Energy & Critical Metals

As Interest Rates Climb, 18% of U.S. New Car Buyers Pay a Whopping $1,000 Monthly

At a yield of 4.8%, the U.S. ten-year Treasury note is trading at around its highest level since 2007. Steadily rising

The post As Interest Rates Climb,…

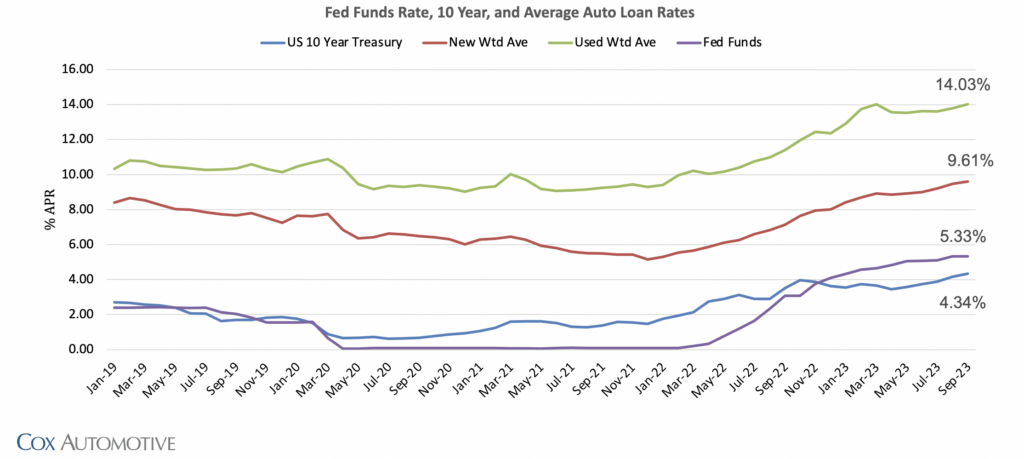

At a yield of 4.8%, the U.S. ten-year Treasury note is trading at around its highest level since 2007. Steadily rising interest rates throughout 2023 have impacted many areas of the North American economy.

For example, consumers have been forced to make much higher monthly payments to credit card issuers, and the number of residential real estate transactions have declined markedly as buyers are either unwilling or unable to take on mortgages with fixed rates well above 7%. Even governments are feeling the pinch as rising interest rates are translating into higher deficits.

Much higher monthly car loan payments are likewise an unfortunate byproduct of this higher interest rate regime. Indeed, the average U.S. used car buyer is currently making loan payments of US$592 per month, up 30% from just 2 ½ years ago, according to data from Cox Automotive.

Similarly, a typical new car buyer must allocate US$770 of his or her monthly income to service a vehicle loan. Remarkably, the automotive research firm Edmunds estimates that nearly 18% of U.S. consumers who have financed a new vehicle purchase make monthly payments of at least US$1,000.

Even more concerning are the dramatically higher interest rates that are embedded in car loans versus conditions just two years ago. For example, the weighted average interest rate on used car loans is now a remarkably high 14.03%. Just two years ago, that rate was only about 9%. Similarly, new car loans, which now carry an average 9.61% interest rate, are around 400 basis points higher than they were in October 2021.

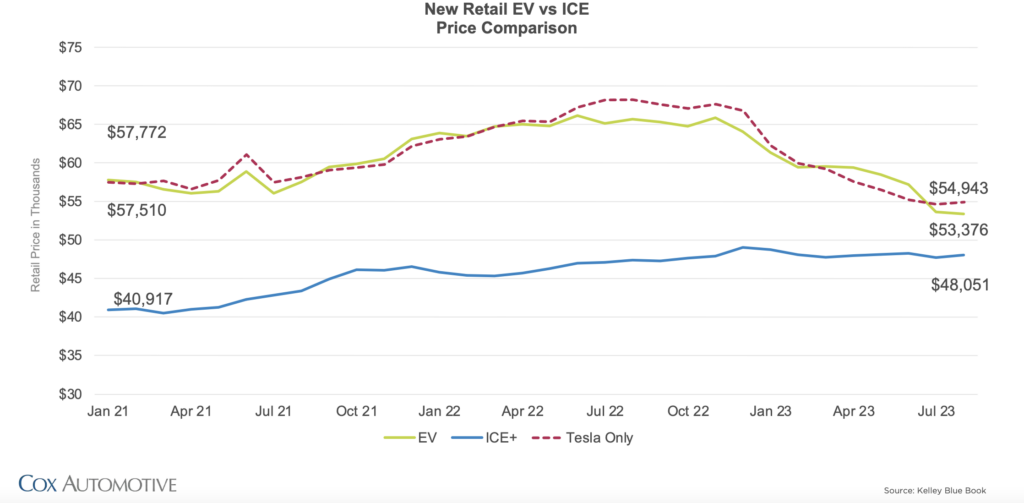

Of course, the much higher car payments that consumers face is translating into lower prices that they can afford to pay for new and used vehicles. This supply-demand impact has seemed to fall most acutely on the prices electric vehicle manufacturers can charge for their cars and explains not only the initiation of the vicious EV price war which began in early 2023, but also why this price war can continue for some time. Tesla, Inc. (NASDAQ: TSLA) announced additional price cuts just last week. EV models have most recently sold in the U.S. at an average transaction price of US$53,400, down 16% from this time last year.

RELATED: Tesla Misses Delivery Estimates In Third Quarter

In simple terms, consumers are struggling to afford current sky-high car payments. Basic economics suggests this unsustainable condition can only be remedied by further price cuts by car makers.

Information for this story was found via Cox Automotive and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

The post As Interest Rates Climb, 18% of U.S. New Car Buyers Pay a Whopping $1,000 Monthly appeared first on the deep dive.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…