Economics

S&P 500 Declines – Recession Anatomy

S&P 500 declined on strong core PCE data, but I doubted the opening gloom, and favored a positive move during the regular session. In spite of the…

S&P 500 declined on strong core PCE data, but I doubted the opening gloom, and favored a positive move during the regular session. In spite of the disastrous market breadth (advance-decline line and advance-decline volume), Monday would bring a tired continuation of the upswing into 3,980 – 4,010s zone, overcoming which with a close near 4,045, doesn‘t look likely given what‘s in store this week.

Tuesday‘s consumer confidence data are likely not to disappoint as personal savings rate had been recently revised upwards (4.7%), suggesting that the consumer still has the wiggle room to withstand inflation.

Get The Full Henry Singleton Series in PDF

Get the entire 4-part series on Henry Singleton in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues

Q4 2022 hedge fund letters, conferences and more

Remember when I was telling you last year that consumer strength would be the defining factor in the shape of the upcoming recession – and contrast that with what we have seen play out in the markets in only the last couple of weeks – from hard to soft landing, then the no landing came (as if strong Jan data in non-farm payrolls and housing not tanking on, are to be proven as little more than a year entry oddity and brief respite).

Seriously, I expect the job market to start noticeably deteriorating (e.g. in unemployment claims) from Mar onwards, and the ongoing mortgage rates of 7% to snuff out the temporary housing stabilization. Circling back to the consumer, retail sales for now wouldn‘t be deteriorating either – while rising in nominal terms, they had been really flat in real terms since mid 2021, revealing the spending growth to be of merely inflationary nature.

So, that‘s Tuesday and consumer confidence which still shouldn‘t tank the markets – regardless of the woeful and nonchalantly ignored bond market performance over the recent weeks (these rates would keep biting even more, especially on the short end).

The latter half of this week doesn‘t look to be promising for stock bulls though – especially the manufacturing, and to a lesser degree services PMIs, are to reveal recessionary clues impossible to ignore.

Remember the sequence of recession countdown and progression – first real estate going down (check), manufacturing down (check), services with a lag (check), inflation peaking (sure the revisions and calculation “revamps” helped here).

And finally job market layoffs spreading (wait for Mar / Apr) together with earnings coming in weak (check) forcing sigtnificant earnings downgradeds for the quarters ahead (still to come, seriously starting late Q2 even as modest earnings recession has already arrived, and the low $180s EPS need solid downgrading).

Plenty to look for as stocks readjust to new economic realities!

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

4,015 will be again a tough nut to crack as the base for S&P 500 advance is so weak after Friday, but can carry the buyers a bit forward from the roughly 3,980 area. The low volume speaks to me of non-confirmation, so the rebound in line with the macroeconomic introduction in the opening part of today’s analysis, and is to be short-lived.

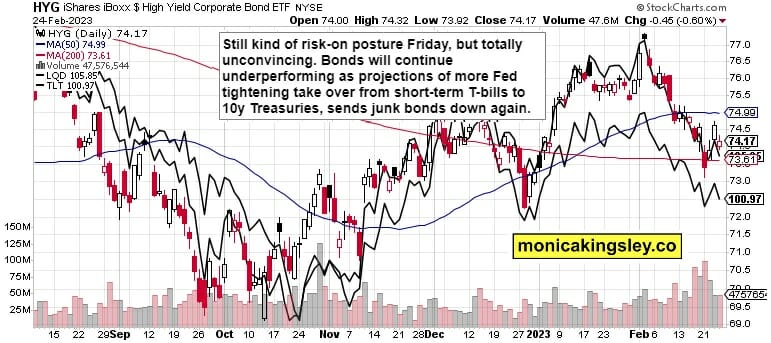

Credit Markets

No, this “risk-on” rebound doesn’t count to me as reversal – the pressure from the short-end of the curve is to keep increasing (just have a look at last week’s extensive analysis aptly called Fuse Has Been Lit.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…