium in Japan to promote WA’s green hydrogen and ammonia potential to major international investors.

He will also meet with South Korean steel giant POSCO following the State Government’s decision this month to allocate industrial land in the Pilbara to the company for its green hydrogen ambitions.

“WA will be a world leader in battery minerals and renewable hydrogen, and this mission will help to position our State as a major supplier to Japan and South Korea in decades to come,” McGowan said.

Japan and South Korea are important trading partners with WA, contributing 85 per cent of the total value of WA’s petroleum exports in 2021-2022.

This article was developed in collaboration with Frontier Energy Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post BW Equities flags BUY rating for Frontier and its near-term green hydrogen project appeared first on Stockhead.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…