Companies

Canada Nickel Company (TSX.V: CNC) – Research Report – 2023 Update

Introduction Updated February, 2023 Nickel is quickly becoming a hot topic among investors, and for good reason. Not only is demand on the rise from the…

Introduction

Updated February, 2023

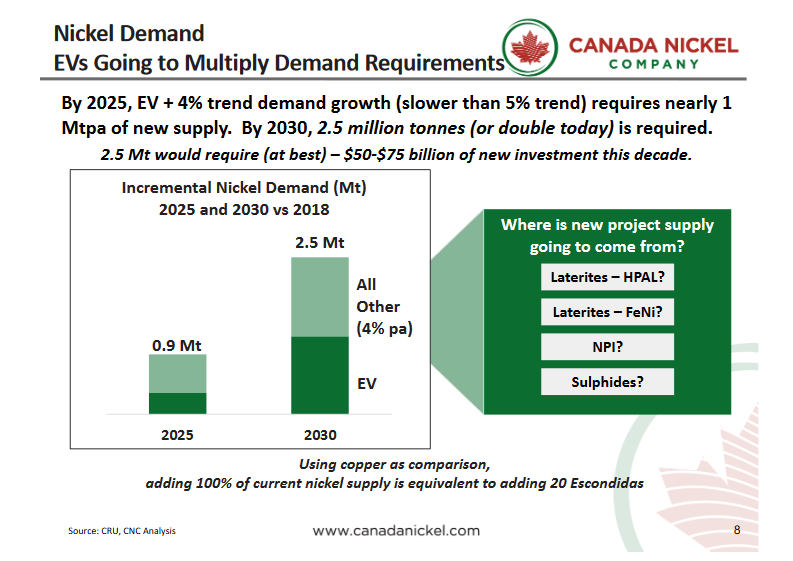

Nickel is quickly becoming a hot topic among investors, and for good reason. Not only is demand on the rise from the stainless steel sector but also from the rapidly developing electric vehicle market which is poised to see substantial growth in the coming decade. As such, we are now seeing governments, auto manufacturers and influential people like Elon Musk calling for increased production of nickel sulphate, but more importantly, in an environmentally friendly way. With most of the world’s nickel supply coming from places like New Caledonia, the Philippines and Indonesia who use coal-powered electricity that is counter intuitive to the concept of greener technologies. This is where an operation like the one Canada Nickel is developing could become a major player in the nickel space in the very near future.

Summary

Overview – A brief description of the company

Crawford PEA Highlights and Notes – A quick look at the 2021 PEA and some notes on whats changed since

Nickel supply and Demand Outlook – A look at world supply and demand, the impacts of the invasion of Ukraine and the needs of manufacturers as they apply to the carbon footprint left behind by nickel mining and refining operations.

History – An in depth look at the discovery of the Crawford Ultramafic Complex that led to the formation of Canada Nickel and every development since.

Canada Nickel – Developing a District Scale Nickel Mining Operation in Ontario – In this section we detail all the work that has been done on the full land package since inception in more general terms. The individual details and results can be found in the following section which hones in on each property individually.

— Expanding Operations – Discussing the addition of 5 more properties in a deal with Noble Mineral Exploration

— Updated Resource Estimate – Breaking down the increase in resources ahead of the PEA

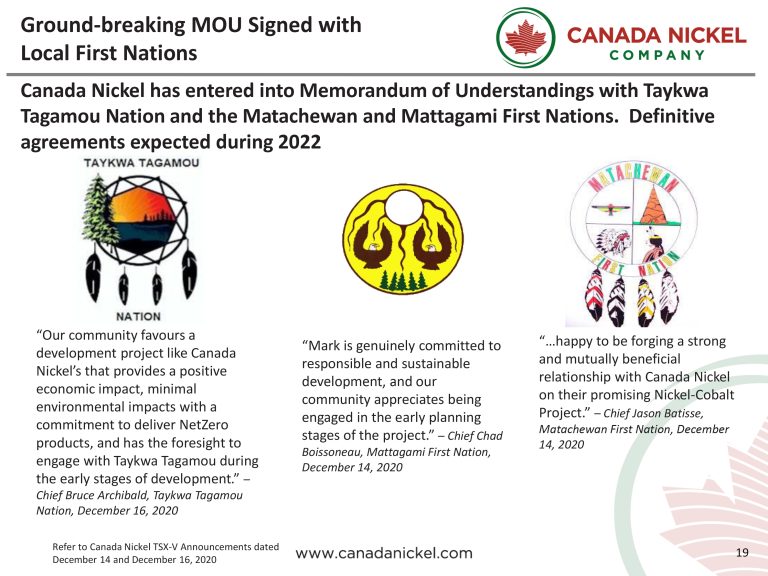

— Community Engagement and First Nations Agreements – In this section we look at how CNC is developing relationships to ensure the success of their projects.

— Crawford Nickel Sulphide Pre Economic Assesment (PEA) – Highlights from the 2021 PEA. Please note, that improvements to the PEA are stated in the ” Crawford PEA Highlights and Notes” section and more detail to be provided below.

— Metallurgical Advancements – As the Project has developed, so has the Metallurgy! This is the first of several improvements highlighted in this report.

— Additional Notes on Crawford Drilling Results from 2021 – Additional Drilling results from 2021 exploration at Crawford

— Additional Assets Acquired in 2021 – Canada Nickel has optioned and acquired several large-scale nickel sulphide targets within a short distance of the Crawford deposit from Noble Minerals, staking and prospectors alike. With the addition of these 18 targets, Canada Nickel now has the potential to become one of the largest nickel sulphide producers in the world, turning the greater Timmins area into a district scale nickle operation.

2022 Exploration, Acquisition and Advancements – Covering all the activity that took place for CNC in 2022 in chronological order from acquisitions to project improvements and everything in between.

— 2022 Mineral Resource Update – A look at the incorporation of the updated resource into the PEA

— Carbon Credit System – A brief description of the Carbon Credit system as it pertains to this project

— Texmont – Highlighting the aquisition of the past producing high grade nickel mine

2023 Exploration, Acquisitions and Advancements – Covering all the activity that took place for CNC in 2022 in chronological order from acquisitions to project improvements and everything in between.

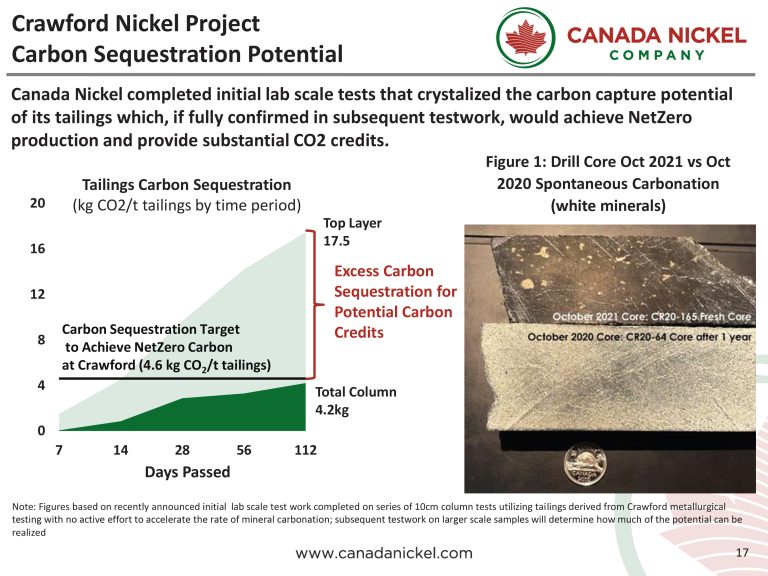

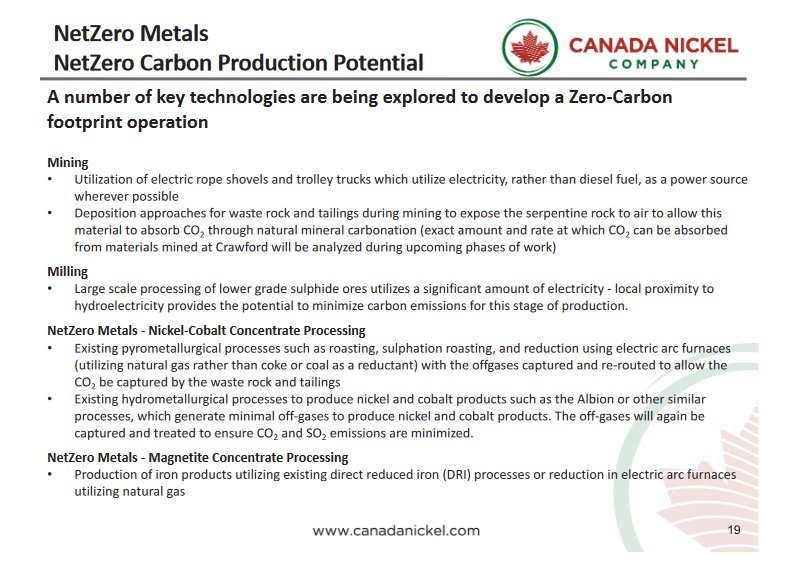

Net Zero Carbon – In a world focused on green energy, Canada Nickel is uniquely poised to be able to meet the demand to produce nickel in an environmentally efficient manner and achieve zero carbon or at least close to it. As a result of the unique advantages of the Timmins region with its proximity to zero-carbon hydroelectricity and Crawford being comprised largely of serpentine rock that naturally absorbs CO2 when exposed to air, Canada Nickel has the potential to develop zero-carbon products. Combined with the company’s plans to use an all electric fleet, CNC could become an industry leader in clean mining techniques.

— IPT Carbonation Process – Discussing the IPT Carbon Sequestration Process developed by CNC

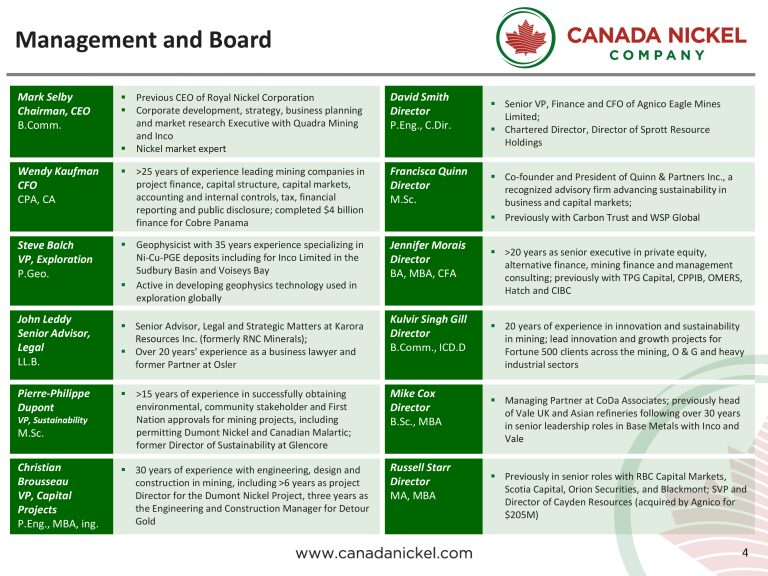

Management and board – A look at the team running Canada Nickel

Conclusion – Closing Statements

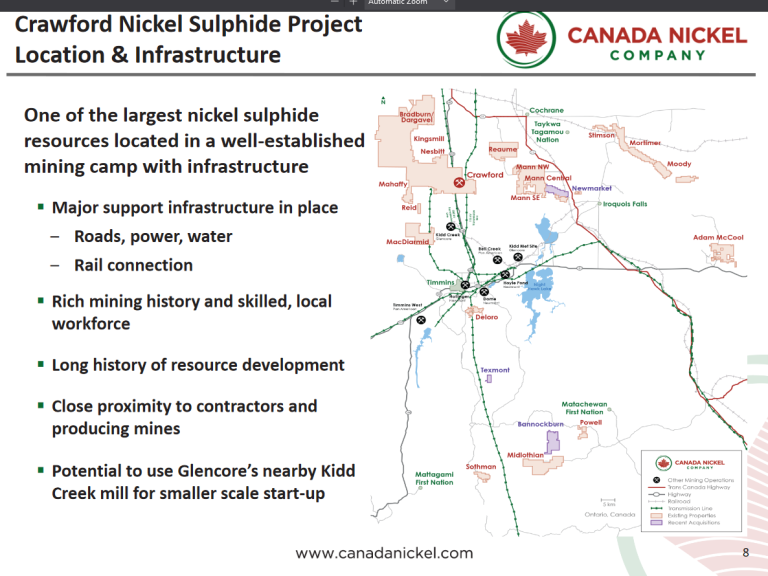

Overview

Canada Nickel Company Inc. (TSX.V: CNC) Located in the mining friendly jurisdiction of Timmins, Ontario and within the world famous Abitibi Greenstone belt, Canada Nickel is focused on advancing the next generation of high quality nickel-cobalt sulphide and PGM projects to deliver the metals needed to power the electric vehicle revolution and feed the high growth stainless steel market. with potential to become one of the largest district scale nickel sulphide mining operations in the world. Once in operation it will be the largest base metal mining operation in North America. In addition to the 100% owned Crawford Nickel-Cobalt Sulphide and PGM Project, Canada Nickel holds 20 additional projects with historical nickel occurrences, and resources such as the past producing Texmont high grade nickel mine and 2-3 other deposits with +1% nickel which will compliment Crawford.

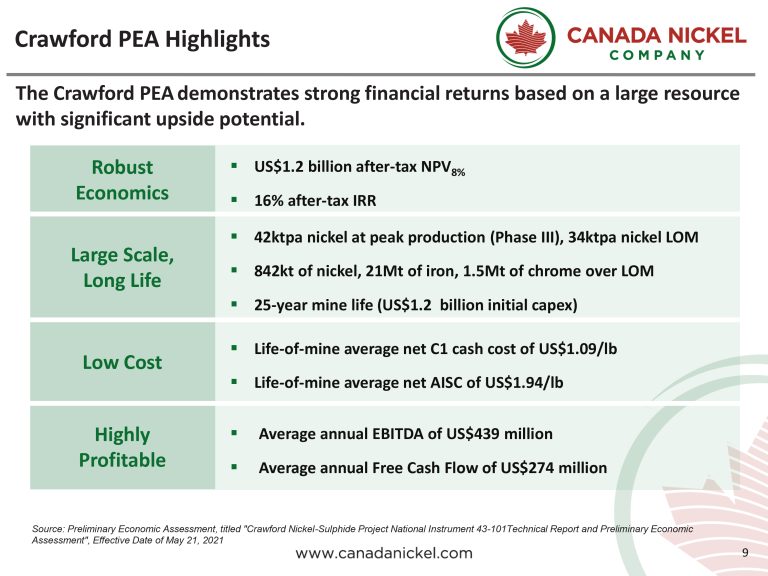

Crawford 2021 PEA Highlights & Notes

The first resource established on Crawford, was initially based on drilling of just over 20 percent of the ultramafic structure, and already it ranked in the top twelve largest nickel sulphide deposits in the world using methods by Wood Mackenzie. So it was no surprise that when they updated the resource estimate shortly after in the maiden PEA on the project, it climbed to number 5 on the global chart with around 50% of the Crawford Ultramific Complex drilled off.

The PEA dated July 2021, indicated a 25-year mine plan based on a phased 120,000 tonnes per day open pit mine and processing operation using conventional nickel sulphide concentrator, producing nickel concentrates and magnetite concentrates.

Over the 25-year mine life Crawford is expected to produce 842,000 tonnes of nickel, 21 million tonnes of iron and 1.5 million tonnes of chrome valued at $24 billion using long-term price assumptions. Annual average nickel production of 75 million pounds (34,000 tonnes) with peak period annual average of 93 million pounds (42,000 tonnes), with significant iron and chrome by-products of 860,000 tonnes per annum and 59,000 tonnes per annum, respectively.

Highlights:

- After-tax, $1.2 billion NPV8% and 16% IRR at long-term price assumptions (Note 1)

- Large scale, low cost, long-life

- Significant iron and chrome by-products of 860,000 tonnes per annum and 59,000 tonnes per annum, respectively

- Life-of-mine net C1 cash cost of $1.09/lb and net AISC of $1.94/lb on a by-product basis (1st quartile) (Notes 2 and 3)

- Life-of-mine production of 25 years with 842,000 tonnes of nickel, 21 million tonnes of iron and 1.5 million tonnes of chrome valued at $24 billion using long-term price assumptions (Note 1)

- Significant earnings and free cash flow generation. Annual EBITDA of $439 million and annual free cash flow of $274 million (Notes 1 and 3)

- Minimization of carbon footprint through use of autonomous trolley trucks and electric shovels, which reduces diesel use by 40%. Optimization of the carbon sequestration potential of tailings and waste rock.

PEA Notes and Assumptions

- All dollar figures are in United States (“US”) dollars. US metal prices used in the PEA were $7.75/lb nickel, $1.04/lb chromium, and $290/tonne iron. A US dollar exchange rate of 0.75 was applied.

- Source for 1st quartile costs – Wood Mackenzie and S&P Capital IQ; Priced as of May 20, 2021.

- C1 cash cost, AISC, EBITDA and cash flow data are non-IFRS measures. Refer to Non-IFRS measures.

- A full copy of the Technical Report and PEA, including material assumptions, notices and cautions, can be found on the Company’s profile at www.sedar.com.

The upcoming Feasibility study will incorporate all the remaining drill data which will increase the size by 50 – 100 percent as much more material has gone into indicated resource from the inferred category.

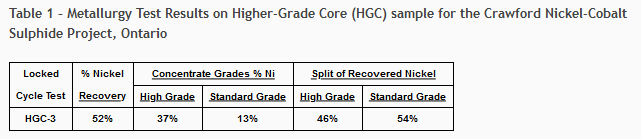

Additionally, the metallurgy has improved exponentially and CNC now boasts one of the highest recovery rates for nickel sulphides on a global scale. The improvements on metallurgy provide additional value to the project and each percentage point improvement in nickel recovery would yield a US$92 million improvement in the value of the NPV8% of the project, based on the PEA metrics

Highlights:

- Flowsheet improvements yield recovery gains and enhanced magnetite concentrate quality (all figures below relative to Preliminary Economic Assessment (“PEA”) model)

- Nickel recovery of 62% – 10 percentage points or 19% improvement

- Iron recovery of 45% – 2 percentage points or 5% improvement

- Magnetite concentrate grade of 54% iron – 6.5 percentage points or 14% improvement

- Cobalt recovery of 70% – 30 percentage points or 75% improvement

Furthermore, The company has also made progress on the carbon sequestration aspect of their tailings which will allow the company to capitalize on the emerging carbon credit sector.

Highlights:

- Initial lab scale testing demonstrates that Crawford tailings have the potential to capture 17.5 kg CO2 per tonne of tailings – more than 3 times the amount required to offset the Project’s projected carbon footprint. Any amounts in excess of projected 4.6 kg CO2 per tonne could be sold for carbon credits.

Notes

Several of improvements have been made since the release of the PEA that will be incorporated into the upcoming Feasibility study and will be covered in this report. But just so you have an idea of where the project is headed, here is what you need to know. Please note that all the following notes will be covered in more detail later in the report.

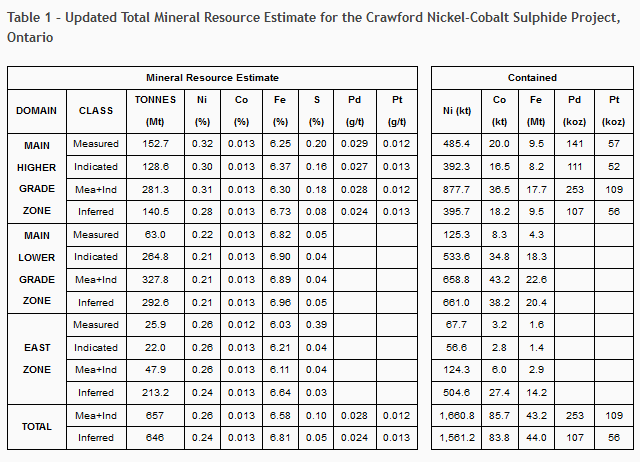

1) Resource – In the PEA it was projected that Crawford had a mine life of 25 years, however our first improved metric was the resource update! This doubled the resource to 1.4 billion tonnes of nickel grading .24% with the addition of 113 new holes. But it will grow because there were 54 additional exploration drillholes in the East and Main Zone that didn’t get included. These additional resources add at least another 20-25 years bringing us to a 45 – 50 -year mine life.

2) Metallurgy – The target for recoveries was 35% so when we see an announcement that they are recovering 63% on low grade material with a 46% concentrate (which is the highest known nickel sulphide concentrate from any project globally based on all available published studies), one might have grounds to get excited! Why? Because, each percentage point of improvement in nickel recovery would yield a US$92 million improvement in the value of the NPV8% of the project, based on the Preliminary Economic Analysis (“PEA”) metrics. Additionally, Nickel recovery from the slimes circuit was not included in the reported results and represents a further opportunity to improve flowsheet performance and will be evaluated during this phase of feasibility work.

3) Carbon Capture – In a huge development, Canada Nickel announced that they can capture 710,000 tonnes of CO2 credits annually and 18 million total tonnes over the expected life of mine! With carbon credits sitting at $50 per and projected to hit $180 it could produce an entirely new revenue stream for the project while helping the environment. For context, that’s $35.5 million in revenue @$50 and $127 Million @ $180… Now add that to these figures… Significant earnings and free cash flow generation. Annual EBITDA of $439 million and annual free cash flow of $274 million.

4) Spot Price of Nickel – The price of nickel will drastically affect profit margins so the fact that its approaching $13 per pound bodes very well for CNC. I’m sure I’m missing something in there but these are just some examples of how the company is creating real value which will reflect in the upcoming Feasibility study. Lastly, I would like to highlight that they have agreements with 2 first nations groups, The city council and local MP’s are in full support, Permitting has already been started and majors are inquiring regularly. Don’t be surprised to see the provincial government invest as there is a glaring need for nickel and CNC might just be the best option on the planet. Anyways, I think you get my point. This stock is grossly undervalued and as noted above you can see why I believe Canada Nickel is in for a big re-rate post feasibility study due mid 2023.

Additionally, Timmins is a world-class, mining friendly jurisdiction, with a wealth of infrastructure and skilled local labour to support a project of this scale. Mark Selby, Chair and CEO of Canada Nickel, is a well-respected expert on nickel and his experience has already accelerated this project much faster than anyone anticipated. With EV sales continuing to grow and the demand for more environmentally friendly mining at the forefront of the sector, we believe Canada Nickel has a real opportunity to become one of the largest and most efficient nickel producers on the planet while creating generational wealth as many of their predecessors have before them.

Finally, The company’s true value cannot be assessed on Crawford alone as they have recently secured the rights to an additional 20 projects (10 of which are comparable to Crawford), A past producing high grade mine in Texmont and a few are higher grade, smaller deposits in the area. But when you start to see the bigger picture of whats shaping up in Northern Ontario, you cant help but get excited for the opportunity this district scale project represents. Now lets have a look at the Nickel Markets in 2023 and beyond before diving into all the details of CNC. Hope you have your coffee ready.

Nickel Supply and Demand Outlook

In March 2020, Nickel hit a low of just $11,000 USD per ton despite the supply crunch being projected by analysts around the world. However, since the crash of 2020 Nickel has seen a steady climb up into the $30,000 USD range and holding on the back of trade disputes, export bans, tariffs, inflation and the war in Ukraine along with the fact that global LME stocks have been dropping dramatically with new demand for the metal coming from both the stainless steel and EV sectors. As 2023 gets under way, nickel is emerging as a clear favorite among base metals after a very volatile year in 2022.

Nickel demand is mainly driven by the stainless steel industry which accounts for roughly 70% of demand, while batteries only account for roughly 13% in 2023. However, battery metals like nickel are slated to triple by 2030 or better and signs can already be seen in the market. Large blue chips producers and auto manufacturers are cutting deals to secure supply and the industry is getting commitments from the government to build the infrastructure and remove the red tape needed to put mines into production and meet the critical mineral demands created by a burgeoning industry. What does that mean for investors? Find Nickel exploration projects with good fundamentals, take a position and let it mature! but I digress.

While there has been a lull in Nickel demand with China shutting down with a Zero Covid policy, they have recently lifted restrictions and the global nickel markets are beginning to heat up again. All signs point to a continued growth pattern, especially when you consider that Indonesia is pulling supply to push the value higher and Russia has already taken a large quantity supply off the open market as they secure feed for their war machine. The end result is that in 2023, we’ve seen nickel gaining strength and it is my opinion that we could see nickel break the $15 USD mark by the end of the year provided that there are no unforeseen macro events that swing the price wildly up or down.

History

For many years the property on which the Crawford Nickel deposit is hosted was owned by a logging company and saw little to no exploration activity while the rest of the Timmins area was being heavily explored and drilled in hopes of finding the next big gold mine. Then in 1963, the discovery of the VMS deposit in Kidd Township which ultimately led to the development of the Kidd Creek Mine, about 15 km south of the Crawford Deposit, led to a flurry of exploration in and around Timmins.

INCO Limited, a Canadian mining company and the world’s leading producer of nickel for much of the 20th century, did the bulk of the exploration work around Crawford Township but they were not interested in low grade high tonnage nickel deposits as the value of these types of deposits were unknown and for the most part they overlooked the potential. So while everyone was looking for the next Kidd Creek, these already identified nickel sulphide targets sat untouched and exploration in these townships all but stopped in the 1980’s until Noble Mineral Explorations acquired the rights to the property in 2011 and dubbed it Project 81.

Originally the property was acquired by Noble because of the Kingsmill Nickel deposit and the Lucas Gold showing. In the first few years they did a range of Geophysics, ran some small drilling campaigns and continued to build out their land package by staking additional claims. Prior to the development of Canada Nickel, Noble had amassed approximately 79,000 hectares of property and tailored their business model to be a project generator whereby they could still maintain exposure to the future success of their property but not have to put out the capital to explore their large land package.

In 2017, Noble Mineral Exploration completed a 1,031.3 line km airborne helicopter MAG-EM survey and hired Orix Geoscience to conduct a data compilation of all known exploration activities on the property. This ultimately led to a joint venture deal with Spruce Ridge Resources to explore certain targets in Crawford Township, including the Crawford Ultramafic Complex (CUC).

In 2018, a fixed-wing 936.1 line km FALCON©, Airborne Gravity Gradiometer and magnetic surveys were conducted, both covering Crawford Township and the CUC. This was followed by the application of Windfall Geotek’s Artificial intelligence, CARDS technology which all but confirmed the CUC as a high priority target. Once Spruce Ridge received the targets from Windfall, they began a diamond drilling program late in the year that continued into 2019.

This was the point where Mark Selby was introduced to Vance White, CEO of Noble Mineral Explorations. Mark reviewed the information on Crawford and immediately pinpointed several similarities to the Dumont project, which he spent 10 years developing from a greenfield discovery into a construction ready and fully permitted project as CEO of RNC Minerals. Knowing that he could leverage his experience, Mark opted to take part in this project and began to work with Noble and Spruce Ridge to acquire the Crawford Ultramafic Complex under a newly formed subsidiary company that was to be spun out from Noble Mineral Exploration, called Canada Nickel Company.

As they waited for approval to get a listing on the TSX venture exchange, Vance was able to acquire a long standing 5% royalty on the property held by Franco Nevada. This deal had been in the works for sometime but worked to the advantage of Canada Nickel as it was completed before the spin out. With the October 1st, 2019 announcement that Noble had created a new entity, Canada Nickel Company took control of the drilling program from Spruce Ridge Resources.

Canada Nickel Company was officially spun out of Noble Mineral Exploration and listed on the Toronto Venture Stock Exchange in February 2020 at an initial listing price of $0.25 cents per share. The company quickly made a name for itself with nickel expert, Mark Selby at the helm as Chairman and CEO. The insight and experience he brings have become very apparent as he has navigated his way through this project very quickly. Dumont really is the most comparable to Crawford in terms of grade, size and metallurgy, thus allowing the CNC team, many of whom worked with Mark on Dumont, to leverage some of their previous work into this project.

Canada Nickel

Developing a District Scale Nickel Mining Operation in Ontario

Following up on the initial four holes completed in late 2018 and reported in early 2019 (see Noble news release date March 4, 2019), results from CNC’s first nine drill holes, which totaled 5,280 m, were announced by Noble on December 9, 2019. A further 11 holes totaling 7,298 m were announced by CNC on February 28, 2020. Total diamond drilling to up to January 2020 was 14,461.70 m in 25 holes which includes 65.5 m from an abandoned drill hole (CR19-14).

The focus of the 2019-2020 drilling was to extend mineralization along strike, test the northeastern and southwestern extents of mineralization (i.e., contacts), and to test deeper portions of the CUC. To date, diamond drilling has outlined a west-northwest trending (~285-315Az) ultramafic body (largely dunite-peridotite) that is at least 1.74 km in strike length, 225 to 425 metres wide, and more than 650 metres deep. Mineralization remains open along strike to the northwest, and at depth. A north-northwest trending regional sinistral, strike–slip fault terminates the ultramafic body along its southeastern extent. A 3D-Inversion magnetic anomaly, nearly one kilometre deep, has been only partially tested at depth with several drill holes extending beyond the 650 m depth containing intervals of >0.25% Ni. Diamond drilling is on-going on the Property.

On February 27th, Canada Nickel Company officially started trading on the TSX venture under the ticker symbol CNC. Under the agreement with Noble and Spruce Ridge Resources; Noble would receive 2 million dollars and 12 million shares of CNC and Spruce Ridge was to receive 20 million shares for their stake in the project.

By February 28th, Canada Nickel had sufficient drilling to put out a maiden resource estimate totaling 600,390,054 tonnes grading at .25% Nickel of Measured and Indicated resource and an additional 310,496,263 tonnes grading .23% Nickel of inferred resource making the Crawford Nickel project the 11th largest nickel sulphide deposit in the world with only 20% of the structure drilled. In addition to the nickel content, there is a section of PGM’s that run in parallel to the nickel body, with the best results to date returned 2.6 g/t palladium + platinum (1.3 g/t Pd, 1.3 g/t Pt) over 7.5 metres within an overall 1.8 g/t (0.9 g/t Pd, 0.9 g/t Pt) over 12 metres at 123 metres downhole. This structure extends over 1.5 kms and continues to expand as drilling continues.

Within the ore body there is also a higher grade core near surface which will allow for higher cash flow in the early years of production. Diamond drill core assay results to date allow for the delineation of the two higher grade (>0.30% Ni and >0.35% Ni) regions within the larger Higher Grade Zone (>0.25%Ni), which in turn are within the larger enveloping Low-Grade Zone (>0.15% Ni), all contained within the host ultramafic body of the CUC. The Higher Grade Zone has a minimum strike length of about 1.57 km, is between approximately 160 and 230 m wide, and contains regions of incrementally higher grade nickel (i.e., >0.30% Ni and >0.35% Ni). The Higher Grade Zone and internal regions of higher grade nickel remain open along strike to the west-northwest and at +650 m depth.

Expanding Operations

With a great start to the project it was only natural that Mark would look to add some of the other prospective targets within Project 81 that were similar in composition to Crawford as highlighted by the work done by INCO in the 1960’s. Then on March 4th, 2021, Canada Nickel Company announced that they agreed to pay Noble $500,000 in cash and issue 500,000 Canada Nickel common shares to acquire the Crawford Annex property and the option to earn up to an 80% interest in 5 additional nickel targets within the Project 81 land package and in close proximity to Crawford.

The Crawford Annex is comprised of 4,909 hectares in Crawford and Lucas Township and the 5 option areas of Crawford-Nesbitt-Aubin, Nesbitt North, Aubin-Mahaffy, Kingsmill-Aubin, and MacDiarmid range in sizes of 903 to 5,543 hectares. If the conditions to earn a 60% interest or 80% interest become satisfied, a joint venture would be formed on that basis and a 2% net smelter return royalty would be granted to Noble.

To understand the significance of acquiring these properties, we need to look at each of the additional 5 targets individually

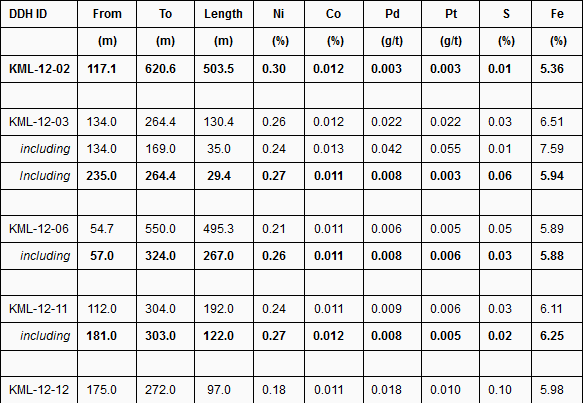

Kingsmill

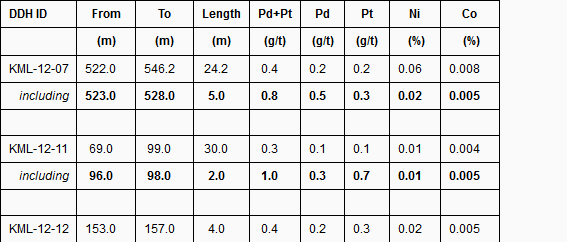

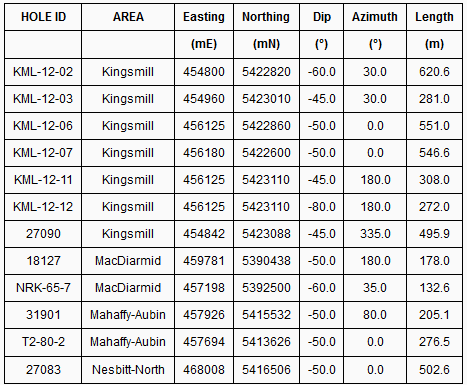

The Kingsmill target is a large serpentinized ultramafic intrusion which is 2.2 km long and between 375-600 metres wide. A thorough review of historical drilling results yielded both significant nickel and PGM intersections and the north side of the structure appears to have the same PGE enrichment as Crawford Main and East Zones: 1.0 g/t PGM over 2 metres from 96 metres within 0.3 g/t PGM over 30 metres from 69 metres in historic hole KML-12-11, 0.8 g/t PGM over 5 metres from 523 metres within 0.5 g/t PGM over 24 metres in historic hole KML-12-07.

Several large portions of the structure remain highly prospective for nickel-cobalt-PGM mineralization:

- The two sections were 1.3 km apart leaving a large portion of the overall structure completely untested.

- There are several intersections which points to the potential for relatively higher quantities of recoverable minerals

- Holes KML-12-06, KML-12-11, KML-12-12 on the Eastern section all contained intersections with significant nickel and sulphur content (which is necessary for formation of nickel sulphide minerals) across wide intersections (see Table 1 below)

- Hole KML-12-03, yielding 0.26% nickel and 0.03% sulphur over 130 metres, was the only hole (of four holes on the Western section) drilled on the northern half of the structure, which has yielded the best mineralized portions of the Crawford Main and East Zones

- Historic hole 27090 also drilled on north side of the structure in 1966 yielded 0.31% nickel over 302 metres (sulphur was not assayed)

The understanding of the mineralogy of these deposits has evolved significantly since the Kingsmill drilling was completed eight years ago, particularly the controls and the deportment of potentially recoverable nickel minerals across the deposit. Initial mineralogy results from Kingsmill in 2012 were less positive as the test was conducted on one master sample compiled from all drill cores – not taking into account the significant variability in mineralogy between rock types, and that some ultramafic rock will have low amounts of potentially recoverable nickel minerals.

Historical Drill Tables

Kingsmill Selected Historical Drilling Key Nickel Intersections – Holes 6, 11, 12 (Eastern), 3 (Western), Kingsmill Township, Ontario

Kingsmill Selected Historical Drilling Key PGM Intersections – Holes 6, 11, 12 (Eastern), 3 (Western), Kingsmill Township, Ontario

Once the new resource update for Crawford is complete, the historic drilling will be re-logged and mineralogical samples will be selected to understand the deportment of potentially recoverable nickel minerals (pentlandite, heazlewoodite, awaruite).

Crawford-Nesbitt-Aubin

The Crawford-Nesbitt-Aubin Township target consists of two ultramafic units 6 km long and 150-200 metres wide containing serpentinized peridotite and much of it was not assayed. Inco drilling in 1964-66 yielded highlights including narrow intervals of up to 0.35% Ni which tested the edges of the geophysical target. For reference, the Crawford Main Zone resource is 1.7 km long and 225-425 metres wide.

Nesbitt North

Two ultramafic units 3.7 km long by 150-300 metres wide with significant nickel intersections were identified in Nesbitt township. Inco 1966 drilling highlights included 0.28% Ni over 163 m in historic hole 27083. For reference, the Crawford Main Zone resource is 1.7 km long and 225-425 metres wide.

July 14th, 2021 – Canada Nickel expands the potential of Nesbitt to 1.8 kms of strike. A step out hole was drilled along the geophysical anomaly that intersected 302 metres of nickel mineralization with intervals of visible disseminated sulphides just like at Crawford, highlighted the size potential of the property and given its proximity to the CUC, the potential for it to be inclusive into future Crawford plans.

MacDiarmid

A target of 3 km by 150-600 metres wide ultramafic intrusion with serpentinized peridotite has been identified, much of it was not assayed. Highlights include historic hole 18127 which intersected 142 m of mineralized peridotite which was not assayed, and narrow intervals of up to 0.22% Ni over 1.5 m in NRK-65-7 (1965). For reference, the Crawford Main Zone resource is 1.7 km long and 225-425 metres wide.

Mahaffy-Aubin

A target of 8 km by 200-500 metres wide interpreted ultramafic intrusion has been identified, much of it was not assayed. Highlights include historic hole 31901 (1966) which intersected 0.23% Ni over 127 m, and hole T2-80-2 (1980) which intersected 277 m of serpentinized ultramafic rock with no assays reported. For reference, the Crawford Main Zone resource is 1.7 km long and 225-425 metres wide.

Table 2 – Historical Drill Hole Orientation, Canada Nickel Option Properties, Ontario

The addition of these areas gives Canada Nickel a larger footprint to fully develop Crawford as each can potentially host nickel-cobalt deposits that are similar in nature to Crawford. With these additional targets Canada Nickel could grow their resource exponentially and easily become one of the top players in the nickel sector or provide a major an opportunity to secure feed for many years to come.

Updated Mineral Resource Estimate

Then on October 21st, 2020 Canada Nickel announced an updated mineral resource for its 100% owned Crawford Nickel-Cobalt Sulfide Project which more than doubled it’s mineral resources in both the Measured and Inferred resource categories. This increase pushed CNC up the global ladder to the number 7th largest nickel sulfide deposit globally. Considering that this was achieved on less than 50% of the structures drilled in the CUC, this leads to great optimism for the Crawford deposit and beyond.

In having such great success in exploration, the company opted to get to work and put deals in place with the local first nations in the Wabun tribal council and initiate a working relationship with the Taykwa Tagamou, which would see them take an active role in building the hydro electric infrastructure required to get the project into production. This was a big step for this project as community acceptance is a big part of developing projects and so far CNC is way ahead of the game.

Then on January 25th, 2021, Canada announced very positive results from its latest metallurgical testing. The first phase of metallurgical testing was designed to confirm initial flowsheet design, which uses a typical nickel sulphide ultramafic flowsheet of two stages of grind-deslime-float with magnetic separation to support recovery of magnetic minerals. Subsequent testing during 2021/22 will continue to optimize various flowsheet parameters towards a final flowsheet for the feasibility study.

Continue reading for additional Flow Sheet Improvements and updates in 2022

Community Engagement and First Nations Agreements

Then came a non-binding Memorandum of Understanding (“MOU”) with Glencore Canada Corporation in order to examine the potential use of Glencore’s Kidd concentration and metallurgical site in Timmins, Ontario for the treatment and processing of material mined from Canada Nickel’s 100% owned Crawford Nickel-Cobalt project located 40 km north of Glencore’s operations. This was a big step forward as the economics of the project will be far more robust not having to build everything from scratch and should have a very positive effect on the project as a whole. This also bodes well from the perspective of having a major establish a working relationship with Canada Nickel Co. For more information on the MOU [Click Here]

In April, Canada Nickel Signed a Memorandum of Understanding with Taykwa Tagamou Nation for Mine Fleet Financing for the Crawford Nickel-Cobalt Sulphide Project. Under the terms of the MOU, TTN will seek favourable financing terms to participate in the financing of all or a portion of the heavy mining equipment fleet required for Crawford’s operation. Training and associated employment opportunities will also be available to TTN where specialized maintenance and operation is required for the equipment and where that equipment is financed or owned in whole or in part by TTN. This deal augments first nations participation in this project and highlights the strong support from the local communities who will benefit from a project like this for generations.

Crawford Nickel Sulphide Pre Economic Assesment (PEA)

Then came the PEA, which put Canada Nickel on the radar of every investor in North America and placed it as the 5th largest Nickel Sulphide project globally with only 50% of the deposit drilled off! The Economics were robust and showed that large low grade deposits like this can be extremely profitable! Using metrics that look low at today’s nickel prices also highlight the long term sustainability of the project as we transition to green energy that is reliant on nickel.

I’m not going to spend much time here aside from providing highlights because so many metric have improved that these numbers are quite frankly outdated and substantially better now. Full PEA can be found @ https://canadanickel.com/wp-content/uploads/2022/08/Crawford-43-101-Technical-Report-and-PEA-May-19-2022-1.pdf

Metallurgical Advancements 2021

In early October, Canada Nickel announced that they achieved 62% nickel recovery through substantial improvements in metallurgical performance at the Crawford Nickel Sulphide Project. This is huge! Each percentage point improvement in nickel recovery yields a US$92 million improvement in the value of the NPV8% of the project, based on the PEA metrics.

Highlights:

- Flowsheet improvements yield recovery gains and enhanced magnetite concentrate quality (all figures below relative to Preliminary Economic Assessment (“PEA”) model)

- Nickel recovery of 62% – 10 percentage points or 19% improvement

- Iron recovery of 45% – 2 percentage points or 5% improvement

- Magnetite concentrate grade of 54% iron – 6.5 percentage points or 14% improvement

- Cobalt recovery of 70% – 30 percentage points or 75% improvement

“I am very pleased with this step change in metallurgical performance that our team has unlocked during this phase of flowsheet optimization. The nickel recovery is substantially higher than the 4-5 percentage point improvement in nickel recovery the Company is targeting for the feasibility study. The improvement in grade and recovery of iron in the magnetite concentrate that has already been unlocked is excellent. I cannot underscore enough the importance of these results, as we believe all of these improvements provide additional value to the project.” said Mark Selby, Chair and CEO

Additional Notes on Crawford Drilling Results 2021

In late October, with 5 drills turning on the property another development came in the discovery of a higher grade core in the East Zone of Crawford. Not only did this discovery add more tons to the Feasibility study but it also boasted fantastic metallurgical results as well. highlights below.

Highlights

- Infill drilling identified an extensive Higher-Grade Core in the East Zone, similar to the Main Zone.

- The higher grade cores span combined strike length of 1.6 kilometres, a width of 20 to 50 metres, to a depth of 690 metres.

- Drilling in the East Zone has successfully infilled and extended strike length to a total of 2.1 kilometres, substantially larger than previously reported resource.

- Hole 142A averaged 0.31% Ni across its entire 576 metre core length, ending in mineralization. Hole 165A (assays pending) was mineralized across its entire 690 metre core length, ending in higher grade mineralization at 735 metres. Five other holes recently completed intersected drill intervals of up to 216.6 metres of higher grade mineralization.

- Samples from East Zone Higher Grade Core yielded the highest grade concentrate from Crawford during metallurgical work reported for the previously released Preliminary Economic Assessment with 43% of the recovered nickel reporting to a 55% nickel concentrate.

While exploration at Crawford was going on full steam ahead and metallurgical work was being improved upon, the work on Carbon Sequestration was developing, making this one of those coveted green nickel mining operations. On November 10th, 2021, CNC announced that Initial lab scale testing demonstrated that Crawford tailings have the potential to capture 17.5 kg CO2 per tonne of tailings – more than 3 times the amount required to offset the Project’s projected carbon footprint but we will cover that below.

Additional Assets Acquired in 2021

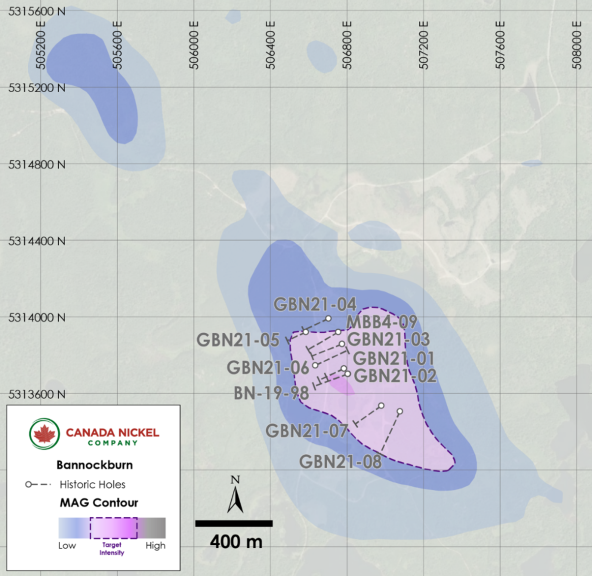

On November 22, 2021, Canada Nickel made a bold statement by going out and securing an additional 13 properties which all share similar geophysical traits and historical exploration data. This was a strategic move to secure a true district scale land package and nobody saw it coming! Lets take a look at those projects. (Taken from News release dated November 22, 2021, Please refer to the news release for more information on the property acquisitions.

Highlights

- Acquisition of 13 additional target properties consolidates district scale potential.

- Combined target surface footprint of 37.7 square km – 40 times larger than current Crawford Main Zone resource of 0.85 square km.

- Ten target properties have larger footprint than Crawford and nine confirmed to contain the same host mineralization as Crawford.

- Sothman target property has historical higher grade, shallow resource of approximately 190,000 tons of 1.24% nickel (with 300 metres strike length)1; remaining 2.2 km of strike length is largely untested.

- Four target areas have yielded drill intersections of > 0.3% nickel including:

- Sothman: 2.31% nickel and 0.19% copper over true width of 3.2 metres within 1.58% nickel and 0.12% copper over true width of 8.6 metres from 41 metres;

- Deloro: 0.38% nickel and 0.22 g/t PGM over core length of 15.5 metres within 0.28% nickel and 0.09 g/t PGM over core length of 299 metres from 241 metres;

- Midlothian: 0.24% nickel over core length of 345 metres, including 0.30% nickel over 42 metres;

- Mann Southeast: multiple 3 metre intervals grading 0.31-0.33% nickel within 111 metres of dunite across entire core length

Sothman

Canada Nickel has entered into an agreement with Glencore Canada Corporation (Glencore) to acquire 50 mining leases that are in Sothman, Kemp and Mond Townships, 45 of which have associated Mining and Surface rights and five of which have Mining Rights only. Glencore will also hold a contingent right to receive a bonus payment in the amount of $10,000,000 (paid in cash or shares, at the Company’s election) in the event the Company discloses a mineral resource pursuant to National Instrument 43-101 of 10,000 tonnes or more of nickel or nickel equivalent. Glencore will also retain offtake rights to purchase the ore, concentrate or other mineral products produced from the property at market pricing. Canada Nickel staked an additional nine mining claims adjacent to the mining leases.

Sothman is a property of approximately 1,000 ha located 70 km south of Timmins. The Property contains an ultramafic sill comprised mainly of dunite (see Figure 2) that is estimated to be up to 200-300 metres thick, 2.2 km long and open at depth. An unclassified historical resource estimate reported as 189,753 tons grading 1.24% nickel (the Sothman West Zone)3 is centred 500 metres west of the sill (the 2.2 km dunite sill is largely untested).

The Sothman West Zone occurs at the north ultramafic contact within a footwall embayment approximately 300 metres wide and open at depth. The best historical intersection was hole DG50-S04 with 1.58% nickel over 12.2 metres (8.6 metres estimated true width) from 41.2 metres downhole including 4.6 metres (3.2 metres estimated true width) of 2.31% nickel and 0.19% copper. A sample of historical drill results is shown in Table 1a and 1b. Two drillholes intersected a deeper pod of similar sulphide mineralization (3.4 metres of 1.32% nickel from 398 metres in SM71-1 and 5.5 metres of 0.49% nickel from 353.2 metres in SM71-2) outside of the resource during the last drill program in 1971.

The Sothman Main Zone has seen very limited exploration but is known to contain dunite and peridotite and is similar in size to the East Zone at Crawford. For example, drill hole SM67-B25, SM67-B26 and SM67-B27 all intersected peridotite below overburden intersecting 54.56 metres of peridotite from 36.6 metres, 112.47 metres of peridotite from 7.6 metres, and 109.43 metres of peridotite from 12.19 metres respectively. All three holes ended in peridotite. Drill hole SM67-B28 was collared in peridotite (intersecting 46.02 metres of ultramafics from 15.24 metres) and crossed the south contact into volcanics at 61.26 metres, completing the only geologic section across the Sothman Main Zone.

Drill hole DG53-S41A is the only hole drilled in the eastern area of the Sothman Main Zone and intersected 60.1 metres of peridotite from 23.8 metres downhole, ending in peridotite. The south contact of the Sothman Main Zone has been intersected in three drill holes (DG51-S09, DG51-S12 and SM67-B28) with all holes starting in peridotite and ending in volcanics.

Table 1a – Historical Drilling – Sothman West Zone – Significant Intersections

| Hole ID | From (m) | To (m) | Length (m) | Estimated True Width (m) |

Ni % | Cu % |

| SM56-K11 | 93.2 | 102.4 | 9.2 | 4.6 | 1.58 | 0.17 |

| including | 93.2 | 97.5 | 4.3 | 2.2 | 2.58 | 0.34 |

| SM67-B06 | 28.7 | 40.5 | 11.8 | 8.4 | 1.57 | 0.11 |

| including | 28.7 | 33.8 | 5.1 | 3.6 | 2.28 | 0.16 |

| DG50-S04 | 41.2 | 53.3 | 12.2 | 8.6 | 1.58 | 0.12 |

| including | 41.2 | 45.7 | 4.6 | 3.2 | 2.31 | 0.19 |

| DG51-S20 | 89.9 | 95.8 | 5.9 | 4.0 | 1.56 | 0.13 |

| DG50-S05 | 19.8 | 21.0 | 1.2 | 0.9 | 7.51 | 0.62 |

| SM71-1 | 398.1 | 409.0 | 11.0 | 4.1 | 0.66 | 0.04 |

| ___________________________ |

| 3 See Statement Regarding Historical Resource Estimates on page 27 of this press release. |

Table 1a – Historical Drilling – Sothman West Zone – Significant Intersections (continued)

| Hole ID | From (m) | To (m) | Length (m) | Estimated True Width (m) |

Ni % | Cu % |

| including | 398.1 | 401.4 | 3.4 | 1.2 | 1.32 | 0.05 |

| SM71-2 | 353.3 | 358.8 | 5.5 | 2.5 | 0.49 | 0.03 |

Table 1b – Historical Drilling – Sothman Property – Selected Lithologies

| Hole ID | From (m) | To (m)* | Rock Type |

| DG-50-S04 | 32.4 | 107.9 | Ultramafics – Peridotite |

| DG-50-S05 | 22.9 | 82.0 | Ultramafics – Peridotite |

| DG-51-S09 | 7.3 | 217.0 | Ultramafics – Peridotite |

| DG-51-S12 | 7.0 | 111.4 | Ultramafics – Peridotite |

| DG-51-S12 | 111.4 | 114.1 | Ultramafics – Gabbro |

| DG-51-S12 | 114.1 | 118.3 | Ultramafics – Peridotite |

| DG-51-S12 | 118.3 | 142.8 | Ultramafics – Gabbro |

| DG-51-S20 | 19.8 | 96.9 | Ultramafics – Peridotite |

| DG-53-S41A | 23.8 | 83.8 | Ultramafics – Peridotite |

| SM-56-K11 | 85.7 | 148.4 | Ultramafics – Peridotite |

| SM-67-B06 | 25.5 | 101.8 | Ultramafics – Peridotite |

| SM-67-B25 | 36.6 | 91.1 | Ultramafics – Peridotite |

| SM-67-B26 | 7.6 | 120.1 | Ultramafics – Peridotite |

| SM-67-B27 | 12.2 | 121.6 | Ultramafics – Peridotite |

| SM-67-B28 | 15.2 | 47.7 | Ultramafics – Peridotite |

| SM-71-01 | 394.0 | 426.7 | Ultramafics – Peridotite |

| SM-71-02 | 351.1 | 366.7 | Ultramafics – Peridotite |

| * Denotes ended in mineralization |

December 1st, 2022 Update

Five drill holes were drilled on the eastern half of the target anomaly (SOT22-01 to SOT22-05). These holes succeeded in confirming the continuation of ultramafic lithologies, primarily peridotite, with moderate to strong serpentinization and variable amounts of mineralization throughout. Assays from all holes are pending.

Deloro Nickel Property

The Deloro Project consists of mining claims and patents acquired from two vendors in separate Purchase Agreements. In the first Purchase Agreement a 100% ownership was acquired to 35 mining claims and 30 mining patents. The mining claims are subject to a 2.00% NSR while the patents are subject to various NSRs, ranging from 2.00-5.50%. In the second Purchase Agreement, Canada Nickel acquired a 100% ownership in four contiguous mining patents. The vendor will retain a 3.00% NSR on any gold resource outlined.

Deloro is a property of approximately 1,800 ha located 10 km southeast of Timmins. It contains an ultramafic unit 1.4 km in length and up to 450 metres wide, striking south-southeast identified by the high magnetic intensity anomaly and historical drilling (see Figure 2). Six holes (FY-02-02, FY-02-06, FY-02-10, FY-02-11, FY-02-12, FY-02-13) were drilled inside and on the edge of the anomaly. Five of six holes intersected serpentinized dunite/peridotite with a core length of 24.2 metres in hole FY-02-10 up to 138.4 metres in hole FY-02-13, with four of five holes ending in serpentinized dunite/peridotite.

All five holes noted presence of magnetite (up to 20-25% magnetite in interval 39.4-89.5 metres from hole FY-02-02) and disseminated sulphides. Only specific non-consecutive intervals were assayed. Two of the four holes had nickel mineralization exceeding 0.40% nickel: FY02-02 with 0.42% nickel over a core length of 4.2 metres, with up to 0.73 g/t Pd and 0.23 g/t Pt over 1.2 metres, and FY-02-10 with 0.48% nickel, 0.28 g/t Pd, and 0.14 g/t Pt over 2.8 metres. See Table 2a and 2b below.

Table 2a – Historical Drilling – Deloro Property – Significant Intersections*

| Hole ID | From (m) | To (m) | Length (m) | Ni % | Cu % | Pd g/t | Pt g/t |

| FY-02-02 | 241.0 | 314.5 | 73.5 | 0.28 | 0.03 | 0.06 | 0.03 |

| Including | 299.0 | 314.5 | 15.5 | 0.38 | 0.06 | 0.15 | 0.07 |

| FY-02-02 | 324.2 | 345.0 | 20.8 | 0.24 | 0.03 | 0.03 | 0.01 |

| including | 342.8 | 343.1 | 0.4 | 0.74 | 0.23 | 0.16 | 0.17 |

| FY-02-10 | 54.7 | 59.7 | 5.0 | 0.27 | 0.03 | 0.01 | 0.00 |

| FY-02-10 | 95.8 | 98.6 | 2.8 | 0.48 | 0.03 | 0.28 | 0.14 |

| FY-02-13 | 122.8 | 152.9 | 30.1 | 0.25 | 0.01 | 0.02 | 0.01 |

| FY-02-13 | 177.5 | 200.5 | 23.0 | 0.24 | <0.01 | 0.00 | 0.00 |

| FY-02-13 | 298.0 | 318.0 | 20.0 | 0.26 | <0.01 | 0.00 | 0.00 |

| * Insufficient drilling completed to determine dip and true width of orebody |

Table 2b – Historical Drilling – Deloro Property – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| FY-02-01 | 4.0 | 11.0 | 7.0 | Peridotite |

| FY-02-01 | 11.0 | 14.1 | 3.1 | Serpentinite |

| FY-02-01 | 14.8 | 18.2 | 3.4 | Serpentinite |

| FY-02-01 | 18.2 | 29.9 | 11.7 | Peridotite |

| FY-02-01 | 29.9 | 31.3 | 1.4 | Peridotite |

| FY-02-01 | 31.3 | 34.8 | 3.5 | Peridotite |

| FY-02-01 | 36.5 | 98.5 | 62.0 | Peridotite |

| FY-02-01 | 98.5 | 102.0 | 3.5 | Serpentinite |

| FY-02-02 | 5.8 | 21.3 | 15.5 | Peridotite/Dunite |

| FY-02-02 | 23.1 | 33.7 | 10.6 | Peridotite/Dunite |

| FY-02-02 | 33.7 | 34.7 | 1.0 | Serpentinite |

| FY-02-02 | 39.4 | 89.5 | 50.1 | Peridotite/Dunite |

| FY-02-02 | 89.5 | 90.4 | 0.8 | Pyroxenite |

| FY-02-02 | 92.1 | 117.1 | 25.0 | Peridotite/Dunite |

| FY-02-02 | 117.1 | 120.7 | 3.6 | Serpentinite |

| FY-02-02 | 132.5 | 134.4 | 1.9 | Peridotite |

| FY-02-02 | 135.4 | 136.8 | 1.4 | Pyroxenite |

| FY-02-02 | 137.1 | 138.6 | 1.5 | Serpentinite |

| FY-02-02 | 138.6 | 149.8 | 11.2 | Peridotite/Dunite |

| FY-02-02 | 151.7 | 206.1 | 54.4 | Peridotite/Dunite |

| FY-02-02 | 210.6 | 217.9 | 7.2 | Serpentinite |

| FY-02-02 | 219.3 | 314.7 | 95.4 | Peridotite |

| FY-02-02 | 316.7 | 319.0 | 2.3 | Pyroxenite |

| FY-02-02 | 319.0 | 319.7 | 0.7 | Peridotite |

| FY-02-02 | 319.7 | 321.2 | 1.5 | Peridotite/Dunite |

| FY-02-02 | 321.2 | 324.2 | 3.0 | Peridotite |

| FY-02-02 | 324.2 | 324.8 | 0.6 | Peridotite |

| FY-02-02 | 324.8 | 325.8 | 1.0 | Peridotite |

| FY-02-02 | 325.8 | 332.2 | 6.4 | Peridotite |

| FY-02-02 | 332.2 | 333.5 | 1.3 | Serpentinite |

| FY-02-02 | 333.5 | 339.7 | 6.2 | Peridotite |

| FY-02-02 | 339.7 | 365.7 | 26.0 | Serpentinite |

| FY-02-02 | 373.5 | 381.1 | 7.7 | Serpentinite |

| FY-02-06 | 25.0 | 110.3 | 85.3 | Serpentinite |

| FY-02-06 | 110.9 | 208.9 | 98.0 | Serpentinite |

Table 2b – Historical Drilling – Deloro Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| FY-02-06 | 211.2 | 301.0 | 89.8 | Serpentinite |

| FY-02-10 | 31.7 | 50.0 | 18.3 | Pyroxenite |

| FY-02-10 | 54.7 | 59.7 | 5.0 | Pyroxenite |

| FY-02-10 | 69.9 | 73.8 | 3.8 | Peridotite |

| FY-02-10 | 75.5 | 97.6 | 22.1 | Pyroxenite/Peridotite |

| FY-02-10 | 97.6 | 113.5 | 15.9 | Peridotite/Dunite |

| FY-02-10 | 113.5 | 121.9 | 8.4 | Peridotite |

| FY-02-10 | 121.9 | 123.5 | 1.7 | Serpentinite |

| FY-02-10 | 123.9 | 124.6 | 0.7 | Serpentinite |

| FY-02-10 | 124.8 | 130.7 | 5.9 | Peridotite |

| FY-02-10 | 130.7 | 135.0 | 4.3 | Peridotite |

| FY-02-12 | 52.4 | 58.6 | 6.2 | Pyroxenite |

| FY-02-12 | 58.6 | 64.7 | 6.1 | Serpentinite |

| FY-02-12 | 75.3 | 79.1 | 3.8 | Serpentinite |

| FY-02-12 | 80.0 | 80.3 | 0.3 | Serpentinite |

| FY-02-12 | 80.3 | 82.3 | 2.0 | Serpentinite |

| FY-02-12 | 85.6 | 86.2 | 0.6 | Serpentinite |

| FY-02-12 | 86.2 | 97.3 | 11.1 | Peridotite |

| FY-02-12 | 97.3 | 113.5 | 16.2 | Pyroxenite |

| FY-02-12 | 113.5 | 118.2 | 4.7 | Peridotite |

| FY-02-12 | 119.4 | 122.0 | 2.5 | Peridotite |

| FY-02-12 | 122.0 | 133.3 | 11.3 | Peridotite/Dunite |

| FY-02-12 | 133.3 | 146.4 | 13.2 | Dunite |

| FY-02-12 | 146.6 | 272.0 | 125.4 | Dunite |

| FY-02-13 | 114.3 | 156.0 | 41.6 | Peridotite |

| FY-02-13 | 166.1 | 168.1 | 2.0 | Peridotite |

| FY-02-13 | 168.1 | 171.9 | 3.8 | Peridotite |

| FY-02-13 | 171.9 | 177.5 | 5.6 | Dunite |

| FY-02-13 | 177.5 | 179.6 | 2.1 | Peridotite |

| FY-02-13 | 179.6 | 318.0 | 138.4 | Dunite |

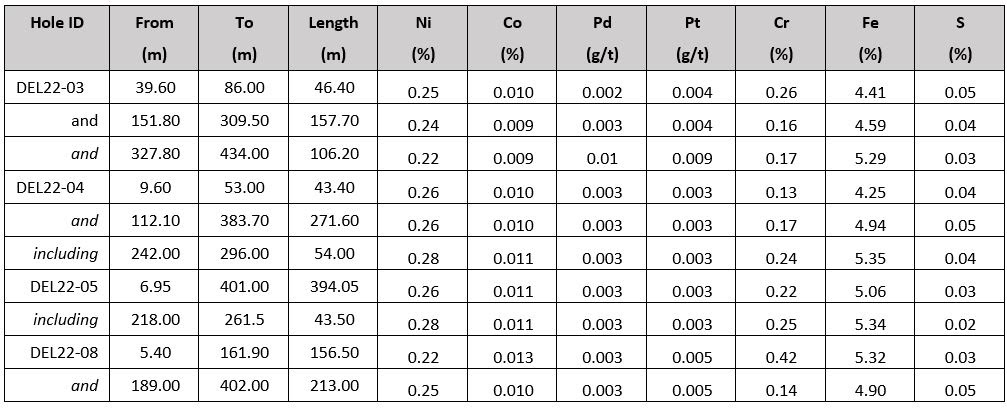

Combined August 17th & September 28th, 2022 update for Deloro Nickel Property

Exploration drilling was performed at Deloro in 2022 as part of Canada Nickel’s campaign to drill test several of the newly acquired targets and Deloro didn’t disappoint!

Highlights

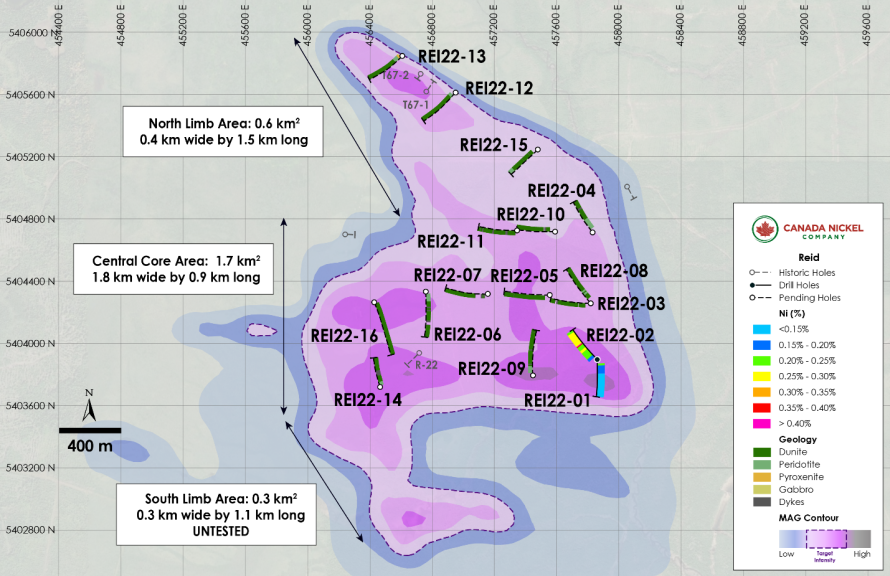

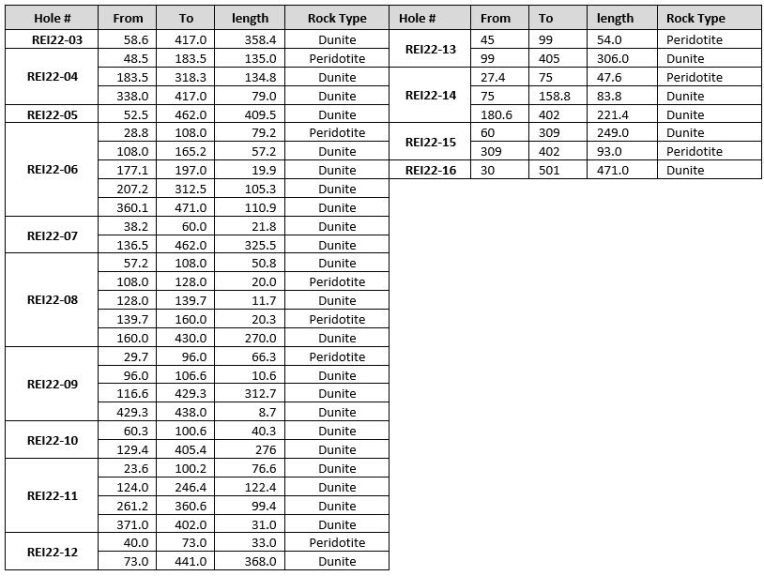

- Second significant discovery from newly acquired regional properties (Reid & Deloro)

- Assay results at Deloro confirmed expected grades over entire core length of 487 metres of 0.25% nickel including 91 metres of 0.28% nickel.

- Mineralization successfully defined over 1.1 kilometres of strike length by 100 – 400 metres wide to a depth of 420 metres.

Drilling was highlighted by hole DEL22-01 which intersected 487 metres of 0.25% nickel with a higher-grade section near the bottom of the hole intersecting 0.28% nickel over 91 metres and hole DEL 22-09 which intersected 393 metres of 0.26% nickel. Complete assays from 5 of the 11 holes are noted below

Hole DEL22-01 collared in dunite on the northern half of the target and was drilled to the southwest. The hole remained largely in dunite for a total length of 487 metres grading 0.25% nickel, with a higher-grade section near the bottom of the hole intersecting 0.28% nickel over 91 metres.

Hole DEL22-02 drilled at the most northern edge of the target, intersected a sequence of pyroxenite, peridotite and dunite rocks with varying degrees of alteration and mineralization.

Hole DEL22-03 collared in dunite on the northern half of the target and was drilled to the southwest. The hole remained and finished in dunite except for a section of pyroxenite in the center. The dunite sections grading up to 0.24% Ni over 157.7 metres, and 0.22% Ni over 106.2 metres with visible pentlandite-heazlewoodite mineralization.

DEL22-04 collared in dunite near the center of the target and drilled to the northeast. The dunite is mineralized throughout, interrupted only by a few minor dykes. Dunite graded 0.26% Ni over 43 metres, and 0.26% Ni over 271 metres. The hole reached the east contact intersecting Peridotite and Mafic volcanics.

DEL22-05 collared in dunite and was drilled to the northeast. The hole intersected 394 metres of 0.26% Ni and finished in dunite, only interrupted by minor dykes. Showing moderate to strong serpentinization and visible pentlandite-heazlewoodite mineralization with minor awaruite.

DEL22-06 collared in peridotite and transitioned in composition from dunite to peridotite and intersected a total of 227 metres of mineralization – 74 metres grading 0.20% nickel starting at 54 metres and 141 metres grading 0.21% nickel starting at 140 metres including a 12-metre core length of 0.33% nickel and 0.15 g/t Pt+Pd from 248 to 260 metres. This higher-grade Pt+Pd in dunite has similar characteristics to the high-grade core in Crawford’s East Zone.

DEL22-07 collared in dunite, on section with DEL22-01, 100 metres to the west. DEL22-10 collared in dunite and remained in dunite for the majority of the hole except for minor pyroxenite and mafic dykes. The hole intersected 79 metres of 0.25% nickel 124 metres downhole, and 87 metres of 0.25% nickel at 235 metres, before intersecting intermediate volcanics at the contact.

DEL22-08 collared in dunite and was drilled to the southwest. Dunite graded 0.22 % Ni over 156.5 metres at the top of the hole, and 0.25% Ni over 213 metres near the bottom and ended in dunite.

DEL22-09 collared in dunite and the hole intersected 393 metres of 0.26% nickel, including 51 metres of 0.28% nickel. The hole finished in peridotite.

Deloro Exploration Drilling Results.

| Hole ID | From | To | Length | Ni | Co | Pd | Pt | Cr | Fe | S |

| (m) | (m) | (m) | ( %) | ( %) | (g/t) | (g/t) | ( %) | ( %) | ( %) | |

| DEL22-01 | 1.8 | 487.0 | 485.2 | 0.25 | 0.010 | 0.003 | 0.003 | 0.22 | 5.03 | 0.03 |

| including | 234.0 | 365.9 | 131.9 | 0.27 | 0.011 | 0.003 | 0.003 | 0.24 | 5.27 | 0.03 |

| including | 373.5 | 464.9 | 91.4 | 0.28 | 0.011 | 0.003 | 0.003 | 0.37 | 5.20 | 0.03 |

| DEL22-06 | 54.5 | 128.2 | 73.7 | 0.20 | 0.011 | 0.003 | 0.006 | 0.49 | 5.82 | 0.04 |

| and | 140.5 | 281.9 | 141.4 | 0.21 | 0.012 | 0.028 | 0.023 | 0.50 | 6.59 | 0.10 |

| including | 227.5 | 260.0 | 32.5 | 0.27 | 0.012 | 0.049 | 0.034 | 0.57 | 6.55 | 0.14 |

Deloro Exploration Drilling Results (continued).

| Hole ID | From | To | Length | Ni | Co | Pd | Pt | Cr | Fe | S |

| (m) | (m) | (m) | ( %) | ( %) | (g/t) | (g/t) | ( %) | ( %) | ( %) | |

| including | 248.3 | 260.0 | 11.7 | 0.33 | 0.014 | 0.103 | 0.055 | 0.69 | 7.50 | 0.20 |

| DEL22-07 | 3.1 | 113.0 | 109.9 | 0.19 | 0.011 | 0.021 | 0.015 | 0.39 | 6.32 | 0.02 |

| and | 128.2 | 216.4 | 88.2 | 0.17 | 0.011 | 0.018 | 0.016 | 0.39 | 6.72 | 0.04 |

| including | 129.5 | 159.5 | 30.0 | 0.24 | 0.013 | 0.039 | 0.028 | 0.46 | 7.20 | 0.09 |

| DEL22-09 | 9.0 | 402.0 | 393.0 | 0.26 | 0.010 | 0.003 | 0.006 | 0.25 | 4.66 | 0.04 |

| including | 58.5 | 99.0 | 40.5 | 0.28 | 0.010 | 0.003 | 0.005 | 0.45 | 4.51 | 0.01 |

| including | 218.5 | 269.5 | 51.0 | 0.28 | 0.011 | 0.003 | 0.005 | 0.14 | 4.71 | 0.10 |

| DEL22-10 | 3.0 | 87.0 | 84.0 | 0.23 | 0.010 | 0.003 | 0.005 | 0.22 | 5.63 | 0.09 |

| and | 123.5 | 203.0 | 79.5 | 0.25 | 0.010 | 0.003 | 0.005 | 0.16 | 4.92 | 0.10 |

| and | 235.3 | 322.7 | 87.4 | 0.25 | 0.010 | 0.003 | 0.005 | 0.23 | 5.09 | 0.13 |

| *Note: The lengths reported are core lengths and not true widths. Canada Nickel has insufficient information to determine the attitude, either of the ultramafic body or of mineralized zones within it. |

Deloro Exploration Drilling Results (continued). (September 2022)

Mann

The Mann Property was acquired from Noble Mineral Exploration (“Noble”) in an Option Agreement with work commitments, cash payments, share issuances, NSRs, and buy-back provisions. The Company has acquired the right to earn an 80% interest in the Mann Property from Noble. Work commitments are $1.7 million over the Option Term with an initial $500,000 required in the first year. Noble will retain a 2.00% NSR (due to various vendors) with a 1.00% buy-back provision to Canada Nickel for $1.0 million plus 50% of the buy-back provisions that total $4.5 million ($2.25 million to CNC). Once Canada Nickel earns its 80% interest it will form a joint-venture with Noble to continue exploring the Property on an 80%-20% basis. An acceleration provision exists to allow the Company to reach its 80% interest earlier than the Option Period.

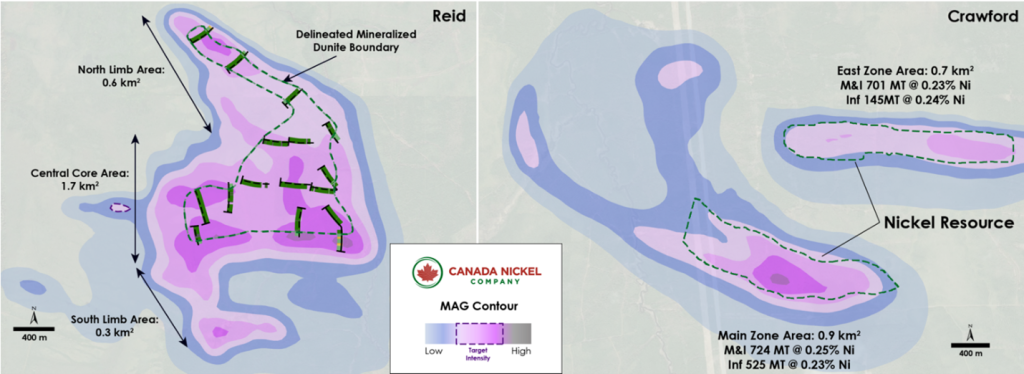

Mann is located 25 km east of Crawford and totals 7,800 ha. The ultramafic is estimated to be a combined 21 km in length with variable thickness and having at least three main dunitic cores like that at Crawford (Mann Central, Mann Northwest, and Mann Southeast). The Company has acquired the right to earn an 80% interest in the Mann Property from Noble by an initial payment of $100,000 in cash and 150,000 shares and paying a further $100,000 per year over the four-year Option Period (for a total cash payment of $400,000) and issuing a further 250,000 common shares, and incurring total exploration expenditures of $1.7 million, over the Option Period. Noble will retain a 2.00% Net Smelter Return (“NSR”) with a 1.00% buy-back to Canada Nickel for $1.0 million plus 50% of the buy-back provisions that total $4.5 million ($2.25 million to CNC).

Mann Central

The Mann Central Property area covers a single 4 km long by up to 1 km wide ultramafic intrusion (see Figure 3) that is evident in TMI geophysical surveys. Historical drilling has already delineated ultramafic mineralization over a strike length of 2,700 metres and 690 metres wide. Only one historical hole had assays – Falconbridge Ltd. intersected 79 metres (MAN43-03) of ultramafic which was intermittently sampled – with the highest reported assay of 0.29% nickel over ~1 metre (See Table 3a below). Historical drilling began in 1951 with seven of eight holes intersecting serpentinized peridotite containing magnetite. The longest intersection occurred in hole M-1, with 212 metres of well serpentinized peridotite along its entire core length. A 1976 drilling campaign reported wide intercepts of serpentinized ultramafic intrusive with visible sulphides and pervasive magnetite. Hole MA5-2-76 was the longest at 114 metres of serpentinized ultramafics along its entire core length (see Table 3a below).

Table 3a – Historical Drilling – Mann Central Property – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| INCO-1 | 5.2 | 162.5 | 157.3 | Peridotite |

| M-1 | 1.5 | 213.7 | 212.1 | Peridotite |

| M-2 | 7.3 | 214.9 | 207.6 | Peridotite |

| M-3 | 7.6 | 14.9 | 7.3 | Peridotite |

| M-3 | 18.0 | 96.3 | 78.3 | Peridotite |

| M-3 | 96.3 | 141.7 | 45.4 | Pyroxenite |

| M-3 | 141.7 | 155.1 | 13.4 | Peridotite |

| M-3 | 165.8 | 172.8 | 7.0 | Pyroxenite |

| M-4 | 11.3 | 50.0 | 38.7 | Dunite |

| M-4 | 50.0 | 54.6 | 4.6 | Pyroxenite |

| M-4 | 54.6 | 88.4 | 33.8 | Dunite |

| M-4 | 88.4 | 191.4 | 103.0 | Peridotite |

| M-4 | 191.4 | 196.0 | 4.6 | Pyroxenite |

| M-5 | 10.1 | 41.1 | 31.1 | Pyroxenite |

| M-5 | 41.1 | 153.3 | 112.2 | Peridotite |

| M-5 | 161.5 | 172.5 | 11.0 | Pyroxenite |

| M-6 | 7.9 | 114.9 | 107.0 | Peridotite |

| M-6 | 123.1 | 128.0 | 4.9 | Pyroxenite |

| M-7 | 11.3 | 107.3 | 96.0 | Peridotite |

| M-7 | 113.4 | 127.1 | 13.7 | Peridotite |

| M-7 | 129.2 | 172.8 | 43.6 | Peridotite |

| 1A | 0.9 | 7.0 | 6.1 | Peridotite |

| 1A | 51.5 | 54.6 | 3.1 | Peridotite |

| 2A | 2.4 | 8.7 | 6.3 | Peridotite |

| 2A | 22.0 | 52.1 | 30.2 | Peridotite |

| 2A | 83.8 | 111.3 | 27.4 | Peridotite |

| 3A | 1.2 | 57.3 | 56.1 | Peridotite |

Table 3a – Historical Drilling – Mann Central Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| 3A | 61.3 | 80.5 | 19.2 | Peridotite |

| 4A | 0.6 | 10.4 | 9.8 | Peridotite |

| 4A | 11.0 | 37.5 | 26.5 | Peridotite |

| MA4-2-76 | 84.4 | 90.8 | 6.5 | Gabbro |

| MA4-2-76 | 90.8 | 121.9 | 31.1 | Pyroxenite |

| MA4-2-76 | 121.9 | 123.1 | 1.2 | Peridotite |

| MA5-1-76 | 102.4 | 108.8 | 6.4 | Gabbro |

| MA5-1-76 | 108.8 | 138.1 | 29.3 | Peridotite |

| MA5-2-76 | 8.7 | 123.1 | 114.4 | Ultramafic |

| MN87-3 | 32.3 | 200.0 | 167.7 | Ultramafic |

| MAN43-01 | 9.0 | 188.0 | 179.0 | Ultramafic |

| MAN43-03 | 78.6 | 158.0 | 79.4 | Ultramafic |

Table 3b – Historical Drilling – Mann Central Property – Significant Intersections

| Hole ID | From (m) | To (m) | Length (m) | Ni % |

| MAN43-03 | 89.1 | 90.3 | 1.2 | 0.29 |

| MAN43-03 | 95.1 | 95.5 | 0.4 | 0.15 |

| MAN43-03 | 107.2 | 107.6 | 0.4 | 0.16 |

| MAN43-03 | 116.0 | 116.5 | 0.5 | 0.19 |

| MAN43-03 | 122.0 | 122.4 | 0.4 | 0.21 |

| MAN43-03 | 131.0 | 131.6 | 0.6 | 0.23 |

| MAN43-03 | 142.7 | 143.0 | 0.3 | 0.21 |

| MAN43-03 | 149.0 | 149.5 | 0.5 | 0.22 |

Mann Northwest

The Mann Northwest Property covers an ultramafic intrusion having dimensions of 3.5 km long by 600-800 metres wide (see Figure 4). The intrusion is described as mostly peridotite, commonly serpentinized, with overlying leuco-gabbro and pyroxenite.

First Point Minerals Corp. conducted a three-hole drill program (468 metres) in 2002 targeting PGMs in pyroxenites that overlie the ultramafic units. While the first hole (FHR-01-01) targeted the contact between the volcanics and the ultramafic rocks, the second hole (FHR02-02) intersected serpentinized peridotite containing magnetite and some sulphide stringers in fractures. Nickel assays were taken at selected intervals and ranged from a low of 0.10% nickel to a high of 0.31% nickel with average values >0.20% nickel (see table 4a).

Drilling conducted by Tres-Or Resources Ltd., did not report nickel assays but did intersect wide sections of serpentinized peridotite with magnetite and/or sulphide minerals (e.g., MAN-87-1) as observed in 22 drill holes (see Table 4b), as well as elevated PGM values (e.g., 0.57-0.59 g/t PGM) from several channel samples. Geological descriptions and geochemistry from these programs resemble what is observed at Canada Nickel’s Crawford property.

Table 4a – Historical Drilling – Mann Northwest Property – Significant Intersections

| Hole ID | From (m) | To (m) | Length (m) | Ni % | S % | Cr % | Co % | Pd (g/t) | Pt (g/t) |

| FHR01-02 | 25.3 | 29.0 | 3.7 | 0.22 | 0.06 | 0.20 | 0.01 | 0.001 | – |

| FHR01-02 | 73.0 | 76.0 | 3.0 | 0.21 | 0.07 | 0.11 | 0.01 | – | – |

| FHR01-02 | 86.0 | 89.0 | 3.0 | 0.23 | 0.06 | 0.08 | 0.01 | 0.002 | – |

| FHR01-02 | 89.0 | 92.3 | 3.3 | 0.24 | 0.05 | 0.07 | 0.01 | 0.002 | – |

| FHR01-02 | 92.6 | 95.0 | 2.4 | 0.23 | 0.05 | 0.06 | 0.01 | 0.003 | – |

| FHR01-02 | 98.0 | 101.0 | 3.0 | 0.24 | 0.05 | 0.06 | 0.01 | 0.002 | 0.007 |

| FHR01-02 | 101.0 | 104.0 | 3.0 | 0.23 | 0.05 | 0.08 | 0.01 | 0.001 | – |

| FHR01-02 | 131.0 | 134.0 | 3.0 | 0.25 | 0.04 | 0.08 | 0.01 | 0.002 | 0.007 |

| FHR02-02 | 33.5 | 35.0 | 1.5 | 0.22 | 0.07 | 0.23 | 0.01 | 0.063 | 0.048 |

| FHR02-02 | 75.4 | 76.4 | 1.0 | 0.21 | 0.10 | 0.14 | 0.01 | 0.003 | – |

| FHR02-02 | 113.0 | 114.3 | 1.3 | 0.31 | 0.17 | 0.10 | 0.02 | 0.021 | 0.013 |

| FHR02-02 | 117.0 | 118.6 | 1.6 | 0.21 | 0.09 | 0.08 | 0.01 | 0.002 | – |

| FHR02-02 | 121.7 | 122.3 | 0.6 | 0.29 | 0.12 | 0.15 | 0.01 | 0.038 | 0.017 |

| FHR02-02 | 134.7 | 135.4 | 0.7 | 0.28 | 0.19 | 0.19 | 0.01 | 0.044 | 0.021 |

| FHR02-02 | 158.0 | 161.0 | 3.0 | 0.27 | 0.14 | 0.07 | 0.01 | 0.031 | 0.009 |

| FHR03-02 | 27.5 | 32.0 | 4.5 | 0.17 | 0.10 | 0.08 | 0.01 | 0.004 | 0.014 |

| FHR03-02 | 133.0 | 137.0 | 4.0 | 0.15 | 0.18 | 0.18 | 0.01 | 0.005 | – |

Table 4b – Historical Drilling – Mann Northwest Property – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| FHR01-02 | 25.3 | 63.5 | 38.2 | Peridotite |

| FHR01-02 | 63.5 | 87.5 | 24.0 | Peridotite |

| FHR01-02 | 87.5 | 92.3 | 4.8 | Peridotite |

| FHR01-02 | 92.6 | 111.8 | 19.2 | Peridotite |

Table 4b – Historical Drilling – Mann Northwest Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| FHR01-02 | 116.9 | 119.1 | 2.2 | Peridotite |

| FHR01-02 | 119.1 | 137.0 | 17.9 | Peridotite |

| FHR02-02 | 7.0 | 33.5 | 26.5 | Peridotite |

| FHR02-02 | 33.7 | 43.5 | 9.8 | Peridotite |

| FHR02-02 | 43.5 | 150.0 | 106.5 | Peridotite |

| FHR02-02 | 150.8 | 161.0 | 10.2 | Peridotite |

| FHR03-02 | 15.0 | 123.8 | 108.8 | Peridotite |

| MAN-73-6 | 12.2 | 112.3 | 100.1 | Peridotite |

| MAN-73-6 | 115.5 | 119.9 | 4.4 | Peridotite |

| MAN-73-6 | 119.9 | 128.0 | 8.1 | Pyroxenite |

| MAN-73-6 | 152.1 | 167.6 | 15.5 | Peridotite |

| MAN-00-01 | 5.2 | 100.3 | 95.1 | Peridotite |

| MAN-00-01 | 100.3 | 104.0 | 3.8 | Gabbro |

| MAN-00-01 | 104.0 | 106.5 | 2.4 | Peridotite |

| MAN-00-01 | 106.5 | 128.8 | 22.3 | Gabbro |

| MAN-00-01 | 128.8 | 200.3 | 71.5 | Peridotite |

| MAN-01 | 5.2 | 100.3 | 95.1 | Peridotite |

| MAN-01 | 100.3 | 104.0 | 3.8 | Gabbro |

| MAN-01 | 104.0 | 106.5 | 2.4 | Peridotite |

| MAN-01 | 106.5 | 128.8 | 22.3 | Gabbro |

| MAN-01 | 128.8 | 200.3 | 71.5 | Peridotite |

| M-01-1 | – | 192.0 | 192.0 | Peridotite |

| M-01-2 | – | 212.3 | 212.3 | Gabbro |

| M-01-2 | 212.3 | 237.1 | 24.8 | Carbonatized Zone |

| M-01-2 | 237.1 | 251.0 | 13.9 | Peridotite |

| M-01-3 | – | 150.0 | 150.0 | Peridotite |

| M-01-4 | – | 102.0 | 102.0 | Peridotite |

| M-01-5 | – | 40.2 | 40.2 | Peridotite |

| M-01-5 | 40.2 | 59.8 | 19.6 | Gabbro |

| M-01-5 | 59.8 | 73.6 | 13.8 | Pyroxenite |

| M-01-5 | 73.6 | 116.9 | 43.3 | Gabbro |

| M-01-5 | 116.9 | 150.0 | 33.1 | Peridotite |

| M-01-6 | – | 51.6 | 51.6 | Peridotite |

| M-01-6 | 51.6 | 70.2 | 18.6 | Gabbro |

| M-01-6 | 70.2 | 81.5 | 11.3 | Pyroxenite |

| M-01-6 | 81.5 | 107.9 | 26.4 | Gabbro |

| M-01-6 | 107.9 | 147.5 | 39.6 | Peridotite |

Table 4b – Historical Drilling – Mann Northwest Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| M-01-6 | 147.5 | 156.0 | 8.5 | Gabbro |

| MAN-87-1 | – | 9.7 | 9.7 | Gabbro |

| MAN-87-1 | 9.7 | 41.2 | 31.4 | Peridotite |

| MAN-87-2 | – | 11.6 | 11.6 | Gabbro |

| MAN-87-2 | 11.6 | 35.4 | 23.8 | Peridotite |

| MAN-88-1 | – | 61.6 | 61.7 | Peridotite |

| MAN-88-1 | 61.6 | 64.0 | 2.4 | Gabbro |

| MAN-88-2 | – | 61.0 | 61.0 | Peridotite |

| MAN-88-3 | – | 60.7 | 60.7 | Peridotite |

| MAN-91-1 | 1.8 | 79.6 | 77.7 | Gabbro |

| MAN-91-1 | 79.6 | 138.9 | 59.4 | Peridotite |

| MAN-91-1 | 138.9 | 155.5 | 16.6 | Gabbro |

| MAN-91-1 | 155.5 | 166.2 | 10.7 | Gabbro |

| MAN-91-1 | 166.2 | 181.9 | 15.7 | Pyroxenite |

| MAN-91-1 | 181.9 | 246.0 | 64.1 | Peridotite |

| MAN-96-1 | 1.5 | 42.1 | 40.5 | Gabbro |

| MAN-96-1 | 42.1 | 107.3 | 65.2 | Peridotite |

| MAN-96-1 | 107.3 | 115.2 | 7.9 | Pyroxenite |

| MAN-96-1 | 115.2 | 227.1 | 111.9 | Peridotite |

| MAN-96-1 | 227.1 | 248.7 | 21.6 | Pyroxenite |

| MAN-96-1 | 248.7 | 279.8 | 31.2 | Peridotite |

| MAN52-02 | 96.6 | 179.0 | 82.4 | Ultramafic |

| MAN07-01 | 6.4 | 37.8 | 31.4 | Peridotite |

| MAN07-01 | 37.8 | 47.7 | 9.9 | Gabbro |

| MAN07-01 | 47.7 | 53.5 | 5.8 | Pyroxenite |

| MAN07-01 | 53.5 | 76.7 | 23.2 | Gabbro |

| MAN07-01 | 76.7 | 102.0 | 25.3 | Peridotite |

| MAN07-02 | 14.2 | 30.0 | 15.8 | Pyroxenite |

| MAN07-02 | 30.0 | 110.0 | 80.1 | Gabbro |

| MAN07-02 | 110.0 | 129.0 | 19.0 | Peridotite |

| MAN07-03 | 40.5 | 41.9 | 1.4 | Gabbro |

| MAN07-03 | 41.9 | 61.7 | 19.8 | Peridotite |

| MAN07-03 | 61.7 | 82.0 | 20.3 | Pyroxenite |

| MAN07-03 | 82.0 | 107.3 | 25.3 | Peridotite |

| MAN07-04 | 9.0 | 21.5 | 12.5 | Peridotite |

| MAN07-04 | 21.5 | 22.3 | 0.8 | Pyroxenite |

| MAN07-04 | 22.3 | 76.8 | 54.5 | Gabbro |

Table 4b – Historical Drilling – Mann Northwest Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| MAN07-04 | 76.8 | 141.0 | 64.2 | Peridotite |

| MAN08-05 | 14.5 | 26.9 | 12.4 | Pyroxenite |

| MAN08-05 | 26.9 | 60.0 | 33.1 | Gabbro |

| MAN08-06 | 13.0 | 25.8 | 12.8 | Peridotite |

| MAN08-06 | 25.8 | 38.3 | 12.5 | Pyroxenite |

| MAN08-06 | 38.3 | 60.0 | 21.7 | Gabbro |

| MAN08-07 | 16.0 | 33.9 | 17.9 | Peridotite |

| MAN08-07 | 33.9 | 46.3 | 12.4 | Pyroxenite |

| MAN08-07 | 46.3 | 54.0 | 7.7 | Gabbro |

| MAN08-07 | 54.0 | 57.5 | 3.5 | Pyroxenite |

| MAN08-07 | 57.5 | 75.0 | 17.5 | Gabbro |

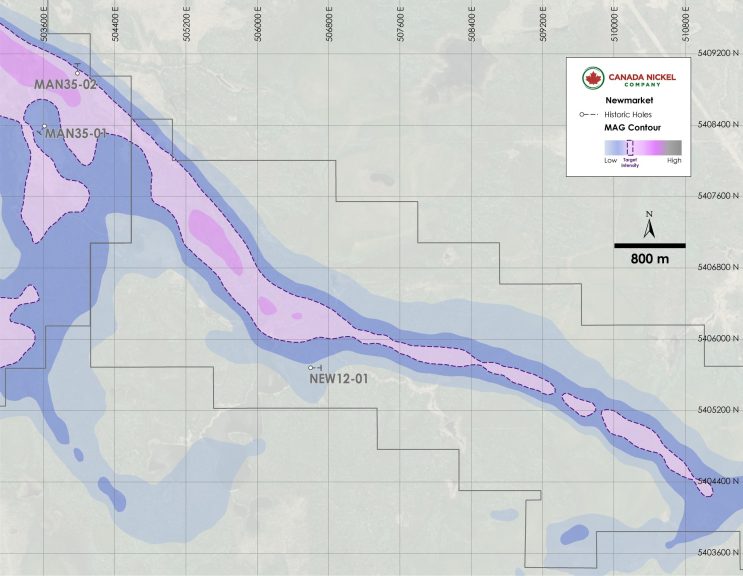

Mann Southeast

Mann Southeast is characterized by an arcuate-shaped ultramafic intrusion located in southeast Mann township with approximate dimensions of 6.2 km long and up to 800 metres wide (see Figure 5). Eight widely spaced holes drilled into the anomaly outlined 5 km of serpentinized dunite / peridotite across the anomaly (see Table 5c below).

In 1996, Falconbridge Ltd. drilled 111 metres of strongly serpentinized peridotite (MAN-35-01) with select assays grading: 0.31-0.33% nickel over 3 metre sampled intervals. See Table 5a.

A drill program conducted in 1973 around the southeast Mann ultramafic intersected wide intervals of serpentinized peridotite in five holes, with assays ranging up to 0.29% nickel (see Table 5b below). The southernmost and largest section of ultramafic – 1.2 km by 800 metres – remains untested with no historical drilling reported.

Table 5a – Historical Drilling – Mann Southeast Property – Significant Intersections

| Hole ID | From (m) | To (m) | Ni % |

| MAN-35-01 | 47.0 | 50.0 | 0.33 |

| MAN-35-01 | 71.0 | 74.0 | 0.32 |

| MAN-35-01 | 101.0 | 104.0 | 0.31 |

Table 5b – Historical Drilling – Mann Southeast Property – Significant Intersections

| Hole ID | From (m) | To (m) | Ni % |

| 73-1 | 41.1 | 42.7 | 0.25 |

| 73-1 | 73.2 | 74.8 | 0.23 |

| 73-1 | 86.7 | 88.4 | 0.22 |

| 73-1 | 103.6 | 105.2 | 0.24 |

| 73-1 | 120.4 | 121.9 | 0.23 |

| 73-1 | 137.2 | 138.7 | 0.22 |

| 73-1 | 153.9 | 155.4 | 0.25 |

| 73-3 | 41.1 | 42.7 | 0.25 |

| 73-3 | 56.4 | 57.9 | 0.28 |

| 73-3 | 73.2 | 74.7 | 0.18 |

| 73-3 | 88.4 | 89.9 | 0.16 |

| 73-3 | 103.6 | 105.2 | 0.20 |

| 73-3 | 120.4 | 121.9 | 0.25 |

| 73-3 | 136.2 | 137.8 | 0.29 |

| 73-3 | 150.9 | 152.1 | 0.29 |

| 73-4 | 69.2 | 70.7 | 0.28 |

| 73-4 | 86.0 | 87.5 | 0.23 |

| 73-4 | 103.6 | 105.2 | 0.23 |

| 73-4 | 120.4 | 121.9 | 0.23 |

| 73-4 | 137.5 | 139.0 | 0.29 |

| 73-6 | 61.6 | 63.1 | 0.27 |

| 73-6 | 76.2 | 77.7 | 0.23 |

| 73-6 | 94.5 | 96.0 | 0.23 |

| 73-6 | 99.1 | 100.6 | 0.22 |

| *Hole 73-2 had assays all below 0.15% |

Table 5c – Historical Drilling – Mann Southeast – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| 73-1 | 38.4 | 159.7 | 121.3 | Peridotite |

| 73-2 | 39.9 | 166.7 | 126.8 | Peridotite |

| 73-3 | 36.6 | 152.1 | 115.5 | Peridotite |

| 73-4 | 55.2 | 64.9 | 9.8 | Peridotite |

| 73-4 | 64.9 | 144.5 | 79.6 | Peridotite |

| 73-6 | 12.8 | 48.5 | 35.7 | Peridotite |

| 73-6 | 48.5 | 112.5 | 64.0 | Peridotite |

| MAN-35-01 | 38.0 | 149.0 | 111.0 | Dunite |

| MAN-45-01 | 99.0 | 155.0 | 56.0 | Peridotite |

| MAN-45-01 | 195.0 | 245.0 | 50.0 | Peridotite |

| MAN-45-02 | 95.0 | 211.0 | 116.0 | Peridotite |

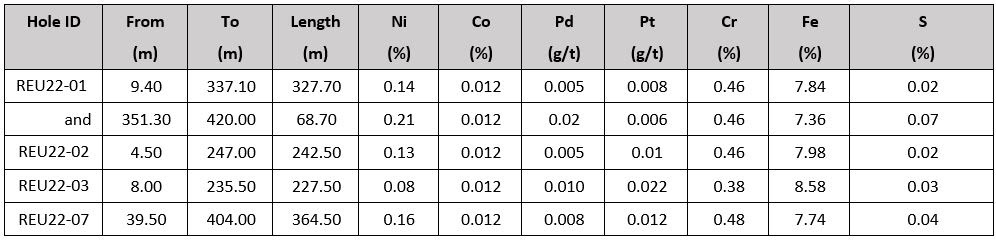

Reaume

The Reaume Property was acquired through a combination of Purchase and Option Agreements. In one Purchase Agreement Canada Nickel acquired a 100% right to 65 contiguous mining claims with a 2.00% NSR to the vendor and a 1.00% buy-back provision. In a second Option Agreement Canada Nickel has the option to earn a 100% interest in 48 mining claims through work expenditures (2,100 metres of diamond drilling) over a 12-month period. In a third Purchase Agreement Canada Nickel acquired a 100% interest in a group of 201 in-fill claims (surrounding the ultramafic units) with the vendor retaining a 2.00% NSR with a buy-back of 1.00%. In a fourth Purchase Agreement Canada Nickel acquired a small group of claims which have a 2.00% NSR with a 1.00% buy-back.

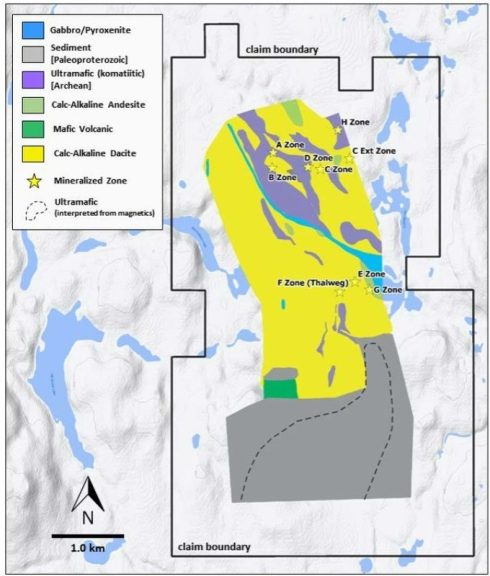

Reaume is a property approximately 5,800 ha located 54 km north-northeast of Timmins and contains a large ultramafic intrusion having an approximate outline of 3 km (east-west) by 1.8 km (north-south) as defined by its magnetic footprint and historical drilling (see Figure 6). Inco holes 28482 and 28483 returned peridotite/dunite mineralization across the entire core length. Hole 28483 intersected from surface approximately 264 metres of serpentinized peridotite/dunite containing magnetite with some disseminated sulphides. Hole 28482 intersected 108 metres of serpentinized peridotite/dunite with up to 20% magnetite and disseminated sulphides. Both drillholes ended in peridotite/dunite.

Seven drillholes by Falconbridge (1995) intersected thick sections of peridotite and dunite (up to 168 metres of dunite in Hole REA-45-07). These historic holes delineated a peridotite/dunite unit with an east-west extent of approximately 1,200 metres and a north-south extent of 900 metres.

Four of the Falconbridge holes ended in peridotite/dunite. Six of seven holes reported the widespread presence of magnetite as well as disseminated sulphides. No assays were reported; however, the TMI exceeds the peak levels at Crawford Main Zone near the centre of the intrusion and is strongly anomalous across the ultramafic.

Table 6 – Historical Drilling – Reaume Property – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| 28483 | 37.0 | 89.0 | 52.0 | Peridotite |

| 28483 | 89.0 | 147.0 | 58.0 | Peridotite |

| 28483 | 147.0 | 301.0 | 154.0 | Peridotite/Dunite |

| 28482 | 140.0 | 158.0 | 18.0 | Peridotite/Dunite |

| 28482 | 158.0 | 248.0 | 90.0 | Peridotite |

| REA-45-03 | 21.0 | 89.0 | 68.0 | Peridotite |

| REA-45-03 | 89.0 | 117.0 | 28.0 | Pyroxenite |

| REA-45-03 | 117.0 | 164.0 | 47.0 | Peridotite |

| REA-45-03 | 164.0 | 198.0 | 34.0 | Pyroxenite |

| REA-45-03 | 198.0 | 278.0 | 80.0 | Peridotite |

| REA-45-03 | 294.0 | 335.0 | 41.0 | Pyroxenite |

| REA-45-04 | 29.0 | 99.0 | 70.0 | Dunite |

Table 6 – Historical Drilling – Reaume Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| REA-45-04 | 101.1 | 156.5 | 55.4 | Dunite |

| REA-45-04 | 160.3 | 198.5 | 38.3 | Peridotite |

| REA-45-04 | 198.5 | 344.9 | 146.4 | Dunite |

| REA-45-05 | 30.0 | 123.8 | 93.8 | Dunite |

| REA-45-05 | 123.8 | 223.1 | 99.3 | Peridotite |

| REA-45-05 | 238.6 | 244.4 | 5.8 | Pyroxenite |

| REA-45-05 | 244.4 | 293.0 | 48.6 | Peridotite |

| REA-45-05 | 293.0 | 300.6 | 7.6 | Dunite |

| REA-45-05 | 300.6 | 308.0 | 7.4 | Peridotite |

| REA-45-06 | 21.7 | 320.0 | 298.3 | Peridotite |

| REA-45-07 | 45.2 | 131.1 | 85.9 | Peridotite |

| REA-45-07 | 131.1 | 299.0 | 167.9 | Dunite |

| REA-45-08 | 33.0 | 54.5 | 21.5 | Dunite |

| REA-45-08 | 54.5 | 64.4 | 9.9 | Pyroxenite |

| REA-46-01 | 15.0 | 28.4 | 13.4 | Dunite |

| REA-46-01 | 28.4 | 136.8 | 108.4 | Dunite |

| REA-46-01 | 136.8 | 259.5 | 122.7 | Peridotite |

| REA-46-01 | 259.5 | 310.0 | 50.5 | Pyroxenite |

| REA-46-01 | 310.0 | 337.9 | 27.9 | Peridotite |

| REA-46-01 | 350.3 | 388.5 | 38.2 | Pyroxenite |

| REA-46-01 | 388.5 | 419.4 | 30.9 | Peridotite |

Update from September 28th, 2022

Drilling this summer successfully confirmed the presence of ultramafic rocks, dominated by peridotite with nickel mineralization in 6 of 7 drillholes. The peridotite intersected was generally lower grade than the peridotites at Crawford. Minor pyroxenite and dunite were also intersected (Figure 6). The North half of the target remains untested, due to difficult access outside of winter. Assays are pending for 3 of the 7 holes.

Hole REU22-01, REU22-02 and REU22-03 drilled a fan of drillholes from the same setup, located near the southwest of the target. REU22-01 drilled to the south-southeast, collaring on peridotite at 9.4 metres and stayed in peridotite for 327.7 metres grading 0.14% Ni. After a small gabbro section, the hole intersected and finished in dunite with an average grade of 0.21% Ni over 68.7 metres (Table 3).

Hole REU22-02 drilled to the east, collaring, and finishing in peridotite averaging 0.13% Ni over 242.5 metres with the whole extent displaying moderate to strong serpentinization and minor pentlandite-heazlewoodite mineralization.