Economics

Meta Soars After Top- & Bottom-Line Beat; ‘Metaverse’ Losses Grow, MAUs Disappoint

Meta Soars After Top- & Bottom-Line Beat; ‘Metaverse’ Losses Grow, MAUs Disappoint

Meta shares are soaring after hours after a top- and…

Meta Soars After Top- & Bottom-Line Beat; ‘Metaverse’ Losses Grow, MAUs Disappoint

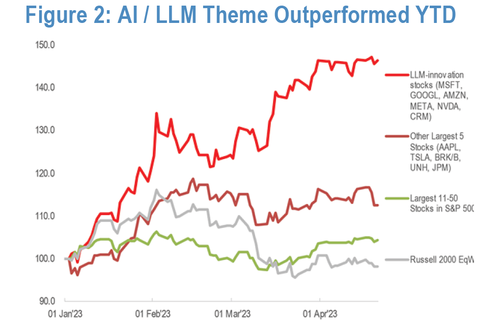

Meta shares are soaring after hours after a top- and bottom-line beat extending gains (above one-year highs) since its earnings report on Feb 1st (and continuing to benefit from the AI bubble craze YTD)…

…Meta’s “year of efficiency” has meant mass layoffs and the stock price up 150% from its post-earnings (mid-Nov) lows. But has the price over-reached the fundamentals?

The Facebook parent was expected to post a fourth consecutive quarter of declining revenue and while META expectations are broadly optimistic, so is positioning which is one of the most long/overweight as the following chart of TMT positioning from Goldman shows (the positioning score= subjective ranking of investor positioning (1= max short/underowned … 10=max long/overweight) as determined by desk based on flows, positioning data, and feedback).

Finally, before we dive into the earnings report, the options market is implying a 10% move following results, compared with an average 14% move over the past two years

Meta’s top- and bottom-line beat expectations in Q1:

-

*META PLATFORMS 1Q REV. $28.65B, EST. $27.67B

-

*META PLATFORMS 1Q EPS $2.20, EST. $2.01

Under the hood, Ad Revenue beat:

-

*META PLATFORMS 1Q AD REV. $28.10B, EST. $26.76B

-

*META 1Q FAMILY OF APPS OPER INCOME $11.22B, EST. $10.32B

However, Meta’s outlook came in at the lowest end of expectations

-

*META PLATFORMS SEES 2Q REV. $29.5B TO $32B, EST. $29.48B

But Zuck remains optimistic of course…

“We had a good quarter and our community continues to grow,” said Mark Zuckerberg, Meta founder and CEO.

“Our AI work is driving good results across our apps and business. We’re also becoming more efficient so we can build better products faster and put ourselves in a stronger position to deliver our long term vision.”

But Reality Labs (the Metaverse builders) saw a smaller revenue than expected and a bigger than expected operating loss:

-

*META PLATFORMS 1Q REALITY LABS REV. $339M, EST. $613.1M

-

*META 1Q REALITY LABS OPER LOSS $3.99B, EST. LOSS $3.8B

Facebook’s user data was mixed with daily active users up 4% (and better than expected) while monthly active users disappointed:

-

*META 1Q FACEBOOK MONTHLY ACTIVE USERS 2.99B, EST. 3.00B

-

*META PLATFORMS 1Q FACEBOOK DAILY ACTIVE USERS 2.04B, EST. 2.01B

Costs are undoubtedly in focus for Meta, and they’re narrowing their expected expense range for 2023 to $86-$90 billion.

That’s significantly lower than the $96-$101 billion initial projection the company gave in October.

Surprisingly, given the significant layoffs that have been announced, headcount was 77,114 as of March 31, 2023, a decrease of 1% year-over-year.

Substantially all employees impacted by the layoff announced in November 2022 are no longer reflected in our reported headcount as of March 31, 2023.

Further, the employees that would be impacted by the 2023 layoffs are included in our reported headcount as of March 31, 2023.

So layoffs affected 13% of staff.. but the total headcount is down only 1% – that’s a lot of hiring and firing in one year.

Meta shares are up 10% on the day now, at their highest since early April 2022…

Perhaps of most note, the word “metaverse” doesn’t appear until the boilerplate “forward looking statements” section at the bottom.

Here is the full META earnings presentation (pdf link).

Tyler Durden

Wed, 04/26/2023 – 16:24

bubble

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…