Economics

If you bought into the first-ever ETF, you were probably wearing this. So what’s changed?

30 years since the launch of the first ever listed exchange traded fund (ETF) how has ETF investing changed? … Read More

The post If you bought into…

- 30 years since State Street launched the first ETF, the sector has grown to be worth US$9.5 trillion globally

- State Street reckons ETFs “democratised investing” enabling retail investors access to institutional grade investments

- The ETF market has become particularly popular among millennial investors according to a recent survey

A lot happened in 1993. Among some key events of the year:

- Bill Clinton was inaugurated as the 42nd US President

- The European Economic Community eliminated trade barriers to create a European single market

- Toy manufacturers Mattel and Fisher-Price announced a $1 billion merger

- Seinfeld (NBC) won the Emmy for Outstanding Comedy Series

Also in 1993, State Street Global Advisors, the asset management business of State Street Corporation (NYSE:STT), launched the first listed exchange traded fund (ETF), the SPDR S&P 500 ETF Trust (SPY) in the US market in conjunction with American Stock Exchange and S&P Dow Jones Indices.

SPY simply tracks the S&P 500 index of the largest US public companies, for a fee of 0.095% of assets per year.

To find out just how ETFs have changed the investing landscape 30 years after SPY was launched Stockhead caught up with State Street Global Advisors Head of SPDR Distribution in Asia Pacific Meaghan Victor.

First, she said SPY has grown to become the world’s largest ETF with more than US$355 billion in assets and the most heavily traded security in the world with an average daily trading volume of US$39 billion.

“To put that in context the ADV of the Australian ETF market in its entirety is worth in Aussie dollars $419 million,” she said.

“If we look at SPY from a securities perspective at the end of 2022 it hit a milestone and was trading three times more than Apple which means it’s the largest security in the world by market cap.”

Victor said when you think about ETFs in general, SPY epitomises what an ETF stands for and aimed to create for investors all those years ago.

It’s the go-to product for retail investors and also institutional money managers looking for a way to get in and out of the market fast.

“It’s not only about its assets but size, performance, and also liquidity and resilience of the fund itself which we’ve seen play out with volatility in the market,” she said.

On February 28, 2020, as the Covid-19 global pandemic hit the world spooking financial markets, the SPY hit another milestone trading more than $100 billion in a single day.

Victor said SPY along with the ETF industry as a whole has demonstrated its resilience throughout major market events, ranging from the burst of the late 1990s dot-com bubble, to the global financial crisis of 2008 and, more recently, the extreme pandemic-era volatility and inflation.

Democratising investing

Victor said in 30 years ETFs have come from an idea through to an investment that is well received and adopted around the globe.

“ETFs democratised investing and made it easier for mums and dads to have access to an institutional grade investment offering,” she said.

“If we put that into the context of people’s confidence in investing it gave them the opportunity through diversification to access a basket of securities through a single trade at a low cost.

“It’s about choice for investors whether you are saving for a home, handbag, or using it as part of an asset allocation in an investment portfolio; ETFs are a really strong investment tool people are able to use.”

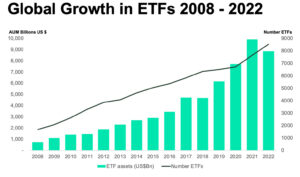

Victor said globally there are now more than 9000 exchange traded products, which include actively managed funds as well as passive ETFs tracking an index.

“In terms of asset growth in 2013 the ETF market was US$3.6 trillion in size and today it’s $9.5 trillion in size so a threefold increase,” she said.

To put that in perspective that’s around four times Australia’s GDP. According to Austrade, nominal GDP will be around A$2.5 trillion (US$1.8 trillion) by the end of 2023.

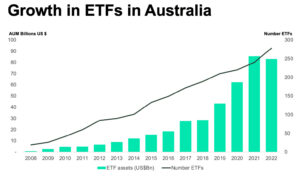

“The Australian ETF market has also grown to be worth around $130 billion of assets with significant growth,” Victor said.

ETF industry evolves to meet investor needs

Victor said the ETF market has evolved enormously since SPY first listed to meet consumer needs from risk profile to broad ETFs and those tracking a particular sector.

“We have seen the growth of fixed income ETFs more recently, there’s commodity ETFs tracking gold, copper or silver for example,” she said.

“We’ve seen hedged ETFs involving currency and seen the growth of sustainable ETFs particularly here in Australia with a strong emphasis on ESG.”

She said barriers to entry and growth of actively managed ETFs have been removed, which meant more are coming onto the market in the US and in Australia.

“That gives investors even greater choice to invest in an ETF that’s either tracking an index or actively managed,” she said.

Millennials love their ETFs

ETFs have proven particularly popular among the millennials. A recent survey by State Street Global showed globally, Millennials have the most positive attitude about ETFs than any other generation surveyed, revealing:

- 51% of ETFs of millennials hold an EFT in their portfolios compared to 32% of Gen X and 25% of Boomers

- 81% of Millennials indicate ETFs have improved the overall performance of their portfolio, versus 73% of Gen X and 48% of Boomers

- Millennials are the most likely to agree that ETFs provide more liquidity during market volatility at 70%, versus 47% of Gen X and 25% of Boomers

- 67% of Millennials believe ETFs are better diversified than other investment products, versus 53% of Gen X and 34% of Boomers

- 66% of Millennials plan to buy ETFs in the next 12 months compared to 46% of Gen X and 20% of Boomers.

Read more about the research findings here.

“The millennials are having increased comfort in holding these investment structures,” Victor said.

“But if we look at the growth of the market, older investors who have been invested for a long time are also retaining their holdings within their portfolios which provides strong confidence among the product itself.”

The post If you bought into the first-ever ETF, you were probably wearing this. So what’s changed? appeared first on Stockhead.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…