Companies

The Cere Villebon Project – Noble Mineral Exploration (TSXV: NOB – OTC: NLPXF)

Introduction Noble Mineral Exploration Inc. is a Canadian-based junior exploration company holding several highly prospective properties in some of Canada’s…

Introduction

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company holding several highly prospective properties in some of Canada’s most prolific mining jurisdictions. Operating as a project generator, Noble de-risks projects through data compilation and exploration in order to generate option agreements and joint venture exploration programs to benefit shareholders. Projects include;

- Project 81 ~25,000+ ha – Nickel-Cobalt/VMS/Gold property in the Timmins-Cochrane area of Northern Ontario

- Nagagami ~ 14,600 ha – Niobium and Rare Earths in the Nagagami River Carbonatite prospect near Hearst, Ontario

- Boulder ~ 4,600 ha – VMS/Copper/Gold property just outside Hearst, Ontario

- Buckingham ~ 3,700 ha -High grade Graphite property in the Outaouais area of South Western Quebec

- Cere-Villebon ~ 482 ha – Copper-Nickel-PGM property near Val d’Or, Quebec

- Laverlochere ~ 518 ha – Nickel-Copper-Cobalt-Gold and PGM property near Rouyn-Noranda, Quebec

- Island Pond ~14,400 ha – VMS/Copper/Gold in Central Newfoundland

- Holdsworth ~ 304 ha – Gold Project near Wawa, Ontario

In addition to the exploration assets, Noble also holds various royalties and interests in other companies and projects within the mining and exploration sector. Operating under a project generator model has allowed The Company to capitalize on projects through JV’s and spin outs that result in Noble having a robust portfolio of equity positions.

- Canada Nickel Company Inc. – 2.9 million shares + 2% Royalty on all Noble staked claims in 5 townships

- Spruce Ridge Resources Ltd. – 18 million shares

- Go Metals Corp. – 1.4 million shares+ 800,000 warrants

- MacDonald Mines Exploration Ltd. – 350,000 shares

- Private Company #11530313 Canada Inc. – 50/50 JV on certain claims within Project 81

For the purpose of this article, the focus will be on the The Cere Villebon Project

Project Overview

The Cere Villebon property is near Val d’Or, Quebec and consists of 15 claims covering 483 hectares and is accessible throughout the year by an extensive network of dirt roads, tracks and trails which extend to most parts of the claim block from Highway 117.

The topography of the Property is essentially flat at an elevation of approximately 485 metres. Vegetation can be described as boreal, consisting mostly of black spruce, some poplar and alders.

The town of Val d’Or, located 45 kilometres North-west of the Villebon Property, is an important resource as The Forestry and Mining industries are the main drivers of the local economy, which means there is an abundance of access to equipment and man power.

Mineralization

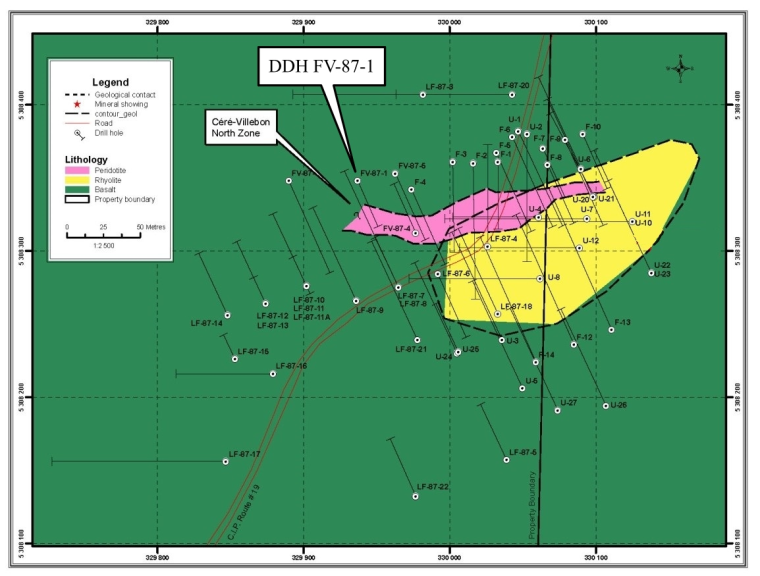

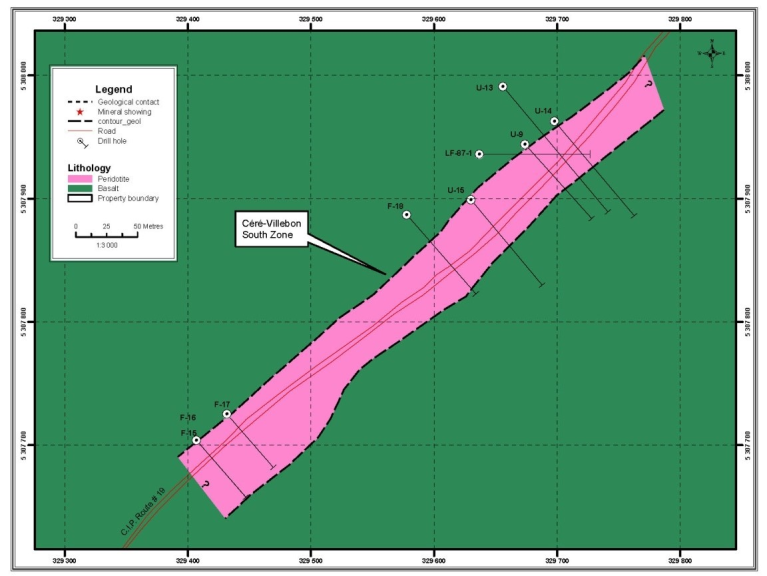

The mineralization on the property consists of pyrrhotite and chalcopyrite in fracture fillings hosted by ultramafic rocks in the metamorphic halo of the Freville Batholith. The copper, nickel, platinum group mineralization is in two distinct zones, one to the North and the other to the South portion of the property. (See Figures 1 & 2 below)

Regional Geology

The Property is located close to the Grenville Front in the southeastern portion of the Abitibi Greenstone Belt of the central Superior Structural Province. Rocks of the region consist of Archean volcano-sedimentary and plutonic suites, and younger Proterozoic north-south and northeast-southwest diabase dykes. Large syn-tectonic and post-tectonic plutonic granitoid rocks were emplaced during the Kenoran Orogeny at approximately 2.68 Ga.

The Abitibi volcanic are crossed by several major shears zones, including the east-west trending Cadillac Break or Deformation Zone that also crosses the northern portion of Villebon Township. The Cadillac Break stretches from Kirkland Lake (Ontario) to past Val d’Or (Quebec), a distance of over 250 kilometres hosting several current and past producing mines which yielded more than 75 million ounces of gold over a 100-year period.

The immediate property is mostly ultramafic to dacitic rocks of the Villebon group which covers more than 90% of the Property. The Pontiac Group covers a thin band in the northwest corner, whereas the Freville Batholith covers the southeast corner.

The ultramafic volcanic rocks are dark green to purplish dense komatiitic flows and their intrusive equivalents, generally with amphibole crystals and are locally heavily ankeritized. Lava breccias, agglomerates and tuffs are also present in the sequence. According to Vogel (1971), the dykes show a gradual variation of texture from coarse-grained at the bottom to finer-grained at the top.

Mapping completed by Westville Mines Ltd., in 1946 in the southwest corner of the Property in Range III, Lots 13 and 19, identified the contact between Pontiac and Villebon Groups. Ultramafics occur mainly to the west and dacites in the east with contacts generally oriented northeast-southwest. Additional mapping in 1972 from Range IV, Lots 22 to 25 identifies serpentinite or peridotite sills trending alongside the CIP#19 forest path.

The North and South Zone in an ultramafic dyke are both mineralized. The North Zone is oriented east-west and the South Zone is oriented northeast-southwest. This dyke coincides with a magnetic anomaly. Fancamp Exploration performed a ground magnetic survey in 2007 on the Céré-Villebon occurrence and obtained a lengthened northeast-southwest magnetic anomaly, which superimposed the South Zone drilled by Faraday in 1968.

Exploration History

Exploration of the Abitibi region goes back to the turn of the century when prospectors were scattered across northern Ontario and Quebec in search of gold and copper. However, the immediate area around Cere Villebon wouldn’t see any exploration until the 1930’s when a gold discovery was made just 2 kilometers to the east of the property. Small mining activities took place at the time but it wouldn’t be until the 1960’s that any copper/ nickel discoveries would be made.

Through the 40’s, the exploration that was carried out Led the Geological Survey of Canada to map the Villebon Township.

Some geophysics, mapping and drilling was done in the area with a focus on gold exploration through the 1940’s and 1950’s.

The first real nickel/copper exploration wouldn’t come until magnetic and electromagnetic surveys were performed in 1965 to which one follow up drill hole (V-1) was carried out by Newconex Canadian Exploration Ltd., on the western portion of the Property in the Range III, Lots 5 and 6 area. The anomaly that was targeted was explained by a 4.5 metre mineralized zone containing up to 40 % pyrrhotite (magnetic iron sulphide) hosted in argillites of the Pontiac Group. Others zones containing 15 % and 40 % sulphides were mentioned in drill log and intersected a talc-carbonate rock between 94.1 m and 116.9 m including 1.3 m of disseminated pyrrhotite, and between 106.8 m and 108.7 m including 20 cm with 5% sulphide. The talc rocks were not assayed. The best assay from the argillites returned 0.17% nickel.

The regional aeromagnetic map from 1952 showed three (3) magnetic anomalies to which Broulan Reef Mines Limited decided to test with one drill hole in 1967. The original property (Céré Claims) was held by a local prospector who drilled four (4) Winkie holes with only drill hole C-1 reached fresh rock and intersected a mafic dyke that returned 3.90% copper and 0.51 % nickel.

Broulan Reef Mines Limited optioned the Céré Claims in 1967 and surface mapped around drill hole C-1.

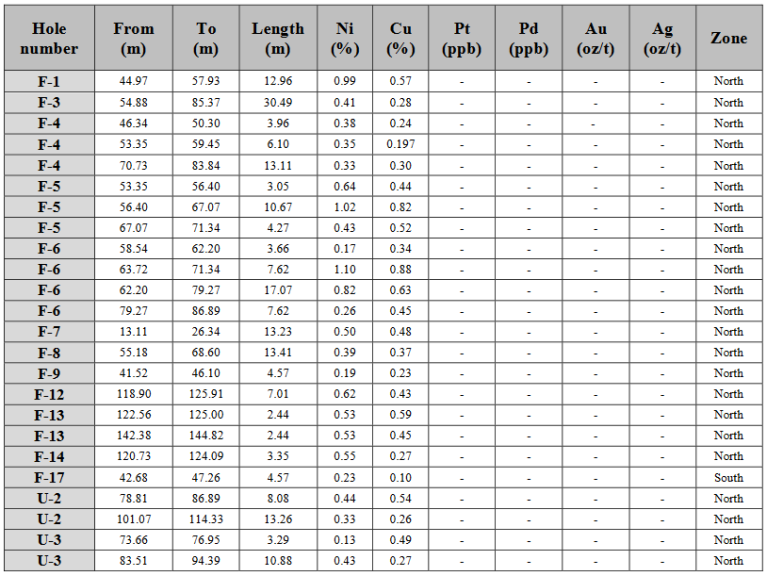

Consolidated Canadian Faraday Ltd., drilled eighteen (18) diamond drill holes (1,943 metres) after completing a ground magnetic survey in 1968. These holes intersected two (2) nickel-copper zones in a peridotite sill, that also included the anomalous C-1 zone, located about 350 metres southwest of the drill C-1. Drill hole F-1 which is close to C-1 gave 13.7 metres averaging 0.99% nickel and 0.57% copper. Between 1970 and 1971, ground magnetic survey and 27 drill holes were undertaken by Univex Exploration & Development Corp. Ltd.

The objective was to find an additional zone and to extend the main zone below a 160-metre depth. A historical mineral resource was completed in 1971 which gave an estimated total of 503,015 tonnes grading 0.51 % nickel and 0.39 % copper for the combined North and South zones.

*This estimate is historical in nature, non-compliant to NI 43-101 Mineral Resources and Mineral Reserves, and therefore should not be relied upon, but should only be considered has an indication of the mineral potential and not necessarily indicative of the mineralization on the Property. A Qualified Person has not done sufficient work to classify the historical estimate as current Mineral Resources.

In 1969, UMEX (Union Minière Exploration) carried out ground magnetic and electromagnetic surveys to retrace an airborne anomaly located in Range V, lots 13 and 14, to the north of the Property which identified a 900m strike potential.

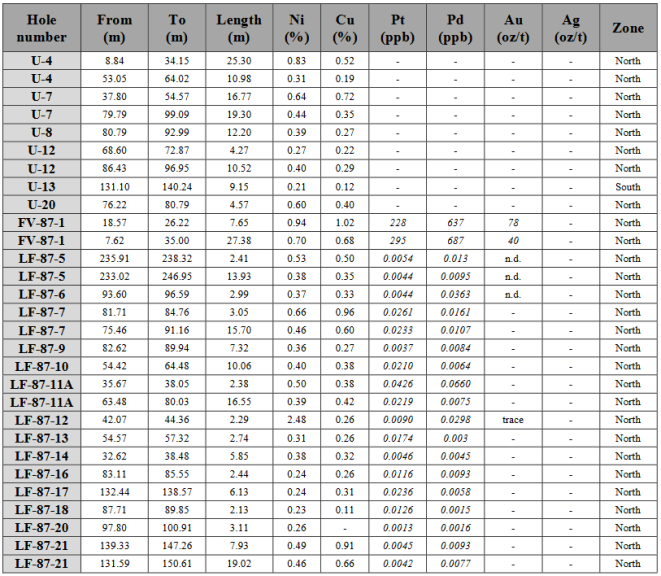

In 1987, La Fosse Platinum Group Inc., undertook an exploration program covering 164 claims in Villebon Township. The program aimed at base metals, PGE’s and gold consisted of line cutting, electromagnetic (HLEM) and, magnetic surveys along with the completion of forty-five diamond drill holes. Fonteneau Resources Ltd., drilled six (6) holes, of which four (4) targeted the copper-nickel bearing peridotite sill previously drilled by Faraday and Univex The first PGE’s analyses come from these four (4) drill holes.

An additional thirty- nine (39) holes were drilled. Nineteen (19) holes targeted the peridotite sill. As a result of this drilling in 1987 and 1988, an updated mineral resource was estimated at 421,840 tonnes grading 0.52 % copper, 0.72% nickel and 1.08 g/t platinum-palladium combined.

Figure 1: North Mineralized Zone with historic drilling and geology (Groupe La Fosse Platinum Inc.)

Figure 2: South Mineralized Zone with historic drilling and geology (Groupe La Fosse Platinum Inc.)

Table 1: Significant results for the holes which intersected the Cu-Ni mineralized peridotite

Table 1a: Significant results for the holes which intersected the Cu-Ni mineralized peridotite continued

*The resource estimate from Groupe De La Fosse is historical in nature, non-compliant to NI 43-101 Mineral Resources and Mineral Reserves standards, and therefore should not be relied upon. A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources, and these estimates should only be considered as an indication of the mineral potential of the Property.

In 2001, Louvicourt Gold Mines Inc., performed a ground magnetic survey on the Céré-Villebon occurrence.

In 2007, Fancamp Exploration Ltd., performed a ground magnetic survey, which delineated the magnetic anomaly associated with the Céré-Villebon occurrence of Les Ressources Tectonic Inc.

Current Exploration

At this time,Noble holds the majority of the defined deposit with St-Georges Eco Mining holding the remaining portion.

St-Georges put out a report on the project through Consul-Teck Exploration in 2007 after acquiring their portion of the property. For the full report, follow the link below.

Noble acquired their portion of the project on June 24, 2021 and immediately started a data compilation exercise ahead of a geophysical and drill program.

In 2022, Noble applied for permits to drill on the property.

On February 22nd, 2023 Noble mobilized a crew to the site to perform geophysics and commence a 7-hole, 2,000 meter drill campaign.

July 11, 2023 – Noble Mineral Exploration reported the final drill core analysis results on the Cere Villebon drill program.

Highlights

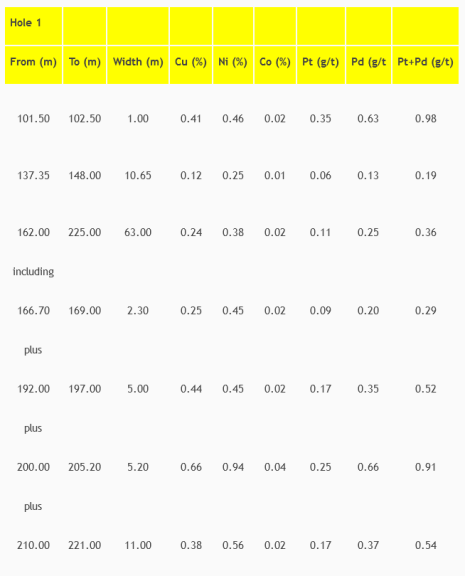

- Sampling of Hole 1 from the Cere Villebon drill program returned analyses of 5.2 meters* of 0.66% copper, 0.94% nickel, 0.04% cobalt, 0.25 g/t platinum and 0.66 g/t palladium within a 63 meter* wide mineralized zone grading 0.24% copper, 0.38% nickel, 0.02% cobalt, 0.11 g/t platinum and 0.33 g/t palladium. (*true width not known at this time);

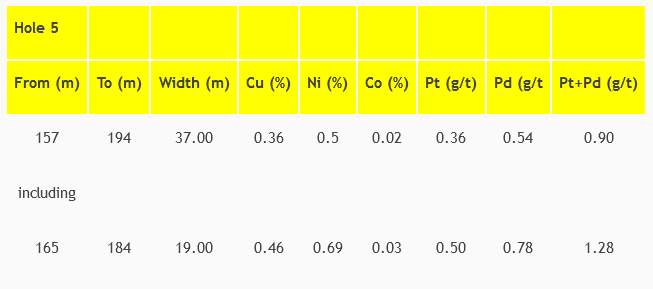

- Sampling of Hole 5, located 25 meters east of Hole 1, of 0.46% copper, 0.69% nickel, 0.03% cobalt 0.78 g/t platinum and 1.28 g/t palladium over 19 meters* within a 37 meter* zone of 0.36% copper, 0.50% nickel, 0.02% cobalt, 0.36 g/t platinum and 0.54 g/t palladium. (*true width not known at this time);

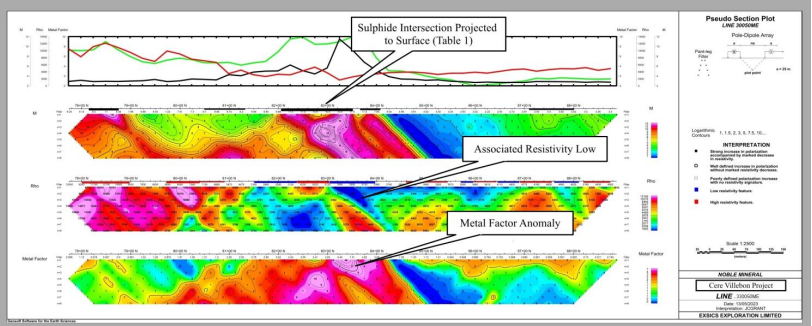

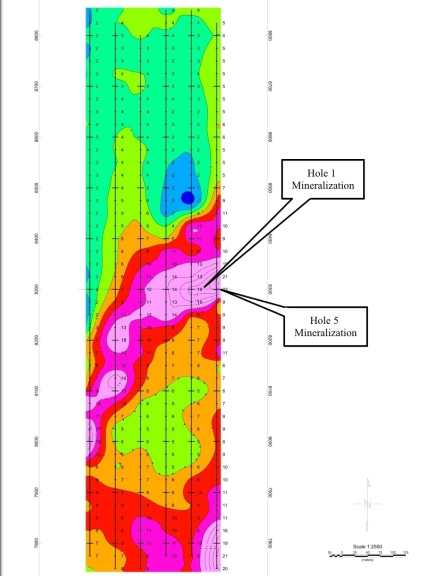

- The mineralization is associated with a strong chargeability anomaly associated with a resistivity low reflecting the sulphide mineralization encountered in the core. (See Figures 3, 4 and Image 1);

- Holes 2, 3, 4, 6, and 7 showed no significant mineralization and were drilled off trend of Hole 1 and 5 to test targets on other parts of the property.

The program included 7 diamond drill holes for a total of 1,955 meters. Significant mineralization was encountered in holes 1 and 5 and are summarized in Table 2.

Table 2: Significant Intersections in Hole 1 and 5

Subsequent to the drilling a 7.2-kilometer program of Induced Polarization and Magnetometer Survey was done in the vicinity of the diamond drilling (See Figure 3). The pseudo-section shows a strong chargeability anomaly associated with a resistivity low reflecting the sulphide mineralization encountered in the core. (See Image 1)

Figure 3: Pseudo-section in the Vicinity of Hole 1

Figure 4: Chargeability Anomaly Showing Mineralization in Hole 1 and 5

Image 1: Drill core from Hole 1, 220.5m depth down hole.

Conclusion

Based on the body of evidence from this campaign, The Compnay believes that a follow up drill program is warranted and is in the planning stages of a second phase of drilling.

Updates will be provided as they occur.

Disclosure

At the time of creation, Noble Mineral Exploration is a client of Insidexploration Analytics Inc.

Disclaimer

Project Reports are under the Issuers editorial control and published on Insidexploration.com. Information contained in Project Reports may change over time and may differ from other sources. For more information, please reference https://www.noblemineralexploration.com/ for Corporate, Technical Information and Project Specifications for the latest public disclosures.

Further;

The information herein is meant for informational and entertainment purposes only and does not constitute a recommendation to buy or sell securities. While every effort is taken to ensure the accuracy of everything contained on this website, no warranty of same is expressed or implied. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. While every caution has been taken to provide readers with most accurate information, we recommend that you consult a registered investment professional in your jurisdiction before undertaking any investment in any asset whatsoever.

All Issuer content within this space is considered authored by the Company as an extension of its digital presence. All copyrights are retained by each respective creator(s).

tsxv

otc

gold

cobalt

rare earths

nickel

copper

iron

niobium

diamond

tsxv-cnc

canada-nickel-company-inc

canada nickel company inc

tsxv-fnc

fancamp-exploration-ltd

fancamp exploration ltd

tsxv-bmk

macdonald-mines-exploration-ltd

macdonald mines exploration ltd

tsxv-nob

noble-mineral-exploration-inc

noble mineral exploration inc

tsxv-shl

spruce-ridge-resources-ltd

spruce ridge resources ltd

cse-goco

go-metals-corp

go metals corp

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…