Economics

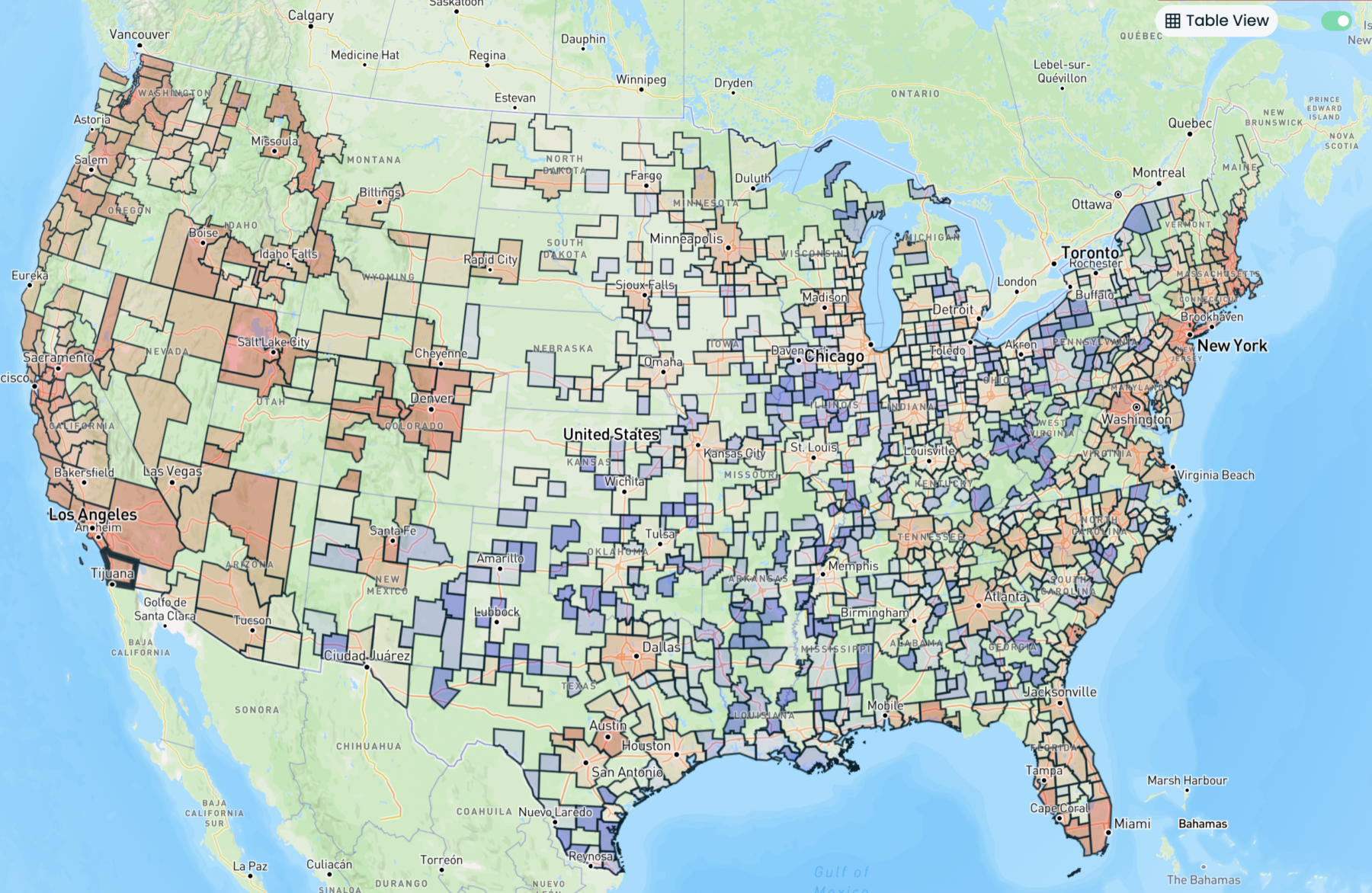

Mapping Changes in US Home Prices

Source: Reventure Let’s get to the caveats up front: Re:Ventures has been pretty bearish on housing the past few years forecasting a crash; their…

Source: Reventure

Let’s get to the caveats up front: Re:Ventures has been pretty bearish on housing the past few years forecasting a crash; their landing page claims “The US Housing Market is in a record Bubble in 2023,” and this post “90% Chance: RECESSION in 2022?” has not panned out and stands inapposite of my views.

That said, I am willing to ignore their opinions because I find their data analytics so intriguing.

Check out the map above showing “Home Values.” They generate these maps using Zillow data (as determined by the Zillow Home Value Index (“ZHVI”). It’s hard to tell how Zillow assembles this data (see if you can make any sense of their methodology; I could not).

I get the idea that considering not the mix of expensive and cheap homes together to determine price is less desirable than looking at how home prices change within each price point. Does Zillow use the selling prices of homes that were sold and not listings or estimates? I honestly cannot tell from the methodology disclosures.

With that weasely preface out of the way, consider the various ways these maps can show changes in residential real estate on a national, state, metro-area, county, and zip code level:

Home Value, Home Value Growth (YoY), Home Value Growth (MoM), For Sale Inventory, Sale Inventory Growth (YoY), Price Cut Share (%), Days on Market, Days on Market Growth (YoY), Monthly House Payment, Property Tax Rate, Building Permits, Building Permit (%), Mortgaged Home (%), Housing Units, Housing Units Growth Rate, Sales Inventory Growth (MoM), Inventory as a % of Houses, Rent for Apartments, Rent for Houses

There are similar tools for analyzing population changes: Population, Median Household Income, Median Age, Homeownership Rate, Poverty Rate, Payroll Jobs, Migration Total, Migration % of population.

They also offer a suite of premium analytic mapping tools that cover: Over/Under Valued %, Value/Income Ratio, House Payment as % of Median Income, % Crash from 2007-2012, Shadow Inventory %, Cap Rate, Buy vs Rent Calculator %, Rent as a % of Income.

I have not subscribed, but I have been playing around with the various tools, and they seem quite interesting. The key challenge, of course, is whether the underlying data from Zillow is worthwhile or not. If its good REAL sales data and not just modeled opinion, it looks like it has a lot of potential use.

As to the coming crash, my pal Jonathan Miller observes: “If you talk to brokers on the ground, there are far fewer investors than the prior boom. Heavy primary and second home demand.” This, plus the shortage of single-family homes due to underbuilding and cheaper mortgage lock-in suggests that a housing crash is unlikely any time soon…

Previously:

Are We in a Recession? (No) (June 1, 2022)

What Data Makes NBER Recession Calls? (September 1, 2022)

The Post-Normal Economy (January 7, 2022)

What Recession? (June 26, 2023)

How Everybody Miscalculated Housing Demand (July 29, 2021)

The post Mapping Changes in US Home Prices appeared first on The Big Picture.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…