Economics

“Tesla Wannabe” EV Names Have Run Out Of Cash, As SPAC-Crazed Bubble Bursts

"Tesla Wannabe" EV Names Have Run Out Of Cash, As SPAC-Crazed Bubble Bursts

As EV market saturation continues, the tide is going out on many…

“Tesla Wannabe” EV Names Have Run Out Of Cash, As SPAC-Crazed Bubble Bursts

As EV market saturation continues, the tide is going out on many “Tesla wannabe” startup companies who couldn’t commercialize production quick enough to turn profitable. Now, serious questions remain to the viability of many of the smaller EV companies that didn’t have the “first mover” advantage that Tesla had.

Such was the topic of a new WSJ article this week which highlighted that many EV companies are simply running out of cash.

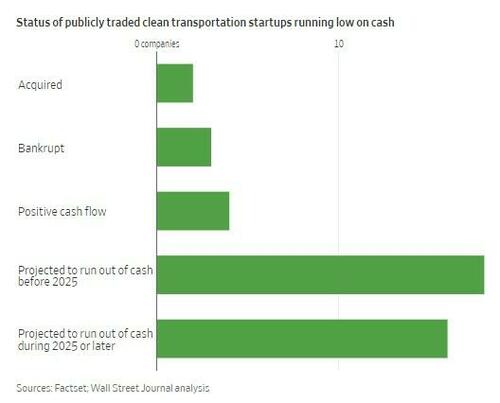

The report noted that at least 18 EV and battery startups, including high-profile names like Nikola and Fisker, face the risk of depleting their cash reserves by the end of 2024. These companies, once known for their ambitious goals to revolutionize the industry with electric trucks and SUVs, have struggled with increasing costs and manufacturing challenges.

Names like Lordstown Motors, Proterra, and Electric Last Mile Solutions have already declared bankruptcy, the report notes. Romeo Power, a battery manufacturer, and Volta, a charging company, were sold for much less than their initial public valuations. The remaining firms are reportedly focusing on cost reduction and have secured additional funding.

Gavin Baker, chief investment officer at Atreides Management, told WSJ: “It was by far the most insane bubble I have ever seen.”

The report reminds readers that most of the struggling companies went public via SPACs, which gained popularity during the pandemic and allowed startups to make unchecked growth projections and skip the rigorous due diligence process associated with a formal IPO.

Meanwhile, the EV industry’s volatility is evident, with demand growing but not exploding as anticipated. Even industry leaders like Tesla are cutting prices, adding pressure on new entrants.

Of the 43 EV and battery companies that went public between 2020 and 2022, five have either filed for bankruptcy or been acquired. The Wall Street Journal’s analysis of their financial health shows 18 are at risk of running out of cash by the end of next year without cost cuts or new funding. Firms like Nikola and Fisker are actively seeking new capital and adjusting strategies.

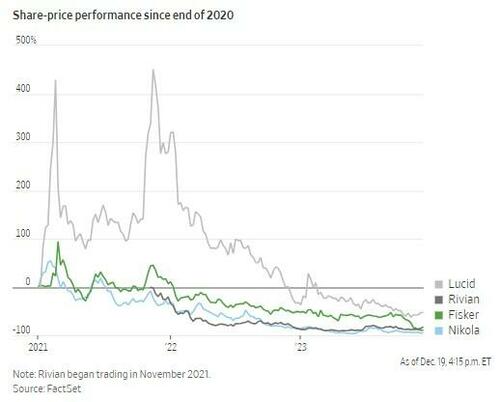

While 16 companies appear financially stable beyond 2024, sales challenges continue to affect their share prices.

Companies like Rivian Automotive and Lucid Group, despite having products in the market, face their own hurdles. Meanwhile, Faraday Future Intelligent Electric, despite raising significant capital, is struggling with production delays and high burn rates.

Companies with a longer cash runway, like Li-Cycle Holdings, are also encountering difficulties, such as rising costs impacting their operations and plans.

“Everyone was out there looking for the next Tesla,” concluded Brian Dobson, a managing director at investment bank Chardan. You can read the WSJ’s full analysis and a full list of EV companies with their respective cash balances here.

Tyler Durden

Wed, 12/20/2023 – 09:40

bubble

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…