Economics

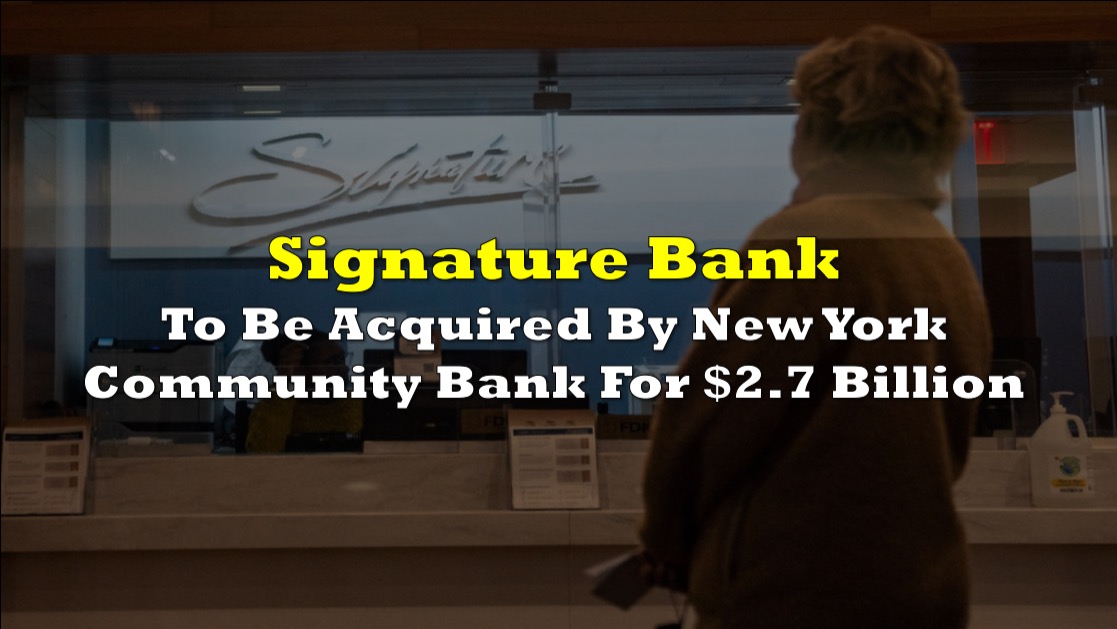

New York Community Bank To Acquire Signature Bank For $2.7 Billion, Rebrand As Flagstar Bank

According to the Federal Deposit Insurance Corporation (FDIC), New York Community Bank (NYSE: NYCB) has agreed to buy a large

The post New York Community…

According to the Federal Deposit Insurance Corporation (FDIC), New York Community Bank (NYSE: NYCB) has agreed to buy a large portion of the insolvent Signature Bank (NYSE: SBNY) for $2.7 billion.

The FDIC said late Sunday that the 40 Signature Bank branches will be renamed Flagstar Bank beginning Monday. Flagstar is a subsidiary of New York Community Bank. The transaction is to include the purchase of $38.4 billion in Signature Bank assets, which represents slightly more than a third of Signature’s entire assets when the bank failed a week ago.

The FDIC stated that $60 billion in Signature Bank loans will stay in receivership and will be sold off over time.

The FDIC also estimates that Signature Bank’s bankruptcy will cost the deposit insurance fund $2.5 billion, although that figure might alter as the regulator sells assets. The deposit insurance fund is funded through bank assessments, and taxpayers face no direct expense when a bank fails.

“As of December 31, 2022, the former Signature Bank had total deposits of $88.6 billion and total assets of $110.4 billion. Today’s transaction included the purchase of about $38.4 billion of Signature Bridge Bank, N.A.’s assets, including loans of $12.9 billion purchased at a discount of $2.7 billion. Approximately $60 billion in loans will remain in the receivership for later disposition by the FDIC. In addition, the FDIC received equity appreciation rights in New York Community Bancorp, Inc., common stock with a potential value of up to $300 million,” the FDIC said in a statement.

The news on Sunday is about one of the two bankrupt banks that the FDIC is in receivership of.

The statement made no mention of the other, much larger bank, Silicon Valley Bank (SVB), which regulators took over two days before Signature.

Signature had $110.36 billion in assets, whereas SVB had $209 billion.

Signature, situated in New York, was a significant commercial lender in the tri-state area that had recently entered the cryptocurrency market as a prospective growth venture.

Depositors were concerned about Signature Bank’s stability after SVB failed due to the bank’s large volume of uninsured deposits as well as its exposure to crypto and other tech-focused lendings. Signature was the third greatest bank failure in US history when it was closed down by regulators.

New York Community Bancorp is a New York-based bank with 225 locations throughout New York, New Jersey, Ohio, Florida, and Arizona. It had $87 billion in assets as of 2022.

In April 2021, New York Community Bank released a press statement announcing the acquisition of Flagstar Bank in an all-stock transaction, which was completed in December 2021.

Information for this briefing was found via The Globe And Mail, AlJazeera, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

The post New York Community Bank To Acquire Signature Bank For $2.7 Billion, Rebrand As Flagstar Bank appeared first on the deep dive.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…