Companies

Osisko Gold applauds Patriot Battery’s MRE, Albemarle deal

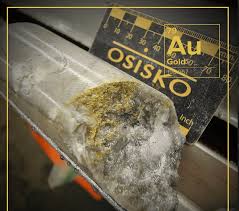

Osisko Gold Royalties Ltd. (OR-TSX, OR-NYSE) is congratulating Patriot Battery Metals Inc. [PMET-TSXV, PMETF-OTCQB, R9GA-FSE]…

Osisko Gold Royalties Ltd. (OR-TSX, OR-NYSE) is congratulating Patriot Battery Metals Inc. [PMET-TSXV, PMETF-OTCQB, R9GA-FSE] for achieving a maiden resource estimate at its Corvette lithium project in Quebec, a move that prompted U.S specialty chemicals company Albemarle Corp. [ALB-NYSE] to make a $109 million strategic investment in Patriot Battery.

Osisko said the maiden resource estimate has established the CV5 spodumene pegmatite on the Corvette property as the largest lithium pegmatite mineral resource in the Americas. The inferred resource is pegged at 109.2 million tonnes at 1.2% Lithium Oxide (Li20) and 160 parts per million (ppm) Tantalum Pentoxide (Ta205) at a cut-off grade of 0.40% Li20, for a total of 3.83 million tonnes of contained lithium carbonate equivalent.

Osisko notes that the resource and geological modelling has outlined significant potential for growth at CV5, which remains open at both ends along strike, and to depth along a significant portion of its length.

Osisko Gold Royalties is an intermediate precious metal royalty company with a focus on the Americas. It holds a portfolio of over 160 royalties, streams and precious metal offtakes. Its portfolio is anchored by a 5.0% NSR royalty on the Canadian Malartic Mine in Quebec, which ranks as the largest gold mine in Canada.

Osisko holds a sliding scale net smelter return (NSR) royalty of 1.5-3.5% on precious metals, and 2.0% on all other products, including lithium at Corvette. Osisko estimates that a large majority (80-95%) of the CV5 MRE falls on its 2.0% lithium NSR royalty area. It points out that the maiden MRE includes only the CV5 Spodumene Pegmatite and therefore does not include any of the other known spodumene pegmatite clusters on the property, namely CV4, CV8, CV9, CV10, CV12 and CV13; some of which are covered by he Osisko royalty.

In addition, Osisko said it wanted to further congratulate Patriot for subsequently announcing the $109 million strategic investment by Albemarle.

Under an agreement, Albemarle will subscribe for 7.12 million common shares of Patriot Battery Metals at $15.29 a share, a move that will leave the U.S. company with a 4.9% stake in Patriot Battery on fully diluted basis. Proceeds will be used to accelerate the development of Patriot Battery’s Corvette lithium project in Quebec.

“The consistency at which the Patriot team has been able to achieve remarkable drilling success going back to the discovery hole in the Fall of 2021, and now punctuated by yesterday’s CV5 MRE (mineral resource estimate), speaks to the unique quality of the Corvette property, as well as Patriot’s vision and understanding of a highly prospective hard rock lithium camp,’’ said Osisko Interim CEO Paul Martin. “Th e subsequently announced strategic investment by Albemarle only serves to further underpin the quality of the asset on a global scale,’’ he said.

The letter of congratulations came after the close of trading on August 1, 2023, when Osisko Gold shares closed at $14.48. The shares trade in a 52-week range of $17.96 and $9.20.

tsx

tsxv

nyse

otcqb

gold

lithium

tantalum

tsx-or

osisko-gold-royalties-ltd

osisko gold royalties ltd

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…