Companies

Solaris Resources’ (TSX:SLS) Lowell Mineral Exploration Earns Level 1 Carbon Footprint Badge from Ecuador’s Ministry of Environment

The mining industry, known for its energy-intensive operations, is increasingly focusing on reducing its greenhouse gas (GHG) emissions. This shift comes…

The mining industry, known for its energy-intensive operations, is increasingly focusing on reducing its greenhouse gas (GHG) emissions. This shift comes in response to mounting pressure from various stakeholders, including investors, customers, and regulators.

Several mining companies have already initiated significant steps toward emission reduction. For example, Lowell Mineral Exploration Ecuador S.A., a subsidiary of Solaris Resources (TSX:SLS) (OTQB:SLSSF)., has been awarded a Level 1 “Carbon Footprint Quantification Badge” by Ecuador’s Ministry of Environment, Water, and Ecological Transition (MAATE). The badge is part of the Ministry’s Zero Carbon Ecuador Program (PECC) and marks Lowell as the first mining company to join the initiative. José Dávalos, the Minister of Environment, Water, and Ecological Transition, noted the difficulty of accurately measuring a mining company’s carbon footprint and praised Lowell for setting an example of responsible mining in Ecuador. He encouraged other companies in various industries to adopt international environmental standards and go beyond what is legally required by Ecuadorian laws.

The PECC aims to help companies quantify, reduce, and neutralize their greenhouse gas (GHG) emissions through a transparent verification system. To earn the Carbon Footprint Quantification Badge, companies must measure and report their emissions, in line with specific guidelines. These guidelines include compliance with the NTE INEN-ISO 14064-1:2018-GHG PROTOCOL, Zero Carbon Ecuador Program PECC MAATE-2021-047 standards, and ISO standards.

Federico Velásquez, President of Solaris for Latin America, commented in a press release: “This milestone is the first step in the implementation of our carbon reduction strategy by quantifying our carbon footprint through an independent, verified entity in order to reduce our emissions and contribute to mitigating climate change. These concrete actions allow us to catalyze change and lead our industry towards a greener future and guarantee the rights of the communities involved in the Warintza Project. We are now actively working towards achieving the targets set for Level 2 of PECC carbon reduction where we not only implement actions to mitigate environmental impacts but also further safeguard natural resources for future generations.”

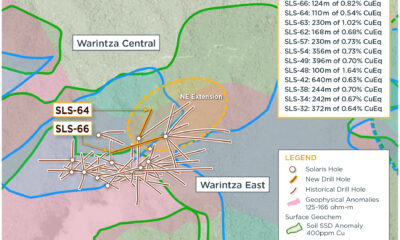

Solaris Resources, the parent company of Lowell, is exploring the Warintza Project in southeastern Ecuador’s Morona Santiago province. The company has a program called “Warintza Verde” through which it aligns with United Nations Sustainable Development Goal #13. This program commits the company to incorporate climate-friendly policies and strategies and to take active steps to reduce its carbon footprint.

Global giants in the industry are also setting ambitious targets. Rio Tinto aims to cut its Scope 1 and 2 emissions by 33% by 2030, focusing on renewable energy, energy efficiency, and electrification. Similarly, BHP has committed to reducing its operational emissions by at least 30% by 2030 through comparable means. Vale has even set goals for Scope 3 emissions, aiming for a 15% reduction by 2035, in addition to a 33% reduction in its Scope 1 and 2 emissions by 2030.

As mentioned, the most common approach is enhancing energy efficiency. By investing in new technologies and upgrading equipment, companies can achieve this goal. Simple changes, like opting for energy-efficient lighting, heating, and ventilation systems, can make a substantial difference. There is also a growing trend to reduce dependence on diesel fuel, a significant source of GHG emissions. Alternatives like renewable energy sources or battery-powered vehicles are being explored to replace diesel-powered machinery.

Switching to renewable energy is another avenue to curb emissions. Investments in solar and wind energy are on the rise within the mining sector. Utilizing these cleaner energy options not only lowers emissions but also diminishes the reliance on fossil fuels, a known contributor to GHG emissions.

Additionally, mining companies are beginning to extend their emission reduction efforts to their supply chain. By setting emissions targets for suppliers and offering support to meet these goals, the industry can create a more comprehensive approach to sustainability.

Investors are demanding these initiatives more frequently for several reasons. Firstly, tackling climate change is an ethical imperative. The growing recognition of climate change as a severe threat to both the environment and human society makes emission reduction efforts more critical. Second, sustainability is becoming a key competitive differentiator. Companies demonstrating a commitment to reducing their environmental impact are more appealing to customers, who are increasingly valuing sustainability. And of course, these initiatives often translate to reduced operational costs, primarily through savings in energy expenses, making them financially advantageous for the companies.

The mining industry is proactively taking steps to lessen its environmental footprint, mainly by focusing on energy efficiency, renewable energy adoption, and collaborative efforts with suppliers, for a new competitive edge that will take the industry into the future.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The post Solaris Resources’ (TSX:SLS) Lowell Mineral Exploration Earns Level 1 Carbon Footprint Badge from Ecuador’s Ministry of Environment appeared first on MiningFeeds.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…