Energy & Critical Metals

3 Most Undervalued Battery Stocks to Buy in April

The clean energy business is likely to have positive tailwinds beyond the decade. Within this broad classification, there are several attractive themes…

The clean energy business is likely to have positive tailwinds beyond the decade. Within this broad classification, there are several attractive themes to consider. Electric vehicle (EV) stocks are one such sub-segment that will create long-term gains for investors. Within this segment, there are some undervalued battery stocks that look particularly attractive right now.

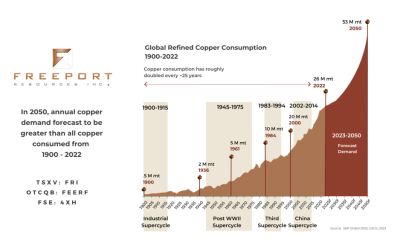

Global demand for lithium-ion batteries is expected to increase from about 700 gigawatt hours (GWh) in 2022 to around 4.7 terawatt-hours (TWh) by 2030. Beyond this period, demand is likely to remain robust as the transition to electric vehicles continues. In other words, the best part of growth for battery companies is still to come.

With the broader markets facing macroeconomic headwinds and EV-related stocks well off their highs, there are several undervalued battery stocks to consider. When the initial reversal rally comes, it’s likely to be sharp. And over the next five years, these stocks are poised for multi-bagger returns.

PCRFY

Panasonic

$9.14

SLDP

Solid Power

$2.93

ALB

Albemarle

$218.43

Panasonic (PCRFY)

Source: Shutterstock

Source: Shutterstock

Panasonic Holdings (OTCMKTS:PCRFY) stock is down 30% in the past two years. However, shares have been consolidating over the past few weeks, and a breakout to the upside looks imminent. The stock currently sits just 3.5% below its 2023 high, made in late January.

Panasonic is on a mission to boost capacity to fill the growing need for EV batteries. The company has been a long-time supplier for Tesla (NASDAQ:TSLA), with the companies partnering up at Tesla’s first Gigafactory. The Nevada plant is one of the biggest producers of batteries in the world.

In November, Panasonic began construction on a $4 billion factory in Kansas. The company plans to deliver 2 billion batteries annually from the plant, according to Allan Swan, the president of Panasonic Energy North America. Panasonic is also partnering with Toyota (NYSE:TM) on a battery venture in Japan. Given its ambitious growth plans, Swan estimates Panasonic will increase its production fourfold by 2030.

The company had 445 patents in the solid-state battery space as of March 2022. The only company with more was Toyota.

Shares trade with a forward price-earnings (P/E) ratio of 10.8, offering a discount to their five-year average. What’s more, the stock throws off a dividend yield of 2.5%.

Solid Power (SLDP)

Source: T. Schneider / Shutterstock.com

Source: T. Schneider / Shutterstock.com

Shares of Colorado-based battery developer Solid Power (NASDAQ:SLDP) lost 67% of their value over the past year as investors turned their back on the EV sector, including battery stocks. However, SLDP stock has shot up 15% so far this year, perhaps signaling a reversal is underway.

The stock’s recent bullish trend is backed by positive business developments. Solid Power focuses on solid-state electrolyte technology. It began producing EV cells in the fourth quarter of 2022, with deliveries expected to begin this year. And the company said in late February that it was on track to commission an electrolyte production facility in Q1.

In another key development, Solid Power has licensed its cell design and manufacturing process to BMW (OTCMKTS:BMWYY). This will enable parallel research and development activities to accelerate the commercialization of its solid-state batteries. Solid Power also counts automaker Ford (NYSE:F) among its partners.

Needham recently issued a “buy” rating on the stock with a $5 price target. That implies upside of more than 70% from the current level, although I think this undervalued battery stock could go significantly higher in the coming years.

Albemarle (ALB)

Source: IgorGolovniov/Shutterstock.com

Source: IgorGolovniov/Shutterstock.com

While Albemarle (NYSE:ALB) is not a battery stock, per se, it is one of the largest lithium producers in the world. And there are no lithium-ion batteries without lithium. Demand for lithium is expected to surge in the coming decade, with reports estimating the lithium supply gap will be at least 1.1 million metric tons by 2035.

ALB stock has traded sideways over the past 12 months. However, a big breakout to the upside is likely considering the supply-demand dynamics for lithium.

Albemarle ended 2022 with lithium conversion capacity of 200 ktpa. The company expects to boost capacity to 500-600 ktpa by 2027. Sustained upside in capacity will support healthy revenue and cash flow growth.

The company reported fourth-quarter revenue of $2.6 billion, up 193% year over year. For the current year, management expects revenue of $12.1 billion at the midpoint of guidance, a 65% increase over last year. They are forecasting adjusted EBITDA of $4.2 billion to $5.1 billion. Further, the company expects operating cash flow of $2.25 billion for the year. Strong cash flow should ensure that capacity expansion is largely through internal accruals.

Currently, ALB stock trades with a forward P/E ratio of 7.7, well below its five-year average of 24.1. Finally, shares offer a 0.7% dividend yield. I expect healthy dividend growth in the coming years, in addition to outsized capital gains.

On the date of publication, Faisal Humayun did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Faisal Humayun is a senior research analyst with 12 years of industry experience in the field of credit research, equity research and financial modeling. Faisal has authored over 1,500 stock specific articles with focus on the technology, energy and commodities sector.

More From InvestorPlace

- Buy This $5 Stock BEFORE This Apple Project Goes Live

- The Best $1 Investment You Can Make Today

- It doesn’t matter if you have $500 or $5 million. Do this now.

The post 3 Most Undervalued Battery Stocks to Buy in April appeared first on InvestorPlace.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…