Companies

Argentina Lithium and Energy receives historic US$90 million in ARS$ equivalent funding from Stellantis

By Ian Foreman Argentina Lithium & Energy Corp. [TSXV-LIT; OTC-PNXLF; FSE-QAY3] has closed a US$ 90…

By Ian Foreman

Argentina Lithium & Energy Corp. [TSXV-LIT; OTC-PNXLF; FSE-QAY3] has closed a US$ 90 million in ARS$ equivalent investment by Stellantis NV, one of the world’s leading automakers with international brands that include Alfa Romeo, Chrysler, Citroen, Dodge, Fiat, Jeep, Lancia, Maserati, Opel, Peugeot, Ram, and Vauxhall.

Pursuant to the transaction, Peugeot Citroen Argentina SA, a subsidiary of Stellantis, invested the Argentine-peso equivalent of US$ 90 million in Argentina Lithium’s Argentinian subsidiary.

Stellantis has the right to exchange their investment for up to 19.9 percent of the outstanding common shares of Argentina Lithium in the future. In connection with the transaction, the parties have also entered into a lithium offtake agreement.

The announcement of raising that significant amount of capital caught everybody off guard, but Argentina Lithium had been working on this for a long time. “This all started about a year ago,” explained Nikolaos Cacos, president and CEO of Argentina Lithium, “We were approached because of our good reputation down in Argentina. They did months of due diligence including visits to all of our properties with well-respected geological consultants.”

The announcement of raising that significant amount of capital caught everybody off guard, but Argentina Lithium had been working on this for a long time. “This all started about a year ago,” explained Nikolaos Cacos, president and CEO of Argentina Lithium, “We were approached because of our good reputation down in Argentina. They did months of due diligence including visits to all of our properties with well-respected geological consultants.”

There is more to the picture than simply having good projects. The attractiveness of Argentina as a country to explore for, and ultimately, produce lithium greatly changed for the better earlier this year. In April of 2023, Chile announced that the state was taking a majority stake in the country’s lithium industry – a quasi-nationalization of Chile’s lithium industry that dictated that companies had to partner with the government in order to exploit the country’s lithium resources. And this move was seismic as Chile is the world’s second-largest lithium producer. (cnbc)

The focus of lithium exploration in Latin America shifted to Argentina. And for good reason too; the International Energy Agency (or ‘IEA’)(https://www.iea.org/) estimates that Argentina holds 21% of the world’s reserves of lithium. (cnbc)

At present, Argentina has two lithium extraction projects, one in the northern province of Catamarca and another in neighboring Salta. Both operations are predicted to double production in 2024 and an additional 10 projects are currently under construction. Analysts at Eurasia Group expect Argentina’s lithium production to grow fivefold next year and approximately tenfold by 2027. (cnbc)

At present, Argentina has two lithium extraction projects, one in the northern province of Catamarca and another in neighboring Salta. Both operations are predicted to double production in 2024 and an additional 10 projects are currently under construction. Analysts at Eurasia Group expect Argentina’s lithium production to grow fivefold next year and approximately tenfold by 2027. (cnbc)

These estimates are in line with those of the IEA, which states that demand for lithium is expected to be supercharged by the rising deployment of clean energy technologies.

Analysts believe prices could spike to record highs as the world begins to face a shortage. BMI, a Fitch Solutions research unit, predicts that a lithium supply deficit will occur by 2025 (due to lithium demand exceeding supply) until capacity can ramp up to meet demand. (cnbc)

According to the World Economic Forum global production of lithium was 540,000 metric tons in 2021, and by 2030 it projects that global demand will reach over 3 million metric tons. Where will production come from to meet that projected six-fold increase in demand? (cnbc)

“Argentina has infinite untapped resources when it comes to mining. We’re talking about a new Chile if not more — with the key ingredient being time,” Mariano Machado, principal analyst for the Americas at Verisk Maplecroft, a global risk intelligence firm, told CNBC. “When it comes to lithium [in Argentina], you cannot skip but you can fast forward that process, so it really reduces that exposure,” he added. (cnbc)

And Argentina Lithium is now poised to take advantage of this very unique situation that the company finds itself in. “Not only do we now have a very strong financial partner, but we are in a very fortunate position as we are fully funded to rapidly advance the exploration work on our high calibre portfolio of projects in order to assess their development potential. As such we will not have to raise money in the market for the foreseeable future”, stated Mr. Cacos.

Argentina Lithium will now advance their projects without interruption. Their portfolio of lithium projects includes the Rincon West Project, Antofalla North, Pocitos and Incahuasi.

Argentina Lithium will now advance their projects without interruption. Their portfolio of lithium projects includes the Rincon West Project, Antofalla North, Pocitos and Incahuasi.

Drilling has resumed at Rincon West. In July 2023, the company received the environmental permit to begin exploring the contiguous Rinconcita II concession, representing the eastward extension of the project over the salt flat. The company subsequently completed 12 line-kilometres of ground geophysical surveys on the property and mobilized a diamond drill rig to site. The drill is currently executing the second hole of a six-hole exploration program.

The Rincon West Project totals 3742.8 hectares in size and is made up of seven concessions that the company either owns outright or has an option to earn a 100% interest in. The project is contiguous with west and north of Rio Tinto Plc’s massive Rincon project. Rio Tinto has a pilot plant currently operating at the site and further work will focus on continuing to optimise the process and recoveries. Rio Tinto has an agreement to develop the project with Ford Motor Company, a direct competitor to Stellantis. (Rio Tinto)

Drilling is continuing on from a successful nine-hole program in which the last hole returned the highest peak lithium value and longest concentrated brine interval reported to date on the Rincon West project. The ninth exploration hole returned a 258-metre interval ranging from 287 to 402 milligrams/litre lithium (with 2 internal intervals not sampled, of 42m & 33m).

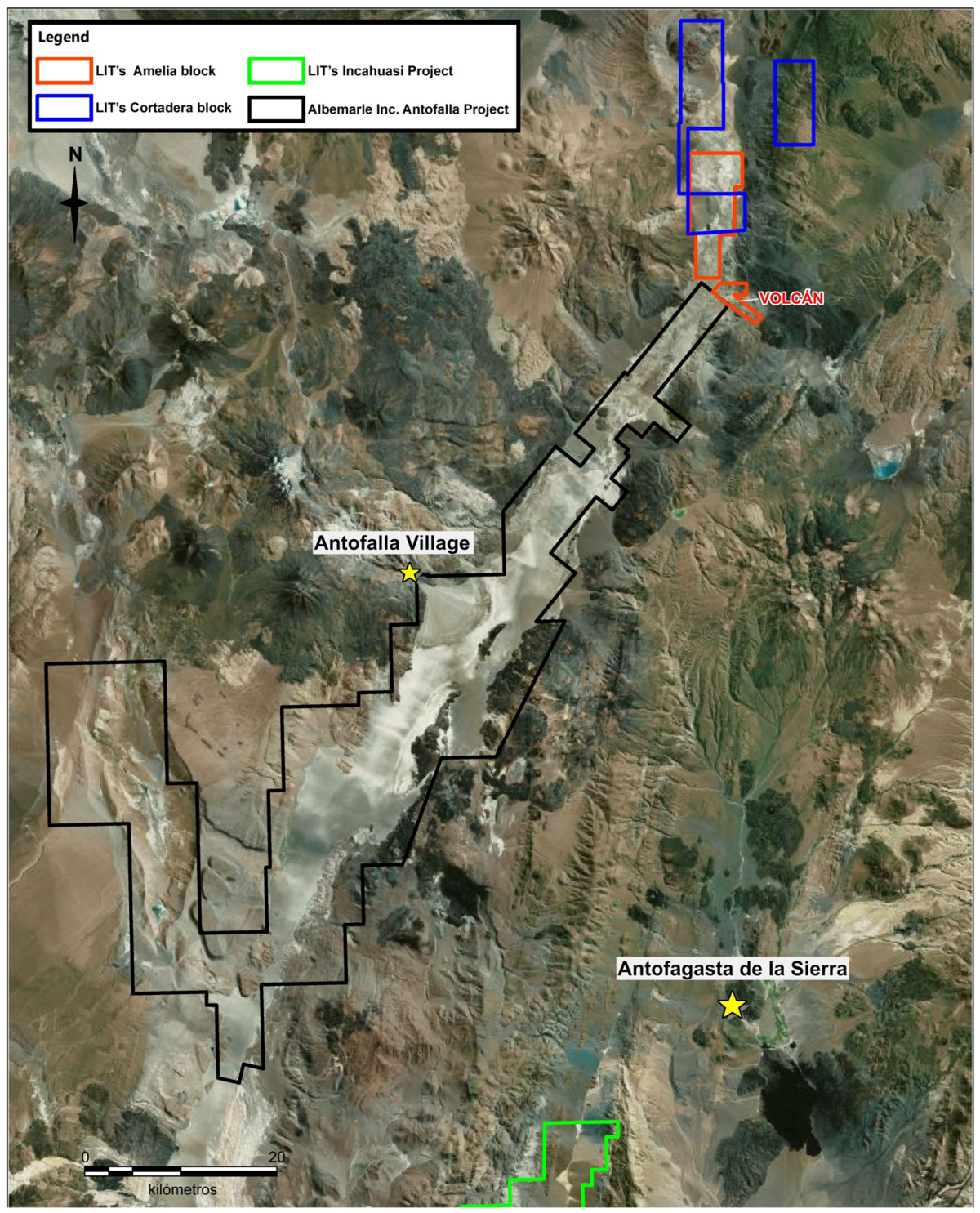

Argentina Lithium’s second project, Antofalla North, covers 15,800 hectares and the entire northern portion of the Salar de Antofalla, which is located on the border of Salta and Catamarca provinces. The southern boundary of the Antofalla North project is situated only 500 metres north of properties controlled by global lithium producer Albemarle Corporation (NYSE: ALB), who has stated that it believes the lithium resource on its property has the potential to rank amongst the largest in Argentina. Argentina Lithium has completed a geophysical survey at Antofalla North and identified high-conductivity targets. Additional ground geophysics and drilling is planned the near term once required permits are received. (LIT)

Argentina Lithium’s second project, Antofalla North, covers 15,800 hectares and the entire northern portion of the Salar de Antofalla, which is located on the border of Salta and Catamarca provinces. The southern boundary of the Antofalla North project is situated only 500 metres north of properties controlled by global lithium producer Albemarle Corporation (NYSE: ALB), who has stated that it believes the lithium resource on its property has the potential to rank amongst the largest in Argentina. Argentina Lithium has completed a geophysical survey at Antofalla North and identified high-conductivity targets. Additional ground geophysics and drilling is planned the near term once required permits are received. (LIT)

The other two projects in the company’s portfolio, Pocitos and Incahuasi, will now see exploration work as Argentina Lithium ramps up to full speed. The Pocitos Project is located approximately 38 kilometres from the company’s Rincon West Project and is made up of five properties that cover a total of 26,211 hectares of the Pocitos Salar. The wholly owned Incahuasi project makes up 25,000 hectares of prospective land at the northern end of the Incahuasi Salar. As the first project that Argentina Lithium acquired, the company has completed the most work outside of Rincon W at Incahuasi, including geophysics, surface sampling and some initial drilling. Future work is planned to focus on sampling the northern part of the salar and identifying sub-domains within the salar that may contain higher lithium grades.

Mr. Cacos added “The US $90 million equivalent investment… comes with the mandate to accelerate exploration at our core projects, with the aim of advancing to the assessment of development potential as quickly as possible. We anticipate increasing the scale and number of our exploration programs as permits are received for our projects. This is a big undertaking, and we are now well financed to aggressively move forward with this work.”

“I feel very privileged as I now have the luxury of focusing on the long-term growth of our company without having to be concerned about financing our exploration programs for some time to come”, concluded Mr. Cacos.

tsxv aim nyse otc lithium tsxv-lit argentina-lithium-energy-corp

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…